|

市场调查报告书

商品编码

1280690

印尼的造纸产业(2023年~2032年)Indonesia Paper Industry Research Report 2023-2032 |

||||||

本报告提供印尼的造纸产业调查分析,主要的促进因素与机会,预测的收益,主要企业的策略等资讯。

样本图

目录

第1章 印尼概要

- 地理情形

- 印尼的人口结构

- 印尼的经济形势

- 印尼的最低工资(2013年~2022年)

- COVID-19对印尼的造纸产业的影响

第2章 印尼的造纸产业概要

- 印尼的造纸产业的历史

- 对印尼的造纸产业的FDI

- 印尼的造纸产业的政策环境

第3章 印尼的造纸产业的供需情形

- 印尼的造纸产业的供给情形

- 印尼的造纸产业的需求情形

第4章 印尼的造纸产业的进出口情形

- 印尼的造纸产业的进口情形

- 印尼的造纸产业的进口量和进口额

- 印尼的造纸产业主要的进口商

- 印尼的造纸产业的出口情形

- 印尼的造纸产业的出口量和出口额

- 印尼的造纸产业主要的外销处

第5章 印尼的造纸产业的成本分析

第6章 印尼的造纸产业的市场竞争

- 印尼的造纸加入产业的阻碍

- 印尼的造纸产业的竞争结构

第7章 印尼的主要的造纸企业和公司的分析

- Asia Pulp & Paper

- Indah Kiat Serang

- PT Kertas Nusantara

- Cussons Baby

- Freshening Industries

- SMB Group

- Satyamitra

- PT Kertas Basuki Rachmat Indonesia Tbk

- Sinar Pancasurya PT

- Super Exim Sari

第8章 印尼的家庭纸产业的分析

- 印尼的家庭纸产业概要

- 印尼的家庭纸产业的供需情形

- 印尼的家庭纸产业的进出口情形

- 印尼的家庭纸产业的成本分析

第9章 印尼的包装纸产业的分析

第10章 印尼的印刷、书写纸产业的分析

第11章 印尼的造纸产业预测(2023年~2032年)

- 印尼的造纸产业的发展要素的分析

- 印尼的造纸产业的促进因素与发展的机会

- 对印尼的造纸产业的威胁与课题

- 印尼的造纸产业的供给预测

- 印尼的造纸产业的市场需求预测

- 印尼的造纸产业的进出口预测

免责声明

服务保证

Indonesia's paper industry has rebounded strongly in recent years. Indonesia's growing paper production coupled with soaring exports of paper products, especially uncoated paper products, have helped the country become one of the world's leading paper suppliers in the global market.

SAMPLE VIEW

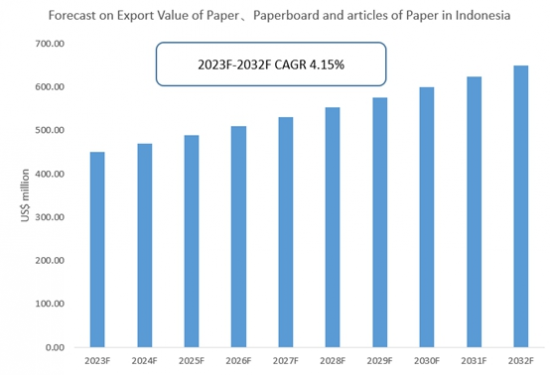

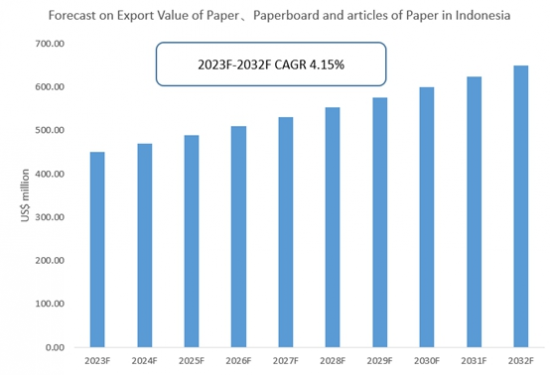

Indonesia's exports of paper, paperboard and their products show a fluctuating upward trend in 2018-2022, with a CAGR of 1.82% from 2018-2022, and in 2022, Indonesia's exports of paper, paperboard and their products total $430 million, up 27.72% year-on-year.

In 2018-2022, Indonesia's imports of paper, paperboard and their products show a fluctuating downward trend, with a CAGR of -1.71% from 2018-2022, and imports in 2021 amount to USD 160 million, the largest annual import of paper, paperboard and their products in Indonesia in the last five years.In 2022, Indonesia's exports of paper, paperboard and their products total USD 140 million, the A year-on-year decrease of 13.15%.

In general, in recent years, Indonesia's exports of paper, paperboard and their products are higher than imports, and exports far exceed imports, showing a trade surplus, and the trade surplus of Indonesia's paper, paperboard and their products in 2018-2022 shows an overall trend of growth, with a compound annual growth rate of 8.34%. In 2022, Indonesia's trade surplus of paper, paperboard and their products is 298 billion, an increase of 62.43% year-on-year.

According to CRI, the export value of paper,paperboard and articles of paper will reach US$ 650.27 million in 2032 and the CAGR in 2023 to 2032 is 4.15%.

Cultural paper refers to writing and printing paper used to spread cultural knowledge. The text is mainly divided into three categories: newsprint, uncoated cultural paper and coated cultural paper, of which uncoated cultural paper includes double-coated paper, writing paper, light paper, highly calendared paper (SC paper), electrostatic copy paper and printing paper. In terms of cultural paper production, the annual production of cultural paper in Indonesia far exceeds domestic demand, and more than half of cultural paper is exported to overseas. According to CRI's analysis, in recent years, Indonesia has been in a surplus position in the trade of cultural paper.

Household paper covers a wide range of thin paper used for home care, mainly including tissue paper, napkins, kitchen paper and tablecloths. In terms of the import and export of household paper, according to CRI's analysis, Indonesia imports very little household paper, only a few thousand tons per year, while exports are seen to be more than a hundred times of imports on average, which can reach hundreds of thousands of tons.

Packaging paper is a generic term for a class of paper used primarily for packaging purposes. It usually has high strength and toughness, can resist pressure and folding, and has simpler quality requirements than paper types such as cultural printing paper. Because paper packaging is more environmentally friendly, paper packaging is popular in Indonesia, and the annual consumption of packaging paper can reach five million tons. Due to the large size of the packaging paper market, many foreign investors have entered Indonesia. In May 2021, SCG Packaging PCL increased its packaging investment in Indonesia, acquiring a 75% stake in IntanGroup, a corrugated packaging company located in the four central provinces. According to CRI, Indonesia's packaging market size is forecast to grow at a CAGR of 4.15% from 2023-2027.

Topics covered:

- Indonesia Paper Industry Overview

- The economic and policy environment of the paper industry in Indonesia

- What is the impact of COVID-19 on the Indonesian paper industry?

- Indonesia Paper Industry Market Size, 2023-2032

- Analysis of major Indonesian paper producers

- Key drivers and market opportunities for Indonesia's paper industry

- What are the key drivers, challenges and opportunities for Indonesia's paper industry during the forecast period 2023-2032?

- Which companies are the key players in the Indonesian paper industry market and what are their competitive advantages?

- What is the expected revenue of Indonesia paper industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Indonesia paper industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the paper industry in Indonesia?

Table of Contents

1 Overview of Indonesia

- 1.1 Geographical situation

- 1.2 Demographic structure of Indonesia

- 1.3 Economic situation in Indonesia

- 1.4 Minimum Wage in Indonesia 2013-2022

- 1.5 Impact of COVID-19 on the Indonesian paper industry

2 Overview of Indonesia's paper industry

- 2.1 History of Indonesia's paper industry

- 2.2 FDI in Indonesian paper industry

- 2.3 Policy Environment of Indonesian Paper Industry

3 Indonesia paper industry supply and demand situation

- 3.1 Indonesia paper industry supply situation

- 3.2 Indonesia paper industry demand situation

4 Indonesia paper industry import and export status

- 4.1 Indonesia paper industry import status

- 4.1.1 Indonesia's paper industry import volume and import value

- 4.1.2 Main import sources of Indonesian paper industry

- 4.2 Indonesia's paper industry export situation

- 4.2.1 Indonesia paper industry export volume and export value

- 4.2.2 Main Export Destinations of Indonesian Paper Industry

5 Cost analysis of the paper industry in Indonesia

6 Indonesia paper industry market competition

- 6.1 Barriers to entry in the Indonesian paper industry

- 6.1.1 Brand barriers

- 6.1.2 Quality Barriers

- 6.1.3 Capital Barriers

- 6.2 Competitive Structure of Indonesian Paper Industry

- 6.2.1 Bargaining power of suppliers in paper industry

- 6.2.2 Consumer bargaining power

- 6.2.3 Competition in Indonesia's Paper Industry

- 6.2.4 Potential entrants in the paper industry

- 6.2.5 Alternatives in the paper industry

7 Indonesia Major Paper Manufacturing and Trading Companies Analysis

- 7.1 Asia Pulp & Paper

- 7.1.1 Asia Pulp & Paper Corporate Profile

- 7.1.2 Asia Pulp & Paper) Operating Conditions

- 7.2 Indah Kiat Serang

- 7.2.1 Indah Kiat Serang Corporate Profile

- 7.2.2 Indah Kiat Serang Operations

- 7.3 PT Kertas Nusantara

- 7.3.1 PT Kertas Nusantara Corporate Profile

- 7.3.2 PT Kertas Nusantara's Operations

- 7.4 Cussons Baby

- 7.4.1 Cussons Baby Corporate Profile

- 7.4.2 Cussons Baby Operations

- 7.5 Freshening Industries

- 7.5.1 Freshening Industries Corporate Profile

- 7.5.2 Freshening Industries Operations

- 7.6 SMB Group

- 7.6.1 SMB Group Corporate Profile

- 7.6.2 SMB Group Operations

- 7.7 Satyamitra

- 7.7.1 Satyamitra Corporate Profile

- 7.7.2 Satyamitra Operations

- 7.8 PT Kertas Basuki Rachmat Indonesia Tbk

- 7.8.1 PT Kertas Basuki Rachmat Indonesia Tbk Corporate Profile

- 7.8.2 PT Kertas Basuki Rachmat Indonesia Tbk Operations

- 7.9 Sinar Pancasurya PT

- 7.9.1 Sinar Pancasurya PT Corporate Profile

- 7.9.2 Sinar Pancasurya PT Operations

- 7.10 Super Exim Sari

- 7.10.1 Super Exim Sari Corporate Profile

- 7.10.2 Super Exim Sari Operations

8 Indonesia Household Paper Industry Analysis

- 8.1 Indonesia Household Paper Industry Overview

- 8.2 Indonesia Household Paper Industry Supply and Demand Situation

- 8.3 Indonesia Household Paper Industry Import and Export Status

- 8.4 Cost Analysis of Indonesian Household Paper Industry

9 Indonesia Packaging Paper Industry Analysis

- 9.1 Indonesia Household Paper Industry Overview

- 9.2 Indonesia Household Paper Industry Supply and Demand Situation

- 9.3 Indonesia Household Paper Industry Import and Export Status

- 9.4 Cost Analysis of Indonesian Household Paper Industry

10 Indonesia Printing and Writing Paper Industry Analysis

- 10.1 Indonesia Household Paper Industry Overview

- 10.2 Indonesia Household Paper Industry Supply and Demand Situation

- 10.3 Indonesia Household Paper Industry Import and Export Status

- 10.4 Cost Analysis of Indonesian Household Paper Industry

11 Indonesia Paper Industry Outlook 2023-2032

- 11.1 Indonesia paper industry development factors analysis

- 11.1.1 Drivers and Development Opportunities for Indonesia's Paper Industry

- 11.1.2 Threats and Challenges to Indonesia's Paper Industry

- 11.2 Indonesia paper industry supply forecast

- 11.3 Indonesia Paper Industry Market Demand Forecast

- 11.4 Indonesia Paper Industry Import and Export Forecast

Disclaimer

Service Guarantees