|

市场调查报告书

商品编码

1884177

连接器产业预测(2025)Connector Industry Forecast 2025 |

||||||

"连接器产业预测(2025)" 报告对全球连接器产业进行了详细而深入的预测。除了对各地区(北美、欧洲、日本、中国、亚太地区和世界其他地区)的详细预测外,该报告还包含行业概览,探讨了当前市场趋势、汇率波动的影响、行业销售业绩和前景。

全球和区域预测包括:

电脑及週边设备

汽车

|

运输设备(非汽车)

|

2025年-出乎意料的一年

真是不平凡的一年!当我们在2025年初做出初步预测时,我想没有人预料到成长会如此强劲。虽然我们一致认为今年订单和收入都会增长,但这是四年多以来(自2021年以来)订单同比增长首次达到如此强劲的水平,今年夏季和2025年下半年的增速尤为显着。收入方面也是如此,在过去九个月中有七个月实现了两位数的同比增长。

继2024年成长5.6%之后,连接器产业预计在2025年将实现12.5%的年成长。这将是自新冠疫情封锁后产业强劲復苏以来,该产业最强劲的年成长率。正如预期的那样,并非所有地区都表现同样出色,一些地区实现了两位数的增长,而另一些地区的同比增长率则较低,仅为个位数。

虽然夏季历来是工厂停工和员工休假的时期,但2025年夏季却迎来了订单和收入两位数增长的开端,无论是同比增长还是年初至今的增长。如此强劲的订单量,很容易预测2025年剩余时间里,这种积极的成长动能将持续下去。

依地区划分的行业销售额

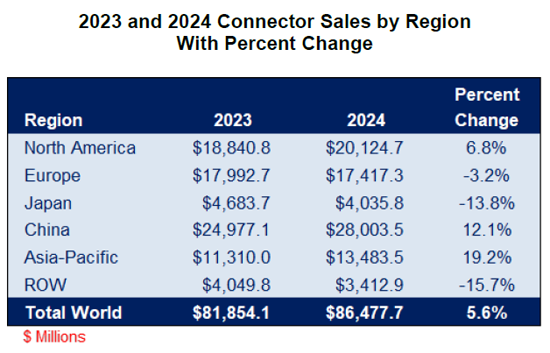

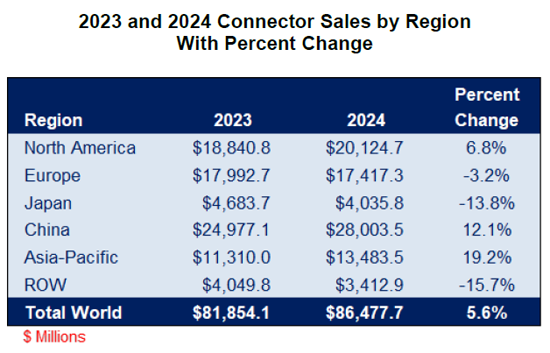

如下表所示,不同地区在2024年经历了不同程度的成长和下滑,预计这一趋势将在2025年继续。亚太地区在2024年实现了最大的成长,增幅达19.2%。大中华区紧随其后,增幅为12.1%。北美地区是唯一另一个实现成长的地区,销售额成长了6.8%。 2024年,除亚太地区外,其他所有地区的销售额均出现下滑。以美元计价,世界其他地区的销售额下降了15.7%,日本紧随其后,下降了13.8%。欧洲是唯一另一个出现下滑的地区,下降了3.2%。

展望2025年,亚太地区在2024年排名第二,预计在2025年跃居榜首。

亚太地区之后是中国。预计其他所有地区都将实现个位数成长。

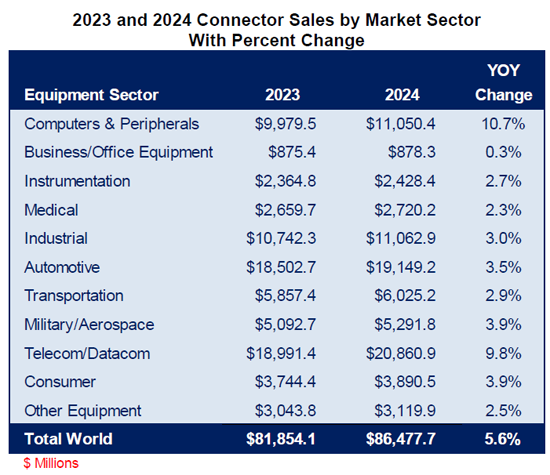

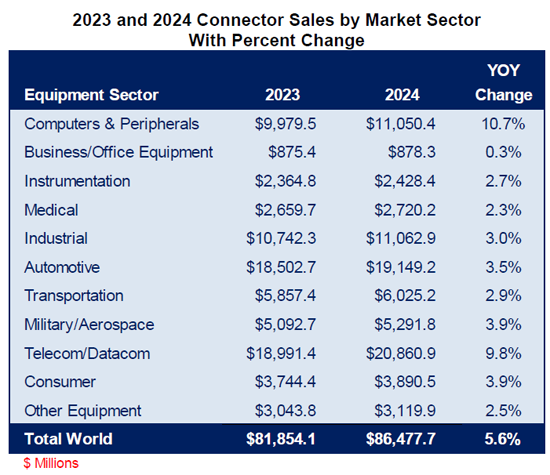

2024年,连接器销售业绩不仅因地区而异,也因市场领域而异。如下表所示,电脑及週边市场板块在2024年录得最高成长率,达到10.7%。值得注意的是,这是自2006年以来,电脑及週边市场板块首次超越所有其他板块。

2025年以后的展望

Bishop预测2025年的销售额将反映出强劲的产业积压订单。预计亚太地区的成长率最高。虽然以美元计价的成长率并非最高,但预计中国地区的销售额增幅最大。

预测假设

鑑于全球经济和地缘政治的不确定性日益增加,预测未来的商业环境极为困难。波动性加剧以及难以预测的意外事件的发生可能会对失业率、贸易政策和通货膨胀率等经济指标产生重大影响。以下经济逆风、政治挑战和不确定性因素值得关注:

- 全球经济不稳定。正如国际货币基金组织(IMF)所言, "儘管短期预测略有上调,但随着新出台的政策逐步显现成效,全球经济成长依然温和。" IMF 也指出, "整体环境依然动盪,支撑 2025 年上半年经济活动的暂时性因素(例如,需求提前)正在消退。" 世界经济论坛(WEF 也显示了类似的经济活动的暂时性因素(例如,需求提前)正在消退。的受访首席经济学家预计,由于贸易摩擦加剧、政策不确定性增加以及技术变革加速,未来 12 个月全球经济将走弱。报告也指出: "在全球公共债务水准不断上升的背景下,受访的首席经济学家强调,关注点已从先前与新兴经济体相关的债务脆弱性转向已开发经济体。80%的受访者预计,未来12个月发达经济体的风险将会增加。财政脆弱性被认为是限制经济成长的主要因素,已开发经济体(41%)的新频率高于市场发展(12%)。各方将重点关注将于2026年1月在瑞士达沃斯举行的世界经济论坛年会的讨论结果。

- 在美国,联准会在2025年9月和10月将利率下调了0.25个百分点,使其降至三年来的最低水准。然而,许多人仍然担心,在持续的经济不确定性下,这项措施是否足以维持稳定的成长。为刺激经济,这些降息措施预计将降低融资成本,并鼓励企业放款以扩大生产和僱用更多员工。这也可能导致抵押贷款利率下降,过去几年抵押贷款利率一直徘徊在7%左右。然而,降息主要影响银行间贷款利率,不太可能对企业和消费者支付的利差产生类似影响。因此,未来几个月抵押贷款利率大幅下降的可能性极低。美国降息将如何影响世界各国央行仍有疑问。许多专家认为,这是全球经济状况恶化的明显讯号,并将促使许多其他国家考虑降低利率。註:联准会今年极有可能再次降息0.25个百分点。

此外,报告还讨论了其他预测假设,包括供应链问题、政治紧张局势、劳工问题、关税、大宗商品价格和网路安全。

报告也对连接器市场在 2026 年以后的成长原因和规模做出了有趣的预测。这主要归功于强劲的订单量、历史成长、低失业率和强劲的消费者支出等因素。

本报告详细分析了 Bishop 预测的成长市场以及推动成长的子产业。报告依地区、市场板块和子行业列出了 2025 年至 2030 年的预测,以及同比变化和五年复合年增长率 (CAGR)。该行业是否会持续成长?哪些年份的成长速度可能会低于其他年份?这些问题的详细分析将在2025年12月发布的 "连接器产业预测" 中揭晓。

目录

第一章 2025年-意想不到的一年

- 年比及年初至今订单量

- 年比及年初至今帐单金额

- 产业积压订单持续下降

- 2024年4月/2025年4月产业积压订单

- 连接器产业订单

- 积压订单变化

- 各地区产业销售业绩

- 2023年及2024年各地区连接器销售额(含百分比变化)

- 2023年及2024年各地区收入变化

- 各地区连接器销售额2024 年及 2025 年(含百分比变动)

- 2024 年及 2025 年各地区收入变化

- 2023 年及 2024 年各市场领域的连接器销售额(百分比变化)(含变动)

- 2024 年和 2025 年各市场领域的连接器收入(百分比变化和美元变化)

- 市占率变化

- 2015-2025 年各地区市占率

- 1994-2025 年各地区市占率

- 月度产业销售业绩

- 历史销售业绩

- 连接器产业商业週期成长週期亮点

- 连接器需求趋势(百分比)

- 2024 年及 2025 年初至今汇率对区域产业成长的影响

- 2024 年 4 月及 2025 年 4 月美元兑当地货币汇率

- 2025年4月产业销售业绩(美元兑当地货币)

- 2025销售预测历史分析

- 2025 年连接器销售预测范围及年成长率

- 2025 年连接器销售预测范围

- 预测假设

- 预测

- 五年展望 (2025-2030)

- 五年预测 - 各地区年成长率

- 五年预测 - 终端设备产业销售额年增

- 设备/市场产业

第二章:全球连结器市场预测

- 全球连接器市场预测 - 美元同比增长

- 全球连接器市场预测 - 年成长

- 六大终端设备类别

- 全球终端设备预测 - 摘要

- 2024-2025 年预测及五年预测百分比变化2025-2030 年复合年增长率预测

- 依设备产业划分的市场占有率,2025 年和 2030 年

- 全球终端设备预测 - 详情

- 电脑及週边设备

- 行动计算机

- 桌上型电脑

- 伺服器

- 储存设备

- 输入/输出设备

- 通讯区域网路设备

- 其他

- 商业/办公设备

- 零售/销售点设备

- 影像系统

- 其他办公设备

- 仪器仪表

- 自动测试设备

- 分析与科学设备

- 其他

- 医疗

- 诊断与影像设备

- 治疗设备设备

- 其他

- 工业

- 重型设备

- 工业自动化与製程控制

- 建筑与土木工程

- 能源市场

- 工具机、机械与机器人

- 其他设备

- 汽车

- 车身布线与配电

- 动力总成

- 舒适、便利与娱乐

- 导航与仪表

- 安全与保全

- 交通运输

- 商用航空

- 商用车辆

- 铁路

- 重型设备

- 休閒娱乐

- 商用船舶

- 军事

- 电信/数据通信

- 营运商网络

- 企业网络

- 行动与无线

- 无线基础设施

- 使用者设备

- 有线设备基础设施

- 其他

- 消费性电器

- 个人/手提电器

- 消费性娱乐电子产品

- 消费白色家电

- 其他

- 其他

第三章 北美连结器市场预测

- 北美连接器市场预测 - 年比美元变化

- 北美连接器市场预测 - 同比变化

- 六大终端设备类别

- 北美终端设备预测 - 摘要

- 2023-2024 年百分比变动预测及 2024-2029 年五年复合年增长率预测

- 2024 年及 2029 年设备产业市场占有率

- 北美终端用户设备预测 - 详情

- 电脑及週边设备

- 行动计算机

- 桌上型电脑

- 伺服器

- 储存设备

- 输入/输出设备

- 通讯区域网路设备

- 其他

- 商业/办公设备

- 零售/销售点设备

- 影像系统

- 其他

- 仪器仪表

- 自动测试设备

- 分析与科学设备

- 其他

- 医疗

- 诊断与影像设备

- 治疗设备设备

- 其他

- 工业

- 重型设备

- 工业自动化与製程控制

- 建筑与土木工程

- 能源市场

- 工具机、机械与机器人

- 其他

- 汽车

- 车身布线与配电

- 动力总成

- 舒适、便利与娱乐

- 导航与仪表

- 安全与保全

- 交通运输

- 商用车辆

- 房车与动力运动

- 商用航空

- 船舶

- 铁路

- 建筑

- 农场与园艺

- 军事

- 电信/数据通信

- 营运商网络

- 企业网络

- 行动和无线

- 无线基础设施

- 使用者设备

- 有线设备基础设施

- 其他

- 消费性电器

- 个人/手提电器

- 居家视讯设备

- 家庭音讯设备

- 消费性白色家电

- 其他

- 其他设备

第 4 章至第 8 章的内容与第 3 章相同。

第 4 章:欧洲连接器市场预测

第 5 章:日本连接器市场预测

第 6 章:中国连接器市场预测

第 7 章:亚太地区连接器市场预测

第 8 章:世界其他地区连接器市场预测

The 2025 "Connector Industry Forecast" report provides an in-depth, and detailed forecast of the worldwide connector industry. In addition to the detailed forecasts for each region of the world (North America, Europe, Japan, China, Asia Pacific, and ROW), an industry overview is included which provides current market trends, currency fluctuation effects, and industry sales performance, as well as an outlook narrative.

Worldwide and each regional forecast includes:

Computers & Peripherals

Automotive

|

Transportation (non-auto)

|

2025- Not the Year we Anticipated

What a year! I don't think when we made our initial forecast at the beginning of 2025, that anyone had anticipated 2025 to be as strong as it appears it will be. We had agreed it was going to be a year of growth for both bookings and billings, but it has been over four years (2021) since we have seen year-over-year bookings as strong as they were this summer and this last half of 2025. The same can be said about billings, with seven out of the last nine months showing double-digit year-over-year growth.

After growing +5.6% in 2024, we are predicting that the connector industry will have year-over-year growth of +12.5% in 2025, the strongest year-over-year growth we have seen since the industry made its strong comeback the year following the COVID shutdown. As is expected, not all regions are performing as well as others, with several regions showing double-digit growth, and others showing low single-digit year-over-year growth.

Unlike previous years, when the summer months reflected a period of factory shutdowns and employee vacations, in 2025, the summer months represented the beginning of double-digit year-over-year and year-to-date growth in bookings and billings. With such strong bookings, it was easy to anticipate the remainder of 2025 to experience positive growth.

Industry Sales Performance by Region

In 2024, as seen by the table below, growth and decline were not equal across all regions, nor will they be in 2025. The Asia Pacific region saw the greatest growth in 2024, growing +19.2%. With growth of +12.1%, the Chinese region followed Asia Pacific. The only other region showing an increase was North America, where sales increased +6.8%. All other regions declined in 2024, with the greatest decline in the ROW region, where sales in US dollars decreased -15.7%, followed by Japan with a decline of -13.8%. Europe, the only other region declining, showed a decrease of -3.2%.

Assessing predicted performance in 2025, Asia Pacific, who was ranked number two in 2024, is anticipated to move up to the number one spot in 2025.

The Asia Pacific region will be followed by China. All other regions are projected to grow in the single digits.

In addition to connector sales results varying by region in 2024, electronic connector sales also varied remarkably by market sector. As the table below shows, in 2024, the computer & peripherals equipment/market sector saw the greatest percentage growth, at +10.7%. It is interesting to note that this was the first time since 2006 that the computer & peripherals market sector outperformed all other sectors!

2025 and Beyond Outlook

With industry backlog remaining strong, Bishop is forecasting 2025 sales. We anticipate the greatest percentage increase will occur in the Asia Pacific region. When looking at growth in U.S. dollars, although not the greatest increase percentage wise, the largest increase in sales will be seen in the Chinese region.

Forecast Assumptions

During times of world economic and geopolitical uncertainty it is very difficult to project future business conditions. Increased volatility as well as the presence of unexpected and random events that are difficult to anticipate can greatly affect economic indicators like unemployment, trade policies, or inflation. Consider the following economic headwinds, political challenges, and uncertainties.

- Instability in the worldwide economy. As announced by the International Monetary Fund, "while the near-term forecast is revised up modestly, global growth remains subdue, as the newly introduced polices slowly come into focus." They continue by stating that "the overall environment remains volatile, and temporary factors that supported activity in the first half of 2025-such as front-loading-are fading. Similar sentiment is being dictated by the World Economic Forum, who states "the global economy is entering a period of weak growth and systemic disruption, and that "some 72% of surveyed chief economists expect the global economy to weaken over the next year, amid intensifying trade disruption, rising policy uncertainty and accelerating technological change." All fundamental changes that will play out in future trade, fiscal policy, and debt, and that could potentially spiral into areas like the financial markets and monetary policies. It was also noted "with global public debt levels mounting, the chief economists surveyed highlight that debt vulnerabilities, once largely associated with emerging economies, are increasingly centred in advanced ones - 80% expect risks in advanced economies to grow in the year ahead. Fiscal vulnerabilities are also more frequently identified among the top growth inhibitors in advanced economies (41%) compared to developing economies (12%)." It will be interesting to hear the outcome of the World Economic Forum's annual meeting in January 2026 taking place in Davos Switzerland.

- Although in the U.S., the Feds dropped interest rates by 0.25 percentage points in September and October of 2025, the lowest level in three years, many are still concerned if this will be enough to keep growth steady, in the face of continuing economic uncertainty. With the supposed plan of giving a boost to the economy, lower interest rates make it cheaper to borrow money and in turn, prompt businesses to take out loans to expand production and hire more people. There is also hope and speculation that the drop will correlate to a drop in mortgage rates, which have been hovering around 7% over the last couple of years. Unfortunately, because a drop in interest rates primarily affects the rates banks use to lend money to each other, it is not going to affect the "interest rate spread" or the interest rates paid by businesses and consumers in the same way. Thus, making it highly unlikely that mortgage interest rates are going to drop drastically in the next few months. Also, there is still some question as to how the drop in the U.S. will affect the global central banks. Many feel that these cuts are a definite sign of economic conditions worsening worldwide, prompting many other countries to also look at cutting interest rates. Note: there is still a good chance that the Feds will cut interest rates by an additional 0.25 percentage points one more time before the year is over.

In addition to these, other forecast assumptions will also be discussed, these will cover supply change issues, political tensions, labor issues, as well as tariffs, commodity prices, and cybersecurity to name a few.

There are also some interesting projections as to why we will see connector growth in 2026 and beyond, and what that growth will be. These include factors such as strong bookings, historical growth, and low unemployment coupled with strong consumer spending.

This report details the markets where Bishop anticipates growth, and which subsectors will drive that growth. This report provides projections for the period 2025F through 2030F, with year-over-year percent change and five-year CAGR by region, market sector, and sub-sector. Will the industry continue to grow, and which years may not be as strong as others? These answers and more are revealed in the December 2025 "Connector Industry Forecast".

Table of Contents

Chapter 1 -2025 - Not the Year we Anticipated

- Bookings Year-over-Year and Year-to-Date

- Billings Year-over-Year and Year-to-Date

- Industry Backlog Continues to Shrink

- Industry Backlog April 2024/2025

- Connector Industry Book-to-Bill

- Change in Backlog

- Industry Sales Performance by Region

- 2023 and 2024 Connector Sales by Region with Percent Change

- 2023 and 2024 Change in Sales Dollars by Region

- 2024 and 2025F Connector Sales by Region with Percent Change

- 2024 and 2025F Change in Sales Dollars by Region

- 2023 and 2024 Connector Sales by Market Sector with Percent Change

- 2024 and 2025F Connector Sales by Market Sector with Percent Change and USD Delta

- Change in Market Share

- Market Share by Region 2015 through 2025F

- Market Share by Region 1994 through 2025F

- Industry Sales Performance by Month

- Historical Sales Performance

- Connector Industry Business Cycles Growth Cycles Highlighted

- Historical Percentage Change in Connector Demand

- 2024 and 2025 YTD Currency Impact on Regional Industry Growth

- Local Currency to One USD April 2024 versus April 2025

- Industry Sales Performance April 2025 USD-vs-Local Currencies

- 2025 Sales Outlook Historical Analysis

- Range of Projected 205 Connector Sales with YOY Percentage Growth

- Range of Projected 2025 Connector Sales

- Forecast Assumptions

- Forecast Projections

- Five-Year Outlook (2025-2030)

- Five Year Forecast - Region Percent Year-Over-Year Change Sales

- Five Year Forecast - End-Use Equipment Sector Percent Year-Over-Year Change Sales

- Equipment/Market Sectors

Chapter 2 - World Connector Forecast

- World Connector Market Forecast - Year-to-Year Dollar Change

- World Connector Market Forecast - Year-to-Year Percent Change

- Top Six End-Use Equipment Categories

- World End-Use Equipment Forecast - Summary

- 2024-2025F Percent Change and 2025F-2030F Five-Year CAGR

- 2025F and 2030F Market Share by Equipment Sector

- World End-Use Equipment Forecast - Detail

- Computers & Peripherals

- Mobile Computers

- Desktops

- Servers

- Storage Equipment

- Input/Output Equipment

- Communication LAN Devices

- Other Computer Equipment

- Business/Office Equipment

- Retail/POS Equipment

- Imaging Systems

- Other Office Equipment

- Instrumentation

- Automatic Test Equipment

- Analytical & Scientific Instruments

- Other Instruments

- Medical

- Diagnostic & Imaging Equipment

- Therapeutic Equipment

- Other Medical Equipment

- Industrial

- Heavy Equipment

- Industrial Automation & Process Control

- Building & Civil Engineering

- Energy Markets

- Machine Tools, Machinery & Robotics

- Other Equipment

- Automotive

- Body Wiring & Power Distribution

- Powertrain

- Comfort, Convenience & Entertainment

- Navigation & Instrumentation

- Safety & Security

- Transportation

- Commercial Air

- Commercial Vehicles

- Rail

- Heavy Equipment

- Recreation

- Commercial Marine

- Military

- Telecom/Datacom

- Carrier Network

- Enterprise Network

- Mobile & Wireless

- Wireless Infrastructure

- Subscriber Equipment

- Cable-Equipment-Infrastructure

- Other Telecommunications

- Consumer

- Personal/Portable Consumer Electronics

- Consumer Entertainment Electronics

- Consumer White Goods

- Other Consumer

- Other Equipment

Chapter 3 - North American Connector Forecast

- North American Connector Market Forecast - Year-to-Year Dollar Change

- North American Connector Market Forecast - Year-to-Year Percent Change

- Top Six End-Use Equipment Categories

- North American End-Use Equipment Forecast - Summary

- 2023-2024F Percent Change and 2024F-2029F Five-Year CAGR

- 2024F and 2029F Market Share by Equipment Sector

- North American End-Use Equipment Forecast - Detail

- Computers & Peripherals

- Mobile Computers

- Desktops

- Servers

- Storage Equipment

- Input/Output Equipment

- Communication LAN Devices

- Other Computer Equipment

- Business/Office Equipment

- Retail/POS Equipment

- Imaging Systems

- Other Office Equipment

- Instrumentation

- Automatic Test Equipment

- Analytical & Scientific Instruments

- Other Instruments

- Medical

- Diagnostic & Imaging Equipment

- Therapeutic Equipment

- Other Medical Equipment

- Industrial

- Heavy Equipment

- Industrial Automation & Process Control

- Building & Civil Engineering

- Energy Markets

- Machine Tools, Machinery & Robotics

- Other Equipment

- Automotive

- Body Wiring & Power Distribution

- Powertrain

- Comfort, Convenience & Entertainment

- Navigation & Instrumentation

- Safety & Security

- Transportation

- Commercial Vehicles

- RV's & Power Sports

- Commercial Air

- Marine

- Rail

- Construction

- Farm & Garden

- Military

- Telecom/Datacom

- Carrier Network

- Enterprise Network

- Mobile & Wireless

- Wireless Infrastructure

- Subscriber Equipment

- Cable-Equipment-Infrastructure

- Other Telecommunications

- Consumer

- Personal/Portable Consumer Electronics

- Home Video Equipment

- Home Audio Equipment

- Consumer White Goods

- Other Consumer

- Other Equipment