|

市场调查报告书

商品编码

1858531

高空伪卫星的全球市场:2025年~2035年Global High Altitude Pseudo Satellites Market 2025-2035 |

||||||

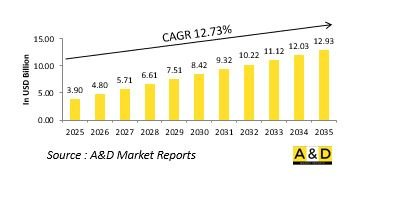

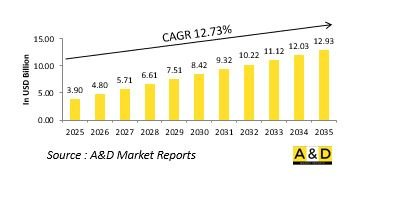

据估计,2025年全球高空伪卫星市场规模为39亿美元,预计到2035年将成长至129.3亿美元,2025年至2035年的复合年增长率(CAGR)为12.73%。

全球高空伪卫星市场简介

国防高空伪卫星(HAPS)市场代表着持续空中监视、通讯和情报领域不断发展的前沿领域。高空平台系统(HAPS)介于无人机和卫星之间,在平流层运行,能够对战略区域进行长期持续监视,而无需承担轨道卫星的高昂成本。国防机构正日益探索将这些系统作为网路中心战和多域作战的关键组成部分。与传统的天基资产相比,它们具有部署灵活、机动性强、维护成本低等优点。随着对即时态势感知、边境监视和弹性通讯基础设施的需求不断增长,HAPS平台正成为现代国防生态系统中不可或缺的一部分。 HAPS能够在气象系统之上运作并保持稳定的飞行姿态,使其成为和平时期监视和作战支援行动的战略资产。

科技对高空平台市场的影响:

技术进步正在重新定义HAPS系统的能力,使其转变为多任务国防资产。轻质复合材料、太阳能推进、自主飞行控制和储能等创新技术延长了飞行续航时间并降低了运行成本。先进感测器有效载荷(包括光电、红外线和雷达系统)的整合增强了侦察和情报收集能力。利用人工智慧进行机载资料分析,可实现即时威胁侦测和自适应任务规划,而安全的通讯链路则确保了国防网路间的无缝资料传输。 5G 和卫星通讯技术的整合进一步强化了其在衝突环境中作为空中中继节点的作用。随着技术的演进,高空伪卫星系统 (HAPS) 正日益成为一种高续航平台,弥合了太空资产和战术无人机系统之间的差距。

高空伪卫星市场的主要驱动因素:

推动国防行动采用高空伪卫星系统的战略因素很多。对大范围区域(尤其是在边境安全和海上监视领域)持续情报、监视和侦察的需求日益增长,是推动高空伪卫星市场发展的关键因素。国防部队正在寻求能够快速部署和灵活执行任务的、经济高效的传统卫星替代方案。网路中心作战日益受到重视,跨域无缝资料连接至关重要,这也推动了人们对基于高空伪卫星(HAPS)的通讯中继系统的兴趣。此外,向低排放和太阳能平台的转变符合永续发展目标,同时也延长了作战续航时间。日益紧张的地缘政治局势以及电子战场景下对高可靠性通讯基础设施的需求,进一步推动了国防组织对这些系统的投资。这些因素共同使得HAPS成为下一代国防战略的重要组成部分。

高空伪卫星市场区域趋势:

国防HAPS市场的区域动态受到战略重点、工业能力和国防现代化计画差异的影响。在北美,发展重点是将HAPS整合到更广泛的指挥控制架构中,以增强态势感知能力。欧洲国家则优先考虑主权和合作研究计划,以减少对传统太空系统的依赖。在亚太地区,日益紧张的边境局势和海上安全挑战正在加速对本土高空伪卫星(HAPS)研发的投资。中东国家正在探索此类系统,以便在恶劣气候条件下进行持续的边境监视和反恐行动。同时,拉丁美洲和非洲新兴的国防工业正将HAPS视为一种经济高效的监视解决方案,以弥补卫星存取的不足。总体而言,区域战略反映出人们日益认识到HAPS是国防资讯和通讯基础设施的重要组成部分。

高空伪卫星重大计画

印度海军已授予位于班加罗尔的新太空研究与技术公司(NRT)一份合同,委託其设计和开发高空伪卫星(HAPS)。该合约是 "国防卓越创新" (iDEX)计画的一部分,旨在提升海军的远程监视能力。去年12月,NRT宣布其太阳能动力长航时HAPS成功完成21小时的首飞。在 iDEX 计画的支持下,该公司目前正在开发一款概念验证飞行器,目标是实现超过 48 小时的太阳能飞行时间。 NRT 执行长兼前空军飞行员 Sameer Joshi 在 X 大会上透露,原型机在 12 月 22 日(冬至日)的试飞中实现了这一里程碑。

目录

高空伪卫星市场- 目录

高空伪卫星市场报告定义

高空伪卫星市场区隔

各地区

各用途

各推动因素

未来十年高海拔假云石市场分析

本章透过对未来十年高海拔假云石市场的分析,详细概述了高海拔假云石市场的成长、趋势变化、技术应用概况以及整体市场吸引力。

高海拔假云母市场技术展望

本部分讨论了预计将影响该市场的十大技术,以及这些技术可能对整体市场产生的影响。

全球高海拔假云母市场预测

以上各部分详细涵盖了未来十年高海拔假云母市场的预测。

区域高海拔假云母市场趋势及预测

本部分涵盖了区域高海拔假云母市场的趋势、驱动因素、限制因素、挑战以及政治、经济、社会和技术因素。此外,还提供了详细的区域市场预测和情境分析。最终的区域分析包括主要公司概况、供应商格局和公司基准分析。目前市场规模是基于 "一切照旧" 情境估算的。

北美

促进因素,阻碍因素,课题

PEST

市场预测与情境分析

主要企业

供应商阶层的形势

企业基准

欧洲

中东

亚太地区

南美

高海拔假云母市场国家分析

本章涵盖该市场的主要国防项目以及最新的市场新闻和专利申请。此外,本章也提供未来十年各国的市场预测和情境分析。

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

高空假云母市场机会矩阵

机会矩阵帮助读者了解该市场中具有高机会的细分领域。

专家对高空假云母市场报告的意见

我们在此提供专家对该市场潜力分析的意见。

结论

关于航空·国防市场报告

The global High Altitude Pseudo Satellite market is estimated at USD 3.90 billion in 2025, projected to grow to USD 12.93 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 12.73% over the forecast period 2025-2035.

Introduction to Global High Altitude Pseudo Satellites market:

The defense High Altitude Pseudo Satellites (HAPS) market represents an evolving frontier in persistent aerial surveillance, communication, and intelligence-gathering systems. Positioned between drones and satellites, HAPS platforms operate in the stratosphere, enabling continuous monitoring over strategic regions for extended durations without the high costs of orbital satellites. Defense agencies are increasingly exploring these systems as a critical component of network-centric warfare and multi-domain operations. They offer flexible deployment, rapid mobility, and low maintenance compared to traditional space-based assets. With increasing demand for real-time situational awareness, border monitoring, and resilient communication infrastructure, HAPS platforms are becoming vital for modern defense ecosystems. Their ability to operate above weather systems while maintaining stable flight profiles makes them a strategic asset for both peacetime surveillance and combat support operations

Technology Impact in High Altitude Pseudo Satellites Market:

Technological advancements are redefining the potential of HAPS systems, transforming them into multi-mission defense assets. Innovations in lightweight composite materials, solar propulsion, autonomous flight control, and energy storage have extended flight endurance and reduced operational costs. The integration of advanced sensor payloads, including electro-optical, infrared, and radar systems, has enhanced their reconnaissance and intelligence-gathering capabilities. AI-driven onboard data analytics enable real-time threat detection and adaptive mission planning, while secure communication links ensure seamless data transfer across defense networks. The convergence of 5G and satellite communication technologies further strengthens their role as aerial relay nodes in contested environments. As technology evolves, HAPS are increasingly positioned as high-resilience platforms bridging the gap between space assets and tactical unmanned aerial systems.

Key Drivers in High Altitude Pseudo Satellites Market:

Several strategic factors are driving the adoption of HAPS in defense operations. The growing need for persistent intelligence, surveillance, and reconnaissance over wide areas is a primary motivator, particularly in border security and maritime monitoring. Defense forces seek cost-effective alternatives to traditional satellites that offer quicker deployment and greater mission flexibility. The rising emphasis on network-centric operations, where seamless data connectivity across domains is critical, also fuels interest in HAPS-based communication relays. Additionally, the shift toward low-emission and solar-powered platforms aligns with sustainability goals while offering extended operational endurance. Heightened geopolitical tensions and the demand for resilient communication infrastructure during electronic warfare scenarios further push defense agencies to invest in these systems. Collectively, these drivers are positioning HAPS as essential enablers of next-generation defense strategies.

Regional Trends in High Altitude Pseudo Satellites Market:

Regional dynamics in the defense HAPS market are shaped by differing strategic priorities, industrial capabilities, and defense modernization programs. In North America, development is focused on integrating HAPS into broader command and control architectures to enhance situational dominance. European nations are emphasizing sovereignty and joint research initiatives to reduce reliance on traditional space systems. In the Asia-Pacific region, rising border tensions and maritime security challenges are accelerating investments in indigenous HAPS development. Middle Eastern countries are exploring these systems for persistent border surveillance and counterterrorism operations under harsh climatic conditions. Meanwhile, emerging defense industries in Latin America and Africa are viewing HAPS as cost-effective surveillance solutions that can compensate for limited satellite access. Overall, regional strategies reflect a growing recognition of HAPS as an indispensable layer in defense intelligence and communications infrastructure.

Key High Altitude Pseudo Satellites Program:

The Indian Navy has signed a contract with Bengaluru-based NewSpace Research and Technologies (NRT) for the design and development of a High Altitude Pseudo Satellite (HAPS). This agreement falls under the Innovations for Defence Excellence (iDEX) initiative and aims to boost the Navy's long-range surveillance capabilities. In December last year, NRT announced that its solar-powered, long-endurance HAPS successfully completed its first 21-hour flight. Under the iDEX programme, the company is now working on a proof-of-concept demonstrator targeting solar-powered flights exceeding 48 hours. NRT's CEO and former Air Force pilot, Sameer Joshi, shared on X that the prototype achieved this milestone during a test flight on December 22, the Winter Solstice-the shortest day of the year-posing the toughest endurance conditions for a solar-powered UAV.

Table of Contents

High Altitude Pseudo Satellites Market - Table of Contents

High Altitude Pseudo Satellites Market Report Definition

High Altitude Pseudo Satellites Market Segmentation

By Region

By Application

By Propulsion

High Altitude Pseudo Satellites Market Analysis for next 10 Years

The 10-year high altitude pseudo satellites market analysis would give a detailed overview of high altitude pseudo satellites market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of High Altitude Pseudo Satellites Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global High Altitude Pseudo Satellites Market Forecast

The 10-year high altitude pseudo satellites market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional High Altitude Pseudo Satellites Market Trends & Forecast

The regional high altitude pseudo satellites market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of High Altitude Pseudo Satellites Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for High Altitude Pseudo Satellites Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on High Altitude Pseudo Satellites Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Propulsion, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Propulsion, 2025-2035

List of Figures

- Figure 1: Global High Altitude Pseudo Satellites Market Forecast, 2025-2035

- Figure 2: Global High Altitude Pseudo Satellites Market Forecast, By Region, 2025-2035

- Figure 3: Global High Altitude Pseudo Satellites Market Forecast, By Application, 2025-2035

- Figure 4: Global High Altitude Pseudo Satellites Market Forecast, By Propulsion, 2025-2035

- Figure 5: North America, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 6: Europe, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 7: Middle East, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 8: APAC, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 9: South America, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 10: United States, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 11: United States, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 12: Canada, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 13: Canada, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 14: Italy, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 15: Italy, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 16: France, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 17: France, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 18: Germany, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 19: Germany, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 22: Belgium, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 24: Spain, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 25: Spain, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 26: Sweden, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 28: Brazil, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 30: Australia, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 31: Australia, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 32: India, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 33: India, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 34: China, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 35: China, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 38: South Korea, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 40: Japan, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 41: Japan, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 44: Singapore, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, High Altitude Pseudo Satellites Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, High Altitude Pseudo Satellites Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, High Altitude Pseudo Satellites Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, High Altitude Pseudo Satellites Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, High Altitude Pseudo Satellites Market, By Application (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, High Altitude Pseudo Satellites Market, By Application (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, High Altitude Pseudo Satellites Market, By Propulsion (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, High Altitude Pseudo Satellites Market, By Propulsion (CAGR), 2025-2035

- Figure 54: Scenario Analysis, High Altitude Pseudo Satellites Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, High Altitude Pseudo Satellites Market, Global Market, 2025-2035

- Figure 56: Scenario 1, High Altitude Pseudo Satellites Market, Total Market, 2025-2035

- Figure 57: Scenario 1, High Altitude Pseudo Satellites Market, By Region, 2025-2035

- Figure 58: Scenario 1, High Altitude Pseudo Satellites Market, By Application, 2025-2035

- Figure 59: Scenario 1, High Altitude Pseudo Satellites Market, By Propulsion, 2025-2035

- Figure 60: Scenario 2, High Altitude Pseudo Satellites Market, Total Market, 2025-2035

- Figure 61: Scenario 2, High Altitude Pseudo Satellites Market, By Region, 2025-2035

- Figure 62: Scenario 2, High Altitude Pseudo Satellites Market, By Application, 2025-2035

- Figure 63: Scenario 2, High Altitude Pseudo Satellites Market, By Propulsion, 2025-2035

- Figure 64: Company Benchmark, High Altitude Pseudo Satellites Market, 2025-2035