|

市场调查报告书

商品编码

1280684

越南的电动车产业(2023年~2032年)Vietnam Electric Vehicle Industry Research Report 2023-2032 |

||||||

本报告提供越南的电动车产业调查分析,主要的促进因素与机会,预测的收益,主要企业的策略等资讯。

样本图

目录

第1章 越南概要

- 地理情形

- 越南的人口结构

- 越南的经济状况

- 越南的最低工资(2013年~2022年)

- COVID-19对越南的电动车产业的影响

第2章 越南的电动车产业概要

- 越南的电动车发展历史

- 对越南的电动车产业的FDI

- 越南的电动车产业的政策环境

第3章 越南的电动车产业的供需情形

- 越南的电动车产业的供给情形

- 越南的电动车产业的需求情形

第4章 越南的电动车产业的进出口情形

- 越南的电动车产业的进口情形

- 越南的电动车的进口量和进口额

- 越南的电动车的主要的进口商

- 越南的电动车产业的出口情形

- 越南的电动车的出口量和出口额

- 越南的电动车的主要的外销处

第5章 越南的电动车产业的成本分析

第6章 越南的电动车产业的市场竞争

- 越南的电动车加入产业的阻碍

- 越南的电动车产业的竞争结构

第7章 越南的主要的电动车企业的分析

- KIA

- Mercedes-Benz

- Toyota

- Tesla

- BYD

- Honda

- Proterra

- Vinfast

- Tan Thanh Nhan Co., Ltd.

- Schneider Electric Vietnam

第8章 越南的电动车产业预测(2023年~2032年)

- 越南的电动车产业的发展要素的分析

- 越南的电动车产业的促进因素与发展的机会

- 对越南的电动车产业的威胁与课题

- 越南的电动车产业的供给预测

- 越南的电动车市场需求预测

- 越南的电动车产业的进出口预测

免责声明

服务保证

In 2022, more than 284,000 passenger cars will be sold in Vietnam, of which only a few thousand will be electric vehicles.

SAMPLE VIEW

The electric vehicle (EV) market in Vietnam is still in its infancy, but there is potential for significant growth. Vietnam's middle class is growing and living in urban areas, and with Evs meeting the criteria for smart cities, people are turning to green vehicles that help reduce environmental pollution.

Meanwhile, Vietnam has been considered a potential market for electric four-wheelers, as these vehicles offer an attractive advantage against the backdrop of rising gasoline prices and environmental concerns associated with gasoline vehicles. In addition, the government has been introducing incentives for the use of electric vehicles: from lowering taxes on electric imports to reducing a portion of registration fees for electric vehicle owners.

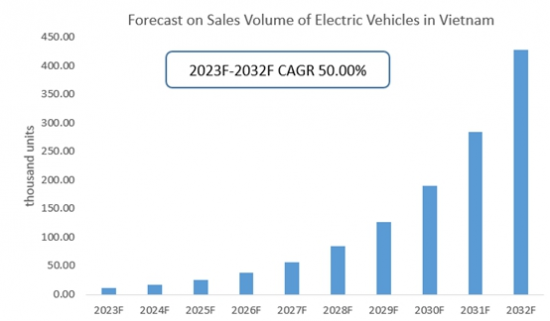

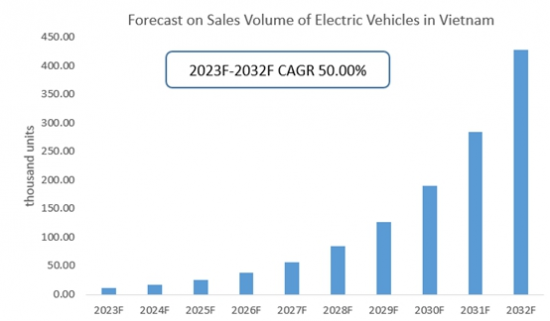

According to CRI, the sales volume of electric vehicles will reach US$ 462.76 thousand in 2032 and the CAGR in 2023 to 2032 is 50%.

Source:CRI

One of the biggest challenges Vietnam has to overcome in this area is the limited number of electric vehicle charging stations. Vietnam's electric vehicle company VinFast is investing in an extensive and secure charging station system, and there is huge room for growth in Vietnam's car market as infrastructure continues to improve. In addition, car ownership in Vietnam remains low, with 23 cars per 1,000 people, compared to one-tenth and one-twentieth in Thailand and Malaysia, respectively, according to CRI. Vietnam is a land of great potential with a population of nearly 100 million and an untapped market for electric vehicles. Meanwhile, according to CRI, electric vehicles are becoming a global trend, with revenues in the electric vehicle sector growing at a rate of 10% per year. According to CRI, the electric vehicle market is forecast to reach approximately $60 billion in revenue by 2025.

According to CRI, Vietnam will have one million electric vehicles by 2028, and that number will grow to 3.5 million by 2040. Although electric vehicles currently represent only a small portion of the country's passenger car market, they are expected to become more common in the future.

Topics covered:

- Vietnam Electric Vehicle Industry Overview

- The economic and policy environment of the electric vehicle industry in Vietnam

- What is the impact of COVID-19 on the electric vehicle industry in Vietnam?

- Vietnam Electric Vehicle Industry Market Size 2023-2032

- Analysis of major Vietnamese electric vehicle industry manufacturers

- Key Drivers and Market Opportunities in Vietnam's Electric Vehicle Industry

- What are the key drivers, challenges and opportunities for the electric vehicle industry in Vietnam during the forecast period 2023-2032?

- Which companies are the key players in the Vietnam Electric Vehicle industry market and what are their competitive advantages?

- What is the expected revenue of the Vietnam Electric Vehicle Industry market during the forecast period of 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Vietnam Electric Vehicle Industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the electric vehicle industry in Vietnam?

Table of Contents

1 Overview of Vietnam

- 1.1 Geographical situation

- 1.2 Demographic structure of Vietnam

- 1.3 The economic situation in Vietnam

- 1.4 Minimum Wage in Vietnam 2013-2022

- 1.5 Impact of COVID-19 on the electric vehicle industry in Vietnam

2 Vietnam Electric Vehicle Industry Overview

- 2.1 History of electric vehicle development in Vietnam

- 2.2 FDI in Vietnam's electric vehicle industry

- 2.3 Policy environment of the electric vehicle industry in Vietnam

3 Vietnam Electric Vehicle Industry Supply and Demand Status

- 3.1 Electric vehicle industry supply situation in Vietnam

- 3.2 Vietnam Electric Vehicle Industry Demand Situation

4 Vietnam electric vehicle industry import and export status

- 4.1.1 Vietnam's electric vehicle import volume and import value

- 4.1.2 Main import sources of electric vehicles in Vietnam

- 4.2 Export status of Vietnam's electric vehicle industry

- 4.2.1 Vietnam's electric vehicle export volume and export value

- 4.2.2 Vietnam's main export destinations for electric vehicles

5 Cost analysis of the electric vehicle industry in Vietnam

6 Vietnam Electric Vehicle Industry Market Competition

- 6.1 Barriers to entry in Vietnam's electric vehicle industry

- 6.1.1 Brand barriers

- 6.1.2 Quality Barriers

- 6.1.3 Capital Barriers

- 6.2 Competitive Structure of Vietnam's Electric Vehicle Industry

- 6.2.1 Bargaining Power of Electric Vehicle Suppliers

- 6.2.2 Consumer bargaining power

- 6.2.3 Competition in Vietnam's Electric Vehicle Industry

- 6.2.4 Potential Entrants in the Electric Vehicle Industry

- 6.2.5 Alternatives to Electric Vehicles

7 Analysis of major electric vehicle companies in Vietnam

- 7.1 KIA

- 7.1.1 KIA Corporate Profile

- 7.1.2 KIA Corporate Electric Vehicle Sales

- 7.2 Mercedes-Benz

- 7.2.1 Mercedes-Benz Corporate Profile

- 7.2.2 Mercedes-Benz Corporate Electric Vehicle Sales

- 7.3 Toyota

- 7.3.1 Toyota Corporate Profile

- 7.3.2 Toyota Corporate Electric Vehicle Sales

- 7.4 Tesla

- 7.4.1 Tesla Corporate Profile

- 7.4.2 Tesla Corporate Electric Vehicle Sales

- 7.5 BYD

- 7.5.1 BYD Company Profile

- 7.5.2 BYD Enterprise Electric Vehicle Sales

- 7.6 Honda

- 7.6.1 Honda Company Profile

- 7.6.2 Honda Corporate Electric Vehicle Sales

- 7.7 Proterra

- 7.7.1 Proterra Corporate Profile

- 7.7.2 Proterra Corporate Electric Vehicle Sales

- 7.8 Vinfast

- 7.8.1 Vinfast Corporate Profile

- 7.8.2 Vinfast Corporate Electric Vehicle Sales

- 7.9 Tan Thanh Nhan Co., Ltd.

- 7.9.1 Corporate Profile of Tan Thanh Nhan Co., Ltd.

- 7.9.2 Electric Vehicle Sales of Tan Thanh Nhan Co., Ltd.

- 7.10 Schneider Electric Vietnam

- 7.10.1 Schneider Electric Vietnam Corporate Profile

- 7.10.2 Schneider Electric Vietnam Corporate Electric Vehicle Sales

8 Vietnam Electric Vehicle Industry Outlook 2023-2032

- 8.1 Analysis of development factors of the electric vehicle industry in Vietnam

- 8.1.1 Drivers and Development Opportunities for the Electric Vehicle Industry in Vietnam

- 8.1.2 Threats and challenges to Vietnam's electric vehicle industry

- 8.2 Vietnam Electric Vehicle Industry Supply Forecast

- 8.3 Vietnam Electric Vehicle Market Demand Forecast

- 8.4 Vietnam Electric Vehicle Industry Import and Export Forecast

Disclaimer

Service Guarantees