|

市场调查报告书

商品编码

1699566

按类型、通路和地区分類的汇款服务市场Money Transfer Services Market, By Type (Inward Money Transfer and Outward Money Transfer), By Channel (Money Transfer Operators, Banks, and Other Channels), By Geography (North America, Latin America, Asia Pacific, Europe, Middle East, and Africa) |

||||||

预计 2025 年全球汇款服务市场规模为 423.1 亿美元,到 2032 年将达到 1,217.6 亿美元,2025 年至 2032 年的复合年增长率为 16.3%。

| 报告范围 | 报告详细信息 | ||

|---|---|---|---|

| 基准年 | 2024 | 2025年的市场规模 | 423.1亿美元 |

| 效能数据 | 从2020年到2024年 | 预测期 | 2025年至2032年 |

| 预测期:2025-2032年复合年增长率: | 16.30% | 2032年价值预测 | 1217.6亿美元 |

由于跨境贸易的成长、全球移民的增加以及数位付款管道的快速普及,市场正在经历显着增长。随着行动钱包和金融科技解决方案的兴起,消费者越来越多地转向更快、更经济、更安全的汇款服务。此外,区块链和人工智慧在汇款服务中的整合正在透过提高透明度和效率进一步改变产业。然而,法规遵循、网路安全威胁和外汇波动等挑战持续成为市场成长的障碍。

市场动态:

全球汇款服务市场的成长主要受到国际移民增加以及对无缝即时付款解决方案日益增长的需求的推动。数位银行基础设施的扩展和对行动交易的日益依赖对产业的发展做出了重大贡献。此外,新兴经济体政府主导的金融包容性倡议正在培育更具竞争力和多样化的市场格局。然而,该行业面临的挑战包括高昂的交易费用、不断变化的监管要求以及持续存在的诈骗和网路威胁风险。同时,区块链技术和人工智慧在金融服务中的融合,以及基于行动的汇款解决方案的扩展,为市场参与者提供创新、经济、安全和高效的汇款服务创造了有利可图的机会。

本研究的主要特点

本报告对全球汇款服务市场进行了详细分析,并以 2024 年为基准年,展示了预测期(2025-2032 年)的市场规模和年复合成长率(CAGR%)。

它还强调了各个领域的潜在商机,并说明了该市场的有吸引力的投资提案矩阵。

它还提供了有关市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景和主要企业采用的竞争策略的重要见解。

全球汇款服务市场的主要企业已根据公司亮点、产品系列、主要亮点、业绩和策略等参数进行了分析。

研究涉及的主要企业包括西联汇款公司、Wise(TransferWise Ltd.)、Revolut Ltd.、Remitly Inc.、速汇金国际公司、PayPal Holdings Inc.、WorldRemit Ltd.、Intermex 电汇、Paytm(One97 Communications Limited)、OFX(OzForex)、摩根大通公司、美国银行公司和花旗银行公司。

从本报告中获得的见解将使负责人和企业经营团队能够就未来的产品发布、新兴趋势、市场扩张和行销策略做出明智的决策。

本研究报告针对该产业的各个相关人员,包括投资者、供应商、产品製造商、经销商、新进业者和财务分析师。

目录

第一章 调查目的与前提条件

- 研究目标

- 先决条件

- 简称

第二章 市场展望

- 报告描述

- 市场定义和范围

- 执行摘要

第三章市场动态、法规与趋势分析

- 市场动态

- 影响分析

- 主要亮点

- 监管情景

- 产品发布/核准

- PEST分析

- 波特分析

- 市场机会

- 监管情景

- 主要进展

- 产业趋势

4. 2020 年至 2032 年全球汇款服务市场(按类型)

- 存款及汇款

- 提款/汇款

5. 2020 年至 2032 年全球汇款服务市场(依通路划分)

- 汇款提供者

- 银行

- 其他管道

6. 2020 年至 2032 年全球汇款服务市场(按地区)

- 北美洲

- 拉丁美洲

- 欧洲

- 亚太地区

- 中东

- 非洲

第七章 竞争态势

- The Western Union Company

- Wise(TransferWise Ltd.)

- Revolut Ltd.

- Remitly Inc.

- MoneyGram International Inc.

- PayPal Holdings Inc.

- WorldRemit Ltd.

- Intermex Wire Transfer

- Paytm(One97 Communications Limited)

- OFX(OzForex)

- JPMorgan Chase & Co.

- Bank of America Corporation

- Citigroup Inc.

- Wells Fargo & Company

- WorldFirst

第 8 章分析师建议

- 命运之轮

- 分析师观点

- 一致的机会图

第九章参考文献与调查方法

- 参考

- 调查方法

- 关于出版商

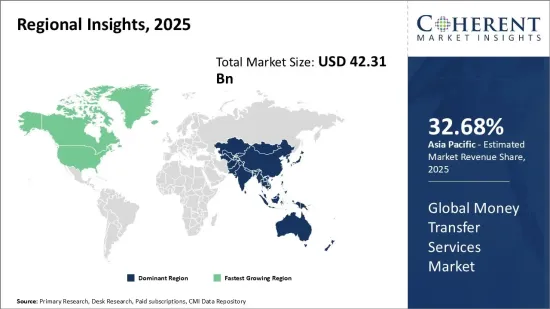

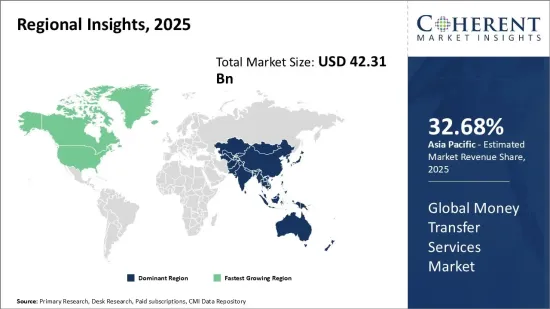

Global Money Transfer Services Market is estimated to be valued at US$ 42.31 Bn in 2025 and is expected to reach US$ 121.76 Bn by 2032, growing at a compound annual growth rate (CAGR) of 16.3% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 42.31 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 16.30% | 2032 Value Projection: | USD 121.76 Bn |

The market has experienced significant expansion driven by increasing cross-border transactions, rising global migration, and the rapid adoption of digital payment platforms. With the growing penetration of mobile wallets and fintech solutions, consumers are increasingly shifting towards faster, cost-effective, and secure money transfer services. Additionally, the integration of Blockchain and artificial intelligence in remittance services is further revolutionizing the industry by enhancing transparency and efficiency. However, challenges such as regulatory compliance, cybersecurity threats, and fluctuating foreign exchange rates continue to pose hurdles for market growth.

Market Dynamics:

The global money transfer services market growth is primarily driven by the rising number of international migrants and the increasing need for seamless, real-time payment solutions. The expansion of digital banking infrastructure, along with the growing reliance on mobile-based transactions, has significantly contributed to the industry's growth. Additionally, government-led financial inclusion initiatives in emerging economies are fostering a more competitive and diverse market landscape. However, the industry faces challenges such as high transaction fees, evolving regulatory requirements, and the persistent risk of fraud and cyber threats. Meanwhile, the integration of Blockchain technology and artificial intelligence in financial services, along with the expansion of mobile-based remittance solutions, presents lucrative opportunities for market players to innovate and offer cost-effective, secure, and efficient money transfer services.

Key Features of the Study:

This report provides in-depth analysis of the global money transfer services market, and provides market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global money transfer services market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include The Western Union Company, Wise (TransferWise Ltd.), Revolut Ltd., Remitly Inc., MoneyGram International Inc., PayPal Holdings Inc., WorldRemit Ltd., Intermex Wire Transfer, Paytm (One97 Communications Limited), OFX (OzForex), JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., Wells Fargo & Company, and WorldFirst

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global money transfer services market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Market Segmentation

- Type Insights (Revenue, USD Bn, 2020 - 2032)

- Inward Money Transfer

- Outward Money Transfer

- Channel Insights (Revenue, USD Bn, 2020 - 2032)

- Money Transfer Operators

- Banks

- Other Channels

- Regional Insights (Revenue, USD Bn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- The Western Union Company

- Wise (TransferWise Ltd.)

- Revolut Ltd.

- Remitly Inc.

- MoneyGram International Inc.

- PayPal Holdings Inc.

- WorldRemit Ltd.

- Intermex Wire Transfer

- Paytm (One97 Communications Limited)

- OFX (OzForex)

- JPMorgan Chase & Co.

- Bank of America Corporation

- Citigroup Inc.

- Wells Fargo & Company

- WorldFirst

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Money Transfer Services Market, By Type

- Global Money Transfer Services Market, By Channel

- Global Money Transfer Services Market, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Market Opportunities

- Regulatory Scenario

- Key Developments

- Industry Trends

4. Global Money Transfer Services Market, By Type, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Inward Money Transfer

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Outward Money Transfer

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

5. Global Money Transfer Services Market, By Channel, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Money Transfer Operators

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Banks

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Other Channels

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Money Transfer Services Market, By Region, 2020 - 2032, Value (USD Bn)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032, Value (USD Bn)

- Market Y-o-Y Growth Analysis (%), 2021 - 2032, Value (USD Bn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country/Region, 2020 - 2032, Value (USD Bn)

- South Africa

- North Africa

- Central Africa

7. Competitive Landscape

- The Western Union Company

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Wise (TransferWise Ltd.)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Revolut Ltd.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Remitly Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- MoneyGram International Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- PayPal Holdings Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- WorldRemit Ltd.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Intermex Wire Transfer

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Paytm (One97 Communications Limited)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- OFX (OzForex)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- JPMorgan Chase & Co.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Bank of America Corporation

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Citigroup Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Wells Fargo & Company

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- WorldFirst

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. References and Research Methodology

- References

- Research Methodology

- About us