|

市场调查报告书

商品编码

1801921

麻混凝土市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Hempcrete Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

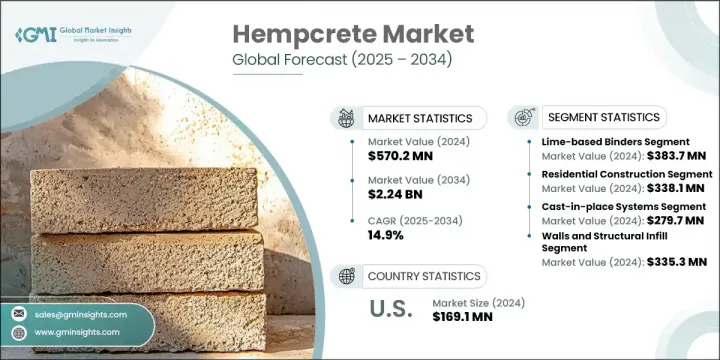

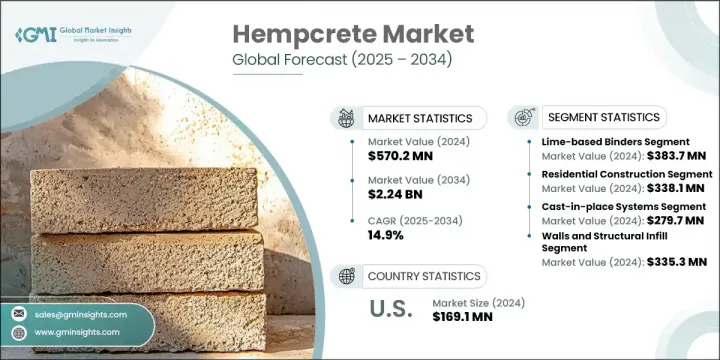

2024年,全球麻混凝土市场规模达5.702亿美元,预计到2034年将以14.9%的复合年增长率成长,达到22.4亿美元。随着人们对环境影响的认识不断增强,开发商和建筑商越来越多地转向低排放、可持续的建筑替代方案。麻混凝土具有可生物降解和碳封存的特性,与全球减少建筑环境碳足迹的目标高度契合。其天然特性使其成为节能建筑和环保住宅设计的理想材料,有助于满足监管要求和消费者对更环保解决方案的期望。

政府推出的降低排放和提高能源效率的法规进一步激发了人们对麻混凝土等天然材料的兴趣。一些国家正在实施更严格的温室气体排放法规,这促使人们转向使用热效率高且天然的隔热材料。此外,LEED 和 BREEAM 等永续发展框架正在促使建筑公司优先考虑环保材料,从而确保住宅、商业和工业领域对麻混凝土的长期稳定需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.702亿美元 |

| 预测值 | 22.4亿美元 |

| 复合年增长率 | 14.9% |

石灰基黏合剂市场在2024年创造了3.837亿美元的收入,预计2025年至2034年的复合年增长率将达到14.5%。这些黏合剂与麻秆完美契合,具有高透气性和强大的碳吸收能力。石灰黏合剂秉承了麻秆混凝土的环保形象,常用于经认证的绿色住宅。儘管石灰黏合剂固化时间较长且结构强度较低,但持续的研发已催生出更多以性能为导向的替代方案,同时保持了永续性。

2024年,住宅建筑业创造了3.381亿美元的收入,占59.2%的市场。预计到2034年,该产业的复合年增长率将达到14.4%,受益于人们对节能自建住宅、低排放建筑和气候意识建筑趋势日益增长的兴趣。麻石的隔热、低毒和二氧化碳吸收特性使其成为永续住宅的理想材料,尤其是在北美和欧洲部分地区等注重环保的市场。

2024年,美国麻混凝土市场规模达1.691亿美元,预计2034年将以14.1%的复合年增长率成长。不断完善的麻混凝土种植法规、绿色建筑产品需求以及永续建筑实践的日益普及,共同推动了美国国内市场的成长。麻混凝土在环境进步的州,尤其在房屋翻新和新建方面备受青睐。加拿大对工业麻混凝土产业的支持也促进了模组化和住宅应用领域强劲的跨境合作和供应链。

塑造全球麻混凝土市场的关键参与者包括 Hempitecture Inc.、Cavac Biomateriaux、Hemp and Block、American Hemp LLC 和 HempStone。为了扩大市场份额,麻混凝土行业的公司正在投资研发,以提升黏合剂性能、加快固化时间并提高结构强度。与永续建筑公司和建筑师的策略合作有助于提高专案的知名度。许多公司正在扩大生产能力并建立在地化供应链,以降低物流成本并提高产品的可及性。此外,围绕绿色建筑标准的教育活动和认证也被用来将麻混凝土定位为传统材料的可行主流替代品。这些努力共同提升了品牌在全球市场的信誉、合规性和消费者信任度。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测,活页夹类型,2021-2034

- 主要趋势

- 石灰基黏合剂

- 水硬石灰

- 地上石灰

- 改质石灰配方

- 水泥基黏合剂

- 波特兰水泥

- 混合水泥体系

- 低碳水泥替代品

- 替代黏合剂

- 碱激活黏合剂

- 空心微珠黏合剂

- 土聚物黏合剂

- 基于菌丝体的黏合剂

- 混合配方

- 石灰水泥混合物

- 聚合物改质体系

- 纤维增强配方

第六章:市场估计与预测:依施工方法,2021-2034 年

- 主要趋势

- 现浇系统

- 手工铸造方法

- 气动放置

- 模板系统

- 预製系统

- 砌块製造

- 面板生产

- 模组化组件

- 喷涂应用

- 湿喷系统

- 干混应用

- 机器人喷涂系统

- 先进製造业

- 3D列印技术

- 自动化生产系统

- 数位化製造方法

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 墙壁和结构填充物

- 住宅应用

- 商业应用

- 工业应用

- 绝缘系统

- 隔热市场

- 隔音应用

- 改造绝缘解决方案

- 屋顶和地板

- 屋顶应用

- 地板系统

- 专业应用

- 预製块和麵板

- 预製砌块市场

- 面板系统

- 模组化建筑应用

- 现浇应用

- 现场铸造

- 喷涂应用

- 定製配方

- 新兴应用

- 3D列印应用

- 复合材料

- 专业建筑用途

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 住宅建筑

- 独栋住宅

- 多户住宅

- 经济适用房项目

- 改造和翻新

- 商业建筑

- 办公大楼

- 零售空间

- 教育设施

- 医疗保健设施

- 工业建筑

- 生产设施

- 仓库和配送中心

- 农业建筑

- 特殊工业应用

- 基础设施项目

- 公共建筑

- 社区中心

- 交通基础设施

- 公用建筑

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- American Hemp LLC

- Cavac Biomateriaux

- Hemp and Block

- Hemp Building Institute

- Hemp Technology Ltd.

- Hempitecture Inc.

- HempStone

- IsoHemp

- Lower Sioux Indian Community

- Rare Earth Global

- rePlant Hemp Advisors

- Sativa Building Systems

The Global Hempcrete Market was valued at USD 570.2 million in 2024 and is estimated to grow at a CAGR of 14.9% to reach USD 2.24 billion by 2034. As awareness of environmental impact grows, developers and builders are increasingly turning toward low-emission, sustainable construction alternatives. Hempcrete, being biodegradable and capable of sequestering carbon, aligns closely with global goals to reduce the carbon footprint in the built environment. Its natural properties make it an ideal material in energy-efficient buildings and eco-conscious residential design, helping meet both regulatory demands and consumer expectations for greener solutions.

Government mandates pushing for lower emissions and enhanced energy efficiency are further driving interest in natural materials like hempcrete. Several countries are enforcing stricter codes to reduce greenhouse gas emissions, which has prompted a shift toward using thermally efficient and natural insulation options. In addition, sustainability frameworks such as LEED and BREEAM are influencing construction companies to prioritize eco-friendly materials, ensuring steady demand for hempcrete across residential, commercial, and even industrial sectors in the long term.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $570.2 Million |

| Forecast Value | $2.24 Billion |

| CAGR | 14.9% |

Lime-based binders segment generated USD 383.7 million in 2024 and is expected to grow at a CAGR of 14.5% from 2025 to 2034. These binders are well-aligned with hemp hurd, offering high breathability and strong carbon absorption. Lime binders uphold the environmentally friendly image of hempcrete and are commonly used in certified green housing. Though they take longer to cure and offer lower structural strength, continuous R&D has given rise to more performance-driven alternatives while keeping sustainability intact.

The residential construction segment generated USD 338.1 million in 2024 and capturing 59.2% share. With a CAGR of 14.4% anticipated through 2034, the sector benefits from rising interest in energy-efficient self-build homes, low-emission structures, and climate-conscious architectural trends. Hempcrete's thermal insulation, low toxicity, and CO2 absorbing qualities make it a favorable material for sustainable housing, particularly in environmentally progressive markets such as North America and parts of Europe.

U.S. Hempcrete Market was valued at USD 169.1 million in 2024 and is forecasted to grow at a CAGR of 14.1% through 2034. Domestic growth is supported by evolving regulations around hemp cultivation, demand for green building products, and increasing adoption of sustainable construction practices. Hempcrete has gained traction particularly in retrofitting and new housing across environmentally progressive states. Canada's support for the industrial hemp industry also contributes to robust cross-border collaborations and supply chains for modular and residential applications.

Key players shaping the Global Hempcrete Market include Hempitecture Inc., Cavac Biomateriaux, Hemp and Block, American Hemp LLC, and HempStone. To expand their market share, companies operating in the hempcrete industry are investing in research and development to enhance binder performance, speed up curing time, and improve structural strength. Strategic collaborations with sustainable construction firms and architects are helping to increase project visibility. Many are scaling their production capabilities and establishing localized supply chains to reduce logistics costs and improve product accessibility. Educational campaigns and certifications around green building standards are also used to position hempcrete as a viable mainstream alternative to traditional materials. These efforts collectively enhance brand credibility, regulatory compliance, and consumer trust across global markets.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Binder Type

- 2.2.3 Construction Method

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2021-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, Binder Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Lime-based binders

- 5.2.1 Hydraulic lime

- 5.2.2 Aerial lime

- 5.2.3 Modified lime formulations

- 5.3 Cement-based binders

- 5.3.1 Portland cement

- 5.3.2 Blended cement systems

- 5.3.3 Low-carbon cement alternatives

- 5.4 Alternative binders

- 5.4.1 Alkali-activated binders

- 5.4.2 Cenosphere binders

- 5.4.3 Geopolymer binders

- 5.4.4 Mycelium-based binders

- 5.5 Hybrid formulations

- 5.5.1 Lime-cement blends

- 5.5.2 Polymer-modified systems

- 5.5.3 Fiber-reinforced formulations

Chapter 6 Market Estimates & Forecast, By Construction Method, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cast-in-place systems

- 6.2.1 Hand-casting methods

- 6.2.2 Pneumatic placement

- 6.2.3 Formwork systems

- 6.3 Precast systems

- 6.3.1 Block manufacturing

- 6.3.2 Panel production

- 6.3.3 Modular components

- 6.4 Spray applications

- 6.4.1 Wet spray systems

- 6.4.2 Dry mix applications

- 6.4.3 Robotic spray systems

- 6.5 Advanced manufacturing

- 6.5.1 3d printing technology

- 6.5.2 Automated production systems

- 6.6 Digital fabrication methods

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Walls and structural infill

- 7.2.1 Residential applications

- 7.2.2 Commercial applications

- 7.2.3 Industrial applications

- 7.3 Insulation systems

- 7.3.1 Thermal insulation market

- 7.3.2 Acoustic insulation applications

- 7.3.3 Retrofit insulation solutions

- 7.4 Roofing and flooring

- 7.4.1 Roofing applications

- 7.4.2 Flooring systems

- 7.4.3 Specialty applications

- 7.5 Precast blocks and panels

- 7.5.1 Precast block market

- 7.5.2 Panel systems

- 7.5.3 Modular construction applications

- 7.6 Cast-in-place applications

- 7.6.1 On-site casting

- 7.6.2 Spray applications

- 7.6.3 Custom formulations

- 7.7 Emerging applications

- 7.7.1 3d printing applications

- 7.7.2 Composite materials

- 7.7.3 Specialty construction uses

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Residential construction

- 8.2.1 Single-family homes

- 8.2.2 Multi-family housing

- 8.2.3 Affordable housing projects

- 8.2.4 Retrofit and renovation

- 8.3 Commercial construction

- 8.3.1 Office buildings

- 8.3.2 Retail spaces

- 8.3.3 Educational facilities

- 8.3.4 Healthcare facilities

- 8.4 Industrial construction

- 8.4.1 Manufacturing facilities

- 8.4.2 Warehouses and distribution centers

- 8.4.3 Agricultural buildings

- 8.4.4 Specialty industrial applications

- 8.5 Infrastructure projects

- 8.5.1 Public buildings

- 8.5.2 Community centers

- 8.5.3 Transportation infrastructure

- 8.5.4 Utility buildings

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 American Hemp LLC

- 10.2 Cavac Biomateriaux

- 10.3 Hemp and Block

- 10.4 Hemp Building Institute

- 10.5 Hemp Technology Ltd.

- 10.6 Hempitecture Inc.

- 10.7 HempStone

- 10.8 IsoHemp

- 10.9 Lower Sioux Indian Community

- 10.10 Rare Earth Global

- 10.11 rePlant Hemp Advisors

- 10.12 Sativa Building Systems