|

市场调查报告书

商品编码

1755350

低压数位变电站市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Low Voltage Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

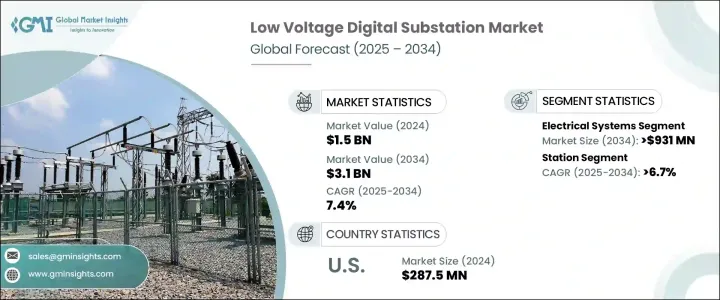

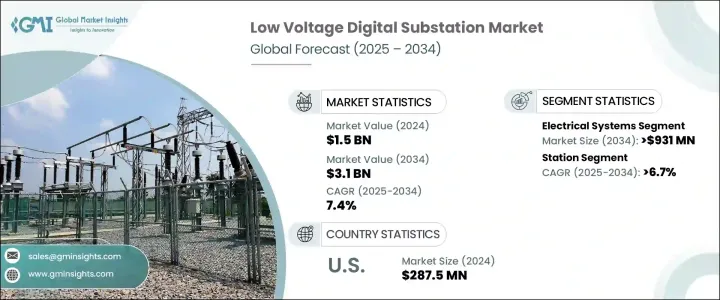

2024年,全球低压数位变电站市场规模达15亿美元,预计2034年将以7.4%的复合年增长率成长,达到31亿美元。这得归功于物联网、人工智慧和下一代通讯系统的广泛整合,这些技术正在将传统变电站转变为智慧自动化节点。这些数位系统提供即时效能洞察、主动维护能力和增强的营运控制。随着能源产业持续向再生能源转型,先进的电网基础设施在管理可变能源投入方面的作用变得至关重要。全球对电网升级的投资正在不断增加,以支持替代能源的可靠整合。

此外,数位孪生解决方案、安全的云端监控以及与 SCADA 和 EMS 平台的先进介面等技术创新正在提升变电站的效能。这些发展正在降低设备的生命週期成本并提高资产利用率。公用事业公司正在积极拥抱这项转型,以改善故障回应、提升自动化水准并减少计画外停电。这些变电站内的预测分析和自动化决策有助于简化运营,同时降低维护费用并提高能源分配效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15亿美元 |

| 预测值 | 31亿美元 |

| 复合年增长率 | 7.4% |

预计到2034年,电力系统领域将创造9.31亿美元的市场规模,这得益于对先进保护、控制和监控技术日益增长的需求,这些技术旨在确保现代电网的无缝运作。随着公用事业公司面临管理分散式能源(尤其是再生能源)日益复杂的局面,迫切需要能够提供即时可视性和响应能力的智慧电气元件。增强型继电器系统、智慧开关设备和精密计量工具正日益集成,以满足这些不断发展的营运标准。这些系统对于在能源输入波动的环境中确保电网稳定性和性能至关重要。

2024年,间隔层占32.8%,凸显了其在数位化变电站架构中的基础性作用。其贡献在于提供高度模组化的配置,可快速调整以满足不断变化的能源需求。间隔层自动化可以更快定位故障,简化维护流程,并提高系统可用性。这些功能降低了营运风险,并增强了电网弹性。透过间隔层数位化,公用事业公司可以在不造成重大中断的情况下扩展或修改变电站容量,使其成为可扩展且面向未来的电网设计的核心组成部分。

2024年,美国低压数位化变电站市场规模达2.875亿美元,这得益于联邦政府和各州为加强能源基础设施和提升电网智慧化而进行的大规模投资。美国在再生能源部署方面持续保持领先地位,并积极推进脱碳和能源效率目标,这推动公用事业公司采用尖端数位化技术。这种环境为低压数位化变电站在城乡电网的广泛应用奠定了坚实的基础。

市场的主要参与者包括施耐德电气、鲍威尔工业、思科系统公司、西门子、通用电气、伊顿公司、日立能源、ABB、东芝能源系统与解决方案公司、Larson & Toubro Limited、Hubbell、Netcontrol Group、WEG 和 WAGO。为了巩固市场地位,各公司正在部署各种策略,例如投资智慧电网研发、推出模组化和可互通的数位变电站解决方案以及扩展数位服务产品。与公用事业和政府机构的合作有助于推出试点计画并确保大规模部署。各公司也正在增强其产品的网路安全功能,以解决人们对数位基础设施安全日益增长的担忧。此外,扩大在新兴市场的影响力并加强售后服务网路有助于参与者提供完整的数位变电站解决方案,确保长期客户保留和市场扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依组件划分,2021 - 2034 年

- 主要趋势

- 变电所自动化系统

- 通讯网路

- 电气系统

- 监控系统

- 其他的

第六章:市场规模及预测:依架构,2021 - 2034

- 主要趋势

- 过程

- 湾

- 车站

第七章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 公用事业

- 工业的

第 8 章:市场规模与预测:按安装量,2021 年至 2034 年

- 主要趋势

- 新的

- 翻新

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第十章:公司简介

- ABB

- Cisco Systems, Inc.

- Eaton Corporation

- General Electric

- Hitachi Energy

- Hubbell

- Larsen & Toubro Limited

- Netcontrol Group

- Powell Industries

- Schneider Electric

- Siemens

- Toshiba Energy Systems & Solutions Corporation

- WEG

- WAGO

The Global Low Voltage Digital Substation Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 3.1 billion by 2034, driven by the widespread integration of IoT, artificial intelligence, and next-generation communication systems that are transforming traditional substations into intelligent, automated nodes. These digital systems offer real-time performance insights, proactive maintenance capabilities, and enhanced operational control. As the energy sector continues to shift toward renewables, the role of advanced grid infrastructure in managing variable energy inputs has become critical. Global investments in grid upgrades are increasing to support the reliable integration of alternative energy sources.

Additionally, technological innovations such as digital twin solutions, secure cloud-based monitoring, and advanced interfacing with SCADA and EMS platforms are elevating substation performance. These developments are reducing the lifecycle costs of equipment and improving asset utilization. Utilities are embracing this transformation to improve fault response, boost automation, and reduce unplanned outages. Predictive analytics and automated decision-making within these substations help streamline operations while lowering maintenance expenses and improving energy distribution efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 7.4% |

The electrical systems segment is projected to generate USD 931 million by 2034, driven by the rising demand for advanced protection, control, and monitoring technologies that ensure the seamless operation of modern power networks. As utilities face the growing complexity of managing distributed energy resources, especially from renewable sources, there is a pressing need for intelligent electrical components that offer real-time visibility and response. Enhanced relay systems, smart switchgear, and precision metering tools are increasingly being integrated to meet these evolving operational standards. These systems are critical for ensuring grid stability and performance in an environment of fluctuating energy input.

The bay segment held a 32.8% share in 2024, underscoring its fundamental role in digital substation architecture. Its contribution lies in offering highly modular configurations that can be adapted quickly to meet changing energy demands. Bay-level automation allows for faster fault localization, streamlined maintenance, and improved system availability. These functions reduce operational risks and enhance grid resilience. By digitizing the bay level, utilities expand or modify substation capacity without causing major disruptions, making it a core component in scalable and future-proof grid designs.

United States Low Voltage Digital Substation Market was valued at USD 287.5 million in 2024 fueled by extensive federal and state investments aimed at reinforcing energy infrastructure and improving grid intelligence. The country's continued leadership in renewable energy deployment, combined with aggressive targets for decarbonization and energy efficiency, is pushing utilities to adopt cutting-edge digital technologies. This environment creates a strong foundation for the widespread implementation of low-voltage digital substations across urban and rural grid networks.

Key players in the market include Schneider Electric, Powell Industries, Cisco Systems, Inc., Siemens, General Electric, Eaton Corporation, Hitachi Energy, ABB, Toshiba Energy Systems & Solutions Corporation, Larson & Toubro Limited, Hubbell, Netcontrol Group, WEG, and WAGO. To strengthen their market position, companies are deploying strategies such as investing in smart grid R&D, launching modular and interoperable digital substation solutions, and expanding digital service offerings. Partnerships with utilities and government bodies are helping to roll out pilot programs and secure large-scale deployments. Companies are also enhancing cybersecurity features in their products to address growing concerns over digital infrastructure safety. Further, expanding their presence in emerging markets and reinforcing after-sales service networks help players deliver complete digital substation solutions, ensuring long-term client retention and market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.5 Monitoring & control system

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Utility

- 7.3 Industrial

Chapter 8 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 New

- 8.3 Refurbished

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Cisco Systems, Inc.

- 10.3 Eaton Corporation

- 10.4 General Electric

- 10.5 Hitachi Energy

- 10.6 Hubbell

- 10.7 Larsen & Toubro Limited

- 10.8 Netcontrol Group

- 10.9 Powell Industries

- 10.10 Schneider Electric

- 10.11 Siemens

- 10.12 Toshiba Energy Systems & Solutions Corporation

- 10.13 WEG

- 10.14 WAGO