|

市场调查报告书

商品编码

1461322

下一代定序市场,按产品类型、按定序类型、按应用、按最终用户、按地理位置Next Generation Sequencing Market, By Product Type, By Sequencing Type, By Application, By End User, By Geography |

||||||

预计2024年下一代定序市场价值为165.1亿美元,预计到2031年将达到426.1亿美元,2024年至2031年年复合成长率(CAGR)为14.5%。

| 报告范围 | 报告详情 | ||

|---|---|---|---|

| 基准年: | 2023年 | 2023/2024 年市场规模: | 165.1 亿美元 |

| 历史数据: | 2019年至2023年 | 预测期: | 2024年至2031年 |

| 预测期间 2023/2024 至 2030/2031 年复合成长率: | 14.50% | 2030/2031 价值预测: | 426.1 亿美元 |

下一代定序(NGS)是指与第一代桑格定序相比,大幅降低了DNA定序成本、提高了DNA定序速度和通量的高通量DNA定序技术。 NGS 允许研究人员对整个基因组进行定序,并大规模分析基因活性或表现的模式。自 2005 年被发现以来,NGS 平台已经取得了巨大的进步,能够在一次运行中对数千到数百万个 DNA 片段进行测序。这种大规模平行定序允许基因组研究中的全面表征和发现,彻底改变了生物学和生物医学研究。 NGS 广泛应用于遗传学、肿瘤学、药物基因组学和个人化医疗等各个领域。

市场动态:

全球下一代定序市场的成长是由基因组学和精准医学在各种疾病中的不断增长的应用所推动的。癌症盛行率的上升以及对药物基因组学的日益关注正在推动临床诊断和监测中对 NGS 平台的需求。基因组学研究活动的不断增长,加上测序成本的持续下降以及便携式和用户友好型测序仪器的推出也推动了市场的成长。然而,由于NGS产生的大量资料和有限的生物资讯学知识导致的资料管理和分析问题仍然是一个挑战。同时,单细胞应用程式和基于云端的 NGS资料管理解决方案的发展带来了利润丰厚的成长机会。

研究的主要特点:

- 该报告对全球下一代定序市场进行了深入分析,并提供了以2023年为基准年的预测期(2024-2031)的市场规模和年复合成长率(CAGR%)。

- 它阐明了不同细分市场的潜在收入机会,并解释了该市场有吸引力的投资主张矩阵。

- 这项研究还提供了有关市场驱动因素、限制因素、机会、新产品发布或批准、市场趋势、区域前景以及主要参与者采取的竞争策略的重要见解。

- 它根据以下参数描述了全球下一代定序市场的主要参与者——公司亮点、产品组合、主要亮点、财务表现和策略。

- 该报告的见解将使行销人员和公司管理当局能够就未来的产品发布、类型升级、市场扩张和行销策略做出明智的决策。

- 全球下一代定序市场报告迎合了该行业的各个利益相关者,包括投资者、供应商、产品製造商、分销商、新进业者和财务分析师。

- 利害关係人可以透过用于分析全球下一代定序市场的各种策略矩阵轻鬆做出决策。

目录

第一章:研究目标与假设

- 研究目标

- 假设

- 缩写

第 2 章:市场范围

- 报告说明

- 市场定义和范围

- 执行摘要

- Coherent Opportunity Map (COM)

第 3 章:市场动态、法规与趋势分析

- 市场动态

- 司机

- 限制

- 市场机会

- 影响分析

- 市场走向

- 最近的发展

- 收购和合作场景

- 技术概览

- 监管场景

- 定价分析

- PEST分析

第 4 章:全球下一代定序市场 - 冠状病毒 (COVID-19) 大流行的影响

- 整体影响

- 政府倡议

- COVID-19 对市场的影响

第 5 章:2019 - 2031 年全球下一代定序市场(依产品类型)

- 概述

- 仪器

- 试剂及耗材

第 6 章:2019 - 2031 年全球下一代定序市场(依定序类型)

- 概述

- 全基因组定序

- 全外显子定序

- RNA定序

- 标靶重测序

- 其他的

第 7 章:2019 - 2031 年全球下一代定序市场(按应用)

- 概述

- 药物发现

- 个人化医疗

- 基因筛检

- 诊断

- 其他的

第 8 章:全球下一代定序市场,按最终用户划分,2019 - 2031 年

- 概述

- 医院和诊所

- 学术及研究机构

- 生物製药公司

- 临床实验室

- 其他的

第 9 章:2019 - 2031 年全球次世代定序市场(按地区)

- 介绍

- 北美洲

- 我们

- 加拿大

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 西班牙

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 东协

- 澳洲

- 韩国

- 亚太地区其他地区

- 中东

- 海湾合作委员会

- 以色列

- 中东其他地区

- 非洲

- 北非

- 中非

- 南非

第 10 章:竞争格局

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc

- bioMerieux SA

- F. Hoffmann-La Roche Ltd

- QIAGEN

- Illumina, Inc.

- Oxford Nanopore Technologies plc.

- BGI

- PerkinElmer Genomics

- Bio-Rad Laboratories Inc.

- Pacific Biosciences

- 10x Genomics

- Promega Corporation

- Macrogen Inc.

- Eurofins Scientific

- DNASTAR Inc.

- CD Genomics

第 11 章:分析师观点

- 命运之轮

- 分析师观点

- 连贯的机会图

第 12 章:参考文献与研究方法

- 参考

- 研究方法论

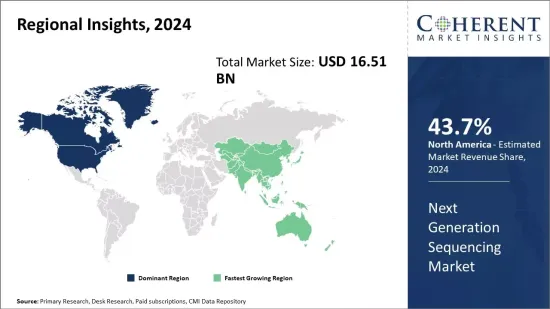

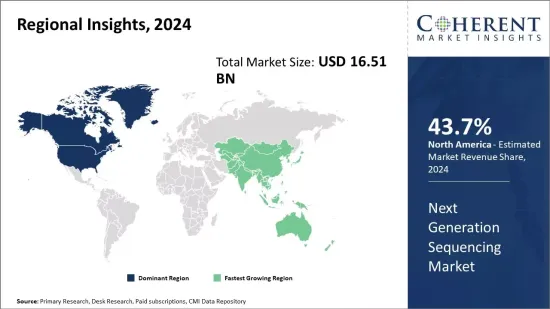

The next generation sequencing market is estimated to be valued at USD 16.51 Bn in 2024 and is expected to reach USD 42.61 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 14.5% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2023/2024: | US$ 16.51 Bn |

| Historical Data for: | 2019 to 2023 | Forecast Period: | 2024 to 2031 |

| Forecast Period 2023/2024 to 2030/2031 CAGR: | 14.50% | 2030/2031 Value Projection: | US$ 42.61 Bn |

Next Generation Sequencing (NGS) refers to the high-throughput DNA sequencing technologies that have substantially decreased the cost and increased the speed and throughput of DNA sequencing as compared to the first-generation Sanger sequencing. NGS allows researchers to sequence entire genomes, as well as to analyze the patterns of gene activity or expression on a large scale. Since its discovery in 2005, there have been tremendous improvements in NGS platforms which has enabled the sequencing of thousands to millions of DNA fragments in a single run. This massively parallel sequencing has revolutionized biological and biomedical research by allowing comprehensive characterization and discovery in genomic research. NGS finds applications across various fields including genetics, oncology, pharmacogenomics and personalized medicine.

Market Dynamics:

The global next generation sequencing market growth is driven by growing applications of genomics and precision medicine across various diseases. Rising prevalence of cancer and growing focus on pharmacogenomics is fueling the demand for NGS platforms in clinical diagnosis and monitoring. Growing genomics research activities, coupled with continuous decline in sequencing costs and introduction of portable and user-friendly sequencing instruments is also boosting the market growth. However, data management and analysis issues due to the massive amount of data generated from NGS, and limited bioinformatics knowledge remains a challenge. Meanwhile, developments in single-cell applications and cloud-based solutions for NGS data management presents lucrative growth opportunities.

Key Features of the Study:

- This report provides in-depth analysis of the global next generation sequencing market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2024-2031), considering 2023 as the base year.

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global next generation sequencing market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study includes Thermo Fisher Scientific Inc., Agilent Technologies Inc, bioMerieux SA, F. Hoffmann-La Roche Ltd, QIAGEN, Illumina Inc., Oxford Nanopore Technologies plc., BGI, PerkinElmer Genomics, Bio-Rad Laboratories Inc., Pacific Biosciences, 10x Genomics, Promega Corporation, Macrogen Inc., Eurofins Scientific, DNASTAR Inc., and CD Genomics.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- The global next generation sequencing market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global next generation sequencing market.

Market Segmentation

- Product Type:

- Instruments

- Reagents & Consumables

- Sequencing Type:

- Whole Genome Sequencing

- Whole Exome Sequencing

- RNA Sequencing

- Targeted Re-sequencing

- Others

- Application:

- Drug Discovery

- Personalized Medicine

- Genetic Screening

- Diagnostics

- Others

- End User:

- Hospitals & Clinics

- Academic & Research Institutes

- Biopharmaceutical Companies

- Clinical Laboratories

- Others

- Regional:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Company Profiles:

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc

- bioMerieux SA

- Hoffmann-La Roche Ltd

- QIAGEN

- Illumina Inc.

- Oxford Nanopore Technologies plc.

- BGI

- PerkinElmer Genomics

- Bio-Rad Laboratories Inc.

- Pacific Biosciences

- 10x Genomics

- Promega Corporation

- Macrogen Inc.

- Eurofins Scientific

- DNASTAR Inc.

- CD Genomics

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot, By Product Type

- Market Snapshot, By Sequencing Type

- Market Snapshot, By Application

- Market Snapshot, By End User

- Market Snapshot, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Impact Analysis

- Market Trends

- Recent Developments

- Acquisitions and Partnerships Scenario

- Technology Overview

- Regulatory Scenario

- Pricing Analysis

- PEST Analysis

4. Global Next Generation Sequencing Market- Impact of Coronavirus (COVID-19) Pandemic

- Overall Impact

- Government Initiatives

- COVID-19 Impact on the market

5. Global Next Generation Sequencing Market, By Product Type, 2019 - 2031, (US$ Billion)

- Overview

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019 - 2031

- Segment Trends

- Instruments

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- Reagents & Consumables

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

6. Global Next Generation Sequencing Market, By Sequencing Type, 2019 - 2031, (US$ Billion)

- Overview

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019 - 2031

- Segment Trends

- Whole Genome Sequencing

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- Whole Exome Sequencing

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- RNA Sequencing

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- Targeted Re-sequencing

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- Others

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

7. Global Next Generation Sequencing Market, By Application, 2019 - 2031, (US$ Billion)

- Overview

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019 - 2031

- Segment Trends

- Drug Discovery

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- Personalized Medicine

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- Genetic Screening

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- Diagnostics

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- Others

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

8. Global Next Generation Sequencing Market, By End User, 2019 - 2031, (US$ Billion)

- Overview

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2019 - 2031

- Segment Trends

- Hospitals & Clinics

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- Academic & Research Institutes

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- Biopharmaceutical Companies

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- Clinical Laboratories

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

- Others

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (US$ Billion)

9. Global Next Generation Sequencing Market, By Region, 2019 - 2031, (US$ Billion)

- Introduction

- Market Share Analysis, By Region, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, For Regions, 2019-2031

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Product Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, and Y-o-Y Growth, By Sequencing Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019 - 2031, (US$ Billion)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Product Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, and Y-o-Y Growth, By Sequencing Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019 - 2031, (US$ Billion)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Product Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, and Y-o-Y Growth, By Sequencing Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019 - 2031, (US$ Billion)

- UK

- Germany

- Italy

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Middle East

- GCC

- Israel

- Rest of Middle East

- Africa

- North Africa

- Central Africa

- South Africa

10. Competitive Landscape

- Thermo Fisher Scientific Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Market Strategies

- Agilent Technologies, Inc

- bioMerieux SA

- F. Hoffmann-La Roche Ltd

- QIAGEN

- Illumina, Inc.

- Oxford Nanopore Technologies plc.

- BGI

- PerkinElmer Genomics

- Bio-Rad Laboratories Inc.

- Pacific Biosciences

- 10x Genomics

- Promega Corporation

- Macrogen Inc.

- Eurofins Scientific

- DNASTAR Inc.

- CD Genomics

11. Analyst View

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

12. References and Research Methodology

- References

- Research Methodology

- About us and Sales Contact