|

市场调查报告书

商品编码

1750542

蒸汽锅炉市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Steam Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

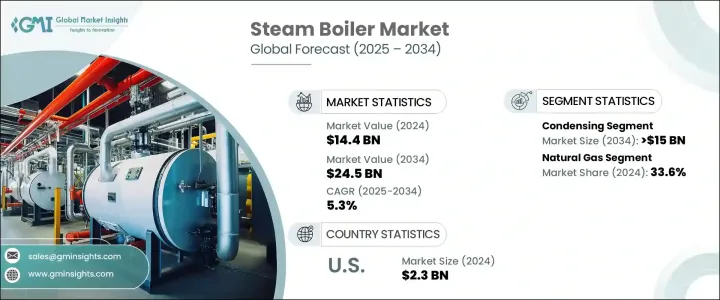

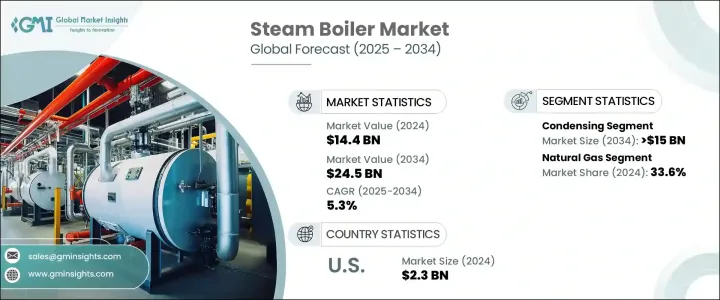

2024年,全球蒸汽锅炉市场规模达144亿美元,预计到2034年将以5.3%的复合年增长率增长,达到245亿美元,这得益于全球主要经济体的快速工业化和能源基础设施的大量投资。各行各业对高效能蒸汽发电系统的需求日益增长,以及其在商业和工业空间供暖中的应用日益增多,将支撑市场扩张。此外,可支配收入的增加和生活水准的提高(尤其是在寒冷地区),也将推动蒸汽锅炉的需求成长。这些因素,加上工业生产中对减少碳足迹的日益重视,将进一步推动市场成长。

减排趋势也在塑造市场方面发挥着至关重要的作用。各国政府正在实施更严格的氮氧化物和硫氧化物排放法规,这鼓励各行各业采用包括高压锅炉在内的先进技术。此外,远端监控、预测性维护和优化负载管理等数位技术的融入将提高营运效率,减少非计划性停机,并增强系统可靠性。这项技术进步也将增加对更先进蒸汽锅炉的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 144亿美元 |

| 预测值 | 245亿美元 |

| 复合年增长率 | 5.3% |

受能源价格上涨和日益严格的排放法规合规要求的推动,冷凝式蒸汽锅炉市场规模预计到2034年将达到150亿美元。冷凝式锅炉效率高,与传统系统相比,燃油经济性更高,碳排放量更低,因此成为寻求降低营运成本和环境足迹的行业的首选。政府推出的节能技术诱因进一步鼓励了这些系统的采用,为市场成长增添了动力。

另一方面,预计到2034年,燃油蒸汽锅炉市场将以4%的复合年增长率成长。这类锅炉在石化、炼油和热油加工等重工业领域尤其受欢迎。燃油锅炉因其高调节比而备受青睐,能够根据需求变化精确调节蒸汽流量。这种适应性使其成为在各种负荷条件下都需要稳定可靠蒸汽供应的工业应用中不可或缺的一部分。这些系统在高需求环境下的可靠性和性能将继续推动其持续需求。

2024年,美国蒸汽锅炉市场规模达23亿美元,这得益于新製造设施的大量投资,以及以现代节能锅炉技术取代过时暖气系统的持续趋势。随着各行各业注重降低能耗和实现永续发展目标,对先进蒸汽锅炉系统的需求持续成长。此外,美国正在经历基础设施的持续现代化,这进一步推动了工业和商业领域对高效蒸汽发电解决方案的需求。

全球蒸汽锅炉市场中的企业正专注于策略创新和扩张,以提升市场份额。例如,一些企业专注于推进锅炉技术,以满足严格的环境法规并提供更节能的解决方案。这些企业还投资于数位监控工具,以更好地控制营运并延长锅炉使用寿命。市场的主要参与者包括 Aggreko、ALFA LAVAL、Miura America 和 Thermax,它们都在推动创新,并致力于透过产品多元化和全球扩张来巩固其市场地位。他们的策略还包括专注于节能解决方案并加强售后支持,以提高客户满意度和忠诚度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 策略倡议

- 公司市占率分析

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:按燃料,2021 - 2034

- 主要趋势

- 天然气

- 油

- 煤炭

- 其他的

第六章:市场规模及预测:依产能,2021 - 2034 年

- 主要趋势

- ≤ 10 百万英热单位/小时

- > 10 - 50 百万英热单位/小时

- > 50 - 100 百万英热单位/小时

- > 100 - 250 百万英热单位/小时

- > 250 百万英热单位/小时

第七章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 冷凝

- 无凝结

第 8 章:市场规模与预测:按应用,2021 - 2034 年

- 主要趋势

- 商业的

- 容量

- ≤ 10 百万英热单位/小时

- > 10 - 50 百万英热单位/小时

- > 50 - 100 百万英热单位/小时

- > 100 - 250 百万英热单位/小时

- > 250 百万英热单位/小时

- 燃料

- 天然气

- 油

- 煤炭

- 其他的

- 科技

- 冷凝

- 无凝结

- 容量

- 工业的

- 容量

- ≤ 10 百万英热单位/小时

- > 10 - 50 百万英热单位/小时

- > 50 - 100 百万英热单位/小时

- > 100 - 250 百万英热单位/小时

- > 250 百万英热单位/小时

- 燃料

- 天然气

- 油

- 煤炭

- 其他的

- 科技

- 冷凝

- 无凝结

- 容量

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 英国

- 波兰

- 义大利

- 西班牙

- 奥地利

- 德国

- 瑞典

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 菲律宾

- 日本

- 韩国

- 澳洲

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 伊朗

- 阿联酋

- 奈及利亚

- 南非

- 拉丁美洲

- 阿根廷

- 智利

- 巴西

第十章:公司简介

- Aggreko

- ALFA LAVAL

- Babcock & Wilcox

- Babcock Wanson

- Bosch Industriekessel

- Clayton Industries

- Cleaver-Brooks

- Cochran

- FERROLI

- Forbes Marshall

- Fulton

- GE Vernova

- Hoval

- Hurst Boiler & Welding

- John Cockerill

- Miura America

- PM Lattner Manufacturing

- PARKER BOILER

- Precision Boilers

- Thermax

- VIESSMANN

- Weil-McLain

The Global Steam Boiler Market was valued at USD 14.4 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 24.5 billion by 2034, driven by the rapid industrialization in key global economies and substantial investments in energy infrastructure. A growing demand for efficient steam generation systems across industries, along with their increasing use for space heating in commercial and industrial settings, will support market expansion. Additionally, the rising disposable income and improved living standards, especially in colder regions, will drive the demand for steam boilers. These factors, combined with a heightened focus on reducing carbon footprints in industrial operations, will further boost the market's growth.

The trend toward reducing emissions is also playing a crucial role in shaping the market. Governments are implementing stricter regulations on NOx and SOx emissions, which is encouraging industries to adopt advanced technologies, including high-pressure boilers. Moreover, the incorporation of digital technologies such as remote monitoring, predictive maintenance, and optimized load management will make operations more efficient, reducing unplanned shutdowns and enhancing system reliability. This technological advancement will also increase demand for more sophisticated steam boilers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.4 Billion |

| Forecast Value | $24.5 Billion |

| CAGR | 5.3% |

The condensing steam boiler market is projected to reach USD 15 billion by 2034, driven by the rising energy prices and the increasing need to comply with stringent emissions regulations. Condensing boilers are highly efficient, offering better fuel economy and lower carbon emissions compared to traditional systems, making them a preferred choice for industries looking to reduce both operational costs and their environmental footprint. Government incentives promoting energy-efficient technologies are further encouraging the adoption of these systems, adding momentum to the market's growth.

On the other hand, the oil-fueled steam boiler market is anticipated to grow at a CAGR of 4% until 2034. These boilers are particularly popular in heavy industries such as petrochemicals, refineries, and thermal oil processing. Oil-fired boilers are valued for their high turndown ratios, allowing them to adjust steam flow precisely according to changing demand. This adaptability makes them indispensable in industrial applications that require a consistent and reliable steam supply under varying load conditions. The ongoing demand for these systems will continue to be driven by their reliability and performance in high-demand environments.

United States Steam Boiler Market generated USD 2.3 billion in 2024, attributed to substantial investments in new manufacturing facilities and the ongoing trend of replacing outdated heating systems with modern, energy-efficient boiler technologies. As industries focus on reducing energy consumption and meeting sustainability goals, the demand for advanced steam boiler systems continues to rise. Additionally, the U.S. is experiencing an ongoing modernization of infrastructure, further driving the demand for efficient steam generation solutions in both the industrial and commercial sectors.

Companies in the Global Steam Boiler Market are focusing on strategic innovations and expansion to enhance their market share. For example, some players are focusing on advancing boiler technology to meet stringent environmental regulations and provide more energy-efficient solutions. The companies are also investing in digital monitoring tools to offer better control over operations and increase boiler longevity. Key players in the market include Aggreko, ALFA LAVAL, Miura America, and Thermax, all of which are driving innovation and aiming to strengthen their market positions through product diversification and global expansion. Their strategies also include focusing on energy-efficient solutions and strengthening after-sales support to enhance customer satisfaction and loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market scope & definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis, 2024

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Coal

- 5.5 Others

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 6.1 Key trends

- 6.2 ≤ 10 MMBTU/hr

- 6.3 > 10 - 50 MMBTU/hr

- 6.4 > 50 - 100 MMBTU/hr

- 6.5 > 100 - 250 MMBTU/hr

- 6.6 > 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 8.1 Key trends

- 8.2 Commercial

- 8.2.1 Capacity

- 8.2.1.1 ≤ 10 MMBTU/hr

- 8.2.1.2 > 10 - 50 MMBTU/hr

- 8.2.1.3 > 50 - 100 MMBTU/hr

- 8.2.1.4 > 100 - 250 MMBTU/hr

- 8.2.1.5 > 250 MMBTU/hr

- 8.2.2 Fuel

- 8.2.2.1 Natural gas

- 8.2.2.2 Oil

- 8.2.2.3 Coal

- 8.2.2.4 Others

- 8.2.3 Technology

- 8.2.3.1 Condensing

- 8.2.3.2 Non-condensing

- 8.2.1 Capacity

- 8.3 Industrial

- 8.3.1 Capacity

- 8.3.1.1 ≤ 10 MMBTU/hr

- 8.3.1.2 > 10 - 50 MMBTU/hr

- 8.3.1.3 > 50 - 100 MMBTU/hr

- 8.3.1.4 > 100 - 250 MMBTU/hr

- 8.3.1.5 > 250 MMBTU/hr

- 8.3.2 Fuel

- 8.3.2.1 Natural gas

- 8.3.2.2 Oil

- 8.3.2.3 Coal

- 8.3.2.4 Others

- 8.3.3 Technology

- 8.3.3.1 Condensing

- 8.3.3.2 Non-condensing

- 8.3.1 Capacity

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 UK

- 9.3.3 Poland

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Austria

- 9.3.7 Germany

- 9.3.8 Sweden

- 9.3.9 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Philippines

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.4.6 Australia

- 9.4.7 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Iran

- 9.5.3 UAE

- 9.5.4 Nigeria

- 9.5.5 South Africa

- 9.6 Latin America

- 9.6.1 Argentina

- 9.6.2 Chile

- 9.6.3 Brazil

Chapter 10 Company Profiles

- 10.1 Aggreko

- 10.2 ALFA LAVAL

- 10.3 Babcock & Wilcox

- 10.4 Babcock Wanson

- 10.5 Bosch Industriekessel

- 10.6 Clayton Industries

- 10.7 Cleaver-Brooks

- 10.8 Cochran

- 10.9 FERROLI

- 10.10 Forbes Marshall

- 10.11 Fulton

- 10.12 GE Vernova

- 10.13 Hoval

- 10.14 Hurst Boiler & Welding

- 10.15 John Cockerill

- 10.16 Miura America

- 10.17 P.M. Lattner Manufacturing

- 10.18 PARKER BOILER

- 10.19 Precision Boilers

- 10.20 Thermax

- 10.21 VIESSMANN

- 10.22 Weil-McLain