|

市场调查报告书

商品编码

1773233

辅酶 Q10 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Coenzyme Q10 Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

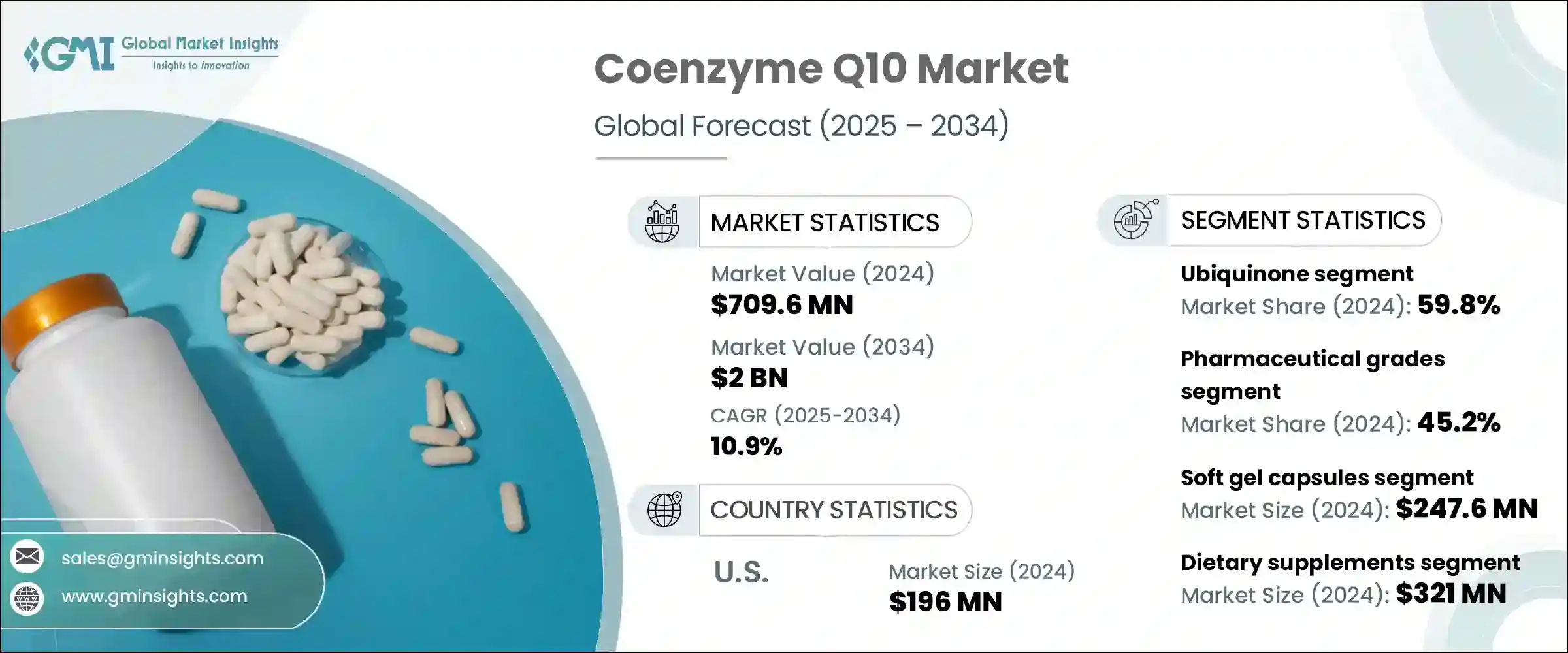

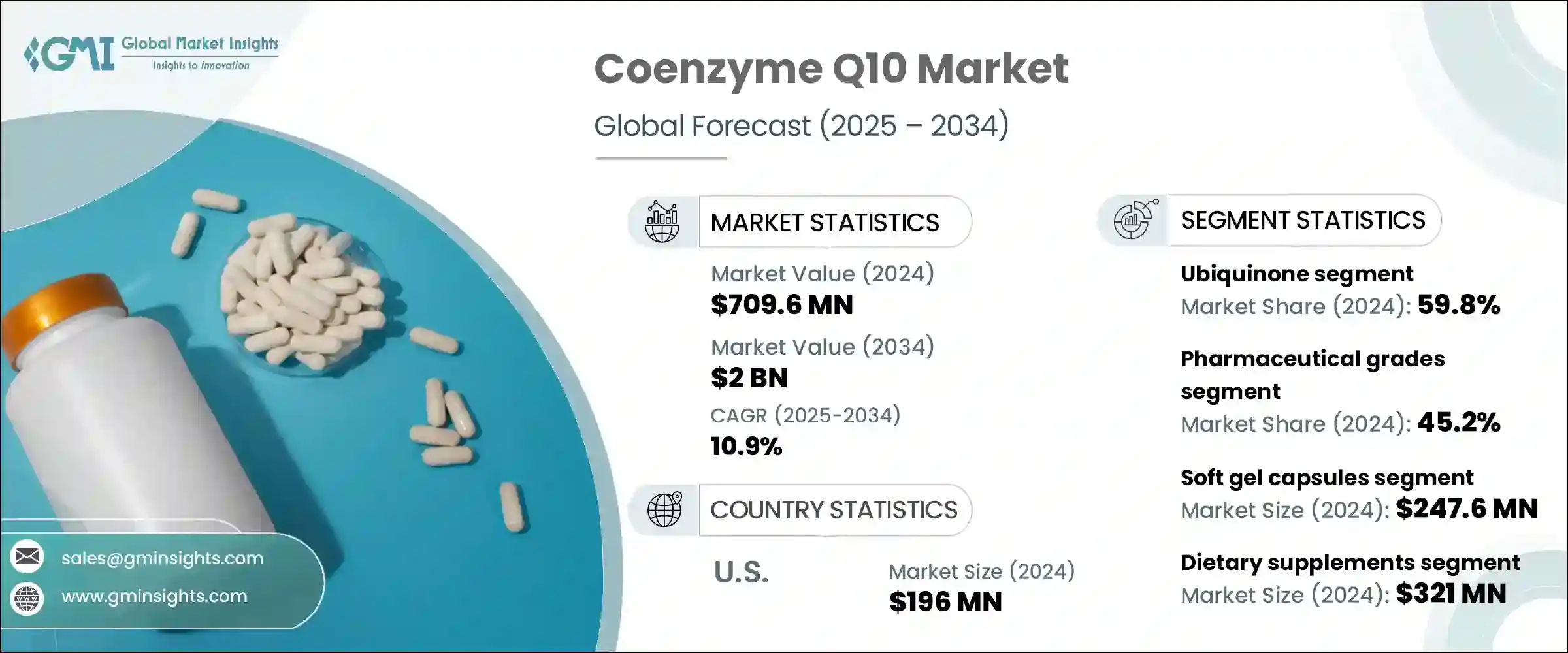

2024年,全球辅酶Q10市场规模达7.096亿美元,预计2034年将以10.9%的复合年增长率成长,达到20亿美元。这一增长主要得益于消费者对预防性医疗保健意识的不断提升、膳食补充剂的日益普及以及辅酶Q10在药品和化妆品中的应用日益广泛。辅酶Q10是人体内天然存在的抗氧化剂,在细胞能量生成中发挥至关重要的作用,并有助于防止氧化损伤。

随着人口老化以及心血管、神经系统和代谢紊乱等慢性疾病的日益普遍,对辅酶Q10补充剂的需求也随之增长。营养保健品公司正在将辅酶Q10添加到软胶囊、心臟保健品和功能性饮料等产品中,以帮助缓解疲劳、增强活力。製药业也依赖辅酶Q10来治疗心臟衰竭、高血压以及他汀类药物引起的肌肉病变等疾病。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.096亿美元 |

| 预测值 | 20亿美元 |

| 复合年增长率 | 10.9% |

在化妆品行业,辅酶Q10 (CoQ10) 因其强大的抗氧化特性和对抗衰老迹象的能力而备受青睐。它被用于护肤配方中,增强肌肤弹性,使肌肤更光滑紧緻。 CoQ10 的作用机制是中和加速老化的自由基,帮助保护肌肤免受紫外线和污染等环境压力造成的氧化伤害。这种抗氧化作用不仅可以减少细纹和皱纹,还能改善整体肤质和肤色。此外,CoQ10 被认为能够促进胶原蛋白的生成,这对于随着年龄增长维持皮肤结构和紧緻度至关重要。因此,CoQ10 常用于各种抗衰老产品中,例如乳霜、精华液和乳液。

2024年,泛醌占据市场主导地位,占59.8%。这种形式的辅酶Q10以其广泛供应、价格实惠和生产过程中的稳定性而闻名,有助于延长其保质期。它在膳食补充剂和药物中的应用使泛醌成为市场领导者。虽然辅酶Q10的还原形式泛醇具有更高的生物利用度和更强的抗氧化特性,但它的稳定性较差且价格昂贵,儘管它在老年消费者和高端补充剂中颇具吸引力,但仍限制了其广泛应用。

2024年,药用级辅酶Q10市占率为45.2%,预计到2034年将以11%的强劲复合年增长率成长。这一增长主要源于心血管疾病、神经系统疾病和他汀类药物缺乏症治疗需求的不断增长。药用级辅酶Q10的高纯度和临床有效性使其在治疗领域中发挥重要作用。儘管食品级辅酶Q10越来越受欢迎,尤其是在功能性食品和膳食补充剂行业,但其市场份额仍然较小。此外,化妆品级辅酶Q10因其抗氧化和抗衰老功效,也被用于乳霜、精华液和乳液等护肤产品中。

2024年,美国辅酶Q10市场规模达1.96亿美元。这一优势得益于美国先进的医疗体系、消费者对膳食补充剂的高度认知以及重视预防性保健的文化。美国受益于《膳食补充剂健康与教育法案》等法规,该法案允许辅酶Q10作为非处方补充剂销售。美国心血管疾病的高发生率也推动了辅酶Q10需求的成长。此外,电商平台也正在推动辅酶Q10的销售,许多线上商店专门销售辅酶Q10补充品。

全球辅酶Q10市场的主要参与者包括钟化株式会社、帝斯曼、SourceOne Global Partners, LLC、Healthy Origins和Vitamin Shoppe, Inc. 这些公司透过提供创新产品并透过各种分销管道扩大影响力,在塑造市场方面发挥关键作用。为了巩固市场地位,辅酶Q10产业的公司正专注于多种策略方法。

他们大力投入研发,以提高辅酶Q10的生物利用度和稳定性,确保其产品满足消费者不断变化的需求。拓展产品线,涵盖高端和价格实惠的辅酶Q10产品,有助于吸引更广泛的客户群。这些公司也利用与经销商和零售商的策略伙伴关係,提升产品在不同市场的供应。此外,他们也透过提高人们对辅酶Q10的认知度和推广其健康益处,尤其是在心血管健康和抗衰老领域,进军新兴市场。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计资料(HS 编码)(註:仅提供主要国家的贸易统计数据

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 辅酶Q10的生物化学和配方

- 生物化学与分子结构

- 化学结构与性质

- 氧化形式与还原形式

- 生物学功能和机制

- 内生生产与消耗因素

- 生产方法

- 化学合成

- 发酵过程

- 从天然来源提取

- 半合成方法

- 新兴生产技术

- 配方技术

- 粉末和结晶形式

- 油悬浮液和溶液

- 乳液和微乳液

- 脂质体和胶束製剂

- 基于奈米粒子的递送系统

- 环糊精复合物

- 生物利用度增强策略

- 溶解度增强技术

- 减小颗粒尺寸

- 脂质基递送系统

- 与增强剂合併使用

- 新型载体系统

- 稳定性和保质期考虑

- 氧化和降解机制

- 温度和光敏感度

- 包装和储存要求

- 稳定技术

- 延长保存期限的策略

- 生物化学与分子结构

- 健康益处和临床应用

- 心血管健康

- 作用机制

- 高血压的临床证据

- 对胆固醇和血脂的影响

- 在心臟衰竭的应用

- 他汀类药物相关肌病变的治疗

- 能量产生和粒线体功能

- 在电子传递链中的作用

- ATP合成增强

- 粒线体疾病应用

- 疲劳和运动表现

- 老化与粒线体功能障碍

- 抗氧化特性和氧化压力

- 自由基清除机制

- 细胞保护作用

- 与其他抗氧化剂的协同作用

- 氧化压力相关疾病

- 发炎调节

- 神经学应用

- 神经保护机制

- 偏头痛预防

- 神经退化性疾病

- 认知功能与大脑健康

- 临床证据和研究现状

- 其他治疗应用

- 生育力与生殖健康

- 牙周健康

- 糖尿病和代谢综合征

- 癌症辅助治疗

- 新兴临床应用

- 剂量和给药注意事项

- 建议剂量范围

- 时间和管理协议

- 药物交互作用与禁忌症

- 安全性和不良反应

- 特殊人群考虑

- 心血管健康

- GMP 和製造标准

- 良好生产规范

- 品质管理体系

- 设施要求

- 文件和记录保存

- 审核和认证计划

- 消费者趋势与市场区隔

- 消费者人口统计与行为

- 年龄和性别分布

- 健康意识和认知

- 收入水平和购买力

- 教育和知识因素

- 区域和文化差异

- 使用模式和偏好

- 预防与治疗用途

- 剂量和频率偏好

- 配方和交付格式偏好

- 品牌忠诚度与转换行为

- 购买管道和决策因素

- 零售与线上购买

- 医疗保健专业人员的影响力

- 资讯来源与研究行为

- 关键购买决策因素

- 促销和行销影响力

- 新兴消费趋势

- 清洁标籤和天然偏好

- 个人化营养兴趣

- 永续性和道德考虑

- 数位健康整合

- 组合产品偏好

- 市场区隔分析

- 大众市场与高端市场

- 医疗与健康定位

- 针对特定年龄的定位

- 针对特定情况的配方

- 区域市场差异

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 泛醌(氧化形式)

- 泛醇(还原型)

第六章:市场估计与预测:依等级,2021-2034

- 主要趋势

- 医药级

- 食品级

- 化妆品级

第七章:市场估计与预测:依配方,2021-2034

- 主要趋势

- 粉末和结晶形式

- 油悬浮液和溶液

- 软胶囊

- 硬胶囊

- 片剂和咀嚼片

- 先进的输送系统

- 脂质体和胶束製剂

- 基于奈米粒子的系统

- 其他先进配方

- 其他配方

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 膳食补充剂

- 整体健康与保健

- 心臟健康

- 能源与性能

- 抗衰老

- 其他补充申请

- 製药

- 处方药

- 非处方(OTC)产品

- 医疗食品

- 化妆品和个人护理

- 抗衰老保养品

- 防晒产品

- 护髮产品

- 其他化妆品应用

- 功能性食品和饮料

- 强化食品

- 功能性饮料

- 营养棒和零食

- 动物营养

- 宠物补品

- 牲畜饲料添加剂

- 其他应用

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 零售药局和药局

- 超市和大卖场

- 保健品专卖店

- 网路零售

- 电子商务平台

- 直接面向消费者的网站

- 订阅服务

- 医疗保健从业者

- 其他分销管道

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Country Life, LLC

- Doctor's Best

- DSM

- GNC Holdings, Inc

- Healthy Origins

- Jarrow Formulas

- Kaneka Corporation

- Natural Organics

- NBTY, Inc.

- Nordic Naturals, Inc.

- NOW Foods

- Pharma Nord, Inc.

- Pharmavite LLC

- QUTEN Research Institute LLC

- SourceOne Global Partners, LLC

- Tishcon Corp.

- Vitamin Shoppe, Inc.

- Xiamen Kingdomway Group

The Global Coenzyme Q10 Market was valued at USD 709.6 million in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 2 billion by 2034. This growth can be attributed to the increasing awareness among consumers about preventive healthcare, the rising popularity of dietary supplements, and the growing use of CoQ10 in pharmaceuticals and cosmetics. CoQ10, a naturally occurring antioxidant in the body, plays a crucial role in cellular energy production and offers protection against oxidative damage.

As the population ages and chronic conditions like cardiovascular, neurological, and metabolic disorders become more common, the demand for CoQ10 supplements rises. Nutraceutical companies are incorporating CoQ10 into products such as soft gel capsules, heart health supplements, and functional beverages that help reduce fatigue and enhance vitality. The pharmaceutical industry also relies on CoQ10 for treating conditions like heart failure, hypertension, and myopathy caused by statins.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $709.6 Million |

| Forecast Value | $2 Billion |

| CAGR | 10.9% |

In the cosmetics industry, Coenzyme Q10 (CoQ10) is gaining significant traction due to its powerful antioxidant properties and its ability to combat the visible signs of aging. It is used in skincare formulations, enhancing skin elasticity and promoting a smoother, firmer complexion. CoQ10 works by neutralizing free radicals that accelerate the aging process, helping to protect the skin from oxidative damage caused by environmental stressors like UV radiation and pollution. This antioxidant action not only reduces the appearance of fine lines and wrinkles but also improves the overall texture and tone of the skin. Furthermore, CoQ10 is believed to boost collagen production, which is essential for maintaining skin structure and firmness as we age. As a result, it is commonly found in a variety of anti-aging products such as creams, serums, and lotions.

In 2024, the ubiquinone segment dominated the market, accounting for 59.8% share. This form of CoQ10 is known for its widespread availability, affordability, and stable characteristics during manufacturing, which contribute to its longer shelf life. Its use in dietary supplements and pharmaceuticals has positioned ubiquinone as the leader in the market. While ubiquinol, the reduced form of CoQ10, offers stronger bioavailability and enhanced antioxidant properties, it remains less stable and more expensive, limiting its widespread adoption despite its appeal among aging consumers and in premium supplements.

The pharmaceutical-grade CoQ10 segment held a 45.2% share in 2024 and is expected to grow at a robust CAGR of 11% by 2034. This growth is driven by the rising treatment needs for cardiovascular diseases, neurological disorders, and statin deficiencies. The high purity and clinical effectiveness of pharmaceutical-grade CoQ10 make it important in therapeutic settings. Although food-grade CoQ10 is gaining popularity, particularly in the functional food and dietary supplement industries, it remains a smaller portion of the market. Additionally, cosmetic-grade CoQ10 is used in skin care products like creams, serums, and lotions due to its antioxidant and anti-aging benefits.

United States Coenzyme Q10 Market was valued at USD 196 million in 2024. This dominance is attributed to the country's advanced healthcare system, high consumer awareness about dietary supplements, and a culture that embraces preventive healthcare. The U.S. benefits from regulations like the Dietary Supplement Health and Education Act, which permits CoQ10 to be sold as an over-the-counter supplement. The high prevalence of cardiovascular diseases in the U.S. has also contributed to the increased demand for CoQ10. Additionally, e-commerce platforms are driving sales, with numerous online stores dedicated to CoQ10 supplements.

Key market players in the Global Coenzyme Q10 Market include Kaneka Corporation, DSM, SourceOne Global Partners, LLC, Healthy Origins, and Vitamin Shoppe, Inc. These companies are pivotal in shaping the market by offering innovative products and expanding their reach through various distribution channels. To strengthen their market position, companies in the CoQ10 industry are focusing on several strategic approaches.

They are heavily investing in research and development to improve the bioavailability and stability of CoQ10, ensuring that their products meet the evolving needs of consumers. Expanding product lines to include both premium and affordable CoQ10 options helps capture a wider customer base. These companies are also leveraging strategic partnerships with distributors and retailers to enhance product availability across diverse markets. Moreover, they are tapping into emerging markets by increasing awareness and promoting the health benefits of CoQ10, particularly in the areas of cardiovascular health and anti-aging.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Grade

- 2.2.4 Formulation

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Coenzyme Q10 biochemistry & formulations

- 3.13.1 Biochemistry & molecular structure

- 3.13.1.1 Chemical structure & properties

- 3.13.1.2 Oxidized vs. Reduced forms

- 3.13.1.3 Biological functions & mechanisms

- 3.13.1.4 Endogenous production & depletion factors

- 3.13.2 Production methods

- 3.13.2.1 Chemical synthesis

- 3.13.2.2 Fermentation process

- 3.13.2.3 Extraction from natural sources

- 3.13.2.4 Semi-synthetic approaches

- 3.13.2.5 Emerging production technologies

- 3.13.3 Formulation technologies

- 3.13.3.1 Powder & crystalline forms

- 3.13.3.2 Oil suspensions & solutions

- 3.13.3.3 Emulsions & microemulsions

- 3.13.3.4 Liposomal & micellar formulations

- 3.13.3.5 Nanoparticle-based delivery systems

- 3.13.3.6 Cyclodextrin complexes

- 3.13.4 Bioavailability enhancement strategies

- 3.13.4.1 Solubility enhancement techniques

- 3.13.4.2 Particle size reduction

- 3.13.4.3 Lipid-based delivery systems

- 3.13.4.4 Co-administration with enhancers

- 3.13.4.5 Novel carrier systems

- 3.13.5 Stability & shelf-life considerations

- 3.13.5.1 Oxidation & degradation mechanisms

- 3.13.5.2 Temperature & light sensitivity

- 3.13.5.3 Packaging & storage requirements

- 3.13.5.4 Stabilization techniques

- 3.13.5.5 Shelf-life extension strategies

- 3.13.1 Biochemistry & molecular structure

- 3.14 Health benefits & clinical applications

- 3.14.1 Cardiovascular health

- 3.14.1.1 Mechanisms of action

- 3.14.1.2 Clinical evidence in hypertension

- 3.14.1.3 Effects on cholesterol & lipid profiles

- 3.14.1.4 Applications in heart failure

- 3.14.1.5 Statin-associated myopathy management

- 3.14.2 Energy production & mitochondrial function

- 3.14.2.1 Role in electron transport chain

- 3.14.2.2 Atp synthesis enhancement

- 3.14.2.3 Mitochondrial disorders applications

- 3.14.2.4 Fatigue & exercise performance

- 3.14.2.5 Aging & mitochondrial dysfunction

- 3.14.3 Antioxidant properties & oxidative stress

- 3.14.3.1 Free radical scavenging mechanisms

- 3.14.3.2 Cellular protection effects

- 3.14.3.3 Synergy with other antioxidants

- 3.14.3.4 Oxidative stress-related conditions

- 3.14.3.5 Inflammation modulation

- 3.14.4 Neurological applications

- 3.14.4.1 Neuroprotective mechanisms

- 3.14.4.2 Migraine prevention

- 3.14.4.3 Neurodegenerative diseases

- 3.14.4.4 Cognitive function & brain health

- 3.14.4.5 Clinical evidence & research status

- 3.14.5 Other therapeutic applications

- 3.14.5.1 Fertility & reproductive health

- 3.14.5.2 Periodontal health

- 3.14.5.3 Diabetes & metabolic syndrome

- 3.14.5.4 Cancer adjuvant therapy

- 3.14.5.5 Emerging clinical applications

- 3.14.6 Dosage & administration considerations

- 3.14.6.1 Recommended dosage ranges

- 3.14.6.2 Timing & administration protocols

- 3.14.6.3 Drug interactions & contraindications

- 3.14.6.4 Safety profile & adverse effects

- 3.14.6.5 Special population considerations

- 3.14.1 Cardiovascular health

- 3.15 GMP & manufacturing standards

- 3.15.1 Good manufacturing practices

- 3.15.2 Quality management systems

- 3.15.3 Facility requirements

- 3.15.4 Documentation & record keeping

- 3.15.5 Audit & certification programs

- 3.16 Consumer trends & market segmentation

- 3.16.1 Consumer demographics & behaviour

- 3.16.2 Age & gender distribution

- 3.16.3 Health consciousness & awareness

- 3.16.4 Income level & purchasing power

- 3.16.5 Education & knowledge factors

- 3.16.6 Regional & cultural variations

- 3.17 Usage patterns & preferences

- 3.17.1 Preventive vs. Therapeutic use

- 3.17.2 Dosage & frequency preferences

- 3.17.3 Formulation & delivery format preferences

- 3.17.4 Brand loyalty & switching behaviour

- 3.18 Purchase channels & decision factors

- 3.18.1 Retail vs. Online purchasing

- 3.18.2 Healthcare professional influence

- 3.18.3 Information sources & research behaviour

- 3.18.4 Key purchase decision factors

- 3.18.5 Promotional & marketing influence

- 3.19 Emerging consumer trends

- 3.19.1 Clean label & natural preferences

- 3.19.2 Personalized nutrition interest

- 3.19.3 Sustainability & ethical considerations

- 3.19.4 Digital health integration

- 3.19.5 Combination product preferences

- 3.20 Market segmentation analysis

- 3.20.1 Mass market vs. Premium segments

- 3.20.2 Medical vs. Wellness positioning

- 3.20.3 Age-specific targeting

- 3.20.4 Condition-specific formulations

- 3.20.5 Regional market differences

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trend

- 5.2 Ubiquinone (oxidized form)

- 5.3 Ubiquinol (reduced form)

Chapter 6 Market Estimates & Forecast, By Grade, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trend

- 6.2 Pharmaceutical grade

- 6.3 Food grade

- 6.4 Cosmetic grade

Chapter 7 Market Estimates & Forecast, By Formulation, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trend

- 7.2 Powder & crystalline forms

- 7.3 Oil suspensions & solutions

- 7.4 Softgel capsules

- 7.5 Hard capsules

- 7.6 Tablets & chewables

- 7.7 Advanced delivery systems

- 7.7.1 Liposomal & micellar formulations

- 7.7.2 Nanoparticle-based systems

- 7.7.3 Other advanced formulations

- 7.8 Other formulations

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trend

- 8.2 Dietary supplements

- 8.2.1 General health & wellness

- 8.2.2 Heart health

- 8.2.3 Energy & performance

- 8.2.4 Anti-aging

- 8.2.5 Other supplement applications

- 8.3 Pharmaceuticals

- 8.3.1 Prescription medications

- 8.3.2 Over-the-counter (OTC) products

- 8.3.3 Medical foods

- 8.4 Cosmetics & personal care

- 8.4.1 Anti-aging skincare

- 8.4.2 Sun protection products

- 8.4.3 Hair care products

- 8.4.4 Other cosmetic applications

- 8.5 Functional foods & beverages

- 8.5.1 Fortified foods

- 8.5.2 Functional beverages

- 8.5.3 Nutritional bars & snacks

- 8.6 Animal nutrition

- 8.6.1 Pet supplements

- 8.6.2 Livestock feed additives

- 8.7 Other applications

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trend

- 9.2 Retail pharmacies & drug stores

- 9.3 Supermarkets & hypermarkets

- 9.4 Specialty health stores

- 9.5 Online retail

- 9.5.1 E-commerce platforms

- 9.5.2 Direct-to-consumer websites

- 9.5.3 Subscription services

- 9.6 Healthcare practitioners

- 9.7 Other distribution channels

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Country Life, LLC

- 11.2 Doctor’s Best

- 11.3 DSM

- 11.4 GNC Holdings, Inc

- 11.5 Healthy Origins

- 11.6 Jarrow Formulas

- 11.7 Kaneka Corporation

- 11.8 Natural Organics

- 11.9 NBTY, Inc.

- 11.10 Nordic Naturals, Inc.

- 11.11 NOW Foods

- 11.12 Pharma Nord, Inc.

- 11.13 Pharmavite LLC

- 11.14 QUTEN Research Institute LLC

- 11.15 SourceOne Global Partners, LLC

- 11.16 Tishcon Corp.

- 11.17 Vitamin Shoppe, Inc.

- 11.18 Xiamen Kingdomway Group