|

市场调查报告书

商品编码

1695947

印度家具业The Furniture Industry in India |

|||||||

该报告透过关键指标、市场动态、需求推动因素、生产因素和印度主要家具製造商的信息,对印度家具行业进行了最新、深入的分析。

印度家具市场:关键指标与基本面

报告透过总结2014年至2024年的家俱生产、消费、进口、出口等关键指标和基本面,以及对2025年和2026年家具市场的预测,分析了印度家具业。报告还根据关键需求决定因素探讨了印度家具市场,并将其分为几个细分市场(软垫家具、厨房家具、办公家具、卧室、餐厅和客厅家具以及其他家具)。对于家具业,製造价值按细分,并显示主要生产要素。除了家具製造和消费之外,该报告还分析了印度的家具贸易、进出口,研究了其动态、原产国和目的地市场。

印度家具市场:竞争格局

该报告还深入探讨了印度家具市场的竞争格局,解释了其结构并提供了约 80 家公司的报告。排名前 50 名的家具销售公司详细概况如下。

- 企业名

- 总公司所在地

- 群组

- 活动内容

- 产品系列

- 销售额和员工人数(去年)

- 出口占总销售额的比例

- 製造设施

印度的家具市场:流通

该报告还涵盖印度家具分销系统、通路和零售,并提供在印度运营的欧洲家具製造商和印度家具零售商(网站和城市)的资讯。大约 150 家家具零售商名单包含以下资讯:

- 企业名

- 网站

- 城市名

亮点

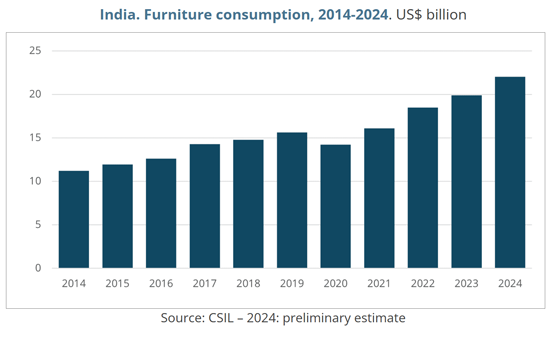

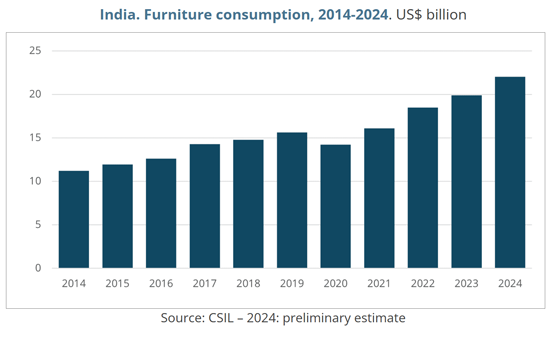

印度家具市场价值约 220 亿美元,过去十年几乎翻了一番,成为世界第四大家具市场,也是亚太地区仅次于中国的第二大家具市场。印度是成长最快的家具市场之一,预计在 2025 年至 2026 年期间将实现成长,这得益于中产阶级的不断壮大、住宅和商业基础设施投资的增加、政府举措以及家具零售业的现代化。

印度家具市场正在经历重大转型,从高度分散和无组织的结构转变为更一体化的竞争格局。快速的城市化、不断增长的可支配收入和全球一体化正在重组产业并提高效率。国际品牌的进入、有组织的零售业的扩张以及市场整合的不断加强正在加速这一变化。

目录 (摘要)

第1章 印度的家具产业的主要资料

第2章 印度的家具市场潜力

- 印度的家具消费,经济环境的预测,家具市场预测

第3章 需求的决策要素

第4章 家具消费趋势与各市场区隔的家具消费

第5章 家具的进口

- 印度的家具进口和家具消费

- 按细分市场划分的进口/消费比率

- 印度家具进口的主要来源地

- 按细分市场划分的家具进口量和家具进口来源

- 家具零件进出口

第6章 印度:生产要素

第7章 家具製造趋势与各市场区隔家具製造

第8章 家具的出口

- 印度的家具出口和家具製造

- 出口/製造比率:各市场区隔

- 家具出口主要的合作国家

- 家具出口和家具外销处:各市场区隔

第9章 印度的家具市场竞争系统的分析与说明

- 总销售额前 50 名的家具製造商

- 其他印度家具製造商

第10章 在印度展现事业的大家具製造商50公司的简介

第11章 与印度的流通管道零售

- 在印度营运的欧洲领先家具公司:分销管道

- 印度顶级家具零售商:网站与城市

附录(全国排名、社会经济资料、家具市场资料、家具进出口)

手法的相关註记

CSIL's Research Report "The furniture industry in India" offers an up-to-date and detailed analysis of the Indian furniture sector, through key indicators, market dynamics, demand drivers, productive factors, and information about the leading furniture manufacturers in India.

An executive summary introduces the study describing the role of India within the global furniture industry and the main factors driving the country's development and the increase in furniture demand, with CSIL's assessment of market potential and challenges.

INDIA FURNITURE MARKET: KEY INDICATORS AND BASIC DATA

The furniture sector in India is analysed through an overview of the main indicators and basic data: values of production, consumption, imports, and exports of furniture for the time series 2014-2024, and furniture market forecasts for 2025 and 2026.

The Indian furniture market is also explored through the main demand determinants and broken down by segment (upholstered furniture; kitchen furniture, office furniture; bedroom, dining and living room furniture; other furniture).

As far as the furniture industry is concerned, the value of production is broken down by segment and the main productive factors are also provided.

In addition to furniture production and consumption, the report also analyses the Indian furniture trade, imports and exports, with insights into dynamics, countries of origin, and destination markets.

THE COMPETITIVE LANDSCAPE OF THE INDIAN FURNITURE MARKET

This report also delves into the Indian furniture competitive system, describing its structure and covering information for about 80 companies.

For the top 50 Indian furniture manufacturers by furniture turnover, it offers detailed profiles including:

- Company name

- Headquarters

- Group

- Activity

- Product Portfolio

- Turnover and number of employees (last available year)

- Exports share on total turnover

- Manufacturing facilities

The competition analysis also offers information on other Indian large furniture manufacturers, with Company name, Web, e-mail address, Activity, Turnover range, Product Portfolio, and Location.

FURNITURE DISTRIBUTION IN INDIA

The study also describes the Indian furniture distribution system, channels, and retail, and provides information for selected European furniture companies with business activity in India and furniture retailers in India (website and city).

A list of about 150 furniture retailers is provided including the following information: company name, website, city

ANNEXES

Annexes containing socio-economic data, furniture market forecasts, trade figures, and methodological notes complement the analysis.

CSIL's Research Report 'The furniture industry in India' is part of the Country Furniture Outlook Series, that currently covers 100 markets.

Highlights:

With a value of around USD 22 billion, the furniture market in India nearly doubled in the last ten years, making it the world's fourth-largest and the second-largest in the Asia-Pacific region, after China. India is also among the fastest-growing furniture markets projected for 2025 and 2026, driven by an expanding middle class, rising investments in residential and commercial infrastructure, government initiatives, and the modernisation of furniture retail.

The Indian furniture market is undergoing a significant transformation, shifting from a highly fragmented and unorganised structure to a more consolidated and competitive landscape. Rapid urbanisation, increasing disposable incomes, and global integration are reshaping industry, and fostering efficiency. The entry of international brands, the expansion of organised retail, and growing market consolidation are accelerating this shift.

TABLE OF CONTENTS (ABSTRACT)

1. Key Facts of the Furniture Sector in India

2. The potential of the Indian furniture market

- Furniture consumption in India, economic environment forecasts and furniture market forecasts

3. Demand Determinants

4. Furniture Consumption trends and and Furniture consumption by segment

5. Furniture Imports

- India's Furniture imports and furniture consumption

- Imports/consumption ratio by segment

- Main countries of origin of Indian furniture imports

- Furniture imports by segment and sources of furniture imports by segment

- Imports and exports of furniture parts

6. India. Productive Factors

7. Furniture Production trends and Furniture production by segment

8. Furniture Exports

- India's Furniture exports and furniture production

- Exports/production ratio by segment

- Main countries destination for furniture exports

- Furniture exports by segment and destination for furniture exports by segment

9. Analysis and description of the competitive system of the furniture market in India

- Top 50 furniture manufacturers by total turnover (Company, Group, Total Turnover, Product portfolio and Location)

- Other Indian furniture manufacturers (Company, Web, Activity, Turnover range, Product Portfolio, Location)

10. Profiles of a sample of 50 leading furniture manufacturers operating in India

11. Distribution channels and retail in India

- Selection of European furniture companies with business activity in India: distribution channels

- Selection of furniture retailers in India: website and city