|

市场调查报告书

商品编码

1896744

全球定向能武器市场(2026-2036)Global Directed Energy Weapons Market 2026-2036 |

||||||

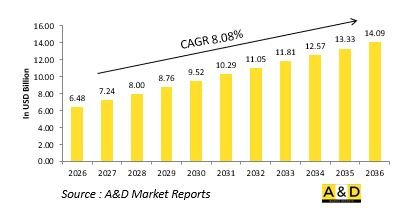

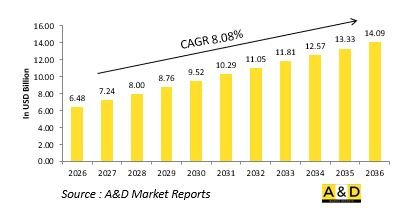

据估计,2026年全球定向能武器市场规模为64.8亿美元,预计到2036年将达到140.9亿美元,2026年至2036年的复合年增长率(CAGR)为8.08%。

定向能武器市场简介

防御性定向能武器市场代表了现代军事技术的尖端水平,专注于利用聚焦电磁能量(例如雷射、微波和粒子束)精确、快速地使目标失效、损坏或摧毁的系统。 与传统的动能武器不同,定向能武器能够瞬间命中目标,减少附带损害,并降低每次使用的运作成本。这些系统正被开发用于空中、陆地和海上平台,包括飞弹防御、反无人机作战和电子干扰。随着全球国防组织追求更高的军事能力精度、灵活性和可扩展性,定向能武器正日益受到关注。这与对能够应对常规和非对称威胁的高机动性、可持续的非动能解决方案的需求不断增长不谋而合。它们的出现标誌着向能量战争迈出了变革性的一步,是对现有威慑和作战能力的补充。

科技对定向能武器市场的影响

技术创新正迅速推动定向能武器的研发和部署。高能量雷射、紧凑型电源和光束控制系统的进步显着提高了射程、精度和效率。热管理和自适应光学技术的突破使得在不影响精度的前提下实现持续运行成为可能。 人工智慧与自主追踪系统的整合增强了动态作战环境中目标捕获和威胁反应能力。组件小型化使定向能系统更加便携,并可适应从地面车辆到飞机和舰艇等各种平台。此外,能量储存和脉衝发生技术的进步使这些武器更可靠,能够持续使用。光子学、材料科学和数位控制技术的整合正在将定向能系统从实验原型转变为实用、可部署的解决方案,重新定义精确打击和防御作战能力的未来。

定向能武器市场的主要驱动因素

对经济高效、快速反应的解决方案的需求不断增长,以应对不断演变的威胁,这是防御性定向能武器市场的主要驱动因素。无人机入侵、飞弹袭击和集群战术日益频繁,催生了对能够同时摧毁多个目标的武器的需求。定向能系统能够以光速打击威胁,且后勤成本极低,对于国防现代化计画极具吸引力。 对精确作战和减少附带损害的日益重视,也进一步推动了向非动能、可扩展武器系统的转变。国防机构也正在投资定向能技术,以应对难以用传统系统拦截的高速弹丸和电子威胁。此外,陆、空、海三域防御一体化作战模式的兴起,也推动了对能够跨平台无缝运作的灵活模组化能量武器的需求。这些因素提升了定向能系统在下一代国防规划中的战略重要性。

定向能武器市场区域趋势

防御性定向能武器市场的区域发展反映了战略重点和技术能力的差异。北美地区继续主导该领域,这得益于其在所有国防领域持续进行雷射和微波武器系统的研发、测试和部署。欧洲则专注于合作研究项目,将定向能解决方案整合到空中和海上应用。亚太地区正在迅速提升自身能力,重点发展用于无人机和飞弹防御的高功率雷射和微波系统。 中东正在探索定向能技术,以保护不稳定环境下的关键基础设施并应对空中威胁。拉丁美洲和非洲正透过技术合作和国防合作逐步进入这一领域。各国政府都认识到定向能武器在重新定义威慑方面的巨大潜力,它能够以精准、可扩展且节能的方式应对战场上的新挑战。

本报告分析了全球定向能武器市场,提供了影响该市场的技术资讯、未来十年的市场预测以及区域市场趋势。

目录

定向能武器市场报告定义

定向能武器市场区隔

按地区

依科技

按平台

未来十年定向能武器市场分析

定向能武器市场技术

全球定向能武器市场预测

区域定向能武器市场趋势及预测

北美

驱动因素、限制因素与挑战

PEST分析

市场预测与情境分析

主要公司

供应商等级

公司基准分析

欧洲

中东

亚太地区

南美洲

定向能武器市场国家分析

美国

国防项目

最新消息

专利

该市场的当前技术成熟度

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

定向能武器市场机会矩阵

定向能武器市场专家意见报告

结论

关于航空与国防市场报告

The Global Directed Energy Weapons market is estimated at USD 6.48 billion in 2026, projected to grow to USD 14.09 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 8.08% over the forecast period 2026-2036.

Introduction to Directed Energy Weapons Market:

The defense directed energy weapons market represents a cutting-edge frontier in modern military technology, focusing on systems that use focused electromagnetic energy-such as lasers, microwaves, or particle beams-to disable, damage, or destroy targets with precision and speed. Unlike traditional kinetic weapons, directed energy weapons offer instantaneous engagement, reduced collateral damage, and low operational costs per use. These systems are being developed for applications across air, land, and naval platforms, including missile defense, anti-drone operations, and electronic disruption. As global defense forces seek enhanced accuracy, flexibility, and scalability in their arsenals, directed energy weapons are becoming increasingly attractive. They align with the growing need for agile, renewable, and non-kinetic solutions capable of addressing both conventional and asymmetric threats. Their emergence marks a transformative step toward energy-based warfare that complements existing deterrence and combat capabilities.

Technology Impact in Directed Energy Weapons Market:

Technological innovation is rapidly propelling the development and deployment of directed energy weapons. Advances in high-energy lasers, compact power sources, and beam control systems have significantly improved range, precision, and efficiency. Breakthroughs in thermal management and adaptive optics enable sustained operation without compromising accuracy. The integration of artificial intelligence and automated tracking enhances targeting and threat engagement in dynamic combat environments. Miniaturization of components has made directed energy systems more portable and adaptable to various platforms, from ground vehicles to aircraft and naval vessels. Additionally, improvements in energy storage and pulse generation have made these weapons more reliable for continuous use. The convergence of photonics, materials science, and digital control technologies has transformed directed energy systems from experimental prototypes into viable, deployable solutions, redefining the future of precision strike and defensive warfare capabilities.

Key Drivers in Directed Energy Weapons Market:

The increasing need for cost-effective, rapid-response solutions against evolving threats is a primary driver of the defense directed energy weapons market. Rising incidents of drone incursions, missile attacks, and swarming tactics have created demand for weapons capable of neutralizing multiple targets simultaneously. The ability of directed energy systems to engage threats at the speed of light, with minimal logistical burden, makes them highly attractive for defense modernization programs. Growing emphasis on precision warfare and reduced collateral damage further supports the transition toward non-kinetic, scalable weapon systems. Defense forces are also investing in directed energy technologies to counter high-speed projectiles and electronic threats that traditional systems struggle to intercept. Additionally, the shift toward multi-domain operations-integrating land, air, and maritime defense-drives the need for flexible, modular energy weapons that can operate seamlessly across platforms. These factors collectively reinforce the strategic importance of directed energy systems in next-generation defense planning.

Regional Trends in Directed Energy Weapons Market:

Regional developments in the defense directed energy weapons market reflect differing strategic priorities and technological capacities. North America continues to dominate the field, driven by sustained research, testing, and deployment of laser-based and microwave weapon systems across all defense branches. Europe is focusing on collaborative research programs aimed at integrating directed energy solutions into air defense and naval applications. The Asia-Pacific region is rapidly advancing its indigenous capabilities, emphasizing high-power laser and microwave systems for counter-drone and missile defense. In the Middle East, directed energy technologies are being explored to protect critical infrastructure and counter aerial threats in volatile environments. Latin America and Africa are gradually entering the domain through technology partnerships and defense collaborations. Across all regions, governments recognize the potential of directed energy weapons to redefine deterrence, offering precise, scalable, and energy-efficient responses to emerging battlefield challenges.

Key Directed Energy Weapons Program:

The Mk-II(A) Shahastra Shakti marked a major milestone in India's directed energy weapons programme in April 2026, following the successful test demonstration of the laser-based system. This indigenous 30 kW, vehicle-mounted platform developed by DRDO's CHESS division has demonstrated the ability to neutralise various aerial threats-including fixed-wing drones, swarm drones and surveillance sensors-at distances of up to 5 km. The Shahastra Shakti system incorporates six 5 kW laser beams and is equipped with advanced electronic warfare capabilities along with a 360-degree Electro-Optical/Infrared (EO/IR) sensor for accurate target engagement. Currently undergoing trials, it is expected to become operational within the next two years. DRDO is also progressing on next-generation variants with projected power levels between 50 and 100 kW, intended to counter more advanced threats such as cruise missiles, fighter aircraft and artillery rounds, thereby significantly enhancing India's directed energy weapons capabilities.

Table of Contents

Directed Energy Weapons Market - Table of Contents

Directed Energy Weapons Market Report Definition

Directed Energy Weapons Market Segmentation

By Region

By Technology

By Platform

Directed Energy Weapons Market Analysis for next 10 Years

The 10-year directed energy weapons market analysis would give a detailed overview of directed energy weapons market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Directed Energy Weapons Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Directed Energy Weapons Market Forecast

The 10-year directed energy weapons market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Directed Energy Weapons Market Trends & Forecast

The regional directed energy weapons market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Directed Energy Weapons Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Directed Energy Weapons Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Directed Energy Weapons Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Range, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Range, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Defense Directed Energy Weapons Forecast, 2025-2035

- Figure 2: Global Defense Directed Energy Weapons Forecast, By Region, 2025-2035

- Figure 3: Global Defense Directed Energy Weapons Forecast, By Range, 2025-2035

- Figure 4: Global Defense Directed Energy Weapons Forecast, By Type, 2025-2035

- Figure 5: North America, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 9: South America, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 10: United States, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 16: France, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 17: France, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 20: Netherlands, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 32: India, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 33: India, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 34: China, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 35: China, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Directed Energy Weapons, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Directed Energy Weapons, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Directed Energy Weapons, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Directed Energy Weapons, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Directed Energy Weapons, By Range (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Directed Energy Weapons, By Range (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Directed Energy Weapons, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Directed Energy Weapons, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Directed Energy Weapons, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Directed Energy Weapons, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Directed Energy Weapons, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Directed Energy Weapons, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Directed Energy Weapons, By Range, 2025-2035

- Figure 59: Scenario 1, Defense Directed Energy Weapons, By Type, 2025-2035

- Figure 60: Scenario 2, Defense Directed Energy Weapons, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Directed Energy Weapons, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Directed Energy Weapons, By Range, 2025-2035

- Figure 63: Scenario 2, Defense Directed Energy Weapons, By Type, 2025-2035

- Figure 64: Company Benchmark, Defense Directed Energy Weapons, 2025-2035