|

市场调查报告书

商品编码

1706023

全球一次性组装市场(按产品、应用、解决方案、最终用户和地区划分)Global Single Use Assemblies Market, By Product, By Application, By Solution, By End User, By Geography |

||||||

2025 年全球一次性组件市场规模估计为 161.9 亿美元,预计到 2032 年将达到 515.6 亿美元,2025 年至 2032 年的年复合成长率(CAGR)为 18.0%。

| 报告范围 | 报告详细信息 | ||

|---|---|---|---|

| 基准年 | 2024 | 2025年的市场规模 | 161.9亿美元 |

| 效能数据 | 2020-2024 | 预测期 | 2025-2032 |

| 预测期:2025-2032年复合年增长率: | 18.00% | 2032年价值预测 | 515.6亿美元 |

一次性组件(也称为一次性系统)是预先组装的流体处理组件,设计用于生物製药製造过程中的一次性使用。与传统的不銹钢生物反应器相比,它具有降低二次污染风险、降低清洗和灭菌成本等优点。随着对生技药品和细胞疗法的需求不断增加,对强大、可扩展的製造能力的需求也不断增加。一次性组件有助于缩短生产週期并提高适应性可扩充性。它还可以使製造空间更加紧凑并提高工作效率。

与传统的不銹钢设备相比,一次性组件具有减少资本投资、降低清洗和维护成本以及消除交叉污染风险等优势。然而,广泛采用引发了人们的担忧,即它会导致固态废弃物产生增加。总体而言,一次性组件使製造商能够降低成本、提高生产力,从而实现快速的製程开发。

市场动态:

全球一次性组件市场的成长受到生物製药需求不断增长、生物製药公司快速采用一次性技术以及与不銹钢组件相比具有灵活的扩充性、更小的设备占地面积和更低的检验成本等优势的推动。然而,对一次性组件所用材料中的可提取物和可浸出物的担忧以及缺乏标准化是限制市场成长的一些因素。对生物相似药、基因和细胞疗法等先进疗法的需求不断增长,为该市场的公司提供了丰厚的机会。

主要市场参与者正专注于业务扩张等各种成长策略,预计这将在预测期内推动市场成长。例如,2021年6月,生物製药製造一次性系统中使用的AdvantaPure高纯度管道产品製造商NewAge Industries宣布在其位于美国宾夕法尼亚州东南部的总部工厂进行产能扩张。该计划将扩大现有设施,增加超过 3,000 平方英尺的 ISO 7 级认证无尘室空间。此空间专门用于生产 AdvantaFlex 焊接密封管、AdvantaSil 硅胶管、增强软管和模製一次性管组件。

本研究的主要特点

- 本研究报告对全球一次性组件市场进行了详细分析,并给出了预测期(2025-2032)的市场规模和年复合成长率(CAGR%),假设 2024 年为基准年。

- 它还强调了各个领域的潜在商机,并说明了该市场的引人注目的投资提案矩阵。

- 它还提供了有关市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景和主要企业采用的竞争策略的重要见解。

- 全球一次性组装市场的主要企业是根据公司亮点、产品系列、关键亮点、财务表现和策略等参数进行的分析。

- 本报告的见解将使负责人和企业经营团队能够就未来的产品发布、新兴趋势、市场扩张和行销策略做出明智的决策。

- 全球一次性组装市场报告涉及该行业的各个相关人员,包括投资者、供应商、产品製造商、经销商、新进入者和金融分析师。

- 可以透过用于分析全球一次性组装市场的各种策略矩阵来促进相关人员的决策。

目录

第一章 调查目的与前提条件

- 研究目标

- 先决条件

- 简称

第二章 市场展望

- 报告描述

- 市场定义和范围

- 执行摘要

- Coherent Opportunity Map(COM)

第三章市场动态、法规与趋势分析

- 市场动态

- 影响分析

- 主要亮点

- 监管情景

- 服务产品组合

- PEST分析

- 波特分析

- 併购场景

4. 全球一次性组件市场-COVID-19 疫情的影响

- COVID-19流行病学

- 供需侧分析

- 经济影响

5. 2020 年至 2032 年全球一次性组装市场(依产品划分)

- 袋子组装

- 2D 袋子组装

- 3D袋组装

- 过滤组件

- 瓶组装

- 管组件

- 其他的

6. 2020 年至 2032 年全球一次性组装市场(按应用)

- 滤

- 细胞培养和混合

- 贮存

- 取样

- 填充和精加工

- 其他的

7. 2020 年至 2032 年全球一次性组装市场(按解决方案)

- 客製化

- 标准

8. 2020 年至 2032 年全球一次性组装市场(依最终用户划分)

- 生物製药公司

- CRO

- CMO

- 其他的

9. 2020 年至 2032 年全球一次性组装市场(按地区)

- 北美洲

- 欧洲

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- ASEAN

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东

- 海湾合作委员会国家

- 以色列

- 其他中东地区

- 非洲

- 北非

- 中部非洲

- 南非

第十章 竞争格局

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Sartorius AG

- Danaher(Pall Corporation)

- Avantor, Inc

- Lonza

- Saint-Gobain

- Corning Incorporated

- Entegris

- KUHNER AG.

- Parker Hannifin Corporation

- Ami Polymer

- HIGH PURITY NEW ENGLAND

- Liquidyne Process Technologies, Inc.

- ESI Ultrapure

第 11 章 章节

- 调查方法

- 关于出版商

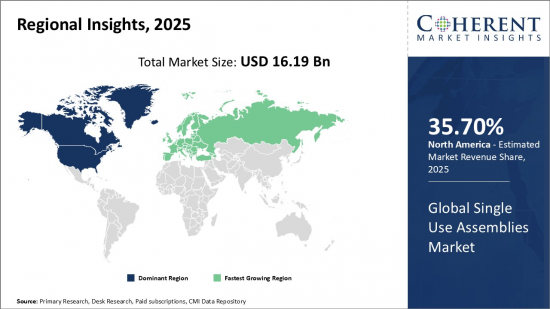

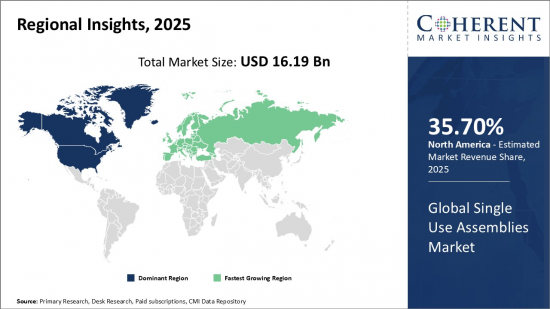

Global Single Use Assemblies Market is estimated to be valued at USD 16.19 Bn in 2025 and is expected to reach USD 51.56 Bn by 2032, growing at a compound annual growth rate (CAGR) of 18.0% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 16.19 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 18.00% | 2032 Value Projection: | USD 51.56 Bn |

Single-use assemblies, also known as single-use systems, are pre-assembled sets of fluid handling components that are designed for single use in the biopharmaceutical manufacturing process. These provide benefits like reduced risk of cross-contamination, lower costs of cleaning and sterilization as compared to traditional stainless-steel bioreactors. As the demand for biologics and cell therapies escalates, there is a heightened need for solid and scalable production capabilities. Single-use assemblies contribute to quicker production cycles and adaptable scalability. They also enable more compact manufacturing spaces and enhanced operational efficiency.

Compared to traditional stainless steel equipment, single-use assemblies provide advantages such as reduced capital investment, lower cleaning and maintenance costs, elimination of cross-contamination risks. However, their widespread adoption also raises concerns about increased solid waste generation. Overall, single-use assemblies have enabled faster process development with reduced costs and improved productivity for manufacturers.

Market Dynamics:

Global single-use assemblies market growth is driven by increasing demand for biopharmaceuticals, fast adoption of single-use technologies by biopharmaceutical companies, and advantages like flexible scalability, lower facility footprint and reduced validation costs compared to stainless steel assemblies. However, concerns about extractable and leachable from materials used in single-use assemblies and lack of standardization are some of the factors restraining the market growth. Growing demand for biosimilars and advanced therapies like gene and cell therapies present lucrative opportunities for players in this market.

The key market players are focusing on various growth strategies such as expansion, and this is expected to propel the market growth over the forecast period. For instance, in June 2021, NewAge Industries, a manufacturer of AdvantaPure high purity tubing products used in single-use systems for biopharmaceutical manufacturing, announced expansion of capacity at its headquarters facility in southeastern Pennsylvania, U.S. The initiative will expand the current facility by adding over 3000 square feet of ISO Class 7 certified cleanroom space. This space is designated for the production of AdvantaFlex weldable and sealable tubing, AdvantaSil silicone tubing, reinforced hose, and molded single-use tubing assemblies.

Key features of the study:

- This report provides in-depth analysis of the global single-use assemblies market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global single-use assemblies market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include Thermo Fisher Scientific, Inc., Merck KGaA, Sartorius AG, Danaher (Pall Corporation), Avantor, Inc., Lonza, Saint-Gobain, Corning Incorporated, Entegris, KUHNER AG., Parker Hannifin Corporation, Ami Polymer, HIGH PURITY NEW ENGLAND, Liquidyne Process Technologies, Inc. and ESI Ultrapure

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- Global single-use assemblies market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global single-use assemblies market

Detailed Segmentation:

- Global Single Use Assemblies Market, By Product

- Bag Assemblies

- 2D bag assemblies

- 3D bag assemblies

- Filtration Assemblies

- Bottle Assemblies

- Tubing Assemblies

- Others

- Global Single Use Assemblies Market, By Application

- Filtration

- Cell Culture & Mixing

- Storage

- Sampling

- Fill-finish

- Others

- Global Single Use Assemblies Market, By Solution

- Customized

- Standard

- Global Single Use Assemblies Market, By End User

- Biopharmaceutical Companies

- CROs

- CMOs

- Others

- Global Single Use Assemblies Market, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

- Company Profiles

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Sartorius AG

- Danaher (Pall Corporation)

- Avantor, Inc

- Lonza

- Saint-Gobain

- Corning Incorporated

- Entegris

- KUHNER AG.

- Parker Hannifin Corporation

- Ami Polymer

- HIGH PURITY NEW ENGLAND

- Liquidyne Process Technologies, Inc.

- ESI Ultrapure

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Single Use Assemblies Market, By Product

- Global Single Use Assemblies Market, By Application

- Global Single Use Assemblies Market, By Solution

- Global Single Use Assemblies Market, By End User

- Global Single Use Assemblies Market, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Increasing Demand for Disposable Systems

- High costs associated with single-use assemblies

- Technological advances in single-use assemblies

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Service offering Portfolio

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Global Single Use Assemblies Market- Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Global Single Use Assemblies Market, By Product, 2020 - 2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Bag Assemblies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- 2D bag assemblies

- 3D bag assemblies

- Filtration Assemblies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Bottle Assemblies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Tubing Assemblies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

6. Global Single Use Assemblies Market, By Application, 2020 - 2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Filtration

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Cell Culture & Mixing

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Storage

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Sampling

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Fill-finish

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

7. Global Single Use Assemblies Market, By Solution, 2020 - 2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Customized

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Standard

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

8. Global Single Use Assemblies Market, By End User, 2020 - 2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Biopharmaceutical Companies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- CROs

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- CMOs

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

9. Global Single Use Assemblies Market, By Region, 2020 - 2032, (US$ Bn)

- Introduction

- Market Share Analysis, By Country, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, For Country, 2021 -2032

- Country Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Product, 2020 - 2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2020 - 2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Solution, 2020 - 2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2020 - 2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020 - 2032,(US$ Bn)

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- North Africa

- Central Africa

- South Africa

10. Competitive Landscape

- Thermo Fisher Scientific, Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Merck KGaA

- Sartorius AG

- Danaher (Pall Corporation)

- Avantor, Inc

- Lonza

- Saint-Gobain

- Corning Incorporated

- Entegris

- KUHNER AG.

- Parker Hannifin Corporation

- Ami Polymer

- HIGH PURITY NEW ENGLAND

- Liquidyne Process Technologies, Inc.

- ESI Ultrapure

- Analyst Views

11. Section

- Research Methodology

- About us