|

市场调查报告书

商品编码

1673078

网路安全保险市场:按保险类型、承保范围、公司规模、最终用户和地区划分Cyber Security Insurance Market, By Insurance Type, By Coverage Type, By Enterprise Size, By End user, By Geography |

||||||

2025 年全球网路安全保险市场规模估计为 193.5 亿美元,预计到 2032 年将达到 714.4 亿美元,2025 年至 2032 年的年复合成长率(CAGR)为 20.5%。

| 报告范围 | 报告详细信息 | ||

|---|---|---|---|

| 基准年 | 2024 | 2025 年市场规模 | 193.5亿美元 |

| 效能资料 | 2020-2024 | 预测期 | 2025-2032 |

| 预测期:2025 年至 2032 年复合年增长率 | 20.50% | 2032 年金额预测 | 714.4亿美元 |

业界的见解

网路威胁的快速增加给全球企业带来了重大挑战。随着网路攻击的频率和规模不断增长,企业正在投入更多资源来加强其安全态势并防范财务和声誉风险。这导致对网路安全保险的需求上升,这种保险可以帮助公司将部分风险转移给保险公司。网路安全保险涵盖与资料外洩、网路中断、勒索软体攻击以及违反隐私法导致的诉讼相关的费用。网路安全保险可协助组织管理风险、限制影响并确保网路攻击后的业务永续营运。

市场动态

针对敏感资料和关键基础设施的复杂网路攻击案例不断增加,是推动网路安全保险市场发展的主要因素。报告预测,到 2025 年,网路犯罪造成的损失将超过每年 10 兆美元。保险公司意识到了这一威胁,并正在利用他们的专业知识来帮助企业。然而,由于保险合约定义不标准化且新风险无法准确评估,承保业务带来了挑战。保险公司正在投资组建专家团队,以掌握不断变化的威胁情况。同时,政府对资料保护的强制要求不断增加,也推动了合规保险的需求。这对保险公司来说是一个创新保险范围、满足产业特定需求的机会。

研究的主要特点

- 本报告对全球网路安全保险市场进行了详细分析,并以 2024 年为基准年,给出了预测期(2025-2032 年)的市场规模和年复合成长率(CAGR %)。

- 它还强调了各个领域的潜在商机并说明了该市场的有吸引力的投资提案矩阵。

- 它还提供了对市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景以及主要企业采用的竞争策略的重要见解。

- 它根据公司亮点、产品系列、关键亮点、财务表现和策略等参数,概述了全球网路安全保险市场的主要企业。

- 全球网路安全保险市场报告针对该行业的各个相关人员,包括投资者、供应商、产品製造商、经销商、新进业者和金融分析师。

- 相关人员可以透过全球网路安全保险市场分析中使用的各种策略矩阵更轻鬆地做出决策。

目录

第一章 调查目的与前提条件

- 研究目标

- 先决条件

- 简称

第二章 市场展望

- 报告描述

- 市场定义和范围

- 执行摘要

- 一致的机会图 (COM)

第三章市场动态、法规与趋势分析

- 市场动态

- 驱动程式

- 限制因素

- 机会

- 监管情景

- 产业趋势

- 合併和收购

- 新系统推出/核准

- 新冠肺炎疫情的影响

4. 2020 年至 2032 年全球网路安全保险市场(依保单类型)

- 介绍

- 独立

- 相容类型

5. 2020 年至 2032 年按保险类型分類的全球网路安全保险市场

- 介绍

- 成员

- 责任险

6. 2020 年至 2032 年全球网路安全保险市场(依公司规模)

- 介绍

- 中小型企业

- 大型企业

7. 2020 年至 2032 年全球网路安全保险市场(依最终使用者划分)

- 介绍

- 医疗

- 零售

- BFSI

- 资讯科技和通讯

- 製造业

- 其他(政府、旅游及旅游业)

8. 2020 年至 2032 年全球网路安全保险市场(按地区划分)

- 介绍

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第九章 竞争格局

- 公司简介

- BitSight

- Prevalent

- RedSeal

- SecurityScorecard

- Cyber Indemnity Solutions

- Allianz

- AIG

- Aon

- Arthur J. Gallagher &Co

- Travelers Insurance

- AXA XL

- Axis

- Chubb

- Travelers Indemnity Company

- American International Group, Inc.

- Beazley Group

- CNA Financial Corporation

- AXIS Capital Holdings Limited

- BCS Financial Corporation

- Zurich Insurance

- The Hanover Insurance, Inc.

第 10 章分析师建议

- 兴衰

- 一致的机会地图

第 11 章调查方法

- 参考

- 调查方法

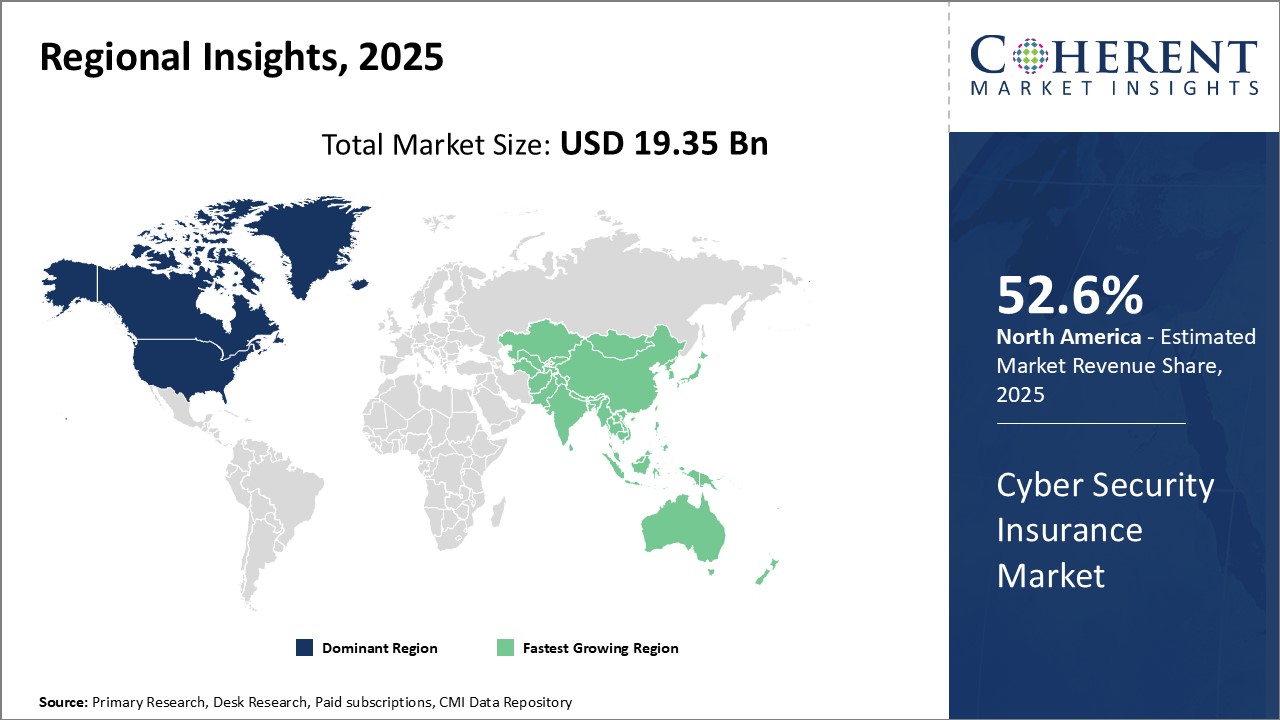

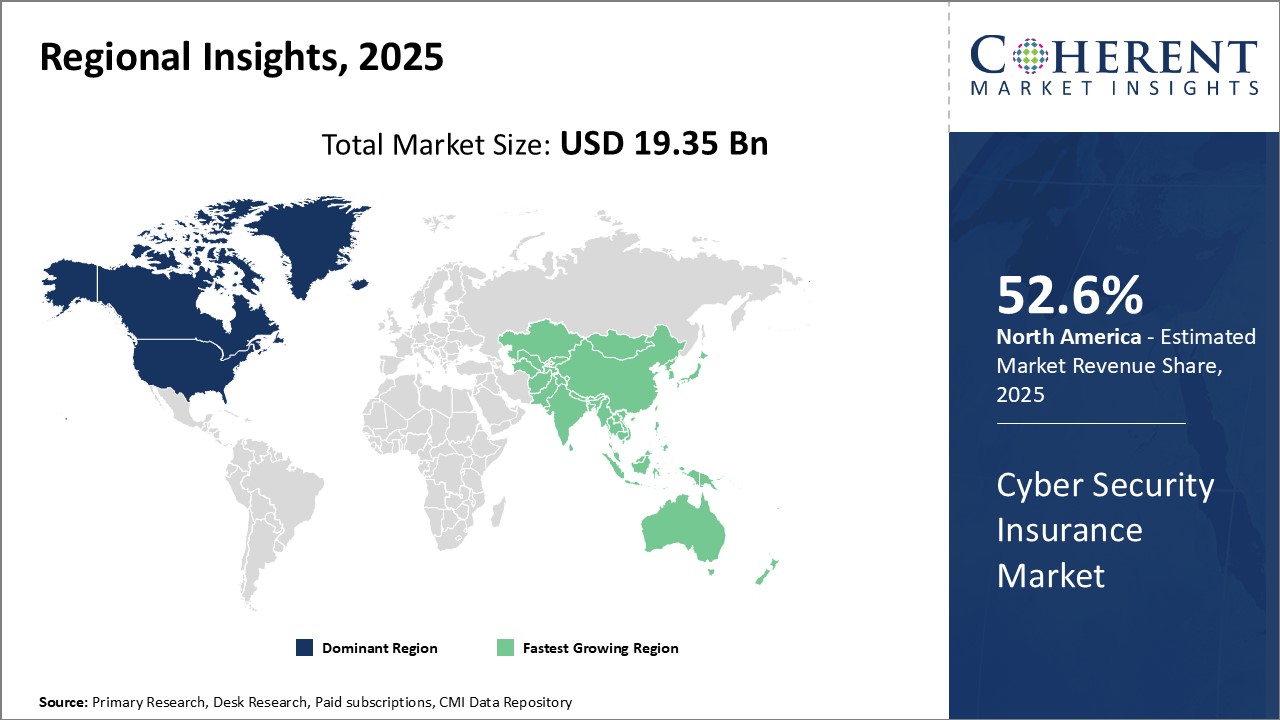

Global Cyber Security Insurance Market is estimated to be valued at USD 19.35 Bn in 2025 and is expected to reach USD 71.44 Bn by 2032, growing at a compound annual growth rate (CAGR) of 20.5% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 19.35 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 20.50% | 2032 Value Projection: | USD 71.44 Bn |

Report Description:

The rapid rise in cyber threats has posed significant challenges for businesses globally. As cyberattacks continue to grow in frequency and scale, organizations are allocating greater resources to strengthen their security posture and protect against financial and reputational risks. This has boosted demand for cybersecurity insurance which helps businesses transfer some risks to insurers. Cybersecurity insurance provides coverage for costs associated with data breaches, network disruptions, ransomware attacks, and litigation arising from privacy law violations. It assists organizations in managing risks, containing impacts, and ensuring business continuity in the wake of a cyberattack.

Market Dynamics:

Growing instances of sophisticated cyberattacks targeting sensitive data and critical infrastructure is a key driver propelling the cybersecurity insurance market. According to reports, cybercrime costs are projected to surpass US$ 10 trillion annually by 2025. Insurers are recognizing this threat and leveraging their expertise to assist businesses. However, the lack of standardized policy definitions and accurately assessing emerging risks pose challenges for underwriting practices. Insurers are investing in expert teams to stay abreast of the evolving threat landscape. Meanwhile, increasing government mandates for data protection are creating demand for compliant policies. This is an opportunity for insurers to innovate covers catering to industry specific requirements.

Key features of the study:

- This report provides in-depth analysis of the global cybersecurity insurance market, and provides market size (US$ Billion) and compound annual growth rate (CAGR %) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global cybersecurity insurance market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include BitSight, Prevalent, RedSeal, SecurityScorecard, Cyber Indemnity Solutions, Allianz, AIG, Aon, Arthur J. Gallagher & Co, Travelers Insurance, AXA XL, Axis, Chubb, Travelers Indemnity Company, American International Group, Inc., Beazley Group, CNA Financial Corporation, AXIS Capital Holdings Limited, BCS Financial Corporation, Zurich Insurance, and The Hanover Insurance, Inc.

- The global cybersecurity insurance market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global cybersecurity insurance market.

Market Segmentation

- By Insurance Type

- Standalone

- Tailored

- By Coverage Type

- First-party

- Liability Coverage

- By Enterprise Size

- SMEs

- Large Enterprise

- By End user

- Healthcare

- Retail

- BFSI

- IT & Telecom

- Manufacturing

- Others (Government, Travel & Tourism)

- By Regional

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Key Players Insights

- BitSight

- Prevalent

- RedSeal

- SecurityScorecard

- Cyber Indemnity Solutions

- Allianz

- AIG

- Aon

- Arthur J. Gallagher & Co

- Travelers Insurance

- AXA XL

- Axis

- Chubb

- Travelers Indemnity Company

- American International Group, Inc.

- Beazley Group

- CNA Financial Corporation

- AXIS Capital Holdings Limited

- BCS Financial Corporation

- Zurich Insurance

- The Hanover Insurance, Inc.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Insurance Type

- Market Snippet, By Coverage Type

- Market Snippet, By Enterprise Size

- Market Snippet, By End user

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New system Launch/Approvals

- Impact of the COVID-19 Pandemic

4. Global Cybersecurity Insurance Market, By Insurance Type, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Standalone

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Tailored

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

5. Global Cybersecurity Insurance Market, By Coverage Type, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- First-party

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Liability Coverage

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

6. Global Cybersecurity Insurance Market, By Enterprise Size, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- SMEs

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Large Enterprise

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

7. Global Cybersecurity Insurance Market, By End user, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Healthcare

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Retail

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- BFSI

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- IT & Telecom

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Manufacturing

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Others (Government, Travel & Tourism)

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

8. Global Cybersecurity Insurance Market, By Region, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- North America

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- U.K.

- Germany

- Italy

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- China

- India

- ASEAN

- Australia

- South Korea

- Japan

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

9. Competitive Landscape

- Company Profiles

- BitSight

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Prevalent

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- RedSeal

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- SecurityScorecard

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Cyber Indemnity Solutions

- Allianz

- AIG

- Aon

- Arthur J. Gallagher & Co

- Travelers Insurance

- AXA XL

- Axis

- Chubb

- Travelers Indemnity Company

- American International Group, Inc.

- Beazley Group

- CNA Financial Corporation

- AXIS Capital Holdings Limited

- BCS Financial Corporation

- Zurich Insurance

- The Hanover Insurance, Inc.

- BitSight

10. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. Research Methodology

- References

- Research Methodology

- About us and Sales Contact