|

市场调查报告书

商品编码

1108744

欧洲浴室家具、固定装置和健康市场The European Market for Bathroom Furniture, Furnishings and Wellness |

||||||

到 2021 年,欧洲浴室家具、固定装置和健康市场将增长 12%,达到 155 亿欧元。预计 2022 年还将再增长 2.7%。儘管价格上涨以及经济和地缘政治不稳定,许多公司在 2022 年上半年继续录得订单增长,也证实了这一趋势。

浴室水龙头、浴室家具和卫浴洁具将成为 2021 年最大的细分市场,分别占整个市场的约 19%、18% 和 17%。德国是欧洲卫浴设备的主要市场,其次是意大利、英国和法国。

本报告探讨了欧洲浴室家具、固定装置和健康市场,以 2016-2021 年的市场趋势、到 2025 年的预测、竞争分析和浴室家具为重点业务领域。提供 100 家欧洲公司的财务和其他信息。

涵盖公司节选

Antonio Lupi, Arbi, Arblu, Arbonia, Arcom, Ballingslöv、Baden Haus、Bathroom Brands、Bette、Boffi、Bristan、Burgbad、Coram、Dansani-INR、Dornbracht、Duravit、Duscholux、Fackelmann、Fournier、Franke、Gebrit、Gessi、Grohe、Guglielmi Rubinetterie、Hansgrohe、Hallo、Hewi、Hoesch、Howden Joinery、Idea、Ideal Standard、Ikea、Inda+Samo、Jacuzzi、Kaldewei、Keuco,Klafs, Kludi, Kohler, Leda, Mattson Mora, Megius, Nuovvo, Nobili Rubinetterie, Norcros, Novellini, Oras, Paini Rubinetterie, Pelipal, Poalgi, Porcelanosa, Puris Bad-Laguna, Roca, Roper Rhodes, Royo, Sanitas Troesch, Savini+Savini Due, Scavolini, Svedbergs, Victoria Plum, Villeroy &Boch, Vitra Vola, Wren.

内容

简介

- 研究方法、研究工具、术语

基本资料

- 欧洲浴室家具、固定装置和保健品市场:按产品分类的销售预测、平均价格

- 梳妆台(浴室家具、浴室家具/配件、浴室镜子、亚克力水槽)淋浴(淋浴屏、淋浴臂、淋浴盆、多功能淋浴房)、水龙头(浴室和厨房水龙头和水龙头)、陶瓷水处理卫浴洁具(WC床单、陶瓷洁具)、浴缸(亚克力浴缸、喷射浴缸)

- 欧洲浴室家具、固定装置和保健品市场:按国家/地区划分的销售估算

- 奥地利、比利时、丹麦、芬兰、法国、德国、希腊、意大利、荷兰、挪威、西班牙、葡萄牙、瑞典、瑞士、英国、爱尔兰、保加利亚、克罗地亚、捷克共和国、爱沙尼亚、匈牙利、拉脱维亚、立陶宛、波兰、罗马尼亚、斯洛伐克、斯洛文尼亚

活动趋势和预测

- 按细分市场:浴室家具、固定装置和健康消费市场趋势(2016-2021 年),每个国家和整个欧洲的总消费量预测(2022-2025 年)

- 每个国家和整个欧洲的各项指标(人口、经济和建筑指标)的趋势(2016-2021 年),预测(2022-2025 年)

财务分析

- 在欧洲製造浴室家具、固定装置和保健产品的 100 家欧洲製造公司样本的每项财务指标:盈利能力指标(ROI、ROE、EBIT、EBITDA)、财务结构指标(资产、股东资金)、现金流, 偿付能力比率), 就业和劳动力指标

分布

- 按产品和分销渠道划分的欧洲浴室销售估算:厨房和浴室专业、带陈列室的浴室批发商、管道工和安装工、家具店/连锁店和百货公司、DIY、合同、电子商务

- 欧洲浴室家具、固定装置和保健品:样本公司按分销渠道的销售额估算

- 合同市场联繫人:建筑公司

- 费用

- 每个目标卫浴产品:样品公司在欧洲的标准零售价

- 浴室家具、固定装置和健康:按价格范围和国家/地区分类的欧洲销售估算

- 每个城市和品牌地理定位样本的需求(阿姆斯特丹、雅典、巴塞罗那、柏林、伯明翰、布鲁塞尔、布加勒斯特、科隆、哥本哈根、都柏林、布达佩斯、法兰克福、汉堡、赫尔辛基、里斯本、伦敦、里昂、马德里、曼彻斯特、米兰)、慕尼黑、奥斯陆、巴黎、布拉格、罗马、斯德哥尔摩、都灵、维也纳、华沙、苏黎世)

按产品划分的市场份额

- 浴室家具、固定装置和健康:欧洲销售估算和主要参与者的示例市场份额

- 浴室家具:浴室装置/配件和镜子、淋浴屏、淋浴臂、淋浴盘、漩涡浴缸和多功能淋浴间、浴室和厨房水龙头和水龙头、马桶座圈、陶瓷洁具、亚克力水槽和浴缸

按国家/地区划分的业务市场份额

- 欧洲国家:浴室销售估算和主要参与者样本的市场份额(奥地利、比利时、丹麦、芬兰、法国、德国、希腊、意大利、荷兰、挪威、西班牙、葡萄牙、瑞典、瑞士、英国、爱尔兰、保加利亚、克罗地亚、捷克共和国、匈牙利、波兰、罗马尼亚、斯洛伐克、斯洛文尼亚)

附录

- 大约 300 家欧洲浴室家具和固定装置公司的地址列表

The 11th of CSIL Report “The European market for bathroom furniture, furnishings and wellness” offers an accurate comprehensive picture of the bathroom furniture and furnishings industry in Europe (covering a total of 28 countries) , providing data and trends (both in value and in volume) on bathroom equipment consumption, at European level as a whole and for each country considered, for the total sector and by segment.

The study presents the main macroeconomic variables necessary to analyse the performance of the sector, the estimated stock of bathrooms in Europe, market trend 2016-2021 and forecast up to 2025, the analysis of the competitive system, a financial analysis on a sample of 100 selected European companies that have bathroom furniture as main business area, are also provided.

The analysis of the distribution system in the bathroom furniture and furnishing sector in Europe considers the main channels of sales: bathroom and kitchen specialist retailers, wholesalers of bathroom products, Plumbers and installers, furniture stores/chains and department stores, DIY, contract, e-commerce, offering estimates, at European level, of the value of each distribution channel by product type. Standard retail prices by product and by price range are also given for a sample of companies. The section also includes a listing of 50 architectural companies valuable for the Project market, and the 30 Local (city) markets to watch on a 2023 perspective.

This report takes into consideration 14 bathroom products grouped in five segments:

- Vanities: bathroom furniture; bathroom furnishings/Accessories (including soap dishes, towel racks, toilet brushes, tumbler supports, toilet tissue holders, robe hooks, shower curtains, etc.); bathroom mirrors; acrylic sinks

- Showers: shower screens (including shower screens/partitions, structures to install on the shower tray and bathtub panels); shower arms; shower trays; multifunctional shower booths (including equipped whirlpool columns that can be installed on the wall inside a simple cabin and Mini Spas)

- Faucets: bathroom faucets; kitchen faucets

- Ceramic hydro sanitary ware: all ceramic products (WC, sinks, bidets, urinals, bathtubs); WC seats

- Bathtubs: acrylic bathtubs; whirlpool bathtubs / Mini Spa.

The countries covered were divided into five areas according to their geographical proximity and similarity in market characteristics. These areas are:

- Northern Europe: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE)

- Western Europe: Belgium (BE) including Luxembourg, France (FR), Ireland (IE) and the United Kingdom (UK)

- Central Europe: Austria (AT), Germany (DE), the Netherlands (NL) and Switzerland (CH)

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

- Central-Eastern Europe (CEE): Bulgaria (BG), Croatia (HR), Czech Republic (CZ), Estonia (EE), Hungary (HU), Latvia (LV), Lithuania (LT), Poland (PL), Romania (RO), Slovakia (SK) and Slovenia (SL)

Via detailed tables are shown sales data and market shares of the top European bathroom furniture and furnishings companies for each bathroom products and in each European country considered, together with short company profiles.

An address list of around 280 European bathroom furniture and furnishings companies completes the study.

Highlights:

CSIL estimates that the European bathroom furniture, furnishing and wellness market increased by 12% in 2021 to a value of Eur 15.5 billion and by 2.9% on average per year since 2016. As a preliminary CSIL estimates a further growth by 2.7% in 2022. This positive trend has been confirmed by the preliminary results of many companies, who kept recording increasing orders in the first half of 2022 despite rising prices, economic and geopolitical instability.

In 2021, bathroom faucets, bathroom furniture, and sanitary ware are the biggest segments, accounting for approximately 19%, 18% and 17% respectively of the total market value. Germany confirms as the major European market for bathroom equipment, followed by Italy, the United Kingdom, and France.

The ten top players in CSIL sample have a cumulative market share of almost 45%. Most of them reported double digit result during 2021. The market leaders are Grohe, Geberit and Roca

Selected companies mentioned:

Antonio Lupi, Arbi, Arblu, Arbonia, Arcom, Ballingslöv, Baden Haus, Bathroom Brands, Bette, Boffi, Bristan, Burgbad, Coram, Dansani-INR, Dornbracht, Duravit, Duscholux, Fackelmann, Fournier, Franke, Geberit, Gessi, Grohe, Guglielmi Rubinetterie, Hansgrohe, Haro, Hewi, Hoesch, Howden Joinery, Idea, Ideal Standard, Ikea, Inda + Samo, Jacuzzi, Kaldewei, Keuco, Klafs, Kludi, Kohler, Leda, Mattson Mora, Megius, Nuovvo, Nobili Rubinetterie, Norcros, Novellini, Oras, Paini Rubinetterie, Pelipal, Poalgi, Porcelanosa, Puris Bad - Laguna, Roca, Roper Rhodes, Royo, Sanitas Troesch, Savini + Savini Due, Scavolini, Svedbergs, Victoria Plum, Villeroy & Boch, Vitra Vola, Wren.

Table of Contents

Introduction

- Methodology; Research tools; Terminology

Basic data

- European market for bathroom furniture, furnishings and wellness. Estimated sales by product. Eur million, thousand units and average prices

- Vanities (bathroom furniture; bathroom furnishings/accessories; bathroom mirrors; acrylic sinks) Shower (shower screens; shower arms; shower trays; multifunctional shower booths); Faucets (bathroom and kitchen taps and faucets); Ceramic hydrosanitary ware (WC seats; ceramic sanitary ware); Bathtubs (acrylic bathtubs; whirlpool bathtubs)

- European market for bathroom furniture, furnishings and wellness. Estimated sales by country. Eur million

- Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Netherlands, Norway, Spain, Portugal, Sweden, Switzerland, United Kingdom, Ireland, Bulgaria, Croatia, Czech Republic, Estonia, Hunagry, Latvia, Lithuania, Poland, Romania, Slovakia, Slovenia

Activity trend and forecasts

- Market trend for the bathroom furniture, furnishings and wellness consumption by segment (2016-2021) and forecast of total consumption (2022-2025) for each country and for Europe as a whole

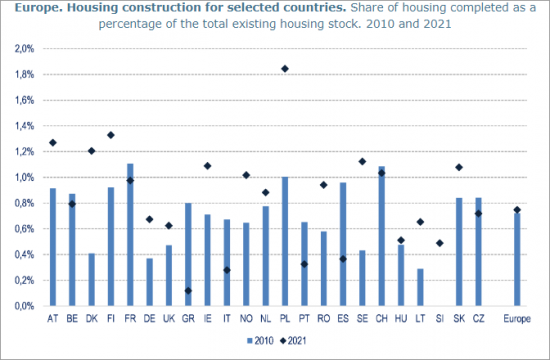

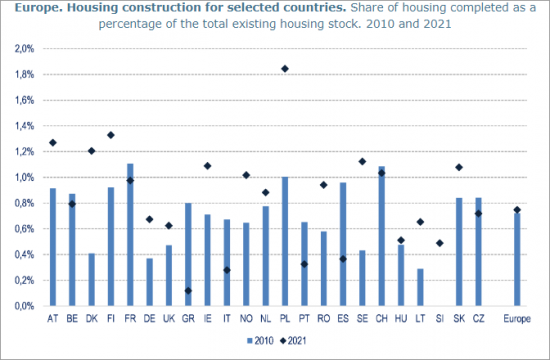

- Trend of selected indicators (population, economic and construction indicators), 2016-2021, and forecast, 2022-2025, foer each country and Europe as a whole

Financial analysis

- Selected financial indicators for a sample of 100 European manufacturing companies that produce bathroom furniture, furnishings and wellness in Europe. Profitability indicators (ROI, ROE, EBIT, EBITDA); Financial structure indicators (Assets, Shareholder funds, Cash flow, solvency ratio); Employment and Labour indicators.

Distribution

- Europe. Estimated bathroom sales by distribution channel by product. Kitchen and Bathroom specialists; Wholesalers of bath products with showroom; Plumbers and installers; Furniture stores/chains and department stores; DIY; Contract; E-commerce

- Europe. Bathroom furniture, furnishings and wellness. Estimated sales by distribution channel in a sample of companies

- A selection of contacts for the Contract market: architectural offices

- Prices

- Standard retail prices in Europe, for each bathroom product considered, for a sample of companies

- Bathroom furniture, furnishings and wellness. Estimated sales value in Europe by price range and by cluster of countries

- Demand in a selected sample of cities and brands geocalization (Amsterdam, Athens, Barcelona, Berlin, Birmingham, Brussels, Bucharest, Cologne, Copenhagen, Dublin, Budapest, Frankfurt, Hamburg, Helsinki, Lisbon, London, Lyon, Madrid, Manchester, Milan, Munich, Oslo, Paris, Prague, Rome, Stockholm, Turin, Vienna, Warsaw, Zurich)

Company market shares by product

- Bathroom furniture, furnishings and wellness. Estimated sales in Europe and market shares of a sample among the leading companies

- Estimated bathroom sales in Europe and market shares by product for a sample among the leading companies: Bathroom furniture; Bathroom furnishings/Accessories and mirrors; Shower screens; Shower arms; Shower trays; Whirlpool bathtubs and Multifunctional shower booths; Bathroom and Kitchen taps and faucets; WC seats; Ceramic sanitary ware; Acrylic sinks and bathtubs

Company market shares by country

- Estimated bathroom sales and market shares by European country considered for a sample among the leading companies: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Netherlands, Norway, Spain, Portugal, Sweden, Switzerland, United Kingdom, Ireland, Bulgaria, Croatia, Czech Republic, Hunagry, Poland, Romania, Slovakia, Slovenia

Annex

- Address list of around 300 European bathroom furniture and furnishings companies