|

市场调查报告书

商品编码

1904999

全球国防抬头显示器市场:2026-2036Global Defense Heads Up Display Market 2026-2036 |

||||||

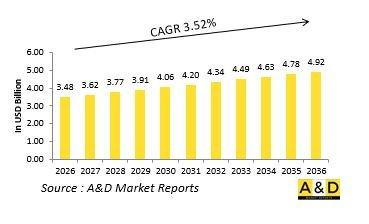

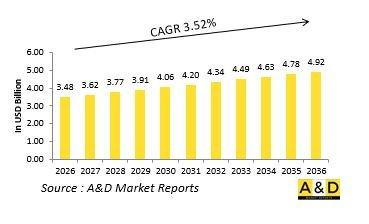

据估计,2026年全球国防抬头显示器市场规模为34.8亿美元,预计到2036年将达到49.2亿美元,2026年至2036年的复合年增长率(CAGR)为3.52%。

国防抬头显示器市场简介

全球国防抬头显示器(HUD)市场涵盖将关键飞行、导航、目标捕捉和感测器资讯投射到飞行员前方视野的系统。这使得飞行员能够同时监控仪表和外部环境。平视显示器 (HUD) 技术最初是为战斗机开发的,使飞行员能够在关键飞行阶段将视线 "移出座舱" 。此后,其应用范围扩展到直升机、地面车辆,甚至步兵系统。现代 HUD 将浮动符号、引导资讯和感测器影像整合在操作员前方的空中,提供上下文讯息,从而提高空间感知能力、减轻工作负荷并缩短反应时间。随着军事行动节奏和复杂性的增加,以及作战平台在更加复杂的环境中运行,无需将视线从战场上移开即可获取资讯的能力,已从战术优势转变为多个领域的作战必需品。

科技对国防平视显示器市场的影响:

HUD 系统的技术进步主要集中在提升显示品质、资讯整合和外形尺寸方面。数位光处理 (DLP) 和雷射扫描投影系统可提供更明亮、对比度更高的影像,即使在阳光直射下也能清晰可见。扩增实境 (AR) 技术可将合成地形、障碍物警告和目标指示直接迭加到真实世界影像上。与头盔显示器集成,可建立分散式显示架构,资讯可根据情况在抬头显示器 (HUD) 和低头显示器 (HDD) 之间自动切换。小型化设计使得 HUD 能够安装在驾驶舱空间有限的车辆和飞机上。先进的符号系统利用颜色、亮度和动态效果直观地传达讯息的紧急程度和优先顺序。无线连接功能实现了跨平台以及与地面人员之间的无缝资讯共享。这些创新正在将 HUD 从简单的飞行仪表显示器转变为全面的态势感知工具,整合平台、感测器和网路数据,提供可操作的视觉资讯。

国防抬头显示器市场的主要驱动因素:

现代军事平台上日益复杂的资讯管理带来了认知负荷挑战,而 HUD 透过在操作员的自然视野范围内呈现优先级数据来应对这一挑战。飞机和车辆平台的人员精简工作要求更有效率的资讯呈现方式,以在人员减少的情况下保持作战效能。低能见度作战,例如天气状况、黑暗和战场掩体造成的低能见度作战,需要HUD(抬头显示器)透过合成视觉和感测器迭加功能提供增强的态势感知工具。网路中心战战术的采用使得外部感测器资料能够显示在HUD上,从而将态势感知扩展到自身感测器之外。更高的安全要求支援能够增强空间和障碍物感知能力的系统,尤其是在高强度作战阶段。此外,来自汽车和游戏产业的技术转移加速了能力的提升,同时也对满足军事环境和安全标准提出了挑战。

国防抬头显示器市场区域趋势:

各区域的HUD发展趋势反映了平台现代化策略和产业能力的差异。北美项目强调与头盔安装系统和网路数据馈送的集成,特别是针对下一代战斗机。欧洲的发展重点是能够处理多用途系统的多用途系统,这些系统可在多国项目中应用于固定翼、旋翼和地面车辆。亚太地区正经历强劲成长,这与本土战斗机和直升机计画密切相关,并日益重视本地设计和製造。以色列的创新能力在升级传统平台和为特定应用打造紧凑型系统方面表现出色。中东地区的采购通常伴随着西方平台的购置,这增加了对技术转移和本地支援的需求。民用技术的整合既带来了机会也带来了挑战,例如,汽车抬头显示器的进步影响着军事系统,同时也引发了人们对民用零件安全漏洞的担忧。训练系统的需求也在推动抬头显示器的进一步普及,而类比显示器必须能够复製实际运作的系统,才能有效地进行技能转移。

主要国防抬头显示器项目:

扩增实境头戴式显示器(ARHMD)系统旨在提升陆基防空武器平台(例如IGLA肩扛式红外线导引飞弹系统和ZU-23mm 2B高射炮)的性能。该系统采用增强迭加技术,将雷达和热成像感测器资料直接呈现在操作员的视野范围内。透过融合多种感测器输入,ARHMD旨在提升目标侦测、追踪和交战效能,尤其是在夜间作战和恶劣天气条件下。即使在白天交战中,即时数据处理和热成像融合也有望缩短反应时间、增强态势感知能力并提升决策支援。为了获得这项先进能力,印度陆军已开始根据 "Make-II" 计画采购556套ARHMD系统。在对各厂商的方案进行详细评估后,印度陆军于2021年2月22日向六家公司发出专案批准订单,委託其开发原型系统。原型开发和评估成功完成后,将根据2020年国防采购程序,在 "购买(本土开发和采购)" 类别下,向其中一家公司授予生产合约。在 "Make II" 框架下开发的ARHMD系统预计将透过加强本土国防技术和工业自力更生,支持印度政府的 "自力更生印度" (Atmanirbhar Bharat)倡议,同时大幅提升防空作战能力。

目录

抬头显示器市场报告定义

抬头显示器市场区隔

按类型

按地区

按最终使用者

未来10年抬头显示器市场分析

本章详细概述了抬头显示器市场的成长、变化趋势、技术应用概况,透过对抬头显示器市场进行为期十年的分析,探讨其市场吸引力。

抬头显示器市场技术

本部分涵盖预计将影响该市场的十大技术及其对整体市场的潜在影响。

全球抬头显示器市场预测

以上各部分详细阐述了该市场未来十年的抬头显示器市场预测。

区域抬头显示器市场趋势及预测

本部分涵盖区域抬头显示器市场的趋势、驱动因素、限制因素和挑战,以及政治、经济、社会和技术因素。此外,也详细分析了区域市场预测和情境分析。最终的区域分析包括主要公司概况、供应商状况和公司基准分析。目前市场规模是基于 "一切照旧" 情境估算的。

北美

驱动因素、限制因素与挑战

PEST分析

市场预测与情境分析

主要公司

供应商层级结构

公司标竿分析

欧洲

中东

亚太地区

南美洲

抬头显示器市场国家分析

本章涵盖该市场的主要国防项目以及最新的市场新闻和专利申请。此外,本章也提供未来十年各国的市场预测和情境分析。

美国

国防项目

最新消息

专利

当前市场技术成熟度

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

南非

韩国

日本

马来西亚

新加坡

巴西

抬头显示器市场机会矩阵

机会矩阵帮助读者了解该市场中高机会细分领域。

抬头显示器市场报告专家意见

本报告总结了我们专家对此市场分析潜力的意见。

结论

关于航空航太与国防市场报告

The Global Defense Heads Up Display market is estimated at USD 3.48 billion in 2026, projected to grow to USD 4.92 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.52% over the forecast period 2026-2036.

Introduction to Defense Heads Up Display Market

The Global Defense Heads Up Display (HUD) Market encompasses systems that project critical flight, navigation, targeting, and sensor information into the operator's forward field of view, allowing simultaneous monitoring of instruments and the external environment. Originally developed for fighter aircraft to enable pilots to keep their eyes "out of the cockpit" during critical phases of flight, HUD technology has expanded to helicopters, ground vehicles, and even dismounted soldier systems. Modern HUDs integrate symbols, cues, and sensor imagery that appear to float in space ahead of the operator, providing situationally referenced information that enhances spatial orientation, reduces workload, and decreases reaction time. As military operations increase in tempo and complexity, and as platforms operate in more cluttered environments, the ability to access information without looking away from the operational scene has transitioned from tactical advantage to operational necessity across multiple domains.

Technology Impact in Defense Heads Up Display Market:

Technological advancement in HUD systems focuses on display quality, information integration, and form factor evolution. Digital light processing and laser scanning projection systems enable brighter, higher-contrast imagery visible in all lighting conditions, including direct sunlight. Augmented reality capabilities overlay synthetic terrain, obstacle warnings, and target designations directly onto the real-world view. Integration with helmet-mounted systems creates distributed display architectures where information migrates between head-up and head-down locations based on context. Miniaturization enables HUD installation in vehicles and aircraft with limited cockpit space. Advanced symbology systems use color, intensity, and motion to convey information urgency and priority intuitively. Wireless connectivity allows seamless information sharing between platforms and dismounted personnel. These innovations transform HUDs from simple flight instrument repeaters into comprehensive situational awareness tools that fuse platform, sensor, and network data into actionable visual presentations.

Key Drivers in Defense Heads Up Display Market:

The increasing complexity of information management in modern military platforms creates cognitive overload challenges that HUDs specifically address by presenting prioritized data in the operator's natural field of view. Reduced crew size initiatives across aircraft and vehicle platforms necessitate more efficient information presentation to maintain effectiveness with fewer personnel. Low-visibility operations-whether from weather, darkness, or battlefield obscurants-require enhanced situational awareness tools that HUDs provide through synthetic vision and sensor overlay capabilities. Network-centric warfare implementation enables off-board sensor data to be displayed on HUDs, extending situational awareness beyond organic sensors. Safety enhancement mandates favor systems that improve spatial orientation and obstacle awareness, particularly during demanding operational phases. Additionally, technology transfer from automotive and gaming industries accelerates capability advancement while presenting challenges in meeting military environmental and security standards.

Regional Trends in Defense Heads Up Display Market:

Regional HUD development reflects differing platform modernization strategies and industrial capabilities. North American programs emphasize integration with helmet-mounted systems and network data feeds, particularly for next-generation combat aircraft. European development focuses on multi-role systems applicable across fixed-wing, rotary-wing, and ground vehicle applications within multinational programs. The Asia-Pacific region shows strong growth tied to indigenous fighter and helicopter programs, with increasing emphasis on local design and manufacturing. Israeli innovation excels in compact systems for upgraded legacy platforms and specialized applications. Middle Eastern procurement often accompanies Western platform acquisitions, with increasing demand for technology transfer and localized support. Commercial technology convergence presents both opportunities and challenges, with automotive HUD advancements influencing military systems while raising concerns about security vulnerabilities in commercial-derived components. Training system requirements further drive HUD adoption, as simulated displays must replicate operational systems for effective skill transfer.

Key Defense Heads Up Display Program:

The Augmented Reality Head Mounted Display (ARHMD) system has been conceptualized as a capability enhancer for land-based air defence weapon platforms, including the IGLA shoulder-launched infrared homing missile system and the ZU-23 mm 2B air defence gun. The system is designed to present radar and thermal imaging sensor data directly within the operator's field of view through augmented overlays. By fusing multiple sensor inputs, the ARHMD aims to improve target detection, tracking, and engagement effectiveness, particularly during night operations and adverse weather conditions. Daytime engagements are also expected to benefit through faster reaction times, enhanced situational awareness, and decision-support features enabled by real-time data processing and thermal imagery integration. To acquire this advanced capability, the Indian Army has initiated procurement of 556 ARHMD systems under the Make-II category. Following a detailed assessment of industry responses, Project Sanction Orders were issued on 22 February 2021 to six vendors for prototype development. Upon successful completion and evaluation of the prototypes, a production contract will be awarded to one of the firms under the Buy (Indian-IDDM) category in accordance with the Defence Acquisition Procedure 2020. The development of the ARHMD system under the Make-II framework is expected to significantly enhance air defence operations while supporting the Government of India's Atmanirbhar Bharat initiative by strengthening indigenous defence technology and industrial self-reliance.

Table of Contents

Heads Up Display Market Report Definition

Heads Up Display Market Segmentation

By Type

By Region

By End user

Heads Up Display Market Analysis for next 10 Years

The 10-year heads up display market analysis would give a detailed overview of heads up display market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Heads Up Display Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Heads Up Display Market Forecast

The 10-year heads up display market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Heads Up Display Market Trends & Forecast

The regional heads up display market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Heads Up Display Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Heads Up Display Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Heads Up Display Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By End User, 2025-2035

List of Figures

- Figure 1: Global Defense Heads Up Display Market Forecast, 2025-2035

- Figure 2: Global Defense Heads Up Display Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Heads Up Display Market Forecast, By Type, 2025-2035

- Figure 4: Global Defense Heads Up Display Market Forecast, By End User, 2025-2035

- Figure 5: North America, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 16: France, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 20: Netherland, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 21: Netherland, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 32: India, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 34: China, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Heads Up Display Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Heads Up Display Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Heads Up Display Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Heads Up Display Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Heads Up Display Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Heads Up Display Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Heads Up Display Market, By End User (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Heads Up Display Market, By End User (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Heads Up Display Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Heads Up Display Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Heads Up Display Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Heads Up Display Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Heads Up Display Market, By Type, 2025-2035

- Figure 59: Scenario 1, Defense Heads Up Display Market, By End User, 2025-2035

- Figure 60: Scenario 2, Defense Heads Up Display Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Heads Up Display Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Heads Up Display Market, By Type, 2025-2035

- Figure 63: Scenario 2, Defense Heads Up Display Market, By End User, 2025-2035

- Figure 64: Company Benchmark, Defense Heads Up Display Market, 2025-2035