|

市场调查报告书

商品编码

1755376

固定太阳能光电支架系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Fixed Solar PV Mounting Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

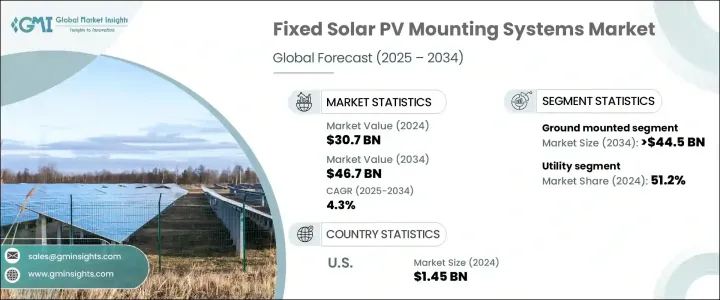

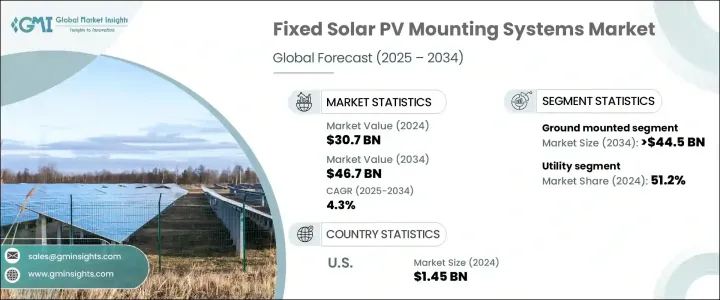

2024 年全球固定太阳能光电支架系统市值为 307 亿美元,预计到 2034 年将以 4.3% 的复合年增长率成长,达到 467 亿美元,这得益于太阳能板和相关组件成本的下降以及全球向再生能源的转变。随着发展中国家在国家政策、激励措施和上网电价 (FiT) 的支持下越来越多地采用太阳能光电模组,对支架系统的需求也将上升。对太阳能装置更高能量产量的需求进一步刺激了对这些系统的需求。太阳能追踪器因其能够增加能量产生量并且与更复杂的追踪系统相比成本相对较低而广受欢迎。此外,由于其设计更简单且没有活动部件,它们对市场扩张做出了重大贡献。

儘管面临关税等挑战,导致太阳能组件成本上涨,但整体市场前景仍乐观。儘管关税上调导致公用事业规模专案成本上升,使太阳能係统成本上涨约30%,但地面太阳能专案中支架系统的采用率仍在持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 307亿美元 |

| 预测值 | 467亿美元 |

| 复合年增长率 | 4.3% |

预计到2034年,地面安装太阳能係统市场规模将达到445亿美元,这得益于再生能源需求的不断增长以及大规模太阳能装置的需求。地面安装系统具有许多优势,包括易于安装和成本效益高,尤其是在土地面积广阔且价格低廉的地区。这些系统的经济性和可扩展性使其对公用事业规模的太阳能专案尤其具有吸引力,因为在这些专案中,最大限度地提高能源输出并最大限度地降低安装成本至关重要。安装系统设计、材料和安装技术的进步显着降低了这些系统的整体成本,进一步增强了其财务可行性。

2024年,公用事业领域占比将达到51.2%,反映出人们越来越依赖大型太阳能发电专案来实现再生能源目标并提高能源产量。地面安装太阳能係统比追踪系统更简单、更经济,在公用事业规模的专案中广受青睐。不断变化的金融和政策环境,包括政府激励措施和支持性法规,持续增强了地面安装解决方案在太阳能发电领域的吸引力。

受有利的政治法规、财政激励措施和快速的技术进步推动,美国固定太阳能光电支架系统产业在2024年的价值达到14.5亿美元。这些因素正在加速太阳能光电系统的普及,尤其是在公用事业规模项目中。随着再生能源生产需求的持续成长,预计高效能太阳能支架系统的部署将会增加,从而推动该地区向更永续、更清洁的能源转型。

全球固定太阳能光电支架系统产业包括 Aerocompact、Arctech、Clenergy、Convert Italia SPA、Esdec、K2 Systems GmbH、Mounting Systems、Schletter Group、UNIRAC、杭州帷盛太阳能有限公司、厦门格瑞斯太阳能新能源科技有限公司等主要参与者。固定太阳能光电支架系统产业的公司实施了多项策略性措施。他们优先考虑设计和技术创新,以满足日益增长的节能解决方案需求。许多公司正在投资研发,以提高产品性能,包括耐用性和易于安装性。此外,主要参与者正在扩大其产品组合,以满足住宅和商业领域的需求,确保他们提供一系列满足不同客户需求的系统。与太阳能电池组件製造商和建筑公司的策略合作伙伴关係也在不断增加,使公司能够简化营运并扩大市场范围。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率

- 策略倡议

- 公司标竿分析

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依产品,2021 年至 2034 年

- 主要趋势

- 地面安装

- 屋顶

第六章:市场规模及预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业和工业

- 公用事业

第七章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 奥地利

- 挪威

- 丹麦

- 芬兰

- 法国

- 德国

- 义大利

- 瑞士

- 西班牙

- 瑞典

- 英国

- 亚太地区

- 中国

- 澳洲

- 韩国

- 日本

- 印度

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿联酋

- 约旦

- 阿曼

- 非洲

- 南非

- 以色列

- 摩洛哥

- 拉丁美洲

- 巴西

- 智利

- 阿根廷

第八章:公司简介

- Aerocompact

- Arctech

- Clenergy

- Convert Italia SPA

- Esdec

- K2 Systems GmbH

- Mounting Systems

- Schletter Group

- UNIRAC

- Versolsolar Hangzhou Co., Ltd.

- Xiamen Grace Solar New Energy Technology Co., Ltd.

The Global Fixed Solar PV Mounting Systems Market was valued at USD 30.7 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 46.7 billion by 2034, driven by the decreasing costs of solar panels and related components, along with the global shift toward renewable energy sources. As developing nations increase their adoption of solar PV modules, supported by state-level policies, incentives, and feed-in tariffs (FiTs), the demand for mounting systems is also set to rise. The need for higher energy yields from solar installations further boosts the demand for these systems. Solar trackers have gained popularity due to their ability to increase energy generation and their relatively lower cost compared to more complex tracking systems. Additionally, with their simpler design and lack of moving parts, they have contributed significantly to the market's expansion.

Despite challenges such as tariffs that have increased the cost of solar modules, the overall market outlook remains positive. While tariff increases have led to higher costs for utility-scale projects, driving up the expense of solar systems by roughly 30%, the adoption of mounting systems in ground-mounted solar projects continues to grow.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.7 Billion |

| Forecast Value | $46.7 Billion |

| CAGR | 4.3% |

The ground-mounted solar systems segment is anticipated to reach USD 44.5 billion by 2034, driven by increasing demand for renewable energy and the need for large-scale solar installations. Ground-mounted systems offer several advantages, including ease of installation and cost-effectiveness, especially in regions with large, inexpensive land areas. The affordability and scalability of these systems make them particularly attractive for utility-scale solar projects, where maximizing energy output while minimizing installation costs is critical. Technological advancements in mounting system design, materials, and installation techniques have significantly lowered the overall cost of these systems, further boosting their financial viability.

The utility segment accounted for 51.2% in 2024, reflecting the growing reliance on large-scale solar power projects to meet renewable energy targets and increase energy production. Ground-mounted solar systems, simpler and more affordable to deploy than tracking systems, are widely favored for utility-scale installations. The evolving financial and policy landscape, including government incentives and supportive regulations, continues to enhance the attractiveness of ground-mounted solutions in solar energy generation.

United States Fixed Solar PV Mounting Systems Industry was valued at USD 1.45 billion in 2024 driven by favorable political regulations, financial incentives, and rapid technological advancements. These factors are accelerating the adoption of solar PV systems, particularly for utility-scale projects. As the demand for renewable energy production continues to rise, deploying efficient solar mounting systems is expected to grow, contributing to the region's shift toward more sustainable and cleaner energy sources.

The Global Fixed Solar PV Mounting Systems Industry includes key players such as Aerocompact, Arctech, Clenergy, Convert Italia SPA, Esdec, K2 Systems GmbH, Mounting Systems, Schletter Group, UNIRAC, Versolsolar Hangzhou Co., Ltd., Xiamen Grace Solar New Energy Technology Co., Ltd. Companies in the fixed solar PV mounting systems industry implement several strategic initiatives. They prioritize innovation in design and technology to meet the growing demand for energy-efficient solutions. Many are investing in R&D to enhance product performance, including durability and ease of installation. Additionally, key players are expanding their product portfolios to cater to residential and commercial segments, ensuring they offer a range of systems that meet diverse customer needs. Strategic partnerships with solar module manufacturers and construction firms are also rising, enabling companies to streamline operations and expand market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic initiatives

- 4.4 Company benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Ground mounted

- 5.3 Rooftop

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial & Industrial

- 6.4 Utility

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Austria

- 7.3.2 Norway

- 7.3.3 Denmark

- 7.3.4 Finland

- 7.3.5 France

- 7.3.6 Germany

- 7.3.7 Italy

- 7.3.8 Switzerland

- 7.3.9 Spain

- 7.3.10 Sweden

- 7.3.11 UK

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 South Korea

- 7.4.4 Japan

- 7.4.5 India

- 7.5 Middle East

- 7.5.1 Israel

- 7.5.2 Saudi Arabia

- 7.5.3 UAE

- 7.5.4 Jordan

- 7.5.5 Oman

- 7.6 Africa

- 7.6.1 South Africa

- 7.6.2 Israel

- 7.6.3 Morocco

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Chile

- 7.7.3 Argentina

Chapter 8 Company Profiles

- 8.1 Aerocompact

- 8.2 Arctech

- 8.3 Clenergy

- 8.4 Convert Italia SPA

- 8.5 Esdec

- 8.6 K2 Systems GmbH

- 8.7 Mounting Systems

- 8.8 Schletter Group

- 8.9 UNIRAC

- 8.10 Versolsolar Hangzhou Co., Ltd.

- 8.11 Xiamen Grace Solar New Energy Technology Co., Ltd.