|

市场调查报告书

商品编码

1745945

欧洲的办公室家具市场The European Market for Office Furniture |

||||||

欧洲办公家具市场目前规模超过95亿欧元,近两年由于进口趋势良好而保持稳定。欧洲的主要消费国是德国、英国和法国。

随着时间的推移,办公家具的界线变得越来越模糊。不断变化的工作模式、产品技术特性的演变(例如高度可调的办公桌、电话亭和隔音隔间),再加上家居环境的影响,正在为创新註入强大的动力,并从根本上改变该行业几年前的传统概念。

本报告对欧洲办公家具市场进行了全面分析,包括2019年至2024年30个国家的产值、市场趋势和国际贸易情况,并概述了产品细分、分销渠道、影响行业的关键趋势以及新的需求推动因素。并提供了欧洲市场预测以及2025年和2026年的市场发展预测。我们也调查了欧洲最大的办公家具公司的表现和市场占有率,并分析了欧洲办公家具产业的竞争格局。

对象企业

对象企业

|

|

|

亮点

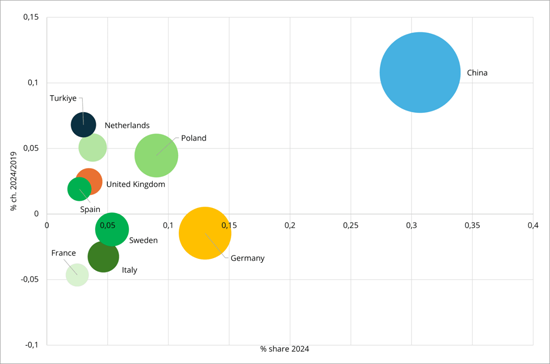

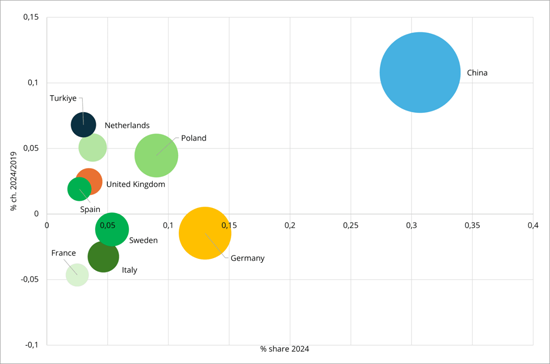

欧洲办公室家具。进口前几名国家 (2019-2024年)

2024年的欧元·占有率, 2024/2019年的变化率

出处CSIL

目录 (摘要)

调查手法,定义及註解

牵引摘要整理:欧洲的办公室家具产业的主要要素

第1章 市场情势:各国的趋势,产品类型,数值

- 各国市场趋势和数值:办公室家具的生产额价格,消费量,国际贸易

- 需求的推动因素

- 欧洲的主要群组及其市场占有率

- 目前趋势·市场预测

第2章 业绩:各地各国的基本资料和宏观经济指标

- 北欧 (丹麦,芬兰,挪威,瑞典)

- 西欧 (比利时,法国,爱尔兰,荷兰,英国)

- 中欧 (DACH:奥地利,德国,瑞士)

- 南欧 (希腊,义大利,葡萄牙,西班牙)

- 中东欧 (保加利亚,克罗埃西亚,赛普勒斯,捷克,爱沙尼亚,匈牙利,立陶宛,拉脱维亚,马尔他,波兰,罗马尼亚,斯洛维尼亚,斯洛伐克)

第3章 办公室家具的国际贸易

- 贸易收支:各市场区隔

- 出口:国家·各市场区隔

- 欧洲以外的目的地

- 进口:国家·各市场区隔

- 主要供给国

第4章 供应结构与产品市场区隔

- 产品市场区隔:欧洲及部分国的办公室家具:各市场区隔

- 办公室座椅:生产额 (类型·填补)·供给量 (类别)

- 工作用办公桌:生产额·供给量 ( 自主型·面板为基础的)

- 执行家具:生产额

- 归檔系统:生产额

- 墙,分区,音响产品:生产额·供给量 (类别)

- 会议室及共用区域的家具:生产额 (类别)

焦点

- 欧洲的电话展位和音响pod

- 欧洲的高度调节可能的表格 (HAT)

- 僱用投资活动

- 永续性再利用

第5章 市场与流通:各流通管道的办公室家具销售

- 欧洲的旋转椅子:销售数和品牌定位

第6章 竞争情形

- 主要製造商的销售额与市场占有率:各产品类型

- 主要製造商的销售额与市场占有率:主要各市场

附录1:国际贸易表

附录2:刊载企业清单

The CSIL Report "The European Market for Office Furniture" offers an extensive analysis of the office furniture market in Europe with production values, market trends, and international trade from 2019 to 2024 for 30 countries, outlining product segments, distribution channels, key trends impacting the industry, and emerging demand drivers. Market forecasts and expected developments in Europe are provided for the years 2025 and 2026. The research report also examines the largest office furniture companies in Europe, their performance and market share, to analyse the European office furniture competitive landscape.

MARKET EVOLUTION AND FIGURES BY COUNTRY

The report provides office furniture demand drivers, production and price trends, macroeconomic indicators, workforce statistics, and 2019-2024 values of office furniture production, consumption, imports, and exports and 2025 and 2026 office furniture consumption forecasts for Europe as a whole and by country.

The international trade of office furniture is thoroughly examined, providing a breakdown of European office furniture imports and exports by country and product type (office furniture and office seating), alongside key trading partners.

COMPETITION: KEY PLAYERS IN THE EUROPEAN OFFICE FURNITURE SECTOR

The study presents sales data and market shares (including trends), significant events in the competitive landscape, and mergers and acquisitions involving the leading European office furniture manufacturers.

Sales of the largest European office furniture manufacturers and their market share are provided on both a country level and for specific sub-segments, with brief profiles of selected firms.

Extra-European business: Office furniture sales Extra-EU and Russia, Middle East, Asia Pacific, North America, Central-South America, and Africa are provided for a sample of European companies.

Additionally, the report includes the addresses of around 300 office furniture companies.

SUPPLY STRUCTURE, TYPES OF PRODUCTS AND TRENDS

European office furniture production is broken down by type of products (Seating, Operative Desking, Partitions / Acoustic Filing / Storage, Communal Areas, and Executive Furniture). For each one, the report includes production values for the time series 2019-2024. The values of Office furniture by segment are also provided for selected countries (Germany, Italy, France, the United Kingdom, Sweden, Spain, Poland, and the Czech Republic)

- Office Seating: production values, breakdown by type and by covering and supply by type in a sample of companies with a FOCUS ON: Swivel Chairs. A detailed analysis of office seating volumes and brand positioning. Brand positioning by average net price and total units sold are given on a European level. The number and the performance of swivel chairs sold in the time series 2020-2024 are also provided for the major countries (Germany, France, United Kingdom, Italy, Spain, Poland, and Sweden). Values include both products manufactured in Europe and products imported from extra-European countries.

- Operative Desking: production values, the breakdown between freestanding and panel-based desking, and supply by freestanding and panel-based desking in a sample of companies, with a FOCUS ON: Height Adjustable Tables (HAT) , production of sit-standing desks by the main country/region (Scandinavia, DACH, Benelux, Italy, France, United Kingdom, Spain & Portugal, Poland, Other) and breakdown of desking supply between fixed and height adjustable, in a sample of companies.

- Executive Furniture: production values.

- Filing Systems: production values, breakdown by type, and supply by type in a sample of companies

- Walls, Partitions and Acoustic Products: production values, partition walls by type, supply by type in a sample of companies, with a FOCUS ON: Phone Booths and Acoustic Pods, values of production of phone booths and acoustic pods, values of consumption of phone booths and acoustic pods by country/region, phone booths and acoustic pods by kind, average list prices.

- Furniture for Meeting Rooms and Communal Areas: production values and breakdown by type.

MARKET AND DISTRIBUTION

The analysis of office furniture distribution channels covers Direct sales, Specialist dealers, Non-specialists, and E-commerce, with the incidence in the major European markets. A breakdown of office furniture sales by distribution channel is available for the top companies.

GEOGRAPHICAL COVERAGE:

- Northern Europe: Denmark (DK), Finland (FI), Norway (NO), and Sweden (SE);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL), and the United Kingdom (UK). Unless otherwise specified, figures for Belgium include those for Luxembourg;

- Central Europe (DACH): Germany (DE), Austria (AT), and Switzerland (CH);

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT), and Spain (ES);

- Central-Eastern Europe: Poland (PL), Czech Republic (CZ), Slovakia (SK), Hungary (HU) and Romania (RO), Slovenia (SL), Croatia (HR), Bulgaria (BG), Cyprus (CY), Malta (MT), Estonia (EE), Latvia (LV), Lithuania (LT)

The CSIL report "The European Market for Office Furniture" aims to answer to the following questions, to better understand the current state and future outlook of the relevant sector:

- What is the European Office Furniture market size?

- What are the main trends in the European office furniture market?

- What are the market forecasts for office furniture in Europe for 2025 and 2026?

- What are the leading office furniture manufacturers in Europe and their performance?

- How is office furniture distribution structured in the European market?

- Which types of office furniture are most in demand in Europe?

Selected companies

Among the considered companies:

|

|

|

Highlights:

Europe. Office Furniture. Top countries of origin of imports, 2019-2024.

Million EUR and shares 2024, % changes 2024/2019

Source: CSIL

The European market for office furniture currently exceeds a value of EUR 9.5 billion, showing a certain stability over the last two years as a result of the positive trend of imports. Leading consuming countries within Europe are Germany, the United Kingdom, and France.

Over time, the world of office furniture has assumed increasingly blurred boundaries. The change in working paradigms, the evolution of the technical characteristics of products (i.e, HAT height adjustable desks, phone booths, and acoustic pods), and the contaminations coming from the home environment have generated a push towards innovation that has radically transformed this sector from the traditional concepts of a few years ago.

TABLE OF CONTENTS (ABSTRACT)

METHODOLOGY, DEFINITIONS AND NOTES

EXECUTIVE SUMMARY: KEY FACTORS DRIVING THE OFFICE FURNITURE INDUSTRY IN EUROPE

1. MARKET SCENARIO: Trends, product types and figures by country

- 1.1. Market evolution and figures by country 2019-2024: Office furniture production values and prices, consumption and international trade

- 1.2. Demand drivers

- 1.3. Leading groups in Europe and their market shares

- 1.4. Current trends and market forecasts for 2025 and 2026

2. BUSINESS PERFORMANCE: Basic data e and macroeconomic indicators by region and by country

- 2.1. Northern Europe (Denmark, Finland, Norway and Sweden)

- 2.2. Western Europe (Belgium, France, Ireland, Netherlands, the UK)

- 2.3. Central Europe (DACH: Austria, Germany, Switzerland)

- 2.4. Southern Europe (Greece, Italy, Portugal, Spain)

- 2.5. Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovenia, Slovakia)

3. THE INTERNATIONAL TRADE OF OFFICE FURNITURE

- 3.1. Trade balance by segment

- 3.2. Exports: by country and segments

- 3.3. Extra-European destinations

- 3.4. Imports: by country and segments

- 3.5. Leading supplying countries

4. SUPPLY STRUCTURE AND PRODUCT SEGMENTS

- 4.1. Product segments: Office furniture by segment in Europe and in selected countries

- Office seating: production values, breakdown by type and covering and supply by type in a sample of companies

- Operative desking: production values, freestanding and panel-based desking, supply by freestanding and panel-based desking in a sample of companies

- Executive furniture: production values

- Filing systems: production values, breakdown by type, supply by type in a sample of companies

- Walls, partitions and acoustic products: production values, partition walls by type, supply by type in a sample of companies

- Furniture for meeting rooms and communal areas: production values and breakdown by type

FOCUS ON

- 4.2. Phone booths and acoustic pods in Europe: values of production of phone booths and acoustic pods, phone booths and acoustic pods by kind, average list prices, a sample of brands and products by year of launch, and price segment.

- 4.3. Height Adjustable Tables (HAT) in Europe: production of sit-standing desks by the main country/region and breakdown of desking supply between fixed and height adjustable, in a sample of companies

- 4.4. Employment and investment activity

- 4.5. Sustainability and reuse

5. MARKET AND DISTRIBUTION: Office furniture Sales by distribution channel

- 5.1. Swivel chairs in Europe: volumes and brand positioning

6. THE COMPETITIVE LANDSCAPE

- Sales and market shares of the leading manufacturers by product category

- Sales and market shares of the leading manufacturers by major markets