|

市场调查报告书

商品编码

1775078

高阶·高级·设计家具的全球市场The World Market for High-End, Luxury & Design Furniture |

|||||||

高端家具市场约占全球家具市场的15%,已成为全球家具产业的策略性和活力驱动力。北美是最大的市场,拥有全球超过40%的高净值人士,其次是亚太地区和欧洲。在财富集中、城市发展、雄心勃勃的房地产投资以及生活方式转变的推动下,印度和海湾国家正成为成长最快的地区。

儘管存在持续的不确定性、快速变化和地缘政治课题,但高端家具市场仍相对抵御贸易衝击等短期波动,并受长期结构性趋势的驱动。这些因素包括高收入人群的成长(全球约有6,000万高净值人士,亚太地区在过去五年中成长了30%)、财富城市化(全球超过15%的超高净值人士居住在排名前十的城市),以及消费者对设计感强、独特且定製家具的偏好不断变化。这些因素正在推动全球客户群的扩张。

本报告探讨了全球高端、奢华和设计师家具市场,并提供了按地区、国家和地区划分的市场规模趋势和预测、关键需求推动因素、按产品和最终用户划分的市场细分、竞争分析、主要公司的市场进入情况、併购活动以及零售策略的全面分析。

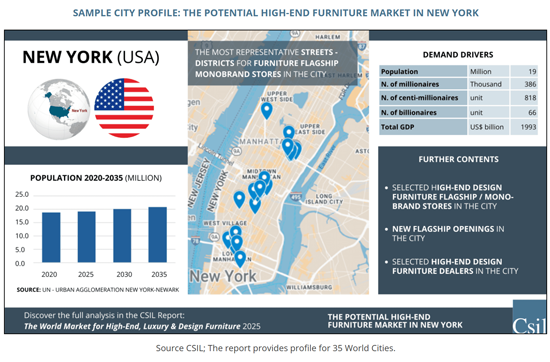

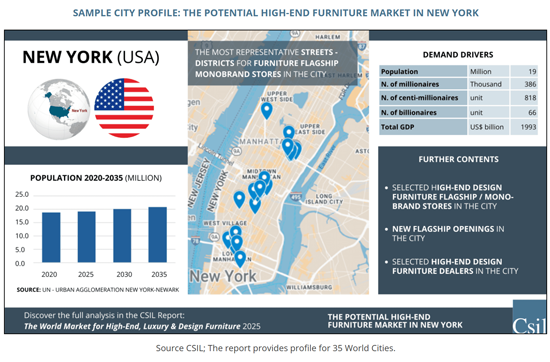

各城市的简介:

- 人口和成长率

- 国内生产总值

- 亿万富翁,亿万富翁,亿万富翁的数

- 代表各城市的家具旗舰店/东西品牌店的大街/地区的地图

- 市内的高级设计家具的旗舰店/东西品牌店

- 市内的高级设计家具经销商

通路分析作为调查对象的高阶设计/流行品牌:

|

|

|

目录

调查领域·调查手法

摘要整理:高阶·豪华·设计家具的全球市场

第1章 全球情势

- 全球影响需求因素:富裕阶级,亿万富翁,观光,品牌住宅,超级游艇

- 全球财富的分配和人口相关主要数值

- 高级饭店和不动产趋势

第2章 高阶家具的市场规模

- 全球市场规模的转变:各地各国

- 市场规模前十名国家

- 各国和各地的进口流通量

- 产品和各终端用户的市场明细

第3章 市场预测

- 世界·各地各国的成长预测

- 预测的需求要素

第4章 竞争情形

- 主要高端家具製造商(按细分):超豪华/客製化、奢华/时尚品牌、高端设计/标誌性、设计驱动/中高端市场

- 分销策略与旗舰店网络

- 併购活动

高阶家具:地区分析

第5章 欧洲

- 推动市场要素,规模,预测,竞争

- 观察对象国家:德国,英国,法国,义大利

- 进口业者,主要製造商,零售业者

第6章 北美

- 推动市场要素,规模,预测,竞争

- 观察对象国家:美国,加拿大

- 进口业者,主要製造商,零售业者

第7章 亚太地区

- 推动市场要素,规模,预测,竞争

- 观察对象国家:中国,日本,印度,韩国

- 进口业者,主要製造商,零售业者

第8章 海湾国家

- 推动市场要素,规模,预测,竞争

- 进口业者,主要製造商,零售业者

其他的国家

第9章 俄罗斯

- 市场趋势,预测

第10章 巴西

- 推动市场要素,进口,预测,竞争

高阶家具市场:全球城市和旗舰店

- 35个全球主要城市:城市概况

- 需求推动因素:人口、GDP和高收入者数量

- 45个欧洲高端设计师家具品牌通路分析

- 旗舰店和单一品牌店(品牌、店铺名称、地址)以及零售商(店铺名称、品牌选择、地址)地图

- 特定地图,显示城市中旗舰店和单一品牌家具店最热门的街道和街区

The CSIL's report "The World Market for High-End, Luxury & Design Furniture" offers a comprehensive in-depth analysis of the high-end furniture market worldwide, providing market size (2019-2024) and forecasts 2025, 2025-2028 at world, area and country level; an analysis of the main demand drivers; breakdown of the market by product and by end-user; in-depth analysis of the competition, clustering of main players by their market of reference, M&A activity and retail strategies; selection of potential 35 cities for high-end furniture demand.

REPORT'S STRUCTURE AND CONTENTS

An Executive Summary opens the study with a snapshot of major insights and trends shaping the global high-end furniture sector and the main findings of CSIL's analysis, delving into drivers and key factors fuelling demand, such as global wealth distribution, the number of millionaires and billionaires, luxury tourism, branded residences, and the superyacht industry. Companies features and strategies are summarized.

World Scenario

Comprehensive global analysis of the high-end, design, luxury furniture market, including:

- The size of the high-end furniture market in 2024 and forecasts 2025, 2025-2028, at world, area and country level.

- An analysis of the main demand drivers: global wealth, number of millionaires, luxury hotels, branded residences, superyachts, international tourism

- An import flows analysis: major imports flows from most important countries for high-end furniture production

- The breakdown of the market by product: upholstered furniture, kitchen furniture, dining and living (incl. tables and chairs), outdoor furniture, bedroom furniture, office furniture and bathroom furniture.

- The breakdown of the market by end-user: residential, hospitality, luxury Retail/shopfitting, office, marine (cruises/yachts)

- Competition analysis: identification of main players for each category (ultra-luxury / bespoke furniture, luxury/fashion-branded, high-end design / signature design, design oriented/upper middle). Profiles and distribution channels for main players are provided.

- M&A deals analysis: main deals between 2019-2025

Regional and Country-Level Analysis

The high-end, design, luxury furniture market is analysed by area and for seleceted countries, including:

- The size of the high-end furniture market (2019-2024) and forecasts 2025, 2025-2028.

- An analysis of the main demand drivers

- An import flows analysis: major imports flows from most important countries for high-end furniture production

- Competition analysis: identification of main players for each area / country by total turnover

- Distribution system insights: main trends, selection of high-end furniture dealers

Geographical coverage: European Union + UK, NO, CH; Central Eastern Europe; North America; Asia and Pacific; South America; Middle East and Africa/Gulf countries.

Country level: Germany, UK, France, Italy, USA, Canada, China, Japan, India, South Korea, Gulf Countries, Brazil, Russia. *For Russia only sector basic data available; for South Korea high-end furniture manufacturers not available.

Hot Topic: The Potential High-End Furniture Market in A Selection of Cities Worldwide and Flagship Stores

This part includes CSIL in-depth analysis on the potential high-end furniture markets in a selection of 35 cities worldwide based on criteria such as the number of ultra-rich individuals, economic growth, and the presence of high-end brands, together with the distribution analysis of 45 leading international high-end design brands. More than 500 flagship / monobrand stores have been identified, together with more than 1300 dealers.

Each city profile includes:

- Population and its growth rate, 2020, 2025, 2030 and 2035

- Total Gross domestic product, US$ billion

- Number of millionaires, centi-millionaires, billionaires

- Maps of most representative streets/districts for furniture flagship/monobrand stores in the city

- High-end design furniture flagship/monobrand stores in the city (brand, store name, address)

- High-end design furniture dealers in the city (store name, selection of brands offered, address)

High-end design /fashion brands considered in the distribution analysis:

|

|

|

Highlights:

Accounting for nearly 15% of the world furniture market, the high-end furniture segment emerges as a strategic and dynamic driver within the global furniture industry. North America is the largest market, largely due to its concentration of affluent consumers, including over 40% of global millionaires. Asia-Pacific and Europe follow in market size, while India and the Gulf countries stand out among the fastest-growing regions, driven by wealth concentration, urban development, ambitious real estate investments and evolving lifestyles.

Despite ongoing uncertainty, rapid transformation, and geopolitical challenges, this segment has demonstrated greater stability and independence from short-term fluctuations, such as trade shocks, and has been driven by long-term structural trends: growth of high-net-worth individuals (nearly 60 million of millionaires worldwide, +30% in Asia and Pacific in the last five years), urban concentration of wealth (top 10 cities in the world are home to more than 15% of global ultra-wealthy individuals), and the evolution of consumer preferences toward design, exclusivity and custom furniture. Those have favoured a customer base expansion globally.

TABLE OF CONTENTS

RESEARCH FIELD AND METHODOLOGY

- Scope of research and definitions

- Product types and geographic coverage

- Data collection and processing methods

- a and presentation notes

EXECUTIVE SUMMARY: The World Market for High-End, Luxury & Design Furniture

1. World Scenario

- Global demand drivers: wealth, millionaires, tourism, branded residences, superyachts

- Key figures on global wealth distribution and population

- Trends in luxury hospitality and real estate

2. High-End Furniture Market Size

- Global market value (2019-2024), by region, country

- Top 10 countries by market size

- Import flows by country and region

- Market breakdown by product and end-user

3. Market Forecasts (2025, 2025-2028)

- Growth projections by world, region, country

- Forecasted demand drivers

4. Competition

- Leading manufacturers of High-End Furniture by segment: Ultra-luxury / Bespoke, Luxury / Fashion-branded, High-end Design / Signature, Design-oriented / Upper-middle market

- Distribution strategies and flagship store networks

- M&A activity (2019-2025)

HIGH END FURNITURE. ANALYSIS BY GEOGRAPHICAL AREA

5. Europe

- Market drivers, size, forecasts, and competition

- Country focus: Germany, UK, France, Italy

- Imports, key manufacturers, and retailers

6. North America

- Market drivers, size, forecasts, and competition

- Country focus: USA and Canada

- Imports, key manufacturers, and retailers

7. Asia-Pacific

- Market drivers, size, forecasts, and competition

- Country focus: China, Japan, India, South Korea

- Imports, key manufacturers, and retailers

8. Gulf Countries

- Market drivers, size, forecasts, and competition

- Imports, key manufacturers, and retailers

OTHER COUNTRIES

9. Russia

- Market trends, forecasts

10. Brazil

- Market drivers, imports, forecasts, and competition

HIGH-END FURNITURE MARKET: GLOBAL CITIES AND FLAGSHIP STORES

- Focus on 35 selected cities worldwide: City-by-city profiles

- Demand drivers: population, GDP, number of millionaires, centi-millionaires, billionaires

- Analysis of 45 leading European high-end / design furniture brands by distribution channels

- Mapping of flagship and mono-brand stores (brand, store name, address) and dealers (store name, selection of brands offered, address)

- Most representative streets/districts for furniture flagship/monobrand stores in the city represented in specific maps