|

市场调查报告书

商品编码

1522208

全球床垫产业The World Mattress Industry |

|||||||

本报告全面提供了全球床垫产业的最新趋势和资料。涵盖2014年至2023年床垫市场指标、生产、消费和国际贸易流向,2024年和2025年床垫市场预测,全球主要床垫製造商的详细概况和竞争格局及其策略。

全球床垫产业主要製造商

全球 35 家领先床垫製造商的详细资料:公司资讯(公司名称、总部、一般联络方式)、财务亮点和销售业绩、製造活动(工厂和生产策略)

本报告涵盖约 600 家公司。

目标公司

Adova、Aquinos、Ashley Furniture、Auping、BRN Sleep Products、Corplet、De Rucci、Emma-The Sleep Company、Eurocomfort、Flex、Healthcare(Mlily)、Herval Moveis e Colches、Hilding Anders、Ikano Industry、Jason Furniture- Kuka、Kurlon、Leggett & Platt、Magniflex、Perdormire、Pikolin、Serta Simmons、Sheela Foam(Sleepwell)、Silentnight、Sinomax、Sleep Number、Tempur Sealy、Xilinmen、Yatas Yatak、Zinus

inus。亮点

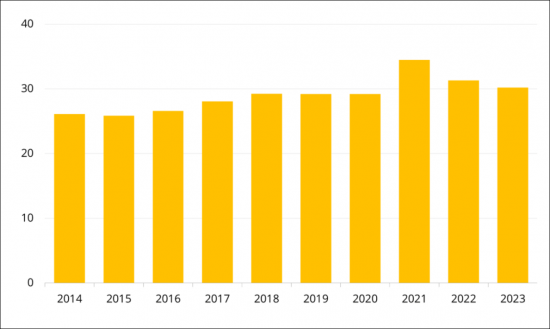

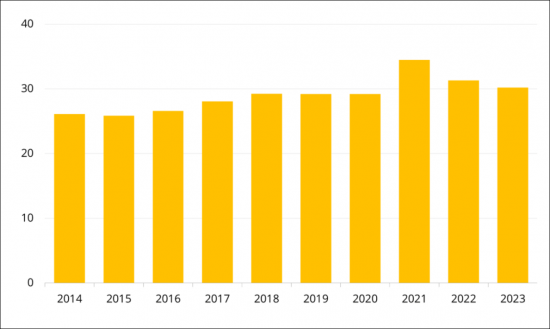

全球床垫消耗量:2014-2023

10 亿美元

来源:CSIL

过去十年,全球床垫市场呈现稳定成长。由于疫情恢復和价格大幅上涨,2021年需求显着成长,但随后2022年和2023年需求下降,市场恢復到2019年的水准。根据CSIL估计,全球床垫消费预计将在2024年陷入停滞,并在2025年恢復成长(以实际价值计算),其中北美和欧洲的成长放缓(低于全球平均值),而亚洲的成长预计将会上升。

全球市场驱动力:床垫产业的一个关键驱动力是消费者越来越意识到更好的睡眠对健康的好处。受通膨影响较小的高端产业存在显着的成长机会。同样重要的是,无论是在线上还是透过传统销售管道,对捲装和压缩床垫的需求不断成长。疫情期间陷入停滞的合约产业的復苏也为企业提供了成长潜力。近年来,电子商务的蓬勃发展也对床垫市场产生了重大影响。

目录(摘要)

研究方法/简介/执行摘要

第一部分:床垫消费、生产与国际贸易

- 床垫消费与进口:2014-2023

- 50个主要市场的床垫消费状况

- 主要市场的进口渗透与开发

- 床垫生产与出口:2014-2023

- 50个主要国家的床垫生产

- 主要出口国家、来源和目的地

- 床垫国际贸易

- 床垫国际贸易:60个国家

- 床垫消费场景

- 世界 GDP 趋势

- 床垫消费:依地区/国家划分

第二部分:床垫市场指标

- 全球床垫产业概况(50个主要国家)

- 60个国家的床垫进出口状况:2014-2023年

- 世界床垫贸易:出口目的地和进口来源地

- 2024-2025年床垫消费:预计将发生重大变化

第三部分:床垫产业排名前20的国家

- 澳洲、比利时、巴西、加拿大、中国、法国、德国、印度、义大利、日本、墨西哥、波兰、葡萄牙、韩国、西班牙、瑞典、土耳其、英国、美国、越南

关于每个国家:

- 2014年至2023年产量、表观消费量、出口、进口、2024年及2025年消费量年度变动预测

- 2018年至2023年的产量:比利时、巴西、加拿大、中国、法国、德国、印度、义大利、日本、墨西哥、波兰、葡萄牙、西班牙、瑞典、土耳其、英国、美国、越南)

- 依材料划分的生产明细资讯:内置弹簧、乳胶、泡棉等(用于澳洲、比利时、巴西、中国、法国、德国、印度、义大利、墨西哥、波兰、葡萄牙、西班牙、土耳其、英国、越南)可能的

- 主要贸易伙伴:进口国和出口国

- 社会经济指标:人口预测、主要城市常住人口、成长预测等。

- 主要床垫製造商的销售简介

第四部分:主要床垫製造商简介

第五部分:依国家划分的床垫市场指标

关于每个国家:

- 2014年至2023年产量、表观消费量、出口、进口、2024年及2025年消费量年度变动预测

- 主要贸易伙伴(进口来源国和出口目的地国)

附录

CSIL's Market Research Report 'The world mattress industry' provides a comprehensive picture of the global mattress sector with the latest trends and data: mattress market indicators from 2014 to 2023, covering production, consumption, and international trade flows, mattress market forecasts for 2024 and 2025, competitive landscape analysis with detailed profiles of the leading world mattress manufacturers and their strategies.

The purpose of this study is to provide an in-depth analysis of the mattress market across regions, countries, and key players, with outlook and market potential approached through a thorough analysis of the main sector's statistics.

THE WORLD MATTRESS INDUSTRY: BASIC DATA AND MATTRESS MARKET INDICATORS

The first part reviews the main drivers and challenges of the global mattress industry, such as supply chain issues, trade tensions, nearshoring, globalization and uncertainties, e-commerce channels, sustainability, and circularity. It also presents updated figures for the world mattress market and its competitive landscape.

This part also presents insights from the CSIL's survey addressed to a sample of global manufacturers involved in the mattress industry (April - June 2024) on Mattress manufacturers' strategies.

KEY MARKETS AND THE MOST IMPORTANT COUNTRIES IN THE GLOBAL MATTRESS SECTOR. 50 COUNTRIES ANALYSIS

The first part of this chapter provides a detailed analysis of the Top 20 world mattress markets (Australia, Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, South Korea, Spain, Sweden, Turkiye, United Kingdom, United States, Vietnam), that includes for each country:

- Mattress production, apparent consumption, exports, imports for the years 2014-2023, and forecasts of yearly changes in mattress consumption in 2024 and 2025.

- Mattress production in quantity (available for Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, Spain, Sweden, Turkiye, United Kingdom, United States, Vietnam)

- Information on breakdown of production by material (innerspring, latex, foam, other) available for Australia, Belgium, Brazil, China, France, Germany, India, Italy, Mexico, Poland, Portugal, Spain, Turkiye, United Kingdom, Vietnam

- Major trading partners (countries of origin of imports and destination of exports of mattresses)

- Socio-economic indicators, including population forecasts and resident population in main cities and projected growth

- Major mattress manufacturers by turnover, and short profiles of selected leading mattress manufacturers (Company name, Headquarters/Main Location, Email, Website, Activity, Product Portfolio, Online Sales, Total Turnover range, Employees range, Manufacturing plants)

Moreover, for further 30 countries (Argentina, Austria, Bulgaria, Chile, Croatia, Czech Republic, Denmark, Estonia, Finland, Greece, Hungary, Indonesia, Ireland, Kuwait, Latvia, Lithuania, Malaysia, Netherlands, Norway, Philippines, Romania, Russia, Saudi Arabia, Serbia, Slovakia, South Africa, Switzerland, Taiwan (China), Thailand, United Arab Emirates), the study provides Mattress production, apparent consumption, exports, imports for the years 2014-2023 and forecasts of yearly changes in mattress consumption in 2024 and 2025; Major trading partners (countries of origin of imports and destination of exports of mattresses).

Data on the international trade of mattresses (in addition to the 50 countries) are provided for a further 10 other countries, for a total of 60 countries covered by the report.

LEADING MANUFACTURERS IN THE WORLD MATTRESS INDUSTRY

Detailed profiles of the 35 world leading mattress manufacturers: company information (company name, headquarter, general contact info), financial highlights and sales performance, manufacturing activity (plants and production strategies).

The report covers overall around 600 companies

Selected companies

Among the considered companies: Adova, Aquinos, Ashley Furniture, Auping, BRN Sleep Products, Correct, De Rucci, Emma-The Sleep Company, Eurocomfort, Flex, Healthcare (Mlily), Herval Moveis e Colches, Hilding Anders, Ikano Industry, Jason Furniture - Kuka, Kurlon, Leggett & Platt, Magniflex, Perdormire, Pikolin, Serta Simmons, Sheela Foam (Sleepwell), Silentnight, Sinomax, Sleep Number, Tempur Sealy, Xilinmen, Yatas Yatak, Zinus.

Highlights:

World Mattress Consumption, 2014-2023.

US$ billion

Source: CSIL

The world mattress market has witnessed stable growth over the past decade, except for a remarkable surge in 2021, due to the recovery from the pandemic combined with considerable price increases. However, in 2022 and 2023, the market experienced a decline in demand, bringing the market back to its 2019 figures. According to CSIL estimates, world consumption of mattresses is expected to stagnate in 2024 and to return to growth in 2025 (in real terms), with slow growth in North America and Europe (below the world average), and a substantial consumption increase in Asia.

Regional and country analysis: Asia Pacific and North America are the leading markets for mattresses, accounting for over 70% of the total. In terms of single countries, the US and China are the largest mattress-consuming countries.

Global market drivers: A significant driver for the mattress industry is growing consumer awareness about the health benefits of better sleep. This trend is evident in both traditional and emerging markets. The high-end segment, less affected by inflation, presents notable growth opportunities. Additionally, the increasing demand for roll-packed and compressed mattresses in both online and traditional sales channels is pivotal. The revival of the contract segment, which was stalled during the pandemic, also offers potential growth for companies. The e-commerce boom has significantly impacted the mattress market in the last few years.

TABLE OF CONTENTS(ABSTRACT)

METHODOLOGY, INTRODUCTION AND EXECUTIVE SUMMARY

- Structure of the report, Basic data, Competitive system and Product trends

- E-commerce and sustainability: major topics of the world mattress market

- Mattress manufacturers' strategies. Insights from the CSIL's survey

PART I. CONSUMPTION, PRODUCTION AND INTERNATIONAL TRADE OF MATTRESSES

- Consumption and imports of mattresses 2014-2023

- Mattress consumption in the 50 major markets

- Import penetration and opening of major markets

- Production and exports of mattresses 2014-2023

- Mattress production in the 50 major countries

- Major exporting countries. Origin and destination of mattresses

- International trade of mattresses

- International trade of mattresses, 60 countries

- Mattress consumption. Scenario

- Evolution of world GDP

- Mattress consumption. Countries grouped by geographical region, 2025.

PART II. MATTRESS MARKET INDICATORS

- Overview of the world mattress industry (50 major countries)

- Mattress exports and imports, 60 countries, 2014-2023

- World mattress trade. Destination of exports and origin of imports

- Mattress consumption 2024-2025. Change forecasts in real terms

PART III. TOP 20 COUNTRIES FOR MATTRESS INDUSTRY (Australia, Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, South Korea, Spain, Sweden, Turkey, United Kingdom, United States, Vietnam)

FOR EACH COUNTRY:

- Mattress production, apparent consumption, exports, imports for the years 2014-2023 and forecasts of yearly changes in mattress consumption in 2024 and 2025.

- Mattress production in quantity 2018-2023 (available for Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, Spain, Sweden, Turkiye, United Kingdom, United States, Vietnam)

- Information on breakdown of production by material (innerspring, latex, foam, other) (available for Australia, Belgium, Brazil, China, France, Germany, India, Italy, Mexico, Poland, Portugal, Spain, Turkiye, United Kingdom, Vietnam)

- Major trading partners (countries of origin of imports and destination of exports of mattresses)

- Socio-economic indicators, including population forecasts and resident population in main cities and projected growth

- Major mattress manufacturers by turnover with short profiles

PART IV. SELECTED PROFILES OF MAJOR MATTRESS MANUFACTURERS

PART V. COUNTRY TABLES: MATTRESS MARKET INDICATORS BY COUNTRY

FOR EACH COUNTRY:

- Mattress production, apparent consumption, exports, imports for the years 2014-2023, and forecasts of yearly changes in mattress consumption in 2024 and 2025.

- Major trading partners (countries of origin of imports and destination of exports of mattresses).