|

市场调查报告书

商品编码

1608714

麻醉设备市场:依产品类型、最终用户、地区Anesthesia Device Market, By Product Type, By End User, By Geography |

||||||

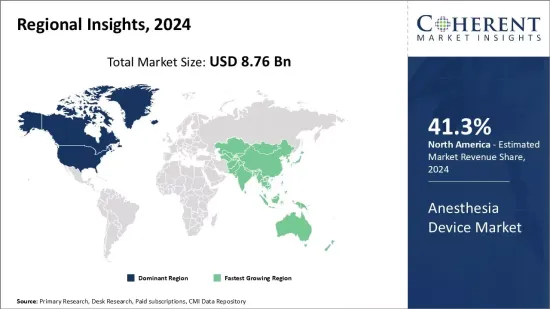

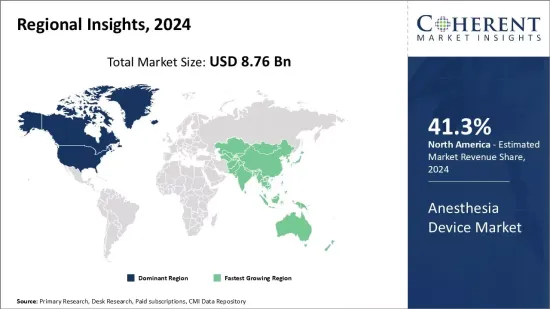

麻醉设备市场预计到2024年将达到87.6亿美元,预计到2031年将达到139.4亿美元,2024年至2031年的复合年增长率为6.9%。

| 分析范围 | 分析详情 | ||

|---|---|---|---|

| 基准年 | 2023年 | 市场规模(2024年) | 87.6亿美元 |

| 实际资料 | 2019-2023 | 预测期 | 2024-2031 |

| 预测期复合年增长率(2024-2031): | 6.90% | 预计金额(2031年) | 139.4亿美元 |

由于全球外科手术数量的增加,麻醉设备市场在过去几年中出现了显着成长。麻醉机对于在手术前和手术期间向患者施用麻醉剂以诱导意识状态改变(包括意识丧失和遗忘)至关重要。各种类型的麻醉机,包括麻醉麻醉仪器、连续麻醉仪器、麻醉呼吸机,广泛应用于医院及门诊手术中心。此外,人口老化加剧,更容易患慢性疾病和损伤,进一步增加了世界各地对各种麻醉手术的需求。随着医疗技术的进步,麻醉设备市场预计在未来几年将稳定成长。

市场动态:

全球麻醉设备市场受到慢性呼吸系统和心臟疾病率增加、复杂外科手术数量增加以及门诊手术中心数量增加等因素的推动。然而,新兴国家先进麻醉设备的高成本和熟练麻醉师的缺乏构成了限制市场成长的重大挑战。可携式麻醉输送设备的引入为製造商提供了有利的机会,以促进在偏远地区进行外科手术。此外,正在进行的研究开发具有更快起效和抵消作用的新型麻醉剂也是市场参与企业的成长途径。

本报告的主要特点

本报告对全球麻醉设备市场进行了详细分析,并提供了以2023年为基准年的预测期(2024-2031)的市场规模和年复合成长率(CAGR%)。

它还揭示了各个细分市场的潜在商机,并说明了该市场有吸引力的投资提案矩阵。

它还提供了有关市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景、主要企业采取的竞争策略等的主要考察。

它根据公司亮点、产品系列、主要亮点、财务表现和策略等参数,介绍了全球麻醉设备市场的主要企业。

本报告涵盖的主要企业包括 GE Healthcare、Septodont Inc.、Draegerwerk AG &Co.KGaA、北京谊安医疗有限公司、HYER Medical AG、ORICARE, Inc.、BD、Getinge AB、3M、Teleflex Incorporated、Ambu A/ S ,Mindray Medical India Pvt. Ltd.、Fisher & Paykel Healthcare Limited.、Koninklijke Philips NV等

该报告的见解使负责人和公司经营团队能够就未来的产品发布、升级、市场扩张和行销策略做出明智的决策。

本研究报告针对该产业的各个相关人员,如投资者、供应商、产品製造商、经销商、新进业者和财务分析师。

透过用于分析全球麻醉设备市场的各种策略矩阵,将促进相关人员的决策。

目录

第一章 分析目的与前提

- 分析目的

- 先决条件

- 简称

第二章 市场展望

- 报告说明

- 市场定义和范围

- 执行摘要

第三章市场动态、法规与趋势分析

- 市场动态

- 影响分析

- 主要亮点

- 监管场景

- 产品发布/核准

- PEST分析

- 波特的分析

- 企业合併(M&A) 场景

第四章全球麻醉设备市场:依产品类型,2019-2031(十亿美元)

- 麻醉人工呼吸器

- 麻醉监控器

- 麻醉剂给药装置

- 麻醉工作站

- 其他的

第五章 全球麻醉设备市场:依最终使用者划分,2019-2031 年(十亿美元)

- 医院

- 门诊手术中心

- 专科诊所

- 其他的

第六章 全球麻醉设备市场:依地区划分,2019-2031 年(十亿美元)

- 北美洲

- 拉丁美洲

- 欧洲

- 亚太地区

- 中东

- 非洲

第七章 竞争格局

- GE Healthcare

- Septodont Inc.

- Draegerwerk AG & Co. KGaA

- Beijing Aeonmed Co., Ltd.

- HYER Medical AG

- ORICARE, Inc.

- BD

- Getinge AB

- 3M

- Teleflex Incorporated

- Ambu A/S

- Mindray Medical India Pvt. Ltd.

- Fisher & Paykel Healthcare Limited.

- Koninklijke Philips NV

第八章 分析师建议

- 命运之轮

- 分析师观点

- 一致的机会图

第9章 参考文献及调查方法

- 参考

- 调查方法

- 关于出版商

The anesthesia device market is estimated to be valued at USD 8.76 Bn in 2024 and is expected to reach USD 13.94 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 6.9% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2024: | 8.76 Bn |

| Historical Data for: | 2019 to 2023 | Forecast Period: | 2024 to 2031 |

| Forecast Period 2024 to 2031 CAGR: | 6.90% | 2031 Value Projection: | 13.94 Bn |

The anesthesia device market has been witnessing significant growth over the past few years owing to the rising number of surgical procedures performed globally. Anesthesia devices are crucial for administering aesthetic agents to patients before and during surgeries to induce altered states of consciousness that include unconsciousness and amnesia. Various types of anesthesia delivery devices such as anesthesia machines, continuous anesthesia machines, and anesthesia ventilators are widely utilized across hospitals and ambulatory surgical centers. Moreover, the growing geriatric population that is more susceptible to chronic diseases and injuries has further fueled the demand for different anesthesia procedures worldwide. With ongoing advancements in medical technologies, the anesthesia device market is expected to grow steadily in the coming years.

Market Dynamics:

The global anesthesia device market is driven by factors such as the increasing prevalence of chronic respiratory diseases and cardiac conditions, rising volume of complex surgical procedures performed, and the growing number of ambulatory surgical centers. However, the high costs associated with advanced anesthesia devices and lack of skilled anaesthesiologists in developing countries are some of the major challenges restraining the market growth. The introduction of portable anesthesia delivery devices offers lucrative opportunities for manufacturers as they enable the performance of surgical procedures at remote locations easily. In addition, ongoing research on developing novel anesthesia agents with faster onset and offset of action presents another growth avenue for market participants.

Key Features of the Study:

This report provides in-depth analysis of the global anesthesia device market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2024-2031), considering 2023 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global anesthesia device market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include GE Healthcare, Septodont Inc., Draegerwerk AG & Co. KGaA, Beijing Aeonmed Co., Ltd., HYER Medical AG, ORICARE, Inc., BD, Getinge AB, 3M, Teleflex Incorporated, Ambu A/S, Mindray Medical India Pvt. Ltd., Fisher & Paykel Healthcare Limited., and Koninklijke Philips N.V.

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global anesthesia device market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global anesthesia device market

Market Segmentation

- By Product Type Insights (Revenue, USD Bn, 2019 - 2031)

- Anesthesia Ventilators

- Anesthesia Monitors

- Anesthesia delivery machines

- Anesthesia Workstation

- Others

- By End User Insights (Revenue, USD Bn, 2019 - 2031)

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

- Regional Insights (Revenue, USD Bn, 2019 - 2031)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- GE Healthcare

- Septodont Inc.

- Draegerwerk AG & Co. KGaA

- Beijing Aeonmed Co., Ltd.

- HYER Medical AG

- ORICARE, Inc.

- BD

- Getinge AB

- 3M

- Teleflex Incorporated

- Ambu A/S

- Mindray Medical India Pvt. Ltd.

- Fisher & Paykel Healthcare Limited.

- Koninklijke Philips N.V.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Anesthesia Device Market, By Product Type

- Anesthesia Device Market, By End User

- Anesthesia Device Market, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Global Anesthesia Device Market, By Product Type, 2019-2031, (USD Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020 - 2031

- Segment Trends

- Anesthesia Ventilators

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Anesthesia Monitors

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Anesthesia delivery machines

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Anesthesia Workstation

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

5. Global Anesthesia Device Market, By End User, 2019-2031, (USD Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020 - 2031

- Segment Trends

- Hospitals

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Ambulatory Surgical Centers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Specialty Clinics

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

6. Global Anesthesia Device Market, By Region, 2019 - 2031, Value (USD Bn)

- Introduction

- Market Share (%) Analysis, 2024,2027 & 2031, Value (USD Bn)

- Market Y-o-Y Growth Analysis (%), 2020 - 2031, Value (USD Bn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Product Type, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By End User, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Country, 2019 - 2031, Value (USD Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Product Type, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By End User, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Country, 2019 - 2031, Value (USD Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Product Type, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By End User, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Country, 2019 - 2031, Value (USD Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Product Type, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By End User, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Country, 2019 - 2031, Value (USD Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Product Type, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By End User, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Country, 2019 - 2031, Value (USD Bn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Product Type, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By End User, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Country/Region, 2019 - 2031, Value (USD Bn)

- South Africa

- North Africa

- Central Africa

7. Competitive Landscape

- GE Healthcare

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Septodont Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Draegerwerk AG & Co. KGaA

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Beijing Aeonmed Co., Ltd.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- HYER Medical AG

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- ORICARE, Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- BD

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Getinge AB

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- 3M

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Teleflex Incorporated

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Ambu A/S

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Mindray Medical India Pvt. Ltd.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Fisher & Paykel Healthcare Limited.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Koninklijke Philips N.V.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. References and Research Methodology

- References

- Research Methodology

- About us