|

市场调查报告书

商品编码

1885919

耳鼻喉科器材市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)ENT Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

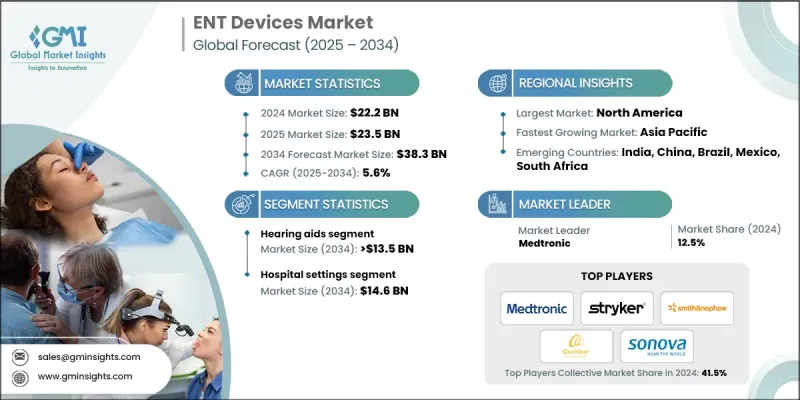

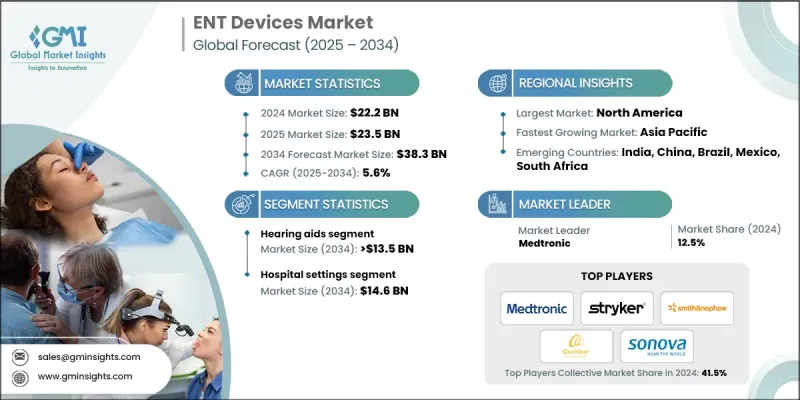

2024 年全球耳鼻喉科设备市场价值为 222 亿美元,预计到 2034 年将以 5.6% 的复合年增长率成长至 383 亿美元。

耳鼻喉疾病盛行率上升、老年人口不断增长以及对微创手术的需求日益增加,是推动市场成长的主要因素。该市场为医疗服务提供者、生命科学公司、支付方和技术公司提供创新解决方案,以改善患者护理、提高合规性并提升营运效率。主要产品包括内视镜系统、人工耳蜗、微创手术器械、诊断设备和数位化耳鼻喉平台,旨在提高手术精准度、疾病管理水平和整体生活品质。全球人口老化导致听力损失、慢性鼻窦炎和平衡障碍的发生率上升,增加了对耳鼻喉科干预的需求。都市化和生活方式的改变也导致呼吸系统和过敏性疾病的发生率上升,扩大了患者群体。由于恢復时间短、併发症风险低、疗效好,临床医生和患者越来越倾向于选择微创技术,这推动了对专用耳鼻喉科设备的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 222亿美元 |

| 预测值 | 383亿美元 |

| 复合年增长率 | 5.6% |

2024年,助听器市占率达37.5%。老年人听力损失盛行率的上升以及包括数位化和人工智慧助听器在内的技术进步推动了这一增长。此细分市场涵盖耳背式(BTE)、耳内式/耳道式(RITE/RIC)、全耳道式/隐形耳道式(CIC/IIC)、耳内式(ITE)和耳道式(ITC)助听器。人们对听力健康的日益重视以及对先进和传统助听器的需求,正在推动医院、诊所和家庭护理机构对助听器的广泛应用。

2024年,耳鼻喉科诊断设备市场规模达到58亿美元,预计2025年至2034年将以6.2%的复合年增长率成长。该市场涵盖硬式和软式内视镜、听力筛检设备以及机器人辅助内视镜。对耳鼻喉科疾病早期检测和精准诊断需求的不断增长,是推动该市场成长的主要动力。

2024年,北美耳鼻喉科器械市占率达到38.6%。其市场主导地位得益于完善的医疗保健基础设施、先进医疗技术的应用以及高昂的医疗支出。慢性鼻窦炎、听力损失和睡眠呼吸中止症等耳鼻喉科疾病病例的增加,推动了对精密诊断和治疗设备的需求。包括高清内视镜、机器人手术系统和人工智慧诊断工具在内的技术创新,提高了手术的准确性和效率,促进了这些设备在医院、门诊手术中心和诊所的应用。

耳鼻喉科器材市场的主要参与者包括美敦力(Medtronic)、德索特医疗(DeSoutter Medical)、捷迈邦美(Zimmer Biomet)、波士顿科学(Boston Scientific)、史赛克(Stryker)、强生(Ethicon)、韦尔奇艾林(Welch Allyn,Hillromance)、索诺瓦(S. Medical、奥林巴斯(Olympus)、史密斯医疗(Smith & Nephew)、Nouvag、Vega Medical 和 WestCMR。这些公司正采取多种策略来巩固自身地位并扩大市场占有率。他们大力投资研发,以推出创新且技术先进的产品。策略合作、协作和收购有助于拓展地域覆盖范围和分销网络。此外,各公司也致力于透过数位化、人工智慧和微创解决方案来扩展产品组合,以满足不同患者的需求。重视监管合规、品质认证和永续发展措施有助于提升公司信誉。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 全球耳鼻喉疾病盛行率不断上升

- 老年人口不断增加

- 耳鼻喉科设备的技术进步

- 对微创耳鼻喉科手术的需求不断增长

- 产业陷阱与挑战

- 高昂的手术和器械成本

- 全球范围内的社会歧视

- 市场机会

- 人工智慧诊断的整合

- 远距耳鼻喉科会诊量不断上升

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 技术格局

- 当前技术趋势

- 微创耳鼻喉科手术器械和内视镜系统的发展

- 实现远距耳鼻喉科会诊和远距诊断的数位化耳鼻喉科平台

- 对患者友善的听力植入体和便携式听力设备

- 新兴技术

- 人工智慧驱动的耳鼻喉科诊断和预测性疾病管理

- 穿戴式及连网式听力及平衡设备

- 具有自适应治疗和个人化治疗模式的智慧耳鼻喉科设备

- 当前技术趋势

- 差距分析

- 波特的分析

- PESTEL 分析

- 未来市场趋势

- 人工智慧整合式耳鼻喉科设备在疾病早期检测和个人化治疗方案製定方面的应用日益广泛

- 远端耳鼻喉科平台和远端监测解决方案在以患者为中心的护理中得到更广泛的应用

- 微创、智慧、穿戴式耳鼻喉科设备的普及提高了手术效率和患者依从性。

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依设备类型划分,2021-2034年

- 主要趋势

- 助听器

- 耳后式(BTE)

- 耳内式/耳道式受话器(RITE/RIC)

- 完全管内式/隐形管内式 (CIC/IIC)

- 耳内式(ITE)

- 运河内(ITC)

- 耳鼻喉科诊断设备

- 硬式内视镜

- 喉镜

- 鼻镜

- 耳科内视镜

- 柔性内视镜

- 听力筛检设备

- 机器人辅助内视镜

- 硬式内视镜

- 耳鼻喉外科器械

- 鼻窦扩张装置

- 电动手术器械

- 耳科钻头

- 射频手柄

- 耳鼻喉科手用器械

- 鼓膜置管

- 鼻腔填塞装置

- 听力植入

- 人工耳蜗

- 骨锚式助听系统

- 听觉脑干植入

- 中耳植入物

- 语音假体装置

- 鼻夹板

- 外鼻夹板

- 鼻内夹板

第六章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 医院

- 门诊手术中心

- 耳鼻喉科诊所

- 居家照护

第七章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Atos Medical

- Boston Scientific

- Cochlear

- DeSoutter Medical

- Johnson & Johnson (Ethicon)

- Lumenis

- Medtronic

- Meril Life Sciences

- Narang Medical

- Nouvag

- Olympus

- Smith & Nephew

- Sonova

- Stryker

- Vega Medical

- Welch Allyn (Hillrom)

- WestCMR

- Zimmer Biomet

The Global ENT Devices Market was valued at USD 22.2 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 38.3 billion by 2034.

Growth is driven by the rising prevalence of ENT disorders, an expanding geriatric population, and increasing demand for minimally invasive procedures. The market offers innovative solutions to healthcare providers, life science companies, payers, and technology firms to improve patient care, regulatory adherence, and operational efficiency. Key offerings include endoscopy systems, hearing implants, minimally invasive surgical tools, diagnostic devices, and digital ENT platforms designed to enhance procedural precision, disease management, and overall quality of life. The global aging population is contributing to higher incidences of hearing loss, chronic sinusitis, and balance disorders, increasing the need for ENT interventions. Urbanization and lifestyle changes are also leading to higher rates of respiratory and allergic conditions, expanding the patient base. Clinicians and patients increasingly prefer minimally invasive techniques due to shorter recovery times, lower complication risks, and improved outcomes, driving the demand for specialized ENT devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.2 Billion |

| Forecast Value | $38.3 Billion |

| CAGR | 5.6% |

The hearing aids segment held a 37.5% share in 2024. Growth is fueled by the rising prevalence of hearing loss among the elderly and technological advancements, including digital and AI-enabled hearing aids. This segment includes behind-the-ear (BTE), receiver-in-ear/receiver-in-canal (RITE/RIC), completely-in-canal/invisible-in-canal (CIC/IIC), in-the-ear (ITE), and in-the-canal (ITC) devices. Increasing awareness of hearing health and the demand for advanced and conventional hearing devices are driving adoption across hospitals, clinics, and home care settings.

The diagnostic ENT devices segment generated USD 5.8 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2034. It includes rigid and flexible endoscopes, hearing screening devices, and robot-assisted endoscopes. Rising demand for early detection and accurate diagnosis of ENT disorders is fueling growth in this segment.

North America ENT Devices Market held 38.6% share in 2024. Market dominance is supported by a well-established healthcare infrastructure, adoption of advanced medical technologies, and high healthcare expenditure. Increasing cases of ENT disorders such as chronic sinusitis, hearing loss, and sleep apnea are boosting demand for sophisticated diagnostic and treatment devices. Technological innovations, including high-definition endoscopes, robotic surgical systems, and AI-powered diagnostic tools, improve procedural accuracy and efficiency, driving adoption in hospitals, ambulatory surgical centers, and clinics.

Key players in the ENT Devices Market include Medtronic, DeSoutter Medical, Zimmer Biomet, Boston Scientific, Stryker, Johnson & Johnson (Ethicon), Welch Allyn (Hillrom), Sonova, Lumenis, Atos Medical, Narang Medical, Olympus, Smith & Nephew, Nouvag, Vega Medical, and WestCMR. Companies in the ENT devices market are employing multiple strategies to strengthen their position and expand their footprint. They are investing heavily in research and development to introduce innovative and technologically advanced products. Strategic partnerships, collaborations, and acquisitions help broaden geographic presence and distribution networks. Companies are also focusing on expanding product portfolios with digital, AI-enabled, and minimally invasive solutions to meet diverse patient needs. Emphasis on regulatory compliance, quality certifications, and sustainability initiatives enhances credibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of ENT disorders globally

- 3.2.1.2 Increasing geriatric population

- 3.2.1.3 Technological advancements in the ENT devices

- 3.2.1.4 Rising demand for minimally invasive ENT procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High procedure and instruments cost

- 3.2.2.2 Social stigma across the globe

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI diagnostics

- 3.2.3.2 Rising tele-ENT consultations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Growth of minimally invasive ENT surgical instruments and endoscopic systems

- 3.5.1.2 Digital ENT platforms enabling tele-ENT consultations and remote diagnostics

- 3.5.1.3 Patient-friendly hearing implants and portable audiology devices

- 3.5.2 Emerging technologies

- 3.5.2.1 AI-powered ENT diagnostics and predictive disease management

- 3.5.2.2 Wearable and connected hearing and balance devices

- 3.5.2.3 Smart ENT devices with adaptive treatment and personalized therapy modes

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Expansion of AI-integrated ENT devices for early disease detection and personalized treatment planning

- 3.9.2 Increased adoption of tele-ENT platforms and remote monitoring solutions for patient-centric care

- 3.9.3 Growth of minimally invasive, smart, and wearable ENT devices enhancing procedural efficiency and patient compliance

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launch

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hearing aids

- 5.2.1 Behind-the-ear (BTE)

- 5.2.2 Receiver in the ear/receiver in canal (RITE/RIC)

- 5.2.3 Completely-in-the-canal/Invisible-in-canal (CIC/IIC)

- 5.2.4 In-the-ear (ITE)

- 5.2.5 In-the-canal (ITC)

- 5.3 Diagnostic ear, nose, and throat (ENT) devices

- 5.3.1 Rigid endoscopes

- 5.3.1.1 Laryngoscopes

- 5.3.1.2 Rhinoscopes

- 5.3.1.3 Otological endoscopes

- 5.3.2 Flexible endoscopes

- 5.3.3 Hearing screening devices

- 5.3.4 Robot assisted endoscopes

- 5.3.1 Rigid endoscopes

- 5.4 Surgical ear, nose, and throat (ENT) devices

- 5.4.1 Sinus dilation devices

- 5.4.2 Powered surgical instrument

- 5.4.3 Otological drill burrs

- 5.4.4 Radiofrequency handpieces

- 5.4.5 ENT hand instruments

- 5.4.6 Tympanostomy tubes

- 5.4.7 Nasal packing devices

- 5.5 Hearing implants

- 5.5.1 Cochlear implants

- 5.5.2 Bone anchored hearing system

- 5.5.3 Auditory brainstem implants

- 5.5.4 Middle ear implants

- 5.6 Voice prosthesis devices

- 5.7 Nasal splints

- 5.7.1 External nasal splints

- 5.7.2 Internal nasal splints

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 ENT clinics

- 6.5 Homecare

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Atos Medical

- 8.2 Boston Scientific

- 8.3 Cochlear

- 8.4 DeSoutter Medical

- 8.5 Johnson & Johnson (Ethicon)

- 8.6 Lumenis

- 8.7 Medtronic

- 8.8 Meril Life Sciences

- 8.9 Narang Medical

- 8.10 Nouvag

- 8.11 Olympus

- 8.12 Smith & Nephew

- 8.13 Sonova

- 8.14 Stryker

- 8.15 Vega Medical

- 8.16 Welch Allyn (Hillrom)

- 8.17 WestCMR

- 8.18 Zimmer Biomet