|

市场调查报告书

商品编码

1231834

东南亚的办公大楼产业(2023年~2032年)Research Report on Southeast Asia Office Building Industry 2023-2032 |

||||||

东南亚的是在世界最急速发展的地区之一,因为整体发展强力稳定,许多投资者彙集到东南亚,企业数年年增加。企业数的剧增与对办公室等的职场需求提高,促进东南亚的办公大楼产业的发展。

本报告提供东南亚的办公大楼产业调查分析,主要的促进因素,课题与机会,COVID-19影响等资讯。

样本图

目录

第1章 新加坡的办公大楼产业的分析

- 新加坡的办公大楼产业的开发环境

- 地区

- 人口

- 经济

- 新加坡的最低工资

- 新加坡的办公大楼产业的经营(2018年~2022年)

- 供给

- 要求

- 新加坡的主要的办公大楼企业的分析

第2章 泰国的办公大楼产业的分析

- 泰国的办公大楼产业的开发环境

- 地区

- 人口

- 经济

- 泰国的最低工资

- 泰国的办公大楼产业的经营(2018年~2022年)

- 供给

- 要求

- 泰国的主要的办公大楼企业的分析

第3章 菲律宾的办公大楼产业的分析

- 菲律宾的办公大楼产业的开发环境

- 地区

- 人口

- 经济

- 菲律宾的最低工资

- 菲律宾的办公大楼产业的经营(2018年~2022年)

- 供给

- 要求

- 菲律宾的主要的办公大楼企业的分析

第4章 马来西亚的办公大楼产业的分析

- 马来西亚的办公大楼产业的开发环境

- 地区

- 人口

- 经济

- 马来西亚的最低工资

- 马来西亚的办公大楼产业的经营(2018年~2022年)

- 供给

- 要求

- 马来西亚的主要的办公大楼企业的分析

第5章 印尼的办公大楼产业的分析

- 印尼的办公大楼产业的开发环境

- 地区

- 人口

- 经济

- 印尼的最低工资

- 印尼的办公大楼产业的经营(2018年~2022年)

- 供给

- 要求

- 印尼的主要的办公大楼企业的分析

第6章 越南的办公大楼产业的分析

- 越南的办公大楼产业的开发环境

- 地区

- 人口

- 经济

- 越南的最低工资

- 越南的办公大楼产业的经营(2018年~2022年)

- 供给

- 要求

- 越南的主要的办公大楼企业的分析

第7章 缅甸的办公大楼产业的分析

- 缅甸的办公大楼产业的开发环境

- 地区

- 人口

- 经济

- 缅甸的最低工资

- 缅甸的办公大楼产业的经营(2018年~2022年)

- 供给

- 要求

- 缅甸的主要的办公大楼企业的分析

第8章 汶莱的办公大楼产业的分析

- 汶莱的办公大楼产业的开发环境

- 地区

- 人口

- 经济

- 汶莱的最低工资

- 汶莱的办公大楼产业的经营(2018年~2022年)

- 供给

- 要求

- 进出口情形

- 汶莱的主要的办公大楼企业的分析

第9章 寮国的办公大楼产业的分析

- 寮国的办公大楼产业的开发环境

- 地区

- 人口

- 经济

- 寮国的最低工资

- 寮国的办公大楼产业的经营(2018年~2022年)

- 供给

- 要求

- 寮国的主要的办公大楼企业的分析

第10章 柬埔寨的办公大楼产业的分析

- 柬埔寨的办公大楼产业的开发环境

- 地区

- 人口

- 经济

- 柬埔寨的最低工资

- 柬埔寨的办公大楼产业的经营(2018年~2022年)

- 供给

- 要求

- 柬埔寨的主要的办公大楼企业的分析

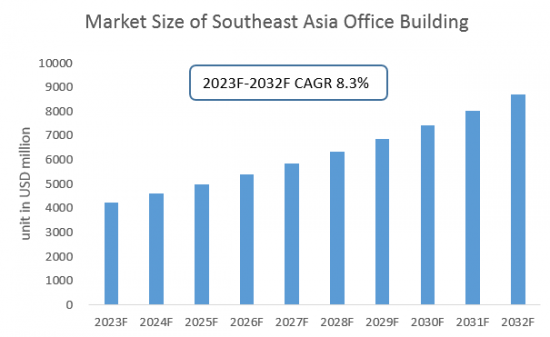

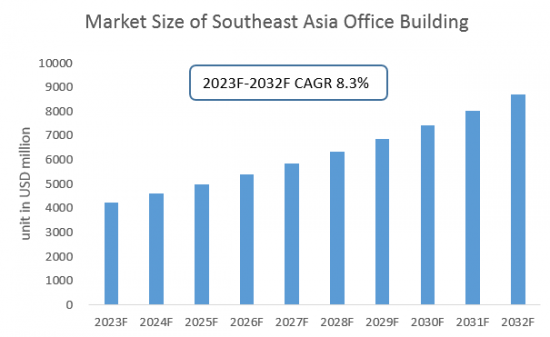

第11章 东南亚的办公大楼产业预测(2023年~2032年)

- 影响东南亚的办公大楼产业的发展要素的分析

- 有利的要素

- 不利的要素

- 东南亚的办公大楼的产业规模的预测(2023年~2032年)

- 东南亚的办公大楼产业的需求的分析(2023年~2032年)

- COVID-19流行对办公大楼产业的影响

Southeast Asia is one of the most rapidly developing regions in the world with strong and stable overall development, attracting numerous investors to Southeast Asia with the number of enterprises increasing year after year. In Vietnam, for example, the total number of enterprises nationwide reached 208,300 in 2022, up 30.3% year-on-year, with 148,500 newly registered enterprises and a total of 981,300 registered employees. The soaring number of enterprises and rising demand for offices and other workplaces are driving the development of the office building industry in Southeast Asia.

SAMPLE VIEW

Singapore, Jakarta (Indonesia), Ho Chi Minh City (Vietnam), Bangkok (Thailand) and Phnom Penh (Cambodia) have well-developed office buildings with low overall vacancy rates and stable or growing rents. As companies in various service industries such as information technology, finance and insurance enter Southeast Asia, local high-quality office building projects are gradually launched, attracting more investors to enter this market.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of over 600 million by the end of 2021, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI's analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021.

CRI expects the office building industry in Southeast Asia to maintain growth from 2023-2032, with both supply and demand for office buildings continuing to rise.

Topics covered:

- Southeast Asia Office Building Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Office Building Industry?

- Which Companies are the Major Players in Southeast Asia Office Building Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Office Building Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Office Building Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Office Building Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Office Building Industry Market?

- Which Segment of Southeast Asia Office Building Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Office Building Industry?

Table of Contents

1 Singapore Office Building Industry Analysis

- 1.1 Singapore Office Building Industry Development Environment

- 1.1.1 Geography

- 1.1.2 Population

- 1.1.3 Economy

- 1.1.4 Minimum Wage in Singapore

- 1.2 Singapore Office Building Industry Operating Conditions 2018-2022

- 1.2.1 Supply

- 1.2.2 Demand

- 1.3 Analysis of Major Office Building Companies in Singapore

2 Analysis of the Office Building Industry in Thailand

- 2.1 Development Environment of Thailand Office Building Industry

- 2.1.1 Geography

- 2.1.2 Population

- 2.1.3 Economy

- 2.1.4 Minimum Wage in Thailand

- 2.2 Thailand Office Building Industry Operation 2018-2022

- 2.2.1 Supply

- 2.2.2 Demand

- 2.3 Analysis of Major Office Building Companies in Thailand

3 Analysis of the Office Building Industry in the Philippines

- 3.1 Development Environment of the Philippine Office Building Industry

- 3.1.1 Geography

- 3.1.2 Population

- 3.1.3 Economy

- 3.1.4 Minimum Wage in the Philippines

- 3.2 Philippine Office Building Industry Operation 2018-2022

- 3.2.1 Supply

- 3.2.2 Demand

- 3.3 Analysis of Major Office Building Companies in the Philippines

4 Analysis of the Office Building Industry in Malaysia

- 4.1 Development Environment of Malaysia Office Building Industry

- 4.1.1 Geography

- 4.1.2 Population

- 4.1.3 Economy

- 4.1.4 Minimum Wage in Malaysia

- 4.2 Malaysia Office Building Industry Operating Conditions 2018-2022

- 4.2.1 Supply

- 4.2.2 Demand

- 4.3 Analysis of Major Office Building Companies in Malaysia

5 Analysis of the Office Building Industry in Indonesia

- 5.1 Development Environment of Indonesia Office Building Industry

- 5.1.1 Geography

- 5.1.2 Population

- 5.1.3 Economy

- 5.1.4 Minimum Wage in Indonesia

- 5.2 Office Building Industry Operation in Indonesia 2018-2022

- 5.2.1 Supply

- 5.2.2 Demand

- 5.3 Analysis of Major Office Building Companies in Indonesia

6 Analysis of Vietnam's Office Building Industry

- 6.1 Development Environment of Vietnam Office Building Industry

- 6.1.1 Geography

- 6.1.2 Population

- 6.1.3 Economy

- 6.1.4 Minimum Wage in Vietnam

- 6.2 Vietnam Office Building Industry Operation 2018-2022

- 6.2.1 Supply

- 6.2.2 Demand

- 6.3 Analysis of Major Office Building Companies in Vietnam

7 Analysis of Myanmar's Office Building Industry

- 7.1 Development Environment of Myanmar Office Building Industry

- 7.1.1 Geography

- 7.1.2 Population

- 7.1.3 Economy

- 7.1.4 Minimum Wage in Myanmar

- 7.2 Myanmar Office Building Industry Operation 2018-2022

- 7.2.1 Supply

- 7.2.2 Demand

- 7.3 Analysis of Major Office Building Companies in Myanmar

8 Brunei Office Building Industry Analysis

- 8.1 Development Environment of Brunei Office Building Industry

- 8.1.1 Geography

- 8.1.2 Population

- 8.1.3 Economy

- 8.1.4 Brunei Minimum Wage

- 8.2 Brunei Office Building Industry Operating Conditions 2018-2022

- 8.2.1 Supply

- 8.2.2 Demand

- 8.2.3 Import and Export Situation

- 8.3 Analysis of Major Office Building Companies in Brunei

9 Analysis of the Office Building Industry in Laos

- 9.1 Development Environment of Laos Office Building Industry

- 9.1.1 Geography

- 9.1.2 Population

- 9.1.3 Economy

- 9.1.4 Minimum Wage in Laos

- 9.2 Operation of the Office Building Industry in Laos 2018-2022

- 9.2.1 Supply

- 9.2.2 Demand

- 9.3 Analysis of Major Office Building Companies in Laos

10 Analysis of Cambodia's Office Building Industry

- 10.1 Development Environment of Cambodia Office Building Industry

- 10.1.1 Geography

- 10.1.2 Population

- 10.1.3 Economy

- 10.1.4 Minimum Wage in Cambodia

- 10.2 Cambodia Office Building Industry Operation 2018-2022

- 10.2.1 Supply

- 10.2.2 Demand

- 10.3 Analysis of Major Office Building Companies in Cambodia

11 Southeast Asia Office Building Industry Outlook 2023-2032

- 11.1 Analysis of Factors Affecting the Development of Southeast Asia Office Building Industry

- 11.1.1 Favorable Factors

- 11.1.2 Unfavorable Factors

- 11.2 Southeast Asia Office Building Industry Size Forecast 2023-2032

- 11.3 Southeast Asia Office Building Industry Demand Analysis 2023-2032

- 11.4 Impact of COVID -19 Epidemic on Office Building Industry