|

市场调查报告书

商品编码

1741035

C反应蛋白检测市场机会、成长动力、产业趋势分析及2025-2034年预测C-Reactive Protein Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

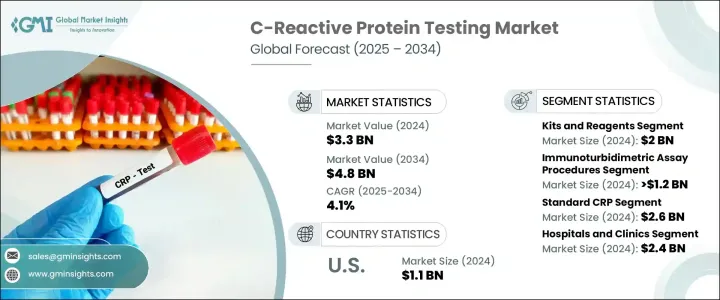

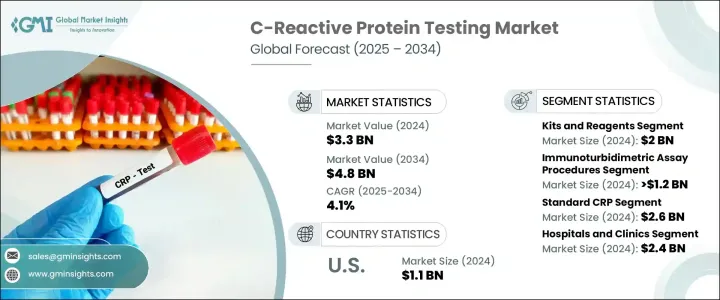

2024 年全球 C 反应蛋白检测市场价值为 33 亿美元,预计到 2034 年将以 4.1% 的复合年增长率增长至 48 亿美元。慢性病盛行率的上升是推动市场成长的主要驱动力之一,因为医疗保健专业人员越来越依赖 CRP 检测进行准确及时的诊断。常规健康筛检和疾病管理方案中 CRP 检测的广泛应用也支持了这种不断增长的需求。此测试可测量肝臟响应发炎而产生的 C 反应蛋白的浓度。其水平可能由于多种触发因素而飙升,包括感染、发炎性疾病和心血管疾病。升高的 CRP 水平是检测和监测体内发炎的重要标誌,可帮助医疗专业人员评估患者病情的严重程度并制定适当的治疗策略。

随着诊断能力的提升,CRP 检测在全球医疗保健系统中持续受到青睐。由于其快速出结果的能力,CRP 检测已成为早期干预不可或缺的手段,尤其是在时间紧迫的临床环境中。 CRP 检测在追踪病情进展和疗效方面也发挥着不可或缺的作用。 CRP 检测的广泛应用不仅改善了患者的预后,还提高了医疗服务的成本效益,使其成为小型诊所和大型医疗机构的可靠选择。检测准确性、效率和易用性的提升进一步推动了市场的成长,提高了 CRP 检测在各个医学专科领域的实用性。因此,CRP 检测现已被广泛用作诊断工具,用于管理从感染、自体免疫疾病到发炎和心血管疾病等各种疾病。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 33亿美元 |

| 预测值 | 48亿美元 |

| 复合年增长率 | 4.1% |

就产品而言,市场细分为仪器和试剂盒及试剂。 2024年,试剂盒及试剂细分市场以20亿美元的总收入领先市场。这些产品因其与多种检测平台相容而被广泛采用,从而能够应用于多种检测技术。其多功能性和快速产生结果的能力使其适用于各种临床环境,在这些环境中,及时决策至关重要。这些试剂盒的易于整合和高效性进一步推动了它们相对于更复杂的检测程序的青睐。

根据检测类型,市场包括酵素连结免疫吸附试验 (ELISA)、化学发光免疫分析 (CLIA)、免疫比浊法等。免疫比浊法在2024年占据了最高的市场份额,价值超过12亿美元。这类检测因其成本效益高、週转时间短而备受青睐,成为资源有限的小型医疗保健机构和实验室的可行选择。它们能够快速提供可靠的结果,这增强了其在临床实践中的作用,因为快速诊断对于有效的患者管理至关重要。

根据检测范围,市场分为高敏感性CRP(Hs-CRP)和标准CRP。标准CRP市场在2024年占据主导地位,预计到2034年将达到26亿美元。标准CRP检测在医院和诊断中心广泛用于一般发炎检测,巩固了其市场领先地位。其经验证的临床可靠性和经济实惠性进一步推动了其持续应用。

从应用角度来看,该市场涵盖心血管疾病、传染病、慢性发炎性疾病及其他领域。心血管疾病领域在2024年创造了超过12亿美元的收入。 CRP检测是心血管风险评估的常见组成部分,可帮助医疗保健专业人员监测病情进展并评估治疗效果。人们对心臟相关疾病的预防保健和早期干预日益重视,这支持了其在该应用领域的持续需求。

就最终用途而言,市场细分为医院和诊所、诊断实验室和其他最终用户。医院和诊所是2024年最大的最终用途细分市场,收入达24亿美元。这些机构定期对出现发炎、感染或心血管事件症状的患者进行CRP检测。快速处理CRP检测结果的能力在急诊和初级保健机构中是一项关键优势,因为在这些机构中,即时的临床决策至关重要。从内科到传染病科,CRP检测的广泛应用也进一步提高了其高利用率。

在美国,CRP 检测市场在 2024 年的规模为 11 亿美元,预计在预测期内将以 3.2% 的复合年增长率成长。在鼓励早期诊断的政策支持下,预防性医疗保健的转变正在推动 CRP 检测在全国的普及。人们对发炎疾病的认识不断提高以及健康教育的不断改进也促进了医疗服务提供者和患者对检测的使用率的提高。

约55%的市场由五家领先公司控制,其中包括持续创新并推出先进检测解决方案的主要参与者。这些公司专注于开发经济高效、用户友好且高精度的CRP检测产品,以满足已开发和发展中医疗保健市场日益增长的需求。他们以技术创新和精简诊断解决方案为策略重点,这加剧了竞争,并推动了市场成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 发炎性疾病等慢性疾病的盛行率不断上升

- 用于诊断和管理慢性病的 CRP 检测需求激增

- 技术进步

- 直接上门检测服务的需求不断增长

- 产业陷阱与挑战

- 缺乏标准化

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 报销场景

- 技术格局

- 未来市场趋势

- 波特的分析

- 差距分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 公司市占率分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 仪器

- 试剂盒和试剂

第六章:市场估计与预测:按检测类型,2021 - 2034 年

- 主要趋势

- 化学发光免疫分析(CLIA)

- 酵素连结免疫吸附试验(ELISA)

- 免疫比浊法

- 其他检测类型

第七章:市场估计与预测:按检测范围,2021 - 2034 年

- 主要趋势

- 高敏感性CRP(hs-CRP)

- 标准CRP

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 心血管疾病

- 传染病

- 慢性发炎疾病

- 其他应用

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 诊断实验室

- 其他最终用途

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Abbott

- Agilent

- AIDIAN

- Boditech

- Creative Diagnostics

- CTK BIOTECH

- Danaher

- DxGen Corp

- Getein Biotech

- GOLDSITE

- HORIBA

- Labcorp

- Merck

- OptiBio

- RANDOX

- Roche

- SIEMENS Healthineers

The Global C-Reactive Protein Testing Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 4.8 billion by 2034. The rising prevalence of chronic conditions is one of the key drivers fueling market growth, as healthcare professionals increasingly rely on CRP tests for accurate and timely diagnosis. This growing demand is also supported by the expanding adoption of CRP testing in routine health screenings and disease management protocols. The test measures the concentration of C-reactive protein, which the liver produces in response to inflammation. Its levels can spike due to a variety of triggers, including infections, inflammatory diseases, and cardiovascular conditions. Elevated CRP levels serve as an important marker to detect and monitor inflammation in the body, assisting medical professionals in assessing the severity of a patient's condition and formulating appropriate treatment strategies.

As diagnostic capabilities evolve, CRP testing continues to gain traction in healthcare systems worldwide. With its ability to deliver rapid results, the test is becoming indispensable for early intervention, especially in clinical settings where time is critical. CRP testing has also become integral in tracking disease progression and therapeutic effectiveness. The increased use of these tests has not only improved patient outcomes but has also contributed to cost-effective care delivery, making them a reliable choice for both small clinics and large healthcare facilities. The market's growth is further supported by advancements in test accuracy, efficiency, and ease of use, which have enhanced the utility of CRP testing across various medical specialties. As a result, CRP testing is now widely used as a diagnostic tool in managing conditions ranging from infections and autoimmune diseases to inflammatory and cardiovascular disorders.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $4.8 Billion |

| CAGR | 4.1% |

In terms of products, the market is segmented into instruments and kits & reagents. In 2024, the kits and reagents segment led the market with revenue totaling USD 2 billion. These products are widely adopted due to their compatibility with diverse testing platforms, allowing their application across multiple assay techniques. Their versatility and ability to produce fast results make them suitable for various clinical settings, where timely decisions are essential. The ease of integration and efficiency of these kits further drive their preference over more complex testing procedures.

Based on assay type, the market includes enzyme-linked immunosorbent assay (ELISA), chemiluminescence immunoassay (CLIA), immunoturbidimetric assay, and others. Immunoturbidimetric assays accounted for the highest market share in 2024, reaching a value of over USD 1.2 billion. These assays are favored for their cost-effectiveness and quick turnaround times, making them an accessible choice for smaller healthcare providers and laboratories with limited resources. Their ability to deliver reliable results swiftly enhances their role in clinical practice, where fast diagnostics are essential for effective patient management.

By detection range, the market is divided into high-sensitivity CRP (Hs-CRP) and standard CRP. The standard CRP segment dominated in 2024 and is expected to reach USD 2.6 billion by 2034. The widespread use of standard CRP tests in hospitals and diagnostic centers for general inflammation detection has contributed to their market lead. Their proven clinical reliability and affordability further drive their continued use.

In terms of application, the market includes cardiovascular diseases, infectious diseases, chronic inflammatory diseases, and other uses. The cardiovascular diseases segment generated over USD 1.2 billion in revenue in 2024. CRP testing is a common component in cardiovascular risk assessment, aiding healthcare professionals in monitoring disease progression and evaluating treatment efficacy. The growing emphasis on preventive care and early intervention in heart-related conditions supports its consistent demand in this application area.

Regarding end use, the market is segmented into hospitals and clinics, diagnostic laboratories, and other end users. Hospitals and clinics were the largest end-use segment in 2024, with revenue reaching USD 2.4 billion. These facilities regularly use CRP tests for patients presenting with symptoms of inflammation, infections, or cardiovascular events. The ability to quickly process CRP test results is a key advantage in emergency and primary care settings, where immediate clinical decisions are critical. The broad scope of departments utilizing CRP testing-from internal medicine to infectious disease units-adds to its high utilization rate.

In the United States, the CRP testing market was valued at USD 1.1 billion in 2024 and is expected to grow at a CAGR of 3.2% through the forecast period. The shift toward preventive healthcare, supported by policies that encourage early diagnosis, is boosting the adoption of CRP testing across the country. Growing awareness around inflammatory conditions and better health education are also contributing to increased test usage among both healthcare providers and patients.

Approximately 55% of the market is controlled by five leading companies, including major players that continue to innovate and launch advanced testing solutions. These companies are focusing on developing cost-effective, user-friendly, and high-precision CRP testing products that meet the rising demand from both developed and developing healthcare markets. Their strategic emphasis on technological innovation and streamlined diagnostic solutions is intensifying competition and pushing market growth forward.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic disorders such as inflammatory diseases

- 3.2.1.2 Surge in demand for CRP testing for diagnosis and management of chronic diseases

- 3.2.1.3 Advances in technology

- 3.2.1.4 Growing demand for direct-to-home testing services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of standardization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Reimbursement scenario

- 3.7 Technology landscape

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 GAP analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company market share analysis

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Kits and reagents

Chapter 6 Market Estimates and Forecast, By Assay Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Chemiluminescence immunoassay (CLIA)

- 6.3 Enzyme-linked immunosorbent assay (ELISA)

- 6.4 Immunoturbidimetric assay

- 6.5 Other assay types

Chapter 7 Market Estimates and Forecast, By Detection Range, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 High-sensitivity CRP (hs-CRP)

- 7.3 Standard CRP

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cardiovascular diseases

- 8.3 Infectious diseases

- 8.4 Chronic inflammatory diseases

- 8.5 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Diagnostic laboratories

- 9.4 Other end uses

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott

- 11.2 Agilent

- 11.3 AIDIAN

- 11.4 Boditech

- 11.5 Creative Diagnostics

- 11.6 CTK BIOTECH

- 11.7 Danaher

- 11.8 DxGen Corp

- 11.9 Getein Biotech

- 11.10 GOLDSITE

- 11.11 HORIBA

- 11.12 Labcorp

- 11.13 Merck

- 11.14 OptiBio

- 11.15 RANDOX

- 11.16 Roche

- 11.17 SIEMENS Healthineers