|

市场调查报告书

商品编码

1716721

蝶阀市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Butterfly Valve Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

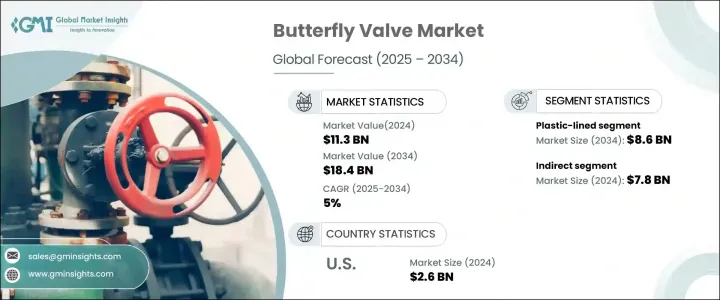

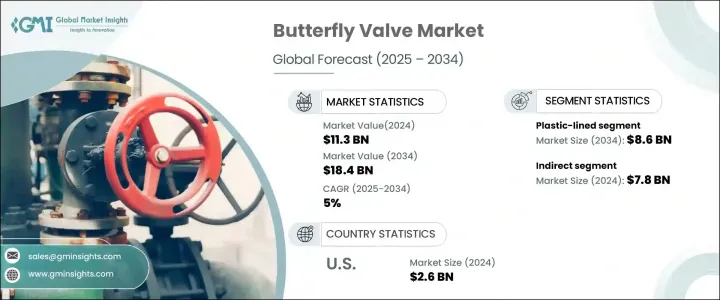

2024 年全球蝶阀市场规模达 113 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5%。这一成长主要得益于石油和天然气、发电和水处理等产业工业自动化的快速发展。随着各行各业越来越重视提高营运效率和减少人为干预,对自动化和远端控制阀门的需求持续上升。蝶阀以其轻巧的设计、成本效益和快速操作而闻名,正在成为智慧流量控制系统的首选。它们的多功能性和可靠性使其成为各种工业应用中不可或缺的一部分,可确保流程的顺利和高效。

全球越来越关注改善水和废水管理基础设施是推动蝶阀需求的另一个重要因素。尤其是发展中地区,正在经历水处理厂建设的激增,以解决人们对水消耗日益增长的担忧以及政府对废水管理的严格规定。随着工业和市政当局对先进水管理系统的投资,蝶阀因其能够高效处理大量水且维护成本极低而成为理想的解决方案。它们的耐用性和成本效益使其成为大规模应用的可靠选择,确保了水处理设施的长期运作效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 113亿美元 |

| 预测值 | 184亿美元 |

| 复合年增长率 | 5% |

蝶阀市场根据衬里类型分为塑胶衬里阀门、金属衬里阀门和橡胶衬里阀门。由于塑胶内衬具有优异的耐腐蚀和耐化学性,该领域在 2024 年创造了 51 亿美元的收入。这些阀门因其耐用性、低维护要求以及在处理腐蚀性流体方面的出色性能而受到化学加工和製药等行业的青睐。随着各行各业越来越多地采用耐腐蚀解决方案来延长设备的使用寿命,塑胶衬里蝶阀的需求持续强劲。

从分销通路来看,市场分为直接销售和间接销售。间接分销通路的价值在 2024 年将达到 78 亿美元,预计到 2034 年将以 4.8% 的复合年增长率成长。儘管直接分销管道有所成长,但许多製造商仍依赖间接网路(包括代理商、批发商和零售商)来推广和分销其产品。这些中间商在扩大市场范围方面发挥关键作用,特别是在工业领域,信任关係和建立的供应链对于推动销售和确保产品供应至关重要。

美国蝶阀市场规模在 2024 年达到 26 亿美元,预计在 2025 年至 2034 年期间的复合年增长率为 5.5%。美国拥有强大的基础设施和先进的製造能力,尤其是在石油和天然气、水管理和发电等行业,使美国成为北美市场的重要参与者。此外,严格的环境法规和工业流程自动化水准的提高继续推动该地区对先进蝶阀的需求。随着美国各行业采用创新技术来满足法规遵循和营运效率,蝶阀市场将在未来几年稳步成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 工业自动化需求不断成长

- 扩建水和废水处理设施

- 石油天然气和化学加工领域的投资不断增加

- 产业陷阱与挑战

- 原物料价格波动

- 替代流量控制技术的可用性

- 成长动力

- 成长潜力分析

- 原料分析

- 监管格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按衬里类型,2021-2034

- 主要趋势

- 橡胶内衬

- 塑胶内衬

- 金属内衬

第六章:市场估计与预测:依材料,2021-2034

- 主要趋势

- 碳钢

- 不銹钢

- 铁

- 其他的

第七章:市场估计与预测:按安装类型,2021-2034

- 主要趋势

- 晶圆

- 半凸耳

- 凸耳

- 双法兰

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 水和废水

- 石油和天然气

- 能源和电力

- 製药

- 化学品

- 其他的

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- Alfa Laval

- AVK Group

- Bray International

- Crane

- Curtiss-Wright

- DeZURIK

- Emerson Electric

- Flowserve

- Grundfos

- Honeywell International

- Neles

- SPX FLOW

- Velan

- Weir Group

- Xylem

The Global Butterfly Valve Market generated USD 11.3 billion in 2024 and is projected to grow at a CAGR of 5% between 2025 and 2034. This growth is primarily driven by rapid advancements in industrial automation across industries such as oil & gas, power generation, and water treatment. As industries increasingly emphasize enhancing operational efficiency and minimizing human intervention, the demand for automated and remotely controlled valves continues to rise. Butterfly valves, known for their lightweight design, cost-effectiveness, and quick operation, are becoming the preferred choice for smart flow control systems. Their versatility and reliability make them indispensable in various industrial applications, ensuring smooth and efficient processes.

The increasing global focus on improving water and wastewater management infrastructure is another significant factor fueling the demand for butterfly valves. Developing regions, in particular, are experiencing a surge in the construction of water treatment plants to address growing concerns over water consumption and stringent government regulations on wastewater management. As industries and municipalities invest in advanced water management systems, butterfly valves emerge as the ideal solution due to their ability to handle large water volumes efficiently and with minimal maintenance. Their durability and cost-effectiveness make them a reliable choice for large-scale applications, ensuring long-term operational efficiency in water treatment facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.3 Billion |

| Forecast Value | $18.4 Billion |

| CAGR | 5% |

The butterfly valve market is segmented by lining type into plastic-lined, metal-lined, and rubber-lined valves. The plastic-lined segment generated USD 5.1 billion in 2024, driven by its superior resistance to corrosion and chemicals. These valves are highly preferred in industries such as chemical processing and pharmaceuticals due to their durability, low maintenance requirements, and excellent performance in handling aggressive fluids. As industries increasingly adopt corrosion-resistant solutions to prolong the lifespan of their equipment, plastic-lined butterfly valves continue to witness strong demand.

In terms of distribution channels, the market is divided into direct and indirect sales. The indirect segment, valued at USD 7.8 billion in 2024, is expected to grow at a CAGR of 4.8% through 2034. Despite the growth of direct distribution channels, many manufacturers still rely on indirect networks, including agents, wholesalers, and retailers, to promote and distribute their products. These intermediaries play a critical role in expanding market reach, particularly in industrial sectors where trusted relationships and established supply chains are essential for driving sales and ensuring product availability.

The U.S. butterfly valve market reached USD 2.6 billion in 2024 and is projected to grow at a CAGR of 5.5% between 2025 and 2034. The country's robust infrastructure and advanced manufacturing capabilities, especially in industries such as oil and gas, water management, and power generation, position the U.S. as a key player in the North American market. Additionally, stringent environmental regulations and increasing levels of automation in industrial processes continue to drive the demand for advanced butterfly valves in the region. As industries in the U.S. adopt innovative technologies to meet regulatory compliance and operational efficiency, the butterfly valve market is poised for steady growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for industrial automation

- 3.2.1.2 Expansion of water and wastewater treatment facilities

- 3.2.1.3 Rising investments in oil & gas and chemical processing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Fluctuating raw material prices

- 3.2.2.2 Availability of alternative flow control technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Raw Material analysis

- 3.5 Regulatory landscape

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Lining Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Rubber lined

- 5.3 Plastic lined

- 5.4 Metal lined

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Carbon steel

- 6.3 Stainless steel

- 6.4 Iron

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Mounting Type, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Wafer

- 7.3 Semi lug

- 7.4 Lug

- 7.5 Double flanges

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Water and wastewater

- 8.3 Oil and gas

- 8.4 Energy and power

- 8.5 Pharmaceuticals

- 8.6 Chemicals

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 9.1 Key Trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Alfa Laval

- 11.2 AVK Group

- 11.3 Bray International

- 11.4 Crane

- 11.5 Curtiss-Wright

- 11.6 DeZURIK

- 11.7 Emerson Electric

- 11.8 Flowserve

- 11.9 Grundfos

- 11.10 Honeywell International

- 11.11 Neles

- 11.12 SPX FLOW

- 11.13 Velan

- 11.14 Weir Group

- 11.15 Xylem