|

市场调查报告书

商品编码

1250854

欧洲合同家具和固定装置市场The Contract Furniture and Furnishings Market in Europe |

||||||

欧洲合同家俱生产目前约为 140 亿欧元。 大部分产量用于欧洲境内的项目,只有不到 20% 用于北美、中东和亚太地区等国际目的地。

承包家具行业正以不同的速度发展,公共和商业家具的需求驱动因素发生深刻变化。 医疗、海洋、房地产、教育、奢侈品和餐饮板块在疫情后呈现快速復苏,而零售板块在大众零售商中大幅下调,儘管杂货板块保持完好。因此几乎没有復苏已经实现。 办公室和医院还没有达到大流行前的水平,但预计在未来几年内会增长。

本报告研究和分析了欧洲合同家具和固定装置市场,包括市场规模、产量、市场发展和预测、需求驱动因素和项目、主要参与者的销售额和市场份额、按细分市场和地区划分的市场。我们提供系统信息,包括分析和竞争格局。

亮点

内容

研究方法:介绍、研究工具、研究部分、样本

第 1 章执行摘要:欧洲合同家具和固定装置市场

第 2 章:欧洲合同家具市场情景

- 代工家具市场的演变:欧洲代工家具的生产和消费

- 合同家俱生产和消费:按国家/部门分类,合同家俱生产:按产品分类

- 合同家具和固定装置的消费:2023 年和 2024 年的市场预测

- 市场方法:欧洲的统包合同和软件合同、内部和贸易产品、分销渠道

- 欧洲主要集团和市场份额:市场集中度和总产量份额

第 3 章合同家具市场表现:按地区和国家分列

- 承包家具和固定装置的消费:北欧国家(丹麦、芬兰、挪威、瑞典)、宏观经济指标

- 合同家具和固定装置的消费:中欧(奥地利、德国、瑞士),宏观经济指标

- 合同家具和固定装置的消费:西欧(比利时/卢森堡、法国、爱尔兰、荷兰、英国)、宏观经济指标

- 合同家具和固定装置的消费:南欧(希腊、意大利、葡萄牙、西班牙)、宏观经济指标

- 合同家具和固定装置的消费:中欧和东欧(波兰、立陶宛、捷克共和国、罗马尼亚),宏观经济指标

第 4 章焦点:教育家具

- 市场价值:教育合同家具和设备市场

- 教育家具的潜在需求:教育建筑、目标人群、公共项目

- 分销渠道和采购流程

- 产品趋势 - 教育家具市场:按产品细分,按高端/非高端细分

- 平均客户预算

- 身份验证

- 项目

第 5 章合同家具市场:按细分、需求驱动因素、市场价值、项目分类:

- 零售、酒店、办公空间、餐厅和酒吧、房地产、娱乐、海洋、医疗、机场

第 6 章竞争对手 - 主要合同家具公司的销售额

- 在欧洲承包家具销售和主要公司的销售

- 零售、酒店、办公室、餐厅和酒吧、房地产、教育、娱乐、博物馆、医疗、船舶、机场

第 7 章竞争对手 - 主要合同家具公司的产品销售额

- 浴室家具和固定装置、卧室家具和床垫、厨房家具、照明装置、办公家具、户外家具、桌椅、软垫家具

第8章财务分析

- 从事承包家具业务的 70 家公司的财务数据

第 9 章附录

- 建筑师/设计师、酒店公司、贸易展览会和製造商名单

CSIL's Research Report "The contract furniture and furnishings market in Europe" offers a comprehensive picture of the European contract furniture business providing market size, production, market development and forecasts, demand drivers and projects, sales and market shares of the leading players, sales by destination segment - with a special focus on furniture for the Education segment - and by product category.

CONTRACT FURNITURE AND FURNISHING SECTOR OVERVIEW IN EUROPE: MARKET EVOLUTION AND PERFORMANCE BY COUNTRY

The European Contract furniture and furnishings production in 2022 and market size for the time series 2016-2022 are broken down by area and by country.

In this edition, the geographical perimeter has been expanded to 30 European countries, in detail: Northern Europe (Denmark, Finland, Norway, Sweden); Central Europe (Austria, Germany, Switzerland); Western Europe (Belgium-Lux, France, Ireland, the Netherlands, the United Kingdom); Southern Europe (Greece, Italy, Portugal, Spain), Central-Eastern Europe (Poland, Lithuania, Czech Republic, Romania, Other Central-Eastern European countries).

The European contract furniture and furnishing market forecasts are provided for the years 2023 and 2024.

Based on a recent survey conducted by CSIL on a sample of over 200 contract furniture and furnishing manufacturers in Europe, this report also shows the segments that are expected to increase faster and companies' market approach in terms of "turn-key" Vs "soft contract", own product Vs traded products, and distribution channels.

The Contract furniture production and consumption in Europe are broken down by destination segment:

- Retail

- Hospitality

- Office spaces

- Restaurants and bars

- Real estates

- Education

- Entertainment (focus of this year's edition)

- Marine

- Healthcare

- Airports

Contract furniture production in Europe is also provided by product category:

- Bathroom furniture and fittings

- Bedroom furniture and mattresses

- Kitchen furniture

- Lighting fixtures

- Office furniture

- Outdoor furniture

- Tables and chairs

- Upholstered furniture

FEATURES OF THE CONTRACT FURNITURE BUSINESS: DESTINATION SEGMENTS AND PRODUCT CATEGORIES

An overview of the main demand drivers and projects in the Retail, Hospitality, Office space, Real estate, Educational and entertainment, Marine, and Healthcare segments is also provided.

THE COMPETITIVE LANDSCAPE FEATURES: SALES OF THE LEADING CONTRACT FURNITURE COMPANIES

For the Top 100 companies operating in the European contract furniture sector, this report includes sales of contract furniture, incidence of the contract business on total company sales, and the company's share of total European production, with short profiles of selected firms.

Contract furniture sales are provided for a sample of companies even by destination segment and by product category.

This study overall considers around 380 firms active in the contract furniture sector.

NEW: FOCUS ON EDUCATION FURNITURE: This year's edition provides a detailed analysis of the Education segment including market values, the potential demand for education furniture, distribution channels, and purchasing process, product trends, average customer budgets, certifications, and projects.

FINANCIAL ANALYSIS: a set of financial indicators (Operating Revenue -Turnover-, Added Value, P/L for Period -Net Income-, Shareholders Funds, Cash Flow, ROI, ROE, EBITDA margin, EBIT margin, Solvency Ratio, Current Ratio, Number of Employees, Turnover per Employee, Added value per Employee) are reported for 70 companies operating in the contract furniture business.

ANNEX: Contact details for about 50 architect and design studios, List of relevant trade exhibitions for Hospitality, Building, Architectural and Design, Interiors, List of the first 300 hotel companies at global level, Contact details for around 380 contract furniture and furnishing manufacturers mentioned in the research.

SELECTED COMPANIES

Among the considered companies mentioned: Ahrend Group, Geberit, HMY Group Hermes Metal & Yudigar, Input Interiör, ISG, Itab Shop Concept, Kinnarps, Lifestyle Design, MillerKnoll, Nobia Group, Nowy Styl, Overbury, Pedrali, Stamhuis Groep, Steelcase, Tegometall International Sales, Umdasch ShopFitting Group, Villeroy & Boch, Vitra, VS Möbel.

Highlights:

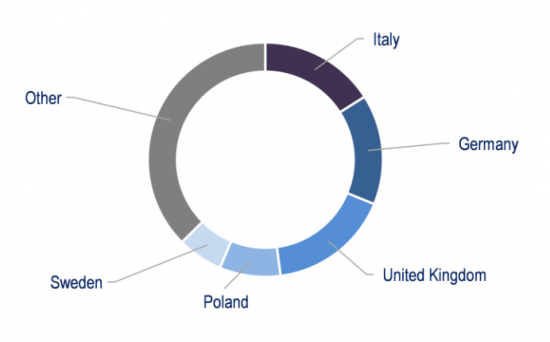

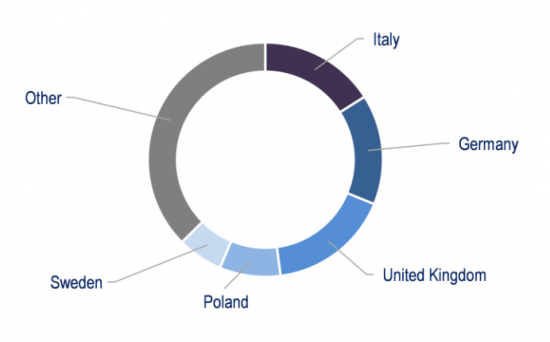

Europe. Contract furniture. Production by country, % shares

Source: CSIL

The contract furniture production in Europe currently amounts to around EUR 14 billion. The largest part of this output is destined for projects within Europe, while less than 20% is addressed outside, to North America, Middle East, and Asia-Pacific.

Italy, Germany, the UK, Poland, and Sweden are the major manufacturing countries, representing together over 60% of the total European contract furniture production.

Contract furniture segments are evolving at a different speed further to a deep transformation of public and commercial furniture demand drivers. While Healthcare, Marine, Real Estate, Education, Luxury Shops, and Restaurant segments are showing a fast post-pandemic recovery, the Retail sector has been hardly challenged with a significant downgrade of the mass market retail, even if sustained by the grocery segment. Office and Hospitality businesses have not yet reached the pre-pandemic level, but are expected to grow in the next years.

TABLE OF CONTENTS

METHODOLOGY. Introduction, Research Tools, Considered segments, and Sample

1. EXECUTIVE SUMMARY: The contract furniture and furnishings market in Europe

2. THE CONTRACT FURNITURE MARKET SCENARIO IN EUROPE

- 2.1. Contract furniture market evolution: European production and consumption of contract furniture

- Production and consumption of contract furniture by country, by segment, and Production of contract furniture by product

- 2.2. Contract furniture and furnishing consumption. Market forecasts for 2023 and 2024

- 2.3. Market approach: Turn-key vs soft contract in Europe, Own product vs traded products, Distribution channels

- 2.4. Leading groups in Europe and their market shares: Market concentration and shares on total production

3. CONTRACT FURNITURE MARKET PERFORMANCE BY AREA AND BY COUNTRY

- 3.1. Consumption of contract furniture and furnishing in Northern Europe and by country (Denmark, Finland, Norway, and Sweden) with macroeconomic indicators

- 3.2. Consumption of contract furniture and furnishing in Central Europe (Austria, Germany, Switzerland) with macroeconomic indicators

- 3.3. Consumption of contract furniture and furnishing in Western Europe (Belgium-Lux, France, Ireland, Netherlands, United Kingdom) with macroeconomic indicators

- 3.4. Consumption of contract furniture and furnishing in Southern Europe (Greece, Italy, Portugal, Spain) with macroeconomic indicators

- 3.5. Consumption of contract furniture and furnishing in Central-Eastern Europe (Poland, Lithuania, Czech Republic, Romania) with macroeconomic indicators

4. FOCUS: EDUCATION FURNITURE

- 4.1. Market values: Contract furniture and furnishings market for education

- 4.2. The potential demand for education furniture: educational buildings, target population, and public programs

- 4.3. Distribution channels and purchasing process

- 4.4. Product trends: education furniture market by product segment and by premium/non-premium segments

- 4.5. Average customer budgets

- 4.6. Certifications

- 4.7. Projects

5. THE CONTRACT FURNITURE MARKET BY SEGMENT. Demand drivers, market values, and projects in the:

- Retail, Hospitality, Office spaces, Restaurants and bars, Real estate, Entertainment, Marine, Healthcare, and Airports segments

6. COMPETITION: SALES OF THE LEADING CONTRACT FURNITURE COMPANIES BY SEGMENT

- 6.1. Contract furniture sales in Europe and leading companies' sales

- Contract furniture sales and leading companies' sales in Retail, Hospitality, Office, Restaurants and bars, Real estate, Education, entertainment, art & museum, Healthcare, Marine, and Airports segments

7. COMPETITION: SALES OF THE LEADING CONTRACT FURNITURE COMPANIES BY PRODUCT

- Contract furniture sales of Bathroom furniture and equipment, Bedroom furniture and mattress, Kitchen furniture, Lighting fixtures, Office furniture, Outdoor furniture, Tables and chairs, and Upholstered furniture

8. FINANCIAL ANALYSIS

- Financial figures of 70 companies active in the contract furniture business

9. APPENDIX

- List of Architects and Designers, Hotel Companies, Trade exhibitions and Manufacturers