|

市场调查报告书

商品编码

1646800

欧洲的家具市场The Furniture Industry in Europe |

|||||||

作为世界第2位的家具市场的欧洲的消费额约1,060亿欧元以(全球市场的4分之一以上),作为生产,市场规模,世界贸易的极为重要的据点,在全球家具产业中接连占着重要的地位。

从2023年到2024年儘管是严苛的市场环境,这个部门证明那个復苏力,被高度的整合和市场集中支撑,超过大流行前的水准推移着。与以欧洲规模开展事业的大间零售产业连锁厂商垄断市场做着,受到着市场内部强的团结力和确立的贸易网路的恩惠。这个结构性的强度,也成为不仅仅支撑市场稳定性,推进域内的进出口大幅度的集中的原动力。同时,欧洲反映国际贸易能放的积极的作用,对全球市场维持着持续性开放性。

预测着2025年的家具需求停滞,中期性慢慢有復苏的征兆。

本报告提供欧洲的家具市场相关调查,彙整2019年~2024年时的家具生产,消费,进口,出口趋势,各国排行榜,2025年和2026年的家具市场预测,主要家具製造商简介等资料。

亮点

目录(摘要)

摘要整理

欧洲的家具产业

- 全球家具产业上欧洲所扮演的角色

- 欧洲和其他地区。家具的生产,消费,出口,进口

- 欧洲的整合流程

- 国际家具贸易,按家具进口的目的地和原产地的家具出口

- 欧洲的家具生产实际成果

- 主要的家具製造国(义大利,德国,波兰英国,法国)的说明

- EU家具製造商竞争力的影响因素

- 欧洲的家具竞争系统

- 最近的欧洲的家具製造商策略,M&A

- 欧洲的上场家具製造商最新资料

- 欧洲的前50大厂商:总销售额排行榜

- 欧洲的家具市场趋势:2019年~2024年

- 市场资讯来源

- 国内生产,欧盟市场整合,进口流通量

- 贸易收支

- 市场开放度的高涨

- 出口意愿

- 欧洲的家具生产的各领域明细

- 家具子区隔趋势

各国分析

- 市场概况及宏观经济趋势、家俱生产、消费、进口、出口、国家排名、家具市场预测、贸易伙伴、各细分市场的家具消费和生产、製造系统以及主要家具製造商的简介:

- 奥地利、比利时、保加利亚、克罗埃西亚、赛普勒斯、捷克、丹麦、爱沙尼亚、芬兰、法国、德国、希腊、匈牙利、爱尔兰、义大利、拉脱维亚、立陶宛、马尔他、荷兰、挪威、波兰、葡萄牙、罗马尼亚、斯洛伐克、斯洛维尼亚、西班牙、瑞典、瑞士、英国

超过2400公司的欧洲的家具製造商简介:

- 活动

- 产品系列

- 销售额范围

- 员工数

- 电子邮件地址

- 网站

方法论的註解

Part of the CSIL Country Furniture Outlook Series covering 100 countries at present with CSIL furniture industry insights, "The Furniture Industry in Europe" contains all the main statistics and indicators useful to analyze the furniture sector in Europe and in 30 European countries: Austria, Belgium-Lux, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, the UK.

THE FURNITURE INDUSTRY IN EUROPE: INSIGHTS AND FORECASTS

The first part of this furniture market report goes in-depth into the future perspectives for the European furniture sector with a particular focus on the green and digital transitions shaping the industry.

European Furniture Market: Key Data and Trends

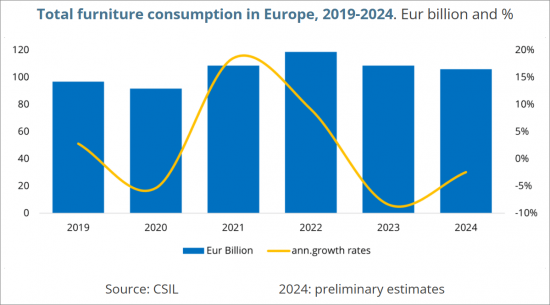

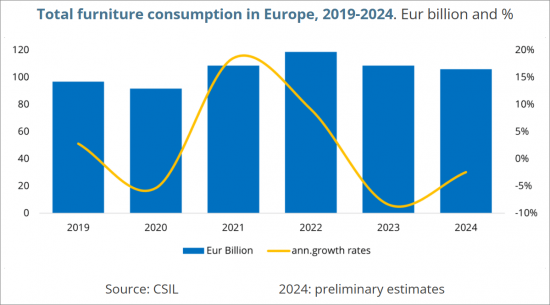

The role of Europe in the global furniture context is analysed with historical series of basic data (furniture production, consumption, and trade 2019-2024), the European furniture production performance and future perspectives, the main factors affecting the competitiveness of manufacturers (labor cost, availability of raw materials and components, investments in technology and machinery, innovations, recycling, sustainability, and circularity), imports penetration, exports orientation, description of the main furniture manufacturing countries.

The European furniture market potential, development insights, and Furniture market trends are analysed through a historical series of furniture consumption data and future perspectives of the furniture sector in Europe, with consumption forecasts for 2025 and 2026.

The Furniture manufacturing system and trends in the development of furniture production by segment (upholstered furniture, kitchen furniture, office furniture, furniture for the bedroom &dining-living room, other furniture) with trends in furniture sub-segments (available data up to 2023).

Top Furniture Manufacturers in Europe

The competitive system in Europe is covered with the recent European furniture manufacturers' strategies, mergers, and acquisitions (M&A).

The competitive system analysis includes figures for the leading 50 European furniture companies (company name, headquarters' country, furniture specialization, total turnover, and the number of employees, share of furniture on total sales) ranked by their turnover.

Financial performance analysis of a selection of publicly listed European furniture manufacturers, including aggregated key annual (2019-2023) figures such as total revenue, EBITDA, total liabilities, total shareholders' equity, and the Debt-to-Equity Ratio, and quarterly (2024) data for total revenue, gross profit, operating expense, operating income, total expense, EBIT and EBITDA, is also provided.

Over 2400 short profiles of furniture manufacturers are also provided, with information on their activity, product portfolio, turnover range, employees range, general email address -when available- and website.

COUNTRY ANALYSIS: FURNITURE INDUSTRY REPORTS FOR 30 EUROPEAN COUNTRIES

For each considered country (Austria, Belgium-Lux, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, the United Kingdom) this study offers a complete report including:

- Market Outline and macroeconomic trends

- Production, consumption, imports, and exports of furniture for the time series 2019-2024

- Comparison with the European furniture sector: country rankings on production, consumption, imports, and exports

- Furniture market forecasts for 2025 and 2026

- Trading partners: the origin of furniture imports and furniture export destination

- Value of furniture consumption and production by segment (upholstered furniture, office furniture, kitchen furniture, Furniture for bedroom, dining-living room * and other furniture)

- Manufacturing system: number of furniture firms, and size

- Short profiles of leading furniture manufacturers

Types of furniture covered: Office furniture, Upholstered furniture, Non-upholstered seats, Kitchen furniture, Bedroom furniture, Dining and living room furniture, and Other Furniture.

* For Bulgaria, Croatia, Estonia, Latvia, Lithuania, Malta, and Slovenia, the furniture consumption and production breakdown by segment is available only by upholstered furniture, office furniture, kitchen furniture, and other furniture.

Selected companies

Among the leading furniture manufacturers mentioned in this study: Aquinos, BRW Black Red White, Cotta Collection, Ekornes, Friul Intagli, Howden Joinery, IKEA, Lifestyle Design, Natuzzi, Nobilia, Nowy Styl, Polipol, Schmidt Groupe, Schuller, Fournier, Steelcase, Welle Holding.

Highlights:

Europe, the world's second-largest furniture market with a consumption value of around EUR 106 billion (over one-quarter of the global market), continues to hold a crucial position in the global furniture industry, acting as a pivotal hub for production, market size, and world trade.

Despite difficult market conditions in 2023-2024, the sector has proven its resilience, staying above pre-pandemic levels, supported by a high level of integration, and market concentration. Dominated by major retail chains and manufacturers operating on a European scale, the market benefits from strong internal cohesion and a well-established trade network. This structural strength not only underpins its stability but also drives the substantial concentration of export and import flows within the region. At the same time, Europe maintains an ongoing openness to global markets, reflecting its proactive role in international trade.

CSIL forecasts stagnant furniture demand in 2025, with signs of a gradual recovery in the medium term.

TABLE OF CONTENTS (ABSTRACT)

EXECUTIVE SUMMARY

- The future perspectives for the European furniture sector

- The global macroeconomic context and furniture market forecasts in Europe

- Green and digital transitions: a hot topic for the European furniture industry

THE EUROPEAN FURNITURE SECTOR

- The Role of Europe in the Global Furniture Context

- Europe and the rest of the world. Furniture production, consumption, exports, imports

- The integration process within Europe

- International furniture trade, furniture exports by destination and origin of furniture imports

- The European furniture production performance

- Description of the main furniture manufacturing countries (Italy, Germany, Poland, The United Kingdom, France)

- Factors affecting the competitiveness of EU furniture producers

- The furniture competitive system in Europe

- Recent European furniture manufacturers' strategies, M&A

- Recent figures of publicly listed European furniture manufacturers

- The TOP 50 European manufacturers. Ranking by total turnover

- European furniture market performance 2019-2024

- Market sources

- National production, EU market integration and import flows

- Trade balance

- The growing degree of market openness

- The export orientation

- European furniture production by segment

- Trends in furniture sub-segments

COUNTRY ANALYSIS

- Market outline and macroeconomic trends, Production, consumption, imports, and exports of furniture, Country rankings, Furniture market forecasts, Trading partners, Furniture consumption and production by segment, Manufacturing system, and short profiles of leading furniture manufacturers for:

- Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom

SHORT PROFILES OF OVER 2400 EUROPEAN FURNITURE COMPANIES:

- activity

- product portfolio

- turnover range

- employees range

- e-mail address

- website