|

市场调查报告书

商品编码

1734974

连接器的产业预测:2025年Connector Industry Forecast 2025 |

||||||

最新的 "2025年连接器产业预测" 报告提供了全球连接器产业的详细预测。报告包含全球各地区(北美、欧洲、日本、中国、亚太地区和世界其他地区)的详细预测,以及产业概览,涵盖当前市场趋势、汇率波动的影响、产业销售业绩以及未来展望。

全球和区域预测如下:

电脑和週边设备

|

汽车

|

商务/办公室设备

|

运输(汽车以外)

|

测量设备

|

军事/航太 |

医疗设备

|

电信/数据通讯

|

产业

|

消费者

|

2025 - 可能受经济和政治不确定性影响的一年

走出负面情绪总是困难的,2024 年也不例外。 2024年开始,连接器产业销售额年比和累计都呈现疲软态势,无疑是令人欣喜却又实至名归的惊喜。连接器产业年增5.6%,所有市场领域和产品类型均成长。然而,并非所有地区都表现良好,部分地区与去年相比出现负成长。不过,亚太地区、中国和北美等地区实现了成长,弥补了先前的下滑。这一年的重要事件包括美国总统大选的结束、欧洲多个国家民粹主义和极右翼政党的崛起、台湾海峡持续的潜在不稳定局势以及世界各地发生的自然灾害。

与往年不同,2024年的订单量年增强劲,除一个月份外,其余月份均实现正成长。订单量较去年成长最大的月份是10月份,为+13.4%,其次是6月份,为+11.3%。全年12个月的预订量都十分强劲,年底的积压订单量超过12週。 2025年预计将再次成为预订量强劲的一年,3月和4月的预订量与前一年相比将实现两位数增长。

各地区产业销售绩效

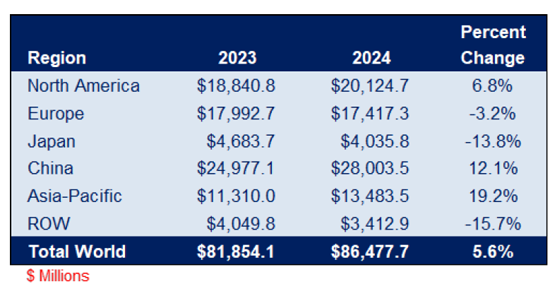

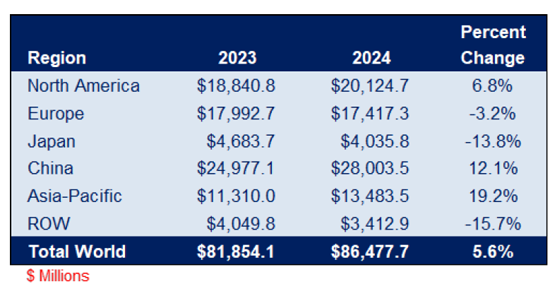

如下表所示,2024年各地区成长及下降幅度不均衡,2025年也不例外。 2024年,亚太地区增幅最大,成长了19.2%。紧随其后的是中国,成长了12.1%。北美是另一个成长的地区,成长了6.8%。 2024年,其他所有地区均出现下滑,其中降幅最大的是其他地区,美元销售额下降了15.7%,其次是日本,下降了13.8%。欧洲是唯一出现下滑的地区,下降了3.2%。

2023年和2024年的各地区连接器销售额

变化率附着

展望 2025 年的预测表现,亚太地区预计将从 2024 年的第二位跃升至 2025 年的第一位。预计其他所有地区都将实现个位数成长。

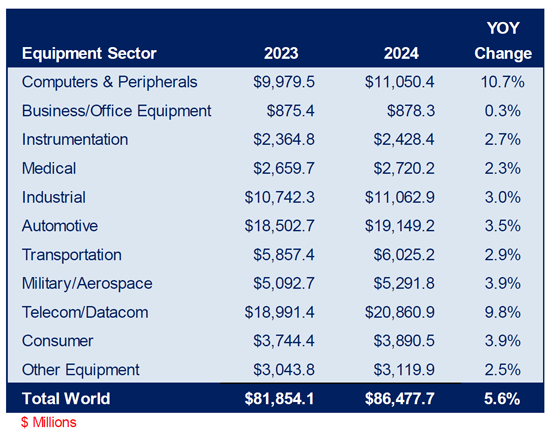

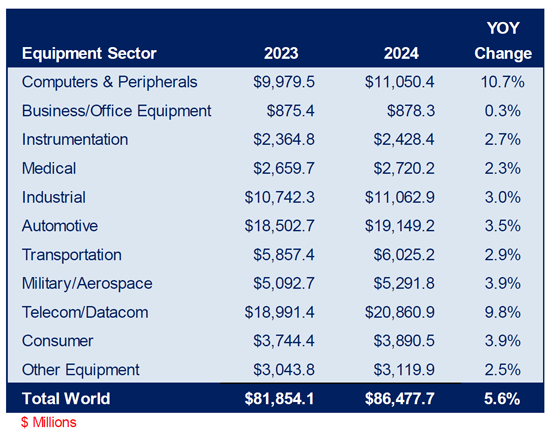

除了 2024 年各地区连接器销售表现存在差异外,电子连接器的销售表现也因细分市场而异。如下表所示,2024 年,电脑及週边设备/市场部门的成长率最高,为 +10.7%。值得注意的是,这是自2006年以来电脑及週边设备市场首次跑赢其他所有产业。

2023年和2024年的市场各部门连接器销售额

2025年及以后展望

鑑于产业订单储备依然强劲,我们预测2025年的营收将有所成长。预计亚太地区增幅最大,其次是中国。以美元计算,中国将是连接器收入增幅最大的地区,儘管并非最大。

预测假设

预测总是困难的,尤其是在经济和地缘政治不确定的时期。在这样的环境下,几乎不可能预测未来。请考虑以下经济逆风、政治课题和不确定性:

- 全球经济不稳定。正如2025年1月世界经济论坛所显示的那样, "56%的首席经济学家预计2025年全球经济状况将减弱,只有17%的经济学家预计会有所改善。" 即使在美国,也存在担忧,44%的首席经济学家预测2025年全球经济将强劲增长,高于去年8月受访时的15%。此外,也有人指出,“由于对债务上升和通膨的担忧,美国近期的成长前景黯淡。”

- 联准会不会降息。 2025年5月中旬投票表决,川普总统仅强烈鼓励维持利率,这强烈反映出他们希望被视为一个不受现任领导层影响的独立机构,其主要目标是鼓励和维持物价稳定,并保持低失业率。联准会主席鲍威尔指出,联准会需要等待关税影响的 "更清晰" 结果,才能做出任何货币政策调整。预计联准会最快将于秋季审查利率。许多人对联准会维持利率不变的决定感到担忧。

- 与2023年一样,全球和供应链问题将在2024年得到显着改善,但仍然存在,并且可能由于潜在的关税、不断加剧的政治紧张局势和经济不确定性而恶化。随着我们进入2025年,我们可以预期货物供应、成本、船期可靠性和国际贸易协定将很容易发生变化。事实上,2024 年通过运河的船舶数量比 2023 年减少了 50% 以上。

- 劳动力短缺,尤其是技术工人,例如电工、水管工、木工、机械师、焊工、水管工、钢铁工人,甚至医生、护士和药剂师。造成劳动力短缺的原因包括学徒制和店内培训班减少、越来越多的员工退休,尤其是婴儿潮一代(通常指 1946 年至 1964 年之间出生的人),没有被年轻员工取代,以及员工期望发生重大变化,包括工资、工时、地点(现场还是远程)、工作与生活的平衡以及灵活性。其他因素包括缺乏便利的儿童保育、人口下降(美国和欧洲的出生率较低)以及受数位商务成长推动的新企业新创公司的增加。

- 政治紧张局势加剧且旷日持久:

- 乌克兰与俄罗斯之间的战争已进入第三年,仍在持续。俄罗斯目前占领着乌克兰约20%的领土,即使在其他国家参与谈判的支持下,战争也看不到尽头。根据 "全球衝突追踪" 的数据, "自2022年1月以来,乌克兰已获得约4070亿美元的援助,其中包括来自美国的超过1180亿美元的援助。" "超过4万平民在战斗和空袭中丧生,370万人在国内流离失所,690 “超过4万平民在战斗和空袭中丧生,370万人在国内流离失所,690万人逃离乌克兰。”

- 巴以之间围绕土地及其控制权的衝突是有史以来持续时间最长、最暴力的衝突之一。 2025年1月15日,美国、埃及和卡达宣布成功促成以色列和哈马斯停火,结束了加萨走廊持续15个月的战斗。然而,紧张局势在3月下旬进一步升级,结束了为期六週的停火协议。

- 海地的安全局势恶化,阻碍了国内外投资,阻碍了新兴经济体的经济发展,导致其GDP出现负成长,经济萎缩。

- 全球经济适用房短缺。根据联合国人居署估计,2030年,全球将有30亿人(约占世界人口的四分之一)生活在贫穷之中。40% 的人口将需要获得舒适的住房。这意味着每天需要额外 96,000 套经济适用房。不幸的是,正如许多国家正在经历的那样,舒适的住房是一个巨大的课题,尤其是在大城市,它们面临着成本上涨、供应有限以及日益严重的负担能力问题。

- 气候变迁也是潜在的不利因素。标普全球报告指出,“气候变迁导致飓风、干旱、洪水和野火等天气事件更加频繁和严重,破坏了基础设施,扰乱了供应链,并加剧了资源短缺和经济不稳定。”

- 大宗商品价格波动。美国银行指出, "大宗商品价格波动往往可以衡量其对通膨的影响。" 大宗商品涵盖了从石油天然气到贵金属和工业金属等一系列资产。

- 或许,最显着的不利因素之一是川普总统执政期间美国征收的关税。为了刺激美国製造业并保护就业,川普总统对进口商品征收了关税。正如BBC所说,许多人认为这将 "扰乱全球经济" 并 "使美国消费者的产品价格更高" 。儘管美国和中国已同意在90天内降低彼此征收的关税,美国和英国也宣布达成协议,但许多人仍然担心这将如何影响全球经济。正如联准会先前指出的那样,需要 "更清晰" 的资讯才能真正确定关税将如何影响全球经济。

我们也对连接器在2025年后为何会成长以及如何成长做出了一些有趣的预测。这些预测包括强劲的订单量、历史性成长、低失业率以及强劲的消费支出等因素。

本报告详细介绍了成长预测市场以及将推动成长的子产业。本报告涵盖了 2025 年至 2030 年按地区、市场领域和子领域划分的预测,并提供了同比变化和 5 年复合年增长率。该行业会持续成长吗?哪些年龄层的市场表现不佳?我们 2025 年 5 月的连接器产业预测将揭示这些问题及其他更多资讯。

目录

第一章 2025 - 经济与政治不确定性可能影响的一年

- 与前一年同期比较及今年累计的预约数

- 申请额的与前一年同期比较及岁首来

- 产业的订单剩余接连缩小

- 产业背部对数(记录)2024年4月/2025年4月

- 连接器产业的订单生产

- 背部对数(记录)的变化

- 各地区产业销售额实际成果

- 2023年和2024年的各地区连接器销售额(百分率变化附着)

- 2023年和2024年的各区域销售额的变化

- 2024年及2025年的各地区连接器销售额(百分率变化)

- 2024年和2025年的各区域销售额的变化

- 2023年和2024年的市场各部门连接器销售额(百分率变化附着)

- 2024年及2025年的市场各部门连接器销售额(百分率变化及美金变动)

- 市场占有率的变化

- 各地区市场占有率:2015年~2025年

- 各地区市场占有率:1994年~2025年

- 月别产业销售额实际成果

- 过去的销售业绩

- 连接器产业的商务循环的成长循环的亮点

- 连接器需求的过去的变化率

- 2024 年及 2025 年初至今货币对区域产业成长的影响

- 2024 年 4 月及 2025 年 4 月每美元兑当地货币

- 2025 年 4 月产业销售业绩(美元兑当地货币)

- 2020 年与 2025 年展望未来展望

- 2015年3月全球连结器累积财务业绩

- 2025年销售预测的历史分析研究方法

- 可能结果范围

- 2023年、2024年及2025年各地区连接器预测(含百分比变化)

- 2024年及2025年各地区连接器市场预测(美元)

- 预测假设

- 五年展望(2025-2030)

- 五年预测 - 各地区销售额年增率

- 五年预测 - 各终端设备细分市场销售额年增率

- 市场预测与评论

- 电脑週边设备部门

- 概要

- 市场趋势

- 全球市场状况

- 子部门趋势

- 2025年的世界电脑及週边设备连接器预测- 各地区市场占有率

- 商务/办公室设备部门

- 全球市场状况

- 子部门趋势

- 整体

- 到2025年前的全球商务/办公室设备连接器市场预测- 各地区市场占有率

- 仪器部门

- 子部门另一个世界测量设备市场

- 全球仪器连接器销售预测-2023年,2024年,2025年,2030年(5年的年复合成长率)

- 自动实验设备子部门

- 分析及科学设备

- 其他的设备

- 地区子部门的见解

- 北美

- 北美的仪器连接器销售预测(2025年~2030年)

- 欧洲

- 欧洲仪器连接器销售预测(2025年~2030年)

- 日本

- 日本仪器连接器销售预测2025年~2030年

- 中国

- 中国的仪器连接器销售预测2025年~2030年

- 亚太地区

- 亚太地区的仪器连接器销售预测(2025年~2030年)

- 其他地区

- 其他地区仪器连接器预测销售额2025年~2030年

- 2025年的世界仪器连接器市场预测- 各地区市场占有率

- 医疗设备部门

- 全球市场状况

- 全球医疗用连接器销售预测的最新版(2023年,2024年,2025年~2030年)(百分率变化及5年的年复合成长率附着)

- 全球医疗市场子部门

- 全球医疗用连接器市场:子部门2025年及2030年

- 诊断及影像诊断设备市场

- 治疗设备市场的状况

- 其他的医疗设备市场的状况

- 地区子部门的见解

- 北美

- 欧洲

- 日本

- 中国

- 亚太地区

- 其他地区

- 2025年的世界医疗用连接器市场占有率预测(各地区)

- 产业设备部门

- 简介和市场定义

- 传统的产业市场- 主要市场市场区隔

- 工业IoT-IIoT市场区隔

- 产业用连接器市场主要市场区隔

- 连接器的世界产业市场展望

- 产业用连接器市场各地区销售业绩2023年~2025年

- 产业用连接器市场销售业绩(各部门)2024年,2025年预测,2030年预测

- 2025年及年复合成长率实际成果2030年- 各地区5年

- 产业用连接器市场销售业绩(市场部门别,2024年,2025年预测,2030年预测),成长率,年复合成长率,市场占有率

- 各地区view

- 北美

- 欧洲

- 日本

- 中国

- 亚太地区

- 其他地区

- 2025年的世界产业用连接器预测- 各地区市场占有率

- 汽车部门

- 科技与市场趋势

- 各地区view

- 北美

- 欧洲

- 日本

- 中国

- 亚太地区

- 其他地区

- 2025年的世界汽车连接器市场预测- 各地区市场占有率

- 运输- 汽车以外

- 商用车

- 民航

- 轨道

- RV及强力运动(摩托车,ATV,其他的类似设备)及Marine

- 到2025年前的全球交通连接器预测- 各地区市场占有率

- 军事/航太部门

- 全球市场状况

- 到2025年前的全球军事/航太连接器市场预测- 各地区市场占有率

- 通讯设备部门

- 全球市场状况

- 科技与市场趋势

- 各地区view

- 北美

- 欧洲

- 日本

- 北美

- 欧洲

- 日本

- 中国

- 亚太地区

- 其他地区

- 2025年的世界通讯/数据通讯连接器预测- 各地区市场占有率

- 消费者取向电子设备市场部门

- 全球市场情形与预测

- 这个市场现状与连接器应用

- 子部门的效能

- 2025年的世界消费者取向连接器预测- 各地区市场占有率

第2章 全球连接器预测

- 世界连接器市场预测- 与前一年同期比较美元变动

- 世界连接器市场预测- 与前一年同期比较变化率

- 最终用途设备的首位6类别

- 全球最终用途设备预测-摘要

- 2024~2025年预测的百分率变化和2025年~2030年的5年年复合成长率预测

- 2025年和2030年的各设备部门市场占有率

- 全球最终用途设备预测- 详细内容

- 电脑和週边设备

- 行动计算

- 桌上型电脑(桌面)

- 伺服器

- 保管设备

- 输入输出设备

- 通讯LAN设备

- 其他的电脑设备

- 商务/办公室设备

- 零售/POS设备

- 成像系统

- 其他的办公室设备

- 仪器

- 自动实验设备

- 分析·科学设备

- 其他的设备

- 医疗

- 诊断及影像诊断设备

- 治疗设备

- 其他的医疗设备

- 产业

- 重机

- 与工业自动化流程控制

- 建筑·土木工程

- 能源市场

- 工具机,机器,机器人技术

- 其他的设备

- 汽车

- 车身线路和电源分配

- 动力传动

- 舒适,便利性,娱乐

- 导航和计量仪器

- 安全和保全

- 交通机关

- 商业航空

- 商用车

- 轨道

- 重机

- 休閒

- 商业船舶

- 军队

- 通讯/数据通讯

- 营运商网路

- 企业网路

- 行动&无线

- 无线基础建设

- 用户设备

- 电缆设备基础设施

- 其他的通讯

- 消费者

- 个人/可携式家电

- 消费者娱乐电子产品

- 消费者取向白色家电

- 其他的消费者

- 其他的设备

第3章 北美的连接器预测

- 北美连接器市场预测- 与前一年同期比较美元变动

- 北美连接器市场预测- 与前一年同期比较变化率

- 最终用途设备的首位6类别

- 北美的最终用途设备预测-摘要

- 年复合成长率2023~2024年预测的百分率变化和2024~2029年预测的5年

- 2024年和2029年的各设备部门市场占有率

- 北美的最终用途设备预测- 详细内容

- 电脑和週边设备

- 商务/办公室设备

- 仪器

- 医疗

- 产业

- 汽车

- 交通机关

- 军队

- 通讯/数据通讯

- 消费者

- 其他的设备

第4章 欧洲的连接器预测

第5章 日本的连接器预测

第6章 中国的连接器预测

第7章 亚太地区的连接器预测

第8章 其他地区的连接器预测

The 2025 "Connector Industry Forecast" update report provides an in-depth, and detailed forecast of the worldwide connector industry. In addition to the detailed forecasts for each region of the world (North America, Europe, Japan, China, Asia Pacific, and ROW), an industry overview is included which provides current market trends, currency fluctuation effects, and industry sales performance, as well as an outlook narrative.

Worldwide and each regional forecast includes:

Computers & Peripherals

|

Automotive

|

Business/Office Equipment

|

Transportation (non-auto)

|

Instrumentation

|

Military/Aerospace |

Medical Equipment

|

Telecom/Datacom

|

Industrial

|

Consumer

|

2025- A Year That Could be Shaped by Economic & Political Uncertainty

Coming out of a negative year is always difficult and 2024 was no exception. A year that started with weak year-over-year and year-to-date billings, 2024 ended up being a pleasant but well-earned surprise for the connector industry. Year-over-year, the connector industry grew +5.6%, with all market sectors and product types showing growth. Not all regions though, performed as well as others, with several regions showing negative year-over-year growth. But the regions that grew, Asia Pacific, China, and North America more than compensated for their decline. Among events that highlighted the year was the completion of a presidential election in the U.S., the rise of populism and far-right parties in several European countries and continued potential instability in the Taiwan Strait, as well as several natural disasters worldwide.

Unlike previous years, where most of these developments were reflected in the bookings, in 2024, year-over-year bookings remained strong and positive for all but one month of the year. The greatest year-over-year growth was seen in October, when bookings grew +13.4%, followed by June with bookings growth of +11.3%. From a year-to-date standpoint, bookings were strong in all 12 months, and we ended the year with over 12 weeks of backlog. 2025 is also shaping up to be a year of strong bookings, with double-digit year-over-year growth in March and April.

Industry Sales Performance by Region

In 2024, as seen by the table below, growth and decline were not equal across all regions, nor will they be in 2025. The Asia Pacific region saw the greatest growth in 2024, growing +19.2%. With growth of +12.1%, the Chinese region followed Asia Pacific. The only other region showing an increase was North America, where sales increased +6.8%. All other regions declined in 2024, with the greatest decline in the ROW region, where sales in US dollars decreased -15.7%, followed by Japan with a decline of -13.8%. Europe, the only other region declining, showed a decrease of -3.2%.

2023 and 2024 Connector Sales by Region

With Percent Change

Examining projected performance in 2025, you see Asia Pacific, who was ranked number two in 2024, is anticipated to move up to the number one spot in 2025.The Asia Pacific region will be followed by China, where sales are anticipated to increase. All other regions are projected to grow in the single digits.

In addition to connector sales results varying by region in 2024, electronic connector sales also varied remarkably by market sector. As the table below shows, in 2024, the computer & peripherals equipment/market sector saw the greatest percentage growth, at +10.7%. It is interesting to note that this was the first time since 2006 that the computer & peripherals market sector outperformed all other sectors!

2023 and 2024 Connector Sales by Market Sector

With Percent Change

2025 and Beyond Outlook

With industry backlog remaining strong, Bishop is forecasting 2025 sales. We anticipate the greatest percentage increase will occur in the Asia Pacific region, followed by the Chinese region where sales are anticipated to increase. When looking at growth in U.S. dollars, although not the greatest increase percentage wise, the largest increase in sales will be seen in the Chinese region, where connector sales will increase.

Forecast Assumptions

Forecasting is always difficult, especially during times of economic and geopolitical uncertainty. Projecting future business conditions in this environment is almost impossible. Consider the following economic headwinds, political challenges, and uncertainties.

- Instability in the worldwide economy. As indicated during the World Economic Forum in January 2025, "56% of leading chief economists expect weaker global economic conditions in 2025, compared to only 17% expecting improvement". Even in the U.S., where 44% of chief economists predicted strong growth in 2025, up from 15% when they were asked in August last year, there is concern. It was also noted that "short-term prospects for US growth were tempered by concerns over rising debt and inflation.

- No drop-in interest rates by the Federal Reserve. Voted on in mid-May 2025, and although highly encouraged by President Trump to rates alone is highly reflective of their desire to be seen as an independent institution that's main goal is to encourage and maintain stable prices and keep unemployment low and not be swayed by current leadership. It was indicated by Fed Chair Jerome Powell that they needed to wait for "greater clarity" regarding the impact of tariffs before making changes to monetary policy, especially considering the fact the U.S. economy looked quite sound prior to the implementation of tariffs. It is believed the Feds will review interest rates sometime early fall. decrease, the Federal Reserve voted to keep the federal funds interest rate between 4.25% and 4.50%. Many feel their decision to leave

- Like 2023, although global supply chain issues improved drastically in 2024, they still exist and could possibly get worse with the impact of potential tariffs and, as political tensions and economic instability increases. It is anticipated that freight availability, costs, schedule reliability and international trade agreements could easily change as we continue into 2025. In fact, there was a decline of over 50% in the number of ships that passed through the canal in 2024 versus 2023.

- A shortage of labor, in particular skilled laborers, such as electricians, plumbers, carpenters, machinists, welders, pipefitters, and steelworkers, even doctors, nurses, and pharmacists. A number of reasons are sited for this shortage including a decline in apprenticeship programs and shop classes, an increase in employees retiring, particularly Baby Boomers (generally classified by those born between 1946 and 1964) and not being replaced by younger workers, and a major shift in workers expectations, covering pay, hours, working location - onsite versus remote, work-life balance, and flexibility. Other factors include lack of accessible childcare, a diminishing population (lower birth rates in the U.S. and Europe), and growth in new business start-ups, led by an increase in digital commerce.

- Increasing and prolonged political tensions:

- Now entering its third year, the war between Ukraine and Russia continues. With Russia currently occupying approximately 20% of Ukraine, it does not appear that even with negotiation assistance from other countries that an end is in sight. It was indicated by Global Conflict Tracker that "since January 2022, Ukraine has received about $407 billion in aid, including over $118 billion from the United States. Fighting and air strikes have inflicted over 40,000 civilian casualties, while 3.7 million people are internally displaced, and 6.9 million have fled Ukraine".

- Israeli - Palestinian conflict over land and who controls it is one of the longest and most violent disputes ever. After it was announced on January 15, 2025, that the United States, Egypt, and Qatar had successfully mediated a cease-fire between Israel and Hamas to end fifteen months of fighting in Gaza, by late March, tensions grew, and the six-week cease-fire ended.

- Worsening instability in Haiti, which discourages domestic and foreign investment, hindering economic development and resulting in negative GDP growth and a contraction of the economy.

- Lack of affordable housing worldwide. According to UN-Habitat, by 2030, an estimated three billion people, or about 40% of the world's population, will need access to adequate housing. This translates into a demand for 96,000 new affordable and accessible housing units every day. Unfortunately, as many countries have seen, adequate housing has become a major challenge, plagued with rising costs, limited availability, and ever-growing affordability issues, particularly in major cities.

- Climate change is also being touted as a potential headwind. According to S&P Global, "climate change has resulted in more frequent and severe weather events such as hurricanes, droughts, floods and wildfires, which have damaged infrastructure and disrupted supply chains, leading to resource scarcity and economic instability.

- Fluctuating commodity prices. Representing a wide range of assets, from oil and gas to precious and industrial metals, commodity price trends as indicated by US Bank, "tend to gauge the impact on inflation.

- Probably one of the most important headwinds that needs to be mentioned is tariffs imposed by the U.S. under President Trump. Intended to boost American manufacturing and protect jobs, President Trump has levied tariffs on imports, as the BBC has stated, throwing "the world economy into chaos" with many arguing that "they will make products more expensive for U.S. consumers". Although the U.S. and China have agreed to slash tariffs they have imposed on each other for 90 days, and the U.S. and U.K. have announced an agreement has been made, many are still concerned how this will affect the world economy. As previously pointed out by the U.S. Fed, "greater clarity" is needed before anyone can actual determine how these tariffs will affect the worldwide economy.

There are also some interesting projections as to why we will see connector growth in 2025 and beyond, and what that growth will be. These include factors such as strong bookings, historical growth, and low unemployment coupled with strong consumer spending.

This report details the markets where Bishop anticipates growth, and which subsectors will drive that growth. This report provides projections for the period 2025F through 2030F, with year-over-year percent change and five-year CAGR by region, market sector, and sub-sector. Will the industry continue to grow, and which years may not be as strong as others? These answers and more are revealed in the May 2025 "Connector Industry Forecast".

Table of Contents

Chapter 1 -2025 - A Year That Could be Shaped by Economic & Political Uncertainty

- Bookings Year-over-Year and Year-to-Date

- Billings Year-over-Year and Year-to-Date

- Industry Backlog Continues to Shrink

- Industry Backlog April 2024/2025

- Connector Industry Book-to-Bill

- Change in Backlog

- Industry Sales Performance by Region

- 2023 and 2024 Connector Sales by Region with Percent Change

- 2023 and 2024 Change in Sales Dollars by Region

- 2024 and 2025F Connector Sales by Region with Percent Change

- 2024 and 2025F Change in Sales Dollars by Region

- 2023 and 2024 Connector Sales by Market Sector with Percent Change

- 2024 and 2025F Connector Sales by Market Sector with Percent Change and USD Delta

- Change in Market Share

- Market Share by Region 2015 through 2025F

- Market Share by Region 1994 through 2025F

- Industry Sales Performance by Month

- Historical Sales Performance

- Connector Industry Business Cycles Growth Cycles Highlighted

- Historical Percentage Change in Connector Demand

- 2024 and 2025 YTD Currency Impact on Regional Industry Growth

- Local Currency to One USD April 2024 versus April 2025

- Industry Sales Performance April 2025 USD-vs-Local Currencies

- 2025 and Beyond Outlook

- World Connector Results YTD March 2015

- 2025 Sales Outlook Historical Analysis Methodology

- Range of Possible Outcomes

- 2023, 2024, and 2025F Connector Forecast by Geographical Region with Percent Change

- 2024 and 2025F Connector Forecast by Geographical Region with Change in US Dollars

- Forecast Assumptions

- Five-Year Outlook (2025-2030)

- Five Year Forecast - Region Percent Year-Over-Year Change Sales

- Five Year Forecast - End-Use Equipment Sector Percent Year-Over-Year Change Sales

- Market Outlook and Comments

- Computers Peripherals Sector

- Overview

- Market Trends

- Global Market Conditions

- Trends by Subsector

- 2025F World Computer and Peripheral Connector Forecast - Market Share by Region

- Business/Office Equipment Sector

- Global Market Conditions

- Trends by Subsector

- Overall

- 2025F World Business/Office Equipment Connector Forecast - Market Share by Region

- Instrumentation Sector

- Worldwide Instrumentation Market by Sub-Sectors

- Worldwide Instrumentation Connector Sales Forecast - 2023, 2024, 2025F and 2030F with Five-Year CAGR

- Automatic Test Equipment Sub-Sector

- Analytical and Scientific Instruments

- Other Instruments

- Regional Sub-Sector Views

- North America

- North American Instrumentation Connector Sales Forecast 2025F through 2030F

- Europe

- Europe Instrumentation Connector Sales Forecast 2025F through 2030F

- Japan

- Japan Instrumentation Connector Sales Forecast 2025F through 2030F

- China

- China Instrumentation Connector Sales Forecast 2025F through 2030F

- Asia Pacific

- Asia Pacific Instrumentation Connector Sales Forecast 2025F through 2030F

- ROW

- ROW Instrumentation Connector Sales Forecast 2025F through 2030F

- 2025F World Instrumentation Connector Forecast - Market Share by Region

- Medical Equipment Sector

- Global Market Conditions

- Worldwide Medical Connector Sales Forecast Update 2023, 2024, 2025F through 2030F with Percent Change and Five-Year CAGR

- Worldwide Medical Market Sub-Sectors

- Worldwide Medical Connector Market by Sub-Sector 2025F and 2030F

- Diagnostics and Imaging Equipment Market

- Therapeutic Equipment Market Conditions

- Other Medical Equipment Market Conditions

- Regional Sub-Sector Views

- North America

- North America Medical Connector Sales Forecast Update 2023, 2024, 2025F, and 2030F with Percent Change and Five-Year CAGR

- Europe

- Europe Medical Connector Sales Forecast Update 2023, 2024, 2025F, and 2030F with Percent Change and Five-Year CAGR

- Japan

- Japan Medical Connector Sales Forecast Update 2023, 2024, 2025F, and 2030F with Percent Change and Five-Year CAGR

- China

- China Medical Connector Sales Forecast Update 2023, 2024, 2025F, and 2030F with Percent Change and Five-Year CAGR

- Asia Pacific

- Asia Pacific Medical Connector Sales Forecast Update 2023, 2024, 2025F, and 2030F with Percent Change and Five-Year CAGR

- ROW

- ROW Medical Connector Sales Forecast Update 2023, 2024, 2025F, and 2030F with Percent Change and Five-Year CAGR

- 2025F World Medical Connector Forecast Market Share by Region

- Industrial Equipment Sector

- Introduction and Market Definitions

- Traditional Industrial Market - Main Market Segments

- Industrial Internet of Things - IIoT Market Segments

- Key Market Segments for the Industrial Connector Market

- Outlook for the Global Industrial Market for Connectors

- Industrial Connector Market Sales Performance by Region 2023 - 2025F

- Industrial Connector Market Sales Performance by Sector 2024, 2025F and 2030F

- 2025F and 2030F - Five-Year CAGR Performance by Region

- Industrial Connector Market Sales Performance by Market Segment 2024, 2025F, & 2030F With Percent Growth, CAGR, and Market Share

- Regional View

- North America

- Annual YoY Growth Rates and Forecast through 2030F of the NA Industrial Market for Connectors

- Europe

- Annual YoY Growth Rates and Forecast through 2030F of the European Industrial Market for Connectors

- Japan

- Annual YoY Growth Rates and Forecast through 2030F of the Japanese Industrial Market for Connectors

- China

- Annual YoY Growth Rates and Forecast through 2030F of the Chinese Industrial Market for Connectors

- Asia Pacific

- Annual YoY Growth Rates and Forecast through 2030F of the AP Industrial Market for Connectors

- ROW

- Annual YoY Growth Rates and Forecast through 2030F of the ROW Industrial Market for Connectors

- 2025F World Industrial Connector Forecast - Market Share by Region

- Automotive Sector

- Technology and Market Trends

- Regional View

- North America

- Europe

- Japan

- China

- Asia Pacific

- ROW

- 2025F World Automotive Connector Forecast - Market Share by Region

- Transportation - Non-Automotive

- Commercial Vehicles

- Civil Aviation

- Rail

- RV and Power Sport (Motorcycles, ATVs, and Other Similar Equipment) and Marine

- 2025F World Transportation Connector Forecast - Market Share by Region

- Military/Aerospace Sector

- Global Market Conditions

- 2025F World Military/Aerospace Connector Forecast - Market Share by Region

- Telecom Equipment Sector

- Global Market Conditions

- Technology and Market Trends

- Regional View

- North America

- Europe

- Japan

- North America

- Europe

- Japan

- China

- Asia Pacific

- ROW

- 2025F World Telecom/Datacom Connector Forecast - Market Share by Region

- Consumer Electronics Market Sector

- Global Market Conditions & Forecast

- Current Nature of this Market and Connector Applications

- Sub-Sector Performance

- 2025F World Consumer Connector Forecast - Market Share by Region

Chapter 2 - World Connector Forecast

- World Connector Market Forecast - Year-to-Year Dollar Change

- World Connector Market Forecast - Year-to-Year Percent Change

- Top Six End-Use Equipment Categories

- World End-Use Equipment Forecast - Summary

- 2024-2025F Percent Change and 2025F-2030F Five-Year CAGR

- 2025F and 2030F Market Share by Equipment Sector

- World End-Use Equipment Forecast - Detail

- Computers & Peripherals

- Mobile Computers

- Desktops

- Servers

- Storage Equipment

- Input/Output Equipment

- Communication LAN Devices

- Other Computer Equipment

- Business/Office Equipment

- Retail/POS Equipment

- Imaging Systems

- Other Office Equipment

- Instrumentation

- Automatic Test Equipment

- Analytical & Scientific Instruments

- Other Instruments

- Medical

- Diagnostic & Imaging Equipment

- Therapeutic Equipment

- Other Medical Equipment

- Industrial

- Heavy Equipment

- Industrial Automation & Process Control

- Building & Civil Engineering

- Energy Markets

- Machine Tools, Machinery & Robotics

- Other Equipment

- Automotive

- Body Wiring & Power Distribution

- Powertrain

- Comfort, Convenience & Entertainment

- Navigation & Instrumentation

- Safety & Security

- Transportation

- Commercial Air

- Commercial Vehicles

- Rail

- Heavy Equipment

- Recreation

- Commercial Marine

- Military

- Telecom/Datacom

- Carrier Network

- Enterprise Network

- Mobile & Wireless

- Wireless Infrastructure

- Subscriber Equipment

- Cable-Equipment-Infrastructure

- Other Telecommunications

- Consumer

- Personal/Portable Consumer Electronics

- Consumer Entertainment Electronics

- Consumer White Goods

- Other Consumer

- Other Equipment

Chapter 3 - North American Connector Forecast

- North American Connector Market Forecast - Year-to-Year Dollar Change

- North American Connector Market Forecast - Year-to-Year Percent Change

- Top Six End-Use Equipment Categories

- North American End-Use Equipment Forecast - Summary

- 2023-2024F Percent Change and 2024F-2029F Five-Year CAGR

- 2024F and 2029F Market Share by Equipment Sector

- North American End-Use Equipment Forecast - Detail

- Computers & Peripherals

- Mobile Computers

- Desktops

- Servers

- Storage Equipment

- Input/Output Equipment

- Communication LAN Devices

- Other Computer Equipment

- Business/Office Equipment

- Retail/POS Equipment

- Imaging Systems

- Other Office Equipment

- Instrumentation

- Automatic Test Equipment

- Analytical & Scientific Instruments

- Other Instruments

- Medical

- Diagnostic & Imaging Equipment

- Therapeutic Equipment

- Other Medical Equipment

- Industrial

- Heavy Equipment

- Industrial Automation & Process Control

- Building & Civil Engineering

- Energy Markets

- Machine Tools, Machinery & Robotics

- Other Equipment

- Automotive

- Body Wiring & Power Distribution

- Powertrain

- Comfort, Convenience & Entertainment

- Navigation & Instrumentation

- Safety & Security

- Transportation

- Commercial Vehicles

- RV's & Power Sports

- Commercial Air

- Marine

- Rail

- Construction

- Farm & Garden

- Military

- Telecom/Datacom

- Carrier Network

- Enterprise Network

- Mobile & Wireless

- Wireless Infrastructure

- Subscriber Equipment

- Cable-Equipment-Infrastructure

- Other Telecommunications

- Consumer

- Personal/Portable Consumer Electronics

- Home Video Equipment

- Home Audio Equipment

- Consumer White Goods

- Other Consumer

- Other Equipment