|

市场调查报告书

商品编码

1483155

主动电子元件市场:依产品类型、最终用户、地区Active Electronic Components Market, By Product Type, By End User, By Geography |

||||||

主动电子元件市场预计到2024年将达到3,631.6亿美元,预计到2031年将达到6,611.8亿美元,2024年至2031年的复合年增长率为8.9%。

| 报告范围 | 报告详情 | ||

|---|---|---|---|

| 基准年 | 2023年 | 2024年市场规模 | 3631.6亿美元 |

| 实际资料 | 2019-2023 | 预测期 | 2024-2031 |

| 2024-2031 年预测期复合年增长率 | 8.90% | 2031 年金额预测 | 6611.8亿美元 |

有源电子元件市场是指用于需要电子讯号放大和开关的应用中的元件的销售。这些组件根据电气原理运作,包括电晶体、积体电路、光电元件、感测器、晶体振盪器等。半导体作为这些组件,彻底改变了电脑、通讯和消费性电子产品等领域。在组件小型化带来的更高功能以及电子和半导体製造领域持续技术进步的推动下,全球主动电子元件市场在过去几十年中经历了稳定成长。 5G 的推出、物联网设备的日益普及以及新兴国家对电子产品的需求不断增长等进步预计将在未来几年推动有源电子元件的需求。

市场动态:

推动主动电子元件市场成长的关键因素包括对智慧型手机、笔记型电脑、穿戴式装置和其他消费性电子产品不断增长的需求。全球5G网路的推出也是一个主要推动力,刺激了对射频元件、电源管理晶片、光学模组等的需求。此外,物联网设备在各行业的快速普及增加了对各种感测器、微控制器和其他电子元件的需求。然而,贸易紧张局势升级、半导体价格波动以及向新製造技术过渡的困难等因素正在抑制市场。主要机会包括更专注于需要先进主动元件的技术,例如边缘运算、自动驾驶汽车和人工智慧。新兴国家的电子产品和零件也拥有巨大的开拓市场潜力。

本研究的主要特点

本报告对全球主动电子元件市场进行了详细分析,并提出了以2023年为基准年的预测期(2024-2031)的市场规模和年复合成长率(CAGR%)。

它还说明了各个细分市场的潜在商机,并为该市场提供了一系列有吸引力的投资提案。

它还提供了有关市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景、主要企业采取的竞争策略等的重要见解。

它根据以下参数介绍了全球主动电子元件市场的主要企业:公司亮点、产品系列、主要亮点、财务表现和策略。

本研究涵盖的主要企业包括Infineon Technologies AG、Advanced Micro Devices, Inc.、STMicroElectronics NV、Microchip Technology, Inc.、Analog Devices, Inc.、Broadcom Inc.、NXP Semiconductors NV、Intel Corporation、Monolithic Power Systems, Inc. 。

该报告的见解使负责人和公司经营团队能够就未来的产品发布、类型升级、市场扩张和行销策略做出明智的决策。

本研究报告针对该产业的各个相关人员,如投资者、供应商、产品製造商、经销商、新进业者和财务分析师。

透过用于分析全球主动电子元件市场的各种策略矩阵,将有助于相关人员做出决策。

目录

第一章 研究目的与前提

- 研究目标

- 先决条件

- 简称

第二章 市场展望

- 报告说明

- 市场定义和范围

- 执行摘要

- 一致的机会地图 (COM)

第三章市场动态、法规及趋势分析

- 市场动态

- 促进因素

- 抑制因素

- 机会

- 监管场景

- 产业动态

- 併购

- 新系统的推出/核准

- COVID-19 大流行的影响

第四章全球主动电子元件市场,依产品类型,2019-2031

- 介绍

- 半导体装置

- 真空管

- 显示装置

第五章 全球主动电子元件市场,依最终用户划分,2019-2031

- 介绍

- 资讯科技

- 家用电器

- 航太和国防

- 车

- 医疗保健

- 其他的

第六章2019-2031年全球主动电子元件市场(按地区)

- 介绍

- 北美洲

第七章 竞争格局

- 公司简介

- Infineon Technologies AG

- Advanced Micro Devices, Inc.

- STMicroelectronics NV

- Microchip Technology, Inc.

- Analog Devices, Inc.

- Broadcom Inc.

- NXP Semiconductors NV

- Intel Corporation

- Monolithic Power Systems, Inc.

- Texas Instruments Incorporated

- Qualcomm Inc.

- Renesas Electronics Corporation

- Semiconductor Components Industries, LLC

- Toshiba Corporation

第八章 分析师建议

- 升起和降落

- 综合机会图

第9章调查方法

- 参考

- 调查方法

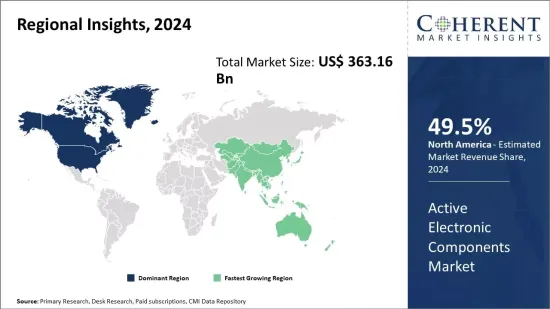

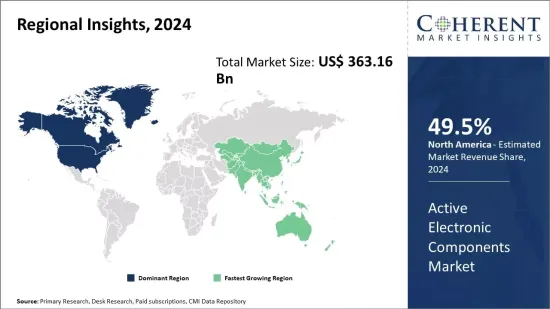

The Active Electronic Components Market is estimated to be valued at US$ 363.16 Bn in 2024 and is expected to reach US$ 661.18 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 8.9% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2024: | US$ 363.16 Bn |

| Historical Data for: | 2019 To 2023 | Forecast Period: | 2024 To 2031 |

| Forecast Period 2024 to 2031 CAGR: | 8.90% | 2031 Value Projection: | US$ 661.18 Bn |

The active electronic components market refers to the sale of components that are used in applications requiring amplification or switching of electronic signals. These components work on the principle of electricity and include transistors, integrated circuits, optoelectronics, sensors and crystal oscillators. Semiconductors act as the building blocks for these components which have revolutionized fields like computing, communications and consumer electronics. The global active electronic components market has witnessed steady growth over the past few decades owing to miniaturization of components leading to increased functionality and continued technological advances in electronics and semiconductor manufacturing. Advancements like 5G rollout, growing adoption of IoT devices, and rising demand for electronic products from emerging economies are expected to boost demand for active electronic components in the coming years.

Market Dynamics:

The key drivers boosting the active electronic components market growth include growing demand for smartphones, laptops, wearables, and other consumer electronics. The rollout of 5G networks worldwide is another major growth driver as it will spur demand for RF components, power management chips and optical modules among others. Furthermore, rapid proliferation of IoT devices across industries is increasing the need for various sensors, microcontrollers and other electronic components. However, factors such as rising trade tensions, volatility in semiconductor prices and difficulties associated with transition to newer manufacturing technologies act as restraints for the market. Some of the major opportunities include increasing focus on technologies like edge computing, autonomous vehicles and artificial intelligence which will require advanced active components. Emerging economies also present a huge untapped market potential for electronic products and components.

Key features of the study:

This report provides in-depth analysis of the global active electronic components market, and provides market size (US$ Billion) and compound annual growth rate (CAGR %) for the forecast period (2024-2031), considering 2023 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global active electronic components market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include Infineon Technologies AG, Advanced Micro Devices, Inc., STMicroelectronics N.V., Microchip Technology, Inc., Analog Devices, Inc., Broadcom Inc., NXP Semiconductors N.V., Intel Corporation, Monolithic Power Systems, Inc., Texas Instruments Incorporated, Qualcomm Inc., Renesas Electronics Corporation, Semiconductor Components Industries, LLC, and Toshiba Corporation

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global active electronic components market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global active electronic components market

Market Segmentation

- By Product Type

- Semiconductor Devices

- Vacuum Tubes

- Display Devices

- By End user

- Information Technology

- Consumer electronics

- Aerospace and defense

- Automotives

- Healthcare

- Others

- By Regional

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Key Players Insights

- Infineon Technologies AG

- Advanced Micro Devices, Inc.

- STMicroelectronics N.V.

- Microchip Technology, Inc.

- Analog Devices, Inc.

- Broadcom Inc.

- NXP Semiconductors N.V.

- Intel Corporation

- Monolithic Power Systems, Inc.

- Texas Instruments Incorporated

- Qualcomm Inc.

- Renesas Electronics Corporation

- Semiconductor Components Industries, LLC

- Toshiba Corporation

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Product Type

- Market Snippet, By End User

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New system Launch/Approvals

- Impact of the COVID-19 Pandemic

4. Global Active Electronic Components Market, By Product Type, 2019-2031 (US$ Billion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020-2031

- Segment Trends

- Semiconductor Devices

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Vacuum Tubes

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Display Devices

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

5. Global Active Electronic Components Market, By End User, 2019-2031 (US$ Billion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020-2031

- Segment Trends

- Information Technology

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Consumer electronics

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Aerospace and defense

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Automotives

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Healthcare

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

- Others

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Billion)

6. Global Active Electronic Components Market, By Region, 2019-2031 (US$ Billion)

- Introduction

- Market Share Analysis, By Region, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020-2031

- North America

- Regional Trends

- Market Size and Forecast, By Product Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By End User, 2019-2031 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Product Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By End User, 2019-2031 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- U.K.

- Germany

- Italy

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Product Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By End User, 2019-2031 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- China

- India

- ASEAN

- Australia

- South Korea

- Japan

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Product Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By End User, 2019-2031 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa

- Regional Trends

- Market Size and Forecast, By Product Type, 2019-2031 (US$ Billion)

- Market Size and Forecast, By End User, 2019-2031 (US$ Billion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

7. Competitive Landscape

- Company Profiles

- Infineon Technologies AG

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Advanced Micro Devices, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- STMicroelectronics N.V.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Microchip Technology, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Analog Devices, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Broadcom Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- NXP Semiconductors N.V.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Intel Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Monolithic Power Systems, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Texas Instruments Incorporated

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Qualcomm Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Renesas Electronics Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Semiconductor Components Industries, LLC

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Toshiba Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Infineon Technologies AG

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. Research Methodology

- References

- Research Methodology

- About us and Sales Contact