|

市场调查报告书

商品编码

1391958

生物工艺验证市场:依测试类型、按工艺组件、按最终用户、按地区Bioprocess Validation Market, By Test Type, By Process Component, By End User, By Geography |

||||||

生物製程验证市场规模预计将从 2023 年的 8.824 亿美元增至 2030 年的 4.609 亿美元,预测期内复合年增长率为 9.7%。

| 报告范围 | 报告详情 | ||

|---|---|---|---|

| 基准年 | 2022年 | 2023年市场规模 | 4.609 亿美元 |

| 实绩资料 | 2018-2021 | 预测期 | 2023-2030 |

| 预测期复合年增长率 | 9.70% | 2030年市场规模预测 | 8.824 亿美元 |

生物工艺验证是从设计阶段到商业生产的资料收集和评估,以建立科学证据,证明工艺可以始终如一地提供高品质的产品。生物製药生产的监管要求。近年来,在生技药品和单株抗体需求不断增长的推动下,生物製程验证市场经历了显着增长。生技药品正在彻底改变各个治疗领域的患者治疗和护理。生技药品的核准和生产的增加正在推动验证工作,以确保这些复杂分子的品质、功效和安全性。包括美国食品药物管理局(US FDA) 在内的各种监管机构对生物製程验证制定了严格的规定,推动了该市场的成长。

市场动态:

生物製程验证市场的成长是由塑造产业形势的各种因素所推动的。主要因素之一是对生物製药的需求不断增加。癌症和自体免疫疾病等慢性病的盛行率日益增加,导致了先进生技药品的开发以及对稳健的生物製程验证策略的需求。

市场成长的另一个因素是美国食品药物管理局(FDA)和欧洲药品管理局(EMA)等监管机构实施的严格监管。这些法规要求生物製药製造商证明製造流程的有效性和一致性,从而推动了对生物製程验证的需求。

此外,越来越多地采用无机活动(例如市场参与企业的收购)预计也将在预测期内推动全球生物製程验证市场的成长。例如,2020年4月,全球生命科学和诊断创新企业丹纳赫公司从通用电气生命科学部门收购了包括层析法系统在内的生物加工业务,以增强生技药品开发和製造解决方案。

但市场也存在一些抑制因素。挑战包括生物过程的复杂性和缺乏标准化验证方案。开发和验证生物製程非常耗时,并且需要对资源和基础设施进行大量投资。此外,生物工艺验证方面缺乏熟练的专业人员也阻碍了市场的成长。

儘管存在这些挑战,市场上仍存在一些成长机会。生物过程自动化和资料分析的技术进步预计将简化验证过程,降低成本并提高效率。此外,对个人化医疗的日益关注以及生物加工中一次性技术的日益采用为市场扩张提供了新的途径。

本研究的主要特点

- 本报告对全球生物製程验证市场进行了详细分析,并列出了以2022年为基准年的预测期(2023-2030)的市场规模和复合年增长率。

- 它还揭示了各个细分市场的潜在商机,并为该市场说明了一系列有吸引力的投资提案。

- 它还提供了有关市场驱动因素、抑制因素、机会、新产品发布和核准、市场趋势、区域前景、主要企业采取的竞争策略等的重要考察。

- 该报告的见解将使行销人员和公司负责人能够就未来的产品发布、升级、市场扩张和行销策略做出资讯的决策。

- 全球生物过程验证市场报告迎合了该行业的各种相关人员,如投资者、供应商、产品製造商、经销商、新进业者和财务分析师。

- 透过用于分析全球生物製程验证市场的各种策略矩阵,将有助于相关人员做出决策。

目录

第1章调查目的和假设

- 研究目标

- 假设

- 简称

第2章市场展望

- 报告说明

- 市场定义和范围

- 执行摘要

- Coherent Opportunity Map(COM)

第3章市场动态、法规及趋势分析

- 市场动态

- 促进因素

- 对生物製药产品的需求增加

- 抑制因素

- 生物过程的复杂性

- 机会

- 生物过程自动化和资料分析的技术进步

- 影响分析

- 主要亮点

- 监管场景

- 开始/核准测试类型

- PEST分析

- 波特的分析

- 併购场景

第4章生物製程验证市场-冠状病毒(COVID-19) 大流行的影响

- 新型冠状病毒感染疾病(COVID-19)的流行病学

- 供需面分析

- 经济影响

第5章全球生物製程验证市场,依测试类型,2018-2030

- 可提取物测试服务

- 微生物检测服务

- 理化检测服务

- 完整性测试服务

- 其他(相容性测试服务等)

第6章全球生物製程验证市场,依製程组成部分,2018-2030 年

- 滤芯

- 媒体容器和袋子

- 冷冻/解冻加工袋

- 生物反应器

- 输送系统

- 其他(搅拌系统等)

第7章全球生物製程验证市场,按最终用户划分,2018-2030 年

- 製药和生物技术公司

- 合约开发/製造组织

- 学术研究所

- 其他(临床研究机构等)

第8章全球生物製程验证市场(按地区),2018-2030

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 西班牙

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- ASEAN

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东和非洲

- 海湾合作委员会国家

- 以色列

- 南非

- 北非

- 中部非洲

- 其他中东地区

第9章竞争形势

- Sartorius Stedim Biotech

- Test Type Portfolio

- Merck KGaA

- Pall Corporation

- Cobetter Filtration Equipment

- Toxikon Corporation

- DOC Srl

- Meissner Filtration Test Types

- Thermo Fisher Scientific

- SGS SA

- Eurofins Scientific

- Lonza Group

- ProBioGen AG

- Charles River Laboratories

- Pacific BioLabs

- Gibraltar Laboratories

- Nelson Laboratories

- BioProcess Technology Consultants

- CMIC HOLDINGS Co., Ltd

- Cytovance Biologics

- Wuxi Biologics

第10章章

- 调查方法

- 关于出版商

The Bioprocess Validation Market size is expected to reach US$ 460.9 million by 2030, from US$ 882.4 million in 2023, growing at a CAGR of 9.7% during the forecast period.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2022 | Market Size in 2023: | US$ 460.9 Mn |

| Historical Data for: | 2018 to 2021 | Forecast Period: | 2023 - 2030 |

| Forecast Period 2023 to 2030 CAGR: | 9.70% | 2030 Value Projection: | US$ 882.4 Mn |

Bioprocess validation is the collection and evaluation of data, from the design stage through commercial production, which establishes scientific evidence that a process is capable of consistently delivering quality product. It is a regulatory requirement for biopharmaceuticals manufacturing. The bioprocess validation market has been witnessing significant growth in recent years driven by the increasing demand for biologics and monoclonal antibodies. Biologics have revolutionized patient care and treatments across various therapeutic areas. Rising biologics approvals and production have been propelling validation activities to guarantee the quality, efficacy, and safety of such complex molecules. Various regulatory agencies including the U.S. Food and Drug Administration (U.S. FDA) have stringent regulations for bioprocess validation, facilitating the growth of this market.

Market Dynamics:

The bioprocess validation market growth is driven by various factors that are shaping the industry landscape. One of the primary drivers is the increasing demand for biopharmaceutical products. The growing prevalence of chronic diseases, such as cancer and autoimmune disorders, has led to the development of advanced biologics, thereby creating a need for robust bioprocess validation strategies.

Another factor contributing to market growth is the stringent regulations imposed by regulatory authorities, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These regulations require biopharmaceutical manufacturers to demonstrate the effectiveness and consistency of their manufacturing processes, driving the demand for bioprocess validation.

Moreover, the increasing adoption of inorganic activities such as acquisition by the market players is expected to drive the growth of the global bioprocess validation market over the forecast period. For instance, in April 2020, Danaher Corporation, a global life sciences and diagnostic innovator, acquired the bioprocessing business from General Electric's life sciences division, including chromatography systems, to enhance biologics development and manufacturing solutions.

However, the market does face some restraints. The complex nature of bioprocessing and the lack of standardized validation protocols pose challenges. The development and validation of bioprocesses are time-consuming and require substantial investments in terms of resources and infrastructure. Additionally, the scarcity of skilled professionals with expertise in bioprocess validation further impedes market growth.

Despite these challenges, the market experiences several opportunities for growth. Technological advancements in bioprocess automation and data analytics are anticipated to streamline the validation process, reducing costs and enhancing efficiency. Furthermore, the increasing focus on personalized medicine and the rising adoption of single-use technologies in bioprocessing offer new avenues for the market expansion.

Key features of the study:

- This report provides in-depth analysis of the global bioprocess validation market, and provides market size (US$ Million) and compound annual growth rate (CAGR %) for the forecast period (2023-2030), considering 2022 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- Key companies covered as a part of this study include Sartorius Stedim Biotech, Merck KGaA, Pall Corporation, Cobetter Filtration Equipment, Toxikon Corporation, DOC S.r.l., MEISSNER FILTRATION PRODUCTS, Thermo Fisher Scientific, SGS SA, Eurofins Scientific, Lonza Group, ProBioGen AG, Charles River Laboratories, Pacific BioLabs, Gibraltar Laboratories, Nelson Laboratories, BioProcess Technology Consultants, CMIC HOLDINGS Co., Ltd, Cytovance Biologics, and Wuxi Biologics.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global bioprocess validation market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global bioprocess validation market.

Bioprocess Validation Market Segmentation:

- By Test Type

- Extractable Testing Services

- Microbiological Testing Services

- Physiochemical Testing Services

- Integrity Testing Services

- Others (Compatibility Testing Services and Others)

- By Process Component

- Filter Elements

- Media containers and bags

- Freezing And Thawing Process Bags

- Bioreactors

- Transfer Systems

- Others (Mixing Systems and Others)

- By End User

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations

- Academic and Research Institutes

- Other (Clinical Research Organizations and Others)

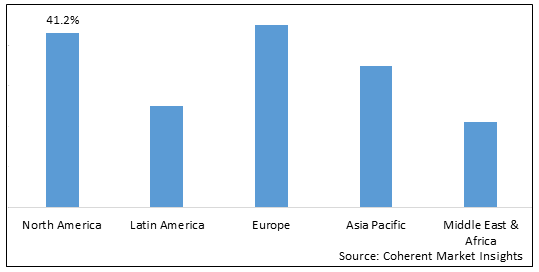

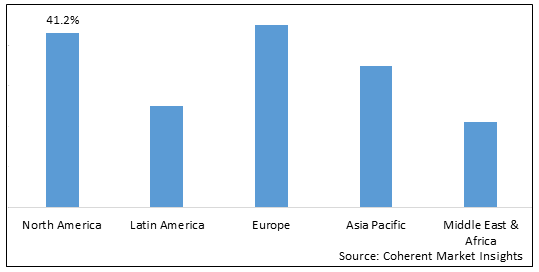

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Top Companies in Bioprocess Validation Market:

- Sartorius Stedim Biotech

- Merck KGaA

- Pall Corporation

- Cobetter Filtration Equipment

- Toxikon Corporation

- DOC S.r.l.

- MEISSNER FILTRATION PRODUCTS

- Thermo Fisher Scientific

- SGS SA

- Eurofins Scientific

- Lonza Group

- ProBioGen AG

- Charles River Laboratories

- Pacific BioLabs

- Gibraltar Laboratories

- Nelson Laboratories

- BioProcess Technology Consultants

- CMIC HOLDINGS Co., Ltd

- Cytovance Biologics

- Wuxi Biologics

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Bioprocess Validation, By Test Type

- Market Bioprocess Validation, By Process Component

- Market Bioprocess Validation, By End User

- Market Bioprocess Validation, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Increasing demand for biopharmaceutical products

- Restraints

- Complex nature of bioprocessing

- Opportunities

- Technological advancements in bioprocess automation and data analytics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Test Type launch/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Bioprocess Validation Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Global Bioprocess Validation Market , By Test Type, 2018-2030, (US$ Mn)

- Introduction

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2018 - 2030

- Segment Trends

- Extractable Testing Services

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

- Microbiological Testing Services

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

- Physiochemical Testing Services

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

- Integrity Testing Services

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

- Others (Compatibility Testing Services and Others)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

6. Global Bioprocess Validation Market , By Process Component, 2018-2030, (US$ Mn)

- Introduction

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2018- 2030

- Segment Trends

- Filter Elements

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

- Media containers and bags

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

- Freezing And Thawing Process Bags

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

- Bioreactors

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

- Transfer Systems

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

- Others (Mixing Systems and Others)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

7. Global Bioprocess Validation Market , By End User, 2018-2030, (US$ Mn)

- Introduction

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2018- 2030

- Segment Trends

- Pharmaceutical & Biotechnology Companies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

- Contract Development & Manufacturing Organizations

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

- Academic and Research Institutes

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

- Other (Clinical Research Organizations and Others)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2018-2030,(US$ Mn)

8. Global Bioprocess Validation Market , By Region, 2018-2030, (US$ Mn)

- Introduction

- Market Share Analysis, By Country, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, For Country 2018-2030

- Country Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Test Type, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Process Component, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2018-2030,(US$ Mn)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Test Type, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Process Component, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2018-2030,(US$ Mn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Test Type, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Process Component, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2018-2030,(US$ Mn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Test Type, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Process Component, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2018-2030,(US$ Mn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Test Type, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Process Component, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2018-2030,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2018-2030,(US$ Mn)

- GCC Countries

- Israel

- South Africa

- North Africa

- Central Africa

- Rest of Middle East

9. Competitive Landscape

- Sartorius Stedim Biotech

- Company Highlights

- Test Type Portfolio

- Key Developments

- Financial Performance

- Strategies

- Merck KGaA

- Pall Corporation

- Cobetter Filtration Equipment

- Toxikon Corporation

- DOC S.r.l.

- Meissner Filtration Test Types

- Thermo Fisher Scientific

- SGS SA

- Eurofins Scientific

- Lonza Group

- ProBioGen AG

- Charles River Laboratories

- Pacific BioLabs

- Gibraltar Laboratories

- Nelson Laboratories

- BioProcess Technology Consultants

- CMIC HOLDINGS Co., Ltd

- Cytovance Biologics

- Wuxi Biologics

- Analyst Views

10. Section

- Research Methodology

- About us