|

市场调查报告书

商品编码

1121029

美国非开挖市场 - 不断变化的水市场成熟:预测、竞争定位和主要趋势(2022-2030 年)U.S. Trenchless Market Matures Amidst Water Market Shifts: Forecasts, Competitive Positioning, and Key Trends, 2022-2030 |

||||||

美国安装的 230 万英里的饮用水管和 180 万英里的废水管因使用年限和材料类型而异。由于供水和污水管道的年更换率平均不到 1.0%,公用事业公司越来越多地寻求替代方法和技术,以最大限度地延长埋地资产的使用寿命。

随着对非开挖解决方案需求的增长,越来越多的公司在市场上变得具有竞争力,包括垂直整合的非开挖公司、多元化的化工公司、专业服务提供商和私募股权 (PE) 投资者。

本报告研究了美国非开挖市场,并提供了包括当前供需动态、2022-2030 年非开挖市场前景以及对竞争格局的影响等信息。

报告+数据选项

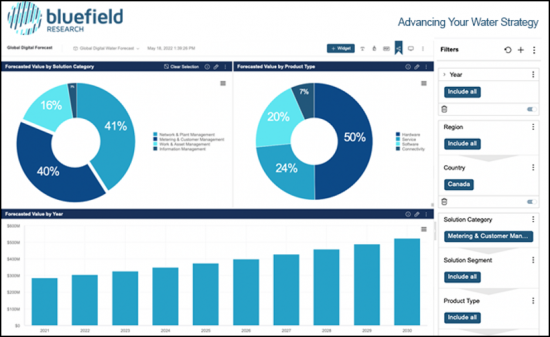

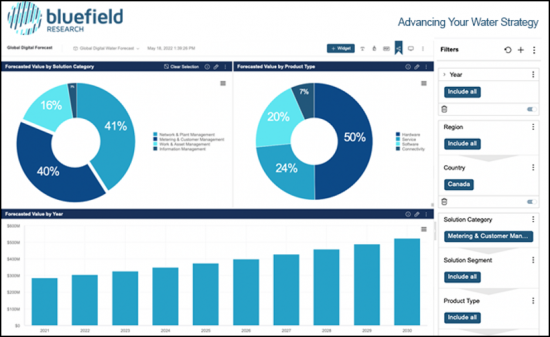

编辑以提供相关数据的仪表板。

示例视图

列出的公司

|

|

|

目录

第 1 章非开挖市场展望

- 预测研究方法

- 因管网老化而促进基础设施投资

- 收集和分发材料的变化凸显了不断变化的需求

- 与传统方法竞争的非开挖技术

- 露天切割方法在新安装和修復方面获得了广泛关注

- 影响非开挖技术部署的关键因素

- 住房开始显示区域需求

- 通过城市化率塑造潜在市场

第 2 章主要市场驱动因素和趋势

- 市场变化影响基础架构部署

- IIJA 为基础设施投资提供必要的资金

- 供应中断导致材料成本上升

- 劳动力供应限制了市场

- 非开挖项目的成本因管道尺寸和应用而异

第 3 章非开挖市场展望(2022-2030 年)

- 非开挖技术支出概览(2022-2030 年)

- 网络市政市场不可阻挡的份额

- 按细分:支出(2022-2030 年)

- 按新建和重建:非法支出(2022-2030 年)

- 按州划分:非开挖预测(2022-2030 年)

- 按技术:支出(2022-2030 年)

- CIPP 树脂在非开挖市场中发挥着重要作用

- 按直径:非开挖支出(2022-2030 年)

- 毗邻非开挖技术市场

第 4 章竞争格局

- 竞争趋势摘要

- 非开挖技术价值链(部分公司)

- 非开挖技术公司类型

- 开挖与重建併购(2021-2022)

The 2.3 million miles of drinking water pipe and 1.8 million miles of wastewater pipe installed across the U.S. vary significantly in age and material type. With current annual water & wastewater pipe replacement rates averaging less than 1.0%, utilities are increasingly turning to alternative methods and technologies to maximize the useful life of their buried assets.

As demand for trenchless solutions continues to scale, a growing roster of firms are carving out competitive positions in the market, including vertically integrated trenchless pure-plays, diversified chemical companies, specialty service providers, and private equity (PE) investors. These players face a dynamic market landscape, shaped by labor and supply chain shortages, record inflationary pressures, and an influx of federal and state infrastructure funding, such as the Infrastructure Investment and Jobs Act (IIJA).

In this report, Bluefield's team of water experts revisits the U.S. trenchless market, evaluating the impact of current supply and demand dynamics on the trenchless market outlook and competitive landscape from 2022 to 2030.

Report + Data Option:

Data is a key component to this analysis. Our team has compiled relevant data dashboards available.

SAMPLE VIEW

Companies Mentioned:

|

|

|

Table of Contents

Section 1: Trenchless Market Landscape

- Forecast Methodology

- Aging Pipe Networks Drive Infrastructure Investment

- Material Shifts in Collection & Distribution Highlight Evolving Needs

- Trenchless Technologies Compete with Traditional Methods

- Trenchless Methods Gain Traction for New Installation & Rehabilitation

- Key Factors Influence Trenchless Technology Deployment

- Housing Starts Indicate Regional Demands

- Urbanization Rates Shape Addressable Market

Section 2: Key Market Drivers & Trends

- Market Shifts Shape Infrastructure Deployment

- IIJA Provides Critical Funding for Infrastructure Investment

- Supply Disruptions Result in High Material Costs

- Labor Supply Restricts Market

- Trenchless Project Costs Vary by Pipe Size, Application

Section 3: Trenchless Market Outlook, 2022-2030

- Trenchless Technology Spend Overview, 2022-2030

- Trenchless Share of Network Municipal Market

- Trenchless Spend by Segment, 2022-2030

- Trenchless Spend by New and Rehab, 2022-2030

- Trenchless Forecast by State, 2022-2030

- Trenchless Spend by Technology, 2022-2030

- CIPP Resins Play Important Role in Trenchless Market

- Trenchless Spend by Diameter, 2022-2030

- Adjacent Trenchless Technology Markets

Section 4: Competitive Landscape

- Competitive Trends Summary

- Trenchless Technology Value Chain (select companies)

- Trenchless Technology Company Type

- Trenchless Construction and Rehab M&A, 2021-2022