|

市场调查报告书

商品编码

1904988

全球国防航空航太平台MRO市场:2026-2036Global Defense MRO - Air Platforms Market 2026-2036 |

||||||

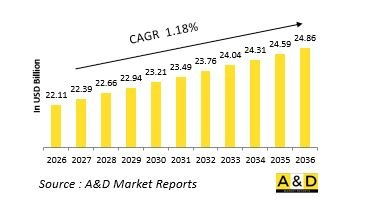

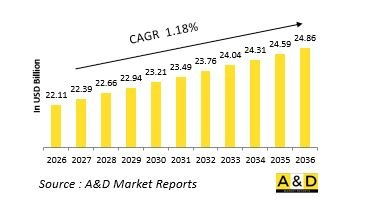

全球国防航太平台MRO市场预计将从2026年的221.1亿美元成长到2036年的248.6亿美元,2026年至2036年的复合年增长率(CAGR)为1.18%。

航空平台MRO概要:

全球国防领域的航空平台MRO(维护、修理和大修)市场是军事战备的关键基础,确保军用航空机队的运作可用性、安全性和使用寿命。空中平台包括战斗机、运输机、预警机、加油机、特殊任务飞机和军用直升机。与采购驱动型市场不同,国防航空的维护、修理和大修 (MRO) 以全生命週期为导向,涵盖定期维护、大修(基地级大修)、结构延寿、发动机维护、航空电子设备升级和现代化改造专案。

随着世界各国空军运作的飞机日益复杂且老旧,MRO 的战略重要性日益凸显。由于预算限制、下一代项目延期或部队结构调整等原因,许多国家仍在继续使用远超设计寿命的老旧飞机。这凸显了先进 MRO 解决方案在维持机队性能并满足现代任务需求方面的关键作用。该市场由政府所有的维护设施、原始设备製造商 (OEM) 和根据长期绩效后勤 (PBL) 合约营运的私人 MRO 供应商组成。

日益加剧的地缘政治紧张局势、不断增加的空中作战频率以及不断扩大的多国联合演习正在推动飞机可用性的提高和维护週期的缩短。同时,向网路中心战和感测器密集型平台的转变,正将MRO(维护、修理和大修)的范围从机械维护扩展到软体保障、网路安全和电子系统维护。因此,国防航空MRO市场正从成本中心演变为支撑空中优势的战略基础。

科技对飞机平台MRO市场的影响:

科技正在从根本上重塑国防航空平台MRO环境,提高效率、可预测性和飞机可用性。其中一个最重要的发展是预测性维护的引入,它由感测器、健康和利用率监测系统(HUMS)以及数据分析提供支援。飞机产生的数据使维护人员能够在潜在缺陷发生之前识别它们,从而减少计划外停机时间并优化备件库存。

数位孪生技术正越来越多地用于模拟飞机在作战场景中的性能和部件退化。这些虚拟副本支援基于状态的维护、结构寿命评估和升级规划,尤其适用于老旧的战斗机和运输机机队。先进的无损检测 (NDT) 技术,例如超音波检测、热成像和射线检测,在提高故障检测率的同时,最大限度地减少了拆卸需求。

积层製造是一项革命性的技术,能够在作战基地或附近快速生产小批量或过时的零件。这项技术显着缩短了交货週期,并降低了对长途全球供应链的依赖,尤其适用于老旧平台。此外,扩增实境 (AR) 和虚拟实境 (VR) 工具正越来越多地应用于维修培训、远端技术支援和复杂的维修程序。

鑑于现代军用飞机对任务系统、航空电子软体和电子战系统的严重依赖,可持续的软体运作正成为一项关键的维护、修理和大修 (MRO) 功能。网路弹性维护方法和安全的软体更新机制对于飞机 MRO 运作至关重要。这些技术正在将国防飞机 MRO 转变为一个数据驱动、数位化赋能的生态系统。

本报告研究了全球国防领域的航空平台MRO市场,并对该市场进行了全面分析,包括市场背景、市场影响因素、市场规模趋势和预测,以及按细分市场和地区划分的详细分析。

目录

国防航空航太平台MRO市场:报告定义

国防航空航太平台MRO市场:细分

按地区

按元件

依飞机类型

国防航空航太平台MRO市场:分析

国防航空航太平台MRO市场:技术

国防航空航太平台MRO市场:预测

国防航空航太平台MRO市场:区域趋势与预测

报告内容:本报告涵盖市场趋势、驱动因素、限制因素、挑战、PEST分析、市场预测、情境分析、主要参与者概况、供应商格局、公司标竿分析、区域市场预测和情境分析以及主要参与者概况。

北美

驱动因素、限制因素与挑战

PEST分析

市场预测与情境分析

主要公司

供应商层级结构

公司标竿分析

欧洲

中东

亚太地区

南美洲

国防领域空中平台MRO市场:国家分析

美国

国防项目

最新资讯

专利

当前市场技术成熟度

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

国防领域空中平台MRO市场:机会矩阵

国防领域空中平台MRO市场:专家分析观点

结论

关于航空与国防市场报告

The Global MRO - Air Platforms market is estimated at USD 22.11 billion in 2026, projected to grow to USD 24.86 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 1.18% over the forecast period 2026-2036.

Introduction to MRO - Air Platforms Market:

The Global Defense Maintenance, Repair, and Overhaul (MRO) - Air Platforms market is a critical pillar of military readiness, ensuring the operational availability, safety, and longevity of military aircraft fleets. Air platforms include fighter jets, transport aircraft, airborne early warning systems, aerial refueling tankers, special mission aircraft, and military helicopters. Unlike procurement-driven markets, defense air MRO is lifecycle-oriented, spanning routine maintenance, heavy depot-level overhauls, structural life extension, engine servicing, avionics upgrades, and modernization programs.

As global air forces operate increasingly complex and aging fleets, MRO activities have become strategically important. Many nations continue to fly legacy aircraft well beyond their original design life due to budget constraints, delayed next-generation programs, or force structure requirements. This has elevated the role of advanced MRO solutions in sustaining fleet performance while meeting modern mission demands. The market is characterized by a mix of government-owned depots, original equipment manufacturers (OEMs), and private MRO providers operating under long-term performance-based logistics (PBL) contracts.

Geopolitical tensions, increased air operations tempo, and expanding multinational exercises have further intensified aircraft utilization rates, driving higher maintenance cycles. At the same time, the shift toward network-centric warfare and sensor-heavy platforms has expanded MRO scope beyond mechanical upkeep to include software sustainment, cybersecurity, and electronic systems maintenance. As a result, the defense air MRO market is evolving from a cost center into a strategic enabler of air power dominance.

Technology Impact in MRO - Air Platforms Market:

Technology is fundamentally reshaping the defense air platforms MRO landscape, improving efficiency, predictability, and aircraft availability. One of the most significant developments is the adoption of predictive maintenance enabled by sensors, health and usage monitoring systems (HUMS), and data analytics. Aircraft-generated data allows maintainers to identify potential failures before they occur, reducing unscheduled downtime and optimizing spare parts inventory.

Digital twins are increasingly used to simulate aircraft performance and component degradation across operational scenarios. These virtual replicas support condition-based maintenance, structural life assessment, and upgrade planning, particularly for aging fighter and transport fleets. Advanced non-destructive testing (NDT) technologies-such as ultrasonic inspection, thermography, and radiographic techniques-have improved fault detection while minimizing disassembly requirements.

Additive manufacturing is another disruptive technology, enabling rapid production of low-volume or obsolete spare parts at or near operational bases. This capability significantly reduces lead times and dependence on long global supply chains, especially for legacy platforms. Additionally, augmented reality (AR) and virtual reality (VR) tools are being adopted for maintenance training, remote technical assistance, and complex repair procedures.

Software sustainment has emerged as a critical MRO function as modern military aircraft rely heavily on mission systems, avionics software, and electronic warfare suites. Cyber-resilient maintenance practices and secure software update mechanisms are becoming integral to air MRO operations. Collectively, these technologies are transforming defense air MRO into a data-driven, digitally enabled ecosystem.

Key Drivers in MRO - Air Platforms Market:

A primary driver of the defense air platforms MRO market is the aging global military aircraft fleet. Many air forces operate aircraft that are 30-40 years old, requiring extensive structural reinforcement, avionics modernization, and engine refurbishment to remain operationally relevant. Life extension programs have become more cost-effective alternatives to immediate fleet replacement.

Rising operational tempo is another key factor. Increased air patrols, intelligence-surveillance-reconnaissance (ISR) missions, and expeditionary deployments accelerate wear and tear, leading to higher maintenance demand. The growing emphasis on readiness and availability metrics has pushed defense ministries toward outcome-based MRO contracts that prioritize aircraft mission-capable rates.

Budget optimization also drives outsourcing trends. Governments increasingly partner with OEMs and private MRO providers to leverage specialized expertise, reduce lifecycle costs, and improve turnaround times. OEM-led sustainment models are particularly prominent for advanced platforms where proprietary technologies and software dominate. Additionally, fleet modernization programs stimulate MRO demand by integrating new sensors, weapons, and communication systems into existing aircraft. Regulatory compliance, airworthiness mandates, and safety upgrades further sustain long-term MRO spending. Together, these drivers ensure stable, recurring demand for defense air platform MRO across global markets.

Regional Trends in MRO - Air Platforms Market:

North America dominates the defense air MRO market, driven by the world's largest military aviation fleet and significant sustainment budgets. The region emphasizes advanced analytics, performance-based logistics, and public-private partnerships, with strong OEM involvement in sustainment activities.

Europe shows robust demand due to multinational aircraft programs, legacy fleet sustainment, and increased defense spending. Collaborative MRO frameworks and regional sustainment hubs are gaining traction, particularly for fighter and transport aircraft. The Asia-Pacific region is experiencing the fastest growth, fueled by expanding air forces, high aircraft utilization, and increasing focus on indigenous MRO capabilities. Countries are investing in domestic depot-level maintenance to reduce foreign dependence and enhance operational autonomy. In the Middle East, harsh operating environments drive intensive maintenance requirements, while strong defense budgets support advanced MRO infrastructure. Latin America and Africa focus primarily on sustaining aging fleets, with gradual movement toward localized MRO capabilities through international partnerships.

Key MRO - Air Platforms Program:

Adani Defence Systems & Technologies Ltd. (ADSTL) has entered into a share purchase agreement to acquire an 85.8% equity stake in Air Works, the largest privately owned aviation maintenance, repair, and overhaul (MRO) provider in India, recognized for its extensive nationwide presence. Air Works delivers a comprehensive range of aviation support services covering line maintenance, heavy maintenance checks, aircraft interiors, painting, redelivery inspections, avionics support, and asset management. The company provides base maintenance services for narrow-body, turboprop, and rotary-wing aircraft through its operational facilities located in Hosur, Mumbai, and Kochi. Its operations are supported by regulatory certifications from civil aviation authorities across more than 20 countries, enabling it to serve both domestic and international customers. Beyond its strong position in civil aviation services, Air Works has established substantial expertise in defense-focused MRO. The company has successfully executed maintenance and sustainment programs for several critical platforms operated by the Indian Navy and the Indian Air Force, demonstrating its capability to support complex military aviation requirements. The acquisition aligns with ADSTL's broader strategy to expand its footprint in the aerospace and defense sustainment ecosystem. By integrating Air Works' technical capabilities and infrastructure, ADSTL aims to strengthen indigenous MRO capacity and enhance long-term support solutions for both civil and defense aviation platforms.

Table of Contents

Defense MRO - Air Platforms Market Report Definition

Defense MRO - Air Platforms Market Segmentation

By Region

By Component

By Aircraft Type

Defense MRO - Air Platforms Market Analysis for next 10 Years

The 10-year Defense MRO - Air Platforms Market analysis would give a detailed overview of Defense MRO - Air Platforms Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense MRO - Air Platforms Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense MRO - Air Platforms Market Forecast

The 10-year Defense MRO - Air Platforms Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense MRO - Air Platforms Market Trends & Forecast

The regional Defense MRO - Air Platforms Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense MRO - Air Platforms Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense MRO - Air Platforms Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense MRO - Air Platforms Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Component, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Aircraft Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Component, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Aircraft Type, 2025-2035

List of Figures

- Figure 1: Global Defense MRO - Air Platforms Market Forecast, 2025-2035

- Figure 2: Global Defense MRO - Air Platforms Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense MRO - Air Platforms Market Forecast, By Component, 2025-2035

- Figure 4: Global Defense MRO - Air Platforms Market Forecast, By Aircraft Type, 2025-2035

- Figure 5: North America, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 16: France, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 32: India, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 34: China, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense MRO - Air Platforms Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense MRO - Air Platforms Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense MRO - Air Platforms Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense MRO - Air Platforms Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense MRO - Air Platforms Market, By Component (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense MRO - Air Platforms Market, By Component (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense MRO - Air Platforms Market, By Aircraft Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense MRO - Air Platforms Market, By Aircraft Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense MRO - Air Platforms Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense MRO - Air Platforms Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense MRO - Air Platforms Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense MRO - Air Platforms Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense MRO - Air Platforms Market, By Component, 2025-2035

- Figure 59: Scenario 1, Defense MRO - Air Platforms Market, By Aircraft Type, 2025-2035

- Figure 60: Scenario 2, Defense MRO - Air Platforms Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense MRO - Air Platforms Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense MRO - Air Platforms Market, By Component, 2025-2035

- Figure 63: Scenario 2, Defense MRO - Air Platforms Market, By Aircraft Type, 2025-2035

- Figure 64: Company Benchmark, Defense MRO - Air Platforms Market, 2025-2035