|

市场调查报告书

商品编码

1750581

食品乳化剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Food Emulsifiers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

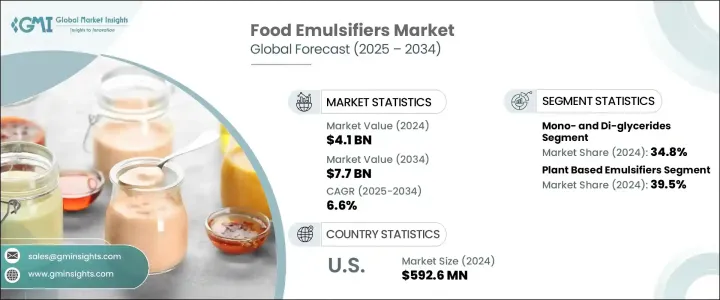

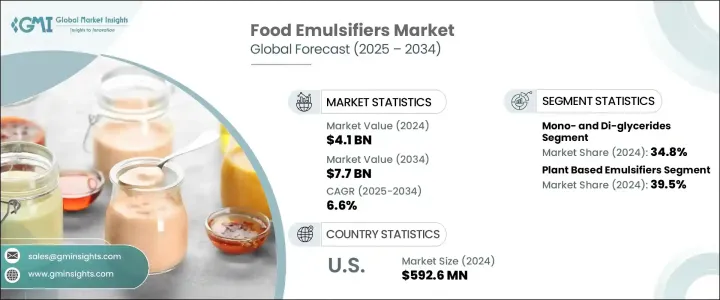

2024年,全球食品乳化剂市场规模达41亿美元,预计到2034年将以6.6%的复合年增长率增长,达到77亿美元,这主要得益于对方便食品、植物性配料和清洁标籤产品日益增长的需求。乳化剂在改善食品结构、稳定性和保质期方面发挥着至关重要的作用,广泛应用于烘焙食品、乳製品、冷冻甜点、饮料、加工肉类、即食食品和婴幼儿营养品等各个食品领域。随着消费者越来越多地转向清洁标籤和纯素食,卵磷脂、葵花籽油和大豆油等天然和植物性乳化剂正日益受到青睐。此外,由于单甘油酯和双甘油酯用途广泛、经济高效,且在功能性食品和方便食品中应用广泛,其需求仍将持续占据主导地位。

就区域成长而言,由于饮食偏好的变化和城市化的加快,亚太市场正在快速扩张。欧洲和北美作为成熟市场,对天然、永续和清洁标籤成分的需求仍然强劲。食品安全和标籤透明度日益增强的监管支持也推动了乳化剂混合物的创新,增强了其在现代食品生产过程中的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 41亿美元 |

| 预测值 | 77亿美元 |

| 复合年增长率 | 6.6% |

单甘油酯和双甘油酯占据34.8%的市场份额,预计到2034年将以6.4%的复合年增长率成长。这些乳化剂因其多功能性、成本效益以及在烘焙、乳製品、糖果和加工食品等多个领域的广泛应用而备受推崇。它们能够作为稳定剂、乳化剂和调质剂,加上其较长的保质期和良好的稳定性,巩固了其作为食品行业最常用乳化剂之一的地位。这种广泛的用途,加上其多功能性,确保了单甘油酯和双甘油酯仍然是食品製造的主导选择。

2024年,植物性乳化剂市场占有39.5%的份额,预计到2034年将以6.2%的复合年增长率增长,这得益于消费者偏好明显转向天然植物成分,这些成分符合更可持续、更注重健康的生活方式。随着越来越多的消费者寻求环保和清洁标籤产品,对源自大豆、葵花籽和油菜籽的乳化剂的需求也在增加。这些植物性乳化剂因其营养价值、清洁标籤和永续采购而日益受到欢迎,所有这些都与消费者对更健康、更环保的食品选择日益增长的需求相契合。

由于美国强大的食品加工产业和大量的方便食品消费,美国食品乳化剂市场在2024年的价值达到5.926亿美元。美国强劲的烘焙、乳製品和冷冻甜点产业进一步支撑了对乳化剂的需求。此外,美国消费者日益增长的健康保健趋势也推动了对更多创新乳化剂的需求,包括植物性和天然替代品。美国完善的供应链和行销体系使其在从本地和国际来源取得原料方面拥有竞争优势。

全球食品乳化剂市场的领导者,例如嘉吉公司、科比昂公司、阿彻丹尼尔斯米德兰公司 (ADM)、凯里集团和禾大国际,正致力于实现产品组合多元化,扩大市场份额。这些公司正在大力投资研发,以创造更干净的植物性乳化剂,满足消费者对永续产品日益增长的需求。他们也正在改进生产工艺,以提高效率并降低成本。合作、併购是这些公司扩大市场足迹、提升其在全球食品乳化剂领域的竞争地位的关键策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国(2021-2024年)

- 主要进口国(2021-2024年)

註:以上贸易统计仅针对重点国家。

- 消费者趋势和偏好

- 清洁标籤运动

- 消费者对乳化剂的看法

- 天然与合成的偏好

- 对产品配方的影响

- 健康与保健趋势

- 营养问题

- 过敏原考虑

- 饮食限制的影响

- 永续性和道德考虑

- 环境影响意识

- 可持续采购偏好

- 包装考虑

- 植物性纯素食趋势

- 对植物源乳化剂的需求

- 素食认证的影响

- 透明度和可追溯性要求

- 区域消费者偏好差异

- 清洁标籤运动

- 消费者行为分析

- 购买决策因素

- 价格敏感度分析

- 品牌忠诚度模式

- 社群媒体和数位对消费者感知的影响

- 供应炼和原料分析

- 原料来源分析

- 关键原料

- 采购地区

- 采购的可持续性

- 生产流程分析

- 製造技术

- 品质控制措施

- 成本结构分析

- 配销通路分析

- 直接通路与间接通路

- 电子商务的影响

- 分销挑战

- 供应链挑战

- 原物料价格波动

- 供应链中断

- 物流挑战

- 供应链优化策略

- 永续供应链实践

- 供应链技术整合

- 原料来源分析

- 定价分析和成本结构

- 依产品类型进行价格点分析

- 2021-2025年价格趋势分析

- 2025-2034年价格预测

- 影响定价的因素

- 原料成本

- 生产成本

- 监理合规成本

- 市场竞争

- 区域价格差异

- 主要参与者的定价策略

- 成本结构分析

- 原料成本

- 製造成本

- 分销成本

- 行销和销售成本

- 依产品类别分析获利能力

- 技术进步与创新

- 近期技术发展

- 乳化剂生产的新兴技术

- 酵素修饰

- 微胶囊化

- 奈米科技应用

- 清洁标籤创新

- 天然乳化剂替代品

- 基于酵素的解决方案

- 植物基创新

- 永续生产技术

- 功能改进

- 增强稳定性

- 改善纹理特性

- 延长保质期的解决方案

- 生产和品质控制中的数位技术

- 专利分析与研发趋势

- 未来技术路线图

- 永续性和环境影响

- 乳化剂的环境足迹

- 碳足迹分析

- 用水量评估

- 废弃物产生和管理

- 永续采购实践

- 棕榈油永续性议题

- 大豆采购挑战

- 替代永续能源

- 生物降解性和生态毒性评估

- 循环经济方法

- 产业永续发展倡议

- 永续性的监管压力

- 消费者对永续产品的需求

- 永续实践的成本效益分析

- 乳化剂的环境足迹

- 市场挑战与机会

- 主要市场挑战

- 健康问题和负面看法

- 监管障碍

- 原物料价格波动

- 清洁标籤配方挑战

- 市场机会

- 植物性乳化剂的开发

- 新兴市场扩张

- 功能性食品应用

- 永续乳化剂解决方案

- 宏观经济因素的影响

- 技术机会评估

- 战略机会图

- 主要市场挑战

- 未来市场展望及预测

- 2025-2030 年产品类型市场预测

- 2025-2030年按应用分類的市场预测

- 2025-2030年各地区市场预测

- 新兴市场趋势

- 未来成长动力

- 市场演变情景

- 乐观情境

- 现实场景

- 悲观情景

- 投资机会评估

- 未来竞争格局预测

- 策略建议

- 市场进入策略

- 产品开发建议

- 区域扩张机会

- 竞争定位策略

- 永续发展实施路线图

- 数位转型策略

- 监理合规策略

- 行销和品牌建议

- 风险缓解策略

- 投资优先框架

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 饮料产业蓬勃发展或将刺激产品需求

- 加工食品消费量的增加将促进产业成长

- 乳製品消费量成长或将有利于食品乳化剂产业成长

- 产业陷阱与挑战

- 日益增长的健康问题

- 产品清洁标籤要求

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场规模及预测:依类型 2021 - 2034

- 主要趋势

- 单甘油酯和双甘油酯

- 卵磷脂

- 脱水山梨醇酯

- 硬脂酰乳酸酯

- 聚甘油酯

- 聚山梨醇酯

- 其他(DATEM、CSL等)

第六章:市场规模及预测:依来源,2021 - 2034

- 主要趋势

- 植物性乳化剂

- 大豆衍生

- 向日葵衍生

- 棕榈衍生

- 其他植物来源

- 动物性乳化剂

- 合成乳化剂

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 烘焙和糖果

- 麵包和捲饼

- 蛋糕和糕点

- 饼干和曲奇

- 巧克力和糖果

- 乳製品和冷冻甜点

- 冰淇淋和冷冻甜点

- 牛奶和奶油製品

- 乳酪製品

- 优格和发酵乳製品

- 加工肉类和海鲜

- 香肠和加工肉类

- 海鲜产品

- 方便食品和即食食品

- 汤和酱汁

- 调味品和蛋黄酱

- 即食食品

- 饮料

- 碳酸饮料

- 果汁和果汁饮料

- 酒精饮料

- 植物饮料

- 婴儿营养和婴儿食品

- 婴儿配方奶粉

- 婴儿食品

- 其他

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Archer Daniels Midland Company (ADM)

- Cargill, Inc.

- Croda International Plc

- Kerry Group plc

- Corbion NV

- Ingredion Incorporated

- Lasenor Emul, SL

- Palsgaard A/S

- Lonza

- Riken Vitamin

The Global Food Emulsifiers Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 7.7 billion by 2034, driven by the increasing demand for convenience foods, plant-based ingredients, and clean-label products. Emulsifiers play a vital role in improving the structure, stability, and shelf life of food products. They are used across various food sectors such as bakery, dairy, frozen desserts, beverages, processed meats, ready-to-eat meals, and infant nutrition. With an increasing shift toward clean label and vegan-friendly options, natural and plant-based emulsifiers such as lecithin, sunflower, and soy are gaining traction. Moreover, the demand for mono- and diglycerides continues to dominate due to their versatility, cost-effectiveness, and wide application in functional and convenience foods.

In terms of regional growth, the Asia Pacific market is expanding rapidly due to changing dietary preferences and rising urbanization. Europe and North America, while mature markets, continue to maintain strong demand for natural, sustainable, and clean-label ingredients. The growing regulatory support for food safety and label transparency is also driving the innovation of emulsifier blends, strengthening their presence in modern food production processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $7.7 Billion |

| CAGR | 6.6% |

The mono- and diglycerides segment holds 34.8% share and is forecasted to grow at a CAGR of 6.4% by 2034. These emulsifiers are highly regarded for their versatility, cost-effectiveness, and wide application across multiple sectors, including bakery, dairy, confectionery, and processed foods. Their ability to act as stabilizers, emulsifiers, and texturizers, combined with their long shelf life and consistency, has cemented their position as one of the most used emulsifiers in the food industry. This widespread usage, coupled with their multifunctionality, ensures that mono and diglycerides remain a dominant choice in food manufacturing.

The plant-based emulsifiers segment held 39.5% share in 2024 and is expected to grow at a CAGR of 6.2% through 2034, driven by a noticeable shift in consumer preferences toward natural, plant-derived ingredients that align with a more sustainable and health-conscious lifestyle. As more consumers seek eco-friendly and clean-label products, the demand for emulsifiers derived from soy, sunflower, and canola is growing. These plant-based emulsifiers are gaining popularity due to their nutritional benefits, clean labeling, and sustainable sourcing, all of which align with the rising consumer demand for healthier and environmentally responsible food options.

U.S. Food Emulsifiers Market was valued at USD 592.6 million in 2024 due to its strong food processing industry and high consumption of convenience foods. The country's robust bakery, dairy, and frozen dessert sectors further support the demand for emulsifiers. Additionally, the growing health and wellness trends among U.S. consumers are driving the need for more innovative emulsifiers, including plant-based and natural alternatives. The well-established supply chains and marketing systems in the U.S. contribute to its competitive advantage in obtaining raw materials from both local and international sources.

Leading players in the Global Food Emulsifiers Market, such as Cargill, Inc., Corbion N.V., Archer Daniels Midland Company (ADM), Kerry Group plc, and Croda International Plc, are focusing on diversifying their product portfolios and expanding their market presence. These companies are investing heavily in research and development to create cleaner, plant-based emulsifiers that meet the growing consumer demand for sustainable products. They are also enhancing their production processes to improve efficiency and reduce costs. Partnerships, mergers, and acquisitions are key strategies used by these companies to expand their market footprint and improve their competitive positioning in the global food emulsifier sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021 - 2024 (Kilo Tons)

- 3.3.2 Major importing countries, 2021 - 2024 (Kilo Tons)

Note: the above trade statistics will be provided for key countries only.

- 3.4 Consumer trends and preferences

- 3.4.1 Clean label movement

- 3.4.1.1 Consumer perception of emulsifiers

- 3.4.1.2 Natural vs. synthetic preferences

- 3.4.1.3 Impact on product formulation

- 3.4.2 Health and wellness trends

- 3.4.2.1 Nutritional concerns

- 3.4.2.2 Allergen considerations

- 3.4.2.3 Dietary restrictions impact

- 3.4.3 Sustainability and ethical considerations

- 3.4.3.1 Environmental impact awareness

- 3.4.3.2 Sustainable sourcing preferences

- 3.4.3.3 Packaging considerations

- 3.4.4 Plant-based vegan trends

- 3.4.4.1 Demand for plant-derived emulsifiers

- 3.4.4.2 Vegan certification impact

- 3.4.5 Transparency and traceability demands

- 3.4.6 Regional consumer preference variations

- 3.4.1 Clean label movement

- 3.5 Consumer behavior analysis

- 3.5.1 Purchase decision factors

- 3.5.2 Price sensitivity analysis

- 3.5.3 Brand loyalty patterns

- 3.6 Social media and digital influence on consumer perception

- 3.7 Supply chain and raw material analysis

- 3.7.1 Raw material sourcing analysis

- 3.7.1.1 Key raw materials

- 3.7.1.2 Sourcing regions

- 3.7.1.3 Sustainability in sourcing

- 3.7.2 Production process analysis

- 3.7.2.1 Manufacturing technologies

- 3.7.2.2 Quality control measures

- 3.7.2.3 Cost structure analysis

- 3.7.3 Distribution channel analysis

- 3.7.3.1 Direct vs. indirect channels

- 3.7.3.2 E-commerce impact

- 3.7.3.3 Distribution challenges

- 3.7.4 Supply chain challenges

- 3.7.4.1 Raw material price volatility

- 3.7.4.2 Supply chain disruptions

- 3.7.4.3 Logistics challenges

- 3.7.5 Supply chain optimization strategies

- 3.7.6 Sustainable supply chain practices

- 3.7.7 Technology integration in supply chain

- 3.7.1 Raw material sourcing analysis

- 3.8 Pricing analysis and cost structure

- 3.8.1 Price point analysis by product type

- 3.8.2 Price trend analysis 2021–2025

- 3.8.3 Price forecast 2025–2034

- 3.8.4 Factors affecting pricing

- 3.8.4.1 Raw material costs

- 3.8.4.2 Production costs

- 3.8.4.3 Regulatory compliance costs

- 3.8.4.4 Market competition

- 3.8.4.5 Regional price variations

- 3.8.4.6 Pricing strategies of key players

- 3.8.4.7 Cost structure analysis

- 3.8.4.8 Raw material costs

- 3.8.4.9 Manufacturing costs

- 3.8.4.10 Distribution costs

- 3.8.4.11 Marketing and sales costs

- 3.8.5 Profitability analysis by product segment

- 3.9 Technological advancements and innovations

- 3.9.1 Recent technological developments

- 3.9.2 Emerging technologies in emulsifier production

- 3.9.2.1 Enzymatic modification

- 3.9.2.2 Microencapsulation

- 3.9.2.3 Nanotechnology applications

- 3.9.3 Clean label innovations

- 3.9.3.1 Natural emulsifier alternatives

- 3.9.3.2 Enzyme-based solutions

- 3.9.3.3 Plant-based innovations

- 3.9.4 Sustainable production technologies

- 3.9.5 Functional improvements

- 3.9.5.1 Enhanced stability

- 3.9.5.2 Improved texture properties

- 3.9.5.3 Extended shelf life solutions

- 3.9.6 Digital technologies in production and quality control

- 3.9.7 Patent analysis and r&d trends

- 3.9.8 Future technology roadmap

- 3.10 Sustainability and environmental impact

- 3.10.1 Environmental footprint of emulsifiers

- 3.10.1.1 Carbon footprint analysis

- 3.10.1.2 Water usage assessment

- 3.10.1.3 Waste generation and management

- 3.10.2 Sustainable sourcing practices

- 3.10.2.1 Palm oil sustainability issues

- 3.10.2.2 Soy sourcing challenges

- 3.10.2.3 Alternative sustainable sources

- 3.10.3 Biodegradability and eco-toxicity assessment

- 3.10.4 Circular economy approaches

- 3.10.5 Industry sustainability initiatives

- 3.10.6 Regulatory pressures for sustainability

- 3.10.7 Consumer demand for sustainable products

- 3.10.8 Cost-benefit analysis of sustainable practices

- 3.10.1 Environmental footprint of emulsifiers

- 3.11 Market challenges and opportunities

- 3.11.1 Key market challenges

- 3.11.1.1 Health concerns and negative perception

- 3.11.1.2 Regulatory hurdles

- 3.11.1.3 Raw material price volatility

- 3.11.1.4 Clean label formulation challenges

- 3.11.2 Market opportunities

- 3.11.2.1 Plant-based emulsifier development

- 3.11.2.2 Emerging markets expansion

- 3.11.2.3 Functional food applications

- 3.11.2.4 Sustainable emulsifier solutions

- 3.11.3 Impact of macro-economic factors

- 3.11.4 Technological opportunity assessment

- 3.11.5 Strategic opportunity mapping

- 3.11.1 Key market challenges

- 3.12 Future market outlook and forecast

- 3.12.1 Market forecast by product type 2025–2030

- 3.12.2 Market forecast by application 2025–2030

- 3.12.3 Market forecast by region 2025–2030

- 3.12.4 Emerging market trends

- 3.12.5 Future growth drivers

- 3.12.6 Market evolution scenarios

- 3.12.6.1 Optimistic scenario

- 3.12.6.2 Realistic scenario

- 3.12.6.3 Pessimistic scenario

- 3.12.7 Investment opportunities assessment

- 3.12.8 Future competitive landscape projection

- 3.13 Strategic recommendations

- 3.13.1 Market entry strategies

- 3.13.2 Product development recommendations

- 3.13.3 Regional expansion opportunities

- 3.13.4 Competitive positioning strategies

- 3.13.5 Sustainability implementation roadmap

- 3.13.6 Digital transformation strategies

- 3.13.7 Regulatory compliance strategies

- 3.13.8 Marketing and branding recommendations

- 3.13.9 Risk mitigation strategies

- 3.13.10 Investment prioritization framework

- 3.14 Supplier landscape

- 3.15 Profit margin analysis

- 3.16 Key news & initiatives

- 3.17 Regulatory landscape

- 3.18 Impact forces

- 3.18.1 Growth drivers

- 3.18.1.1 Growing beverage industry may fuel product demand

- 3.18.1.2 Increasing consumption of processed foods will foster industry growth

- 3.18.1.3 Growth in consumption of dairy products is likely to favor food emulsifier industry growth

- 3.18.2 Industry pitfalls & challenges

- 3.18.2.1 Growing health concerns

- 3.18.2.2 Clean label requirements for the product

- 3.18.1 Growth drivers

- 3.19 Growth potential analysis

- 3.20 Porter’s analysis

- 3.21 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Type 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Mono- and Di-glycerides

- 5.3 Lecithin

- 5.4 Sorbitan esters

- 5.5 Stearoyl lactylates

- 5.6 Polyglycerol esters

- 5.7 Polysorbates

- 5.8 Others (DATEM, CSL, etc.)

Chapter 6 Market Size and Forecast, By Source, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Plant-based emulsifiers

- 6.3 Soy-derived

- 6.4 Sunflower-derived

- 6.5 Palm-derived

- 6.6 Other plant sources

- 6.7 Animal-based emulsifiers

- 6.8 Synthetic emulsifiers

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Bakery and confectionery

- 7.2.1 Bread and rolls

- 7.2.2 Cakes and pastries

- 7.2.3 Biscuits and cookies

- 7.2.4 Chocolate and confectionery

- 7.3 Dairy and frozen desserts

- 7.3.1 Ice cream and frozen desserts

- 7.3.2 Milk and cream products

- 7.3.3 Cheese products

- 7.3.4 Yogurt and fermented dairy

- 7.4 Processed meat and seafood

- 7.4.1 Sausages and processed meats

- 7.4.2 Seafood products

- 7.5 Convenience foods and ready meals

- 7.5.1 Soup and sauces

- 7.5.2 Dressings and mayonnaise

- 7.5.3 Ready-to-eat meals

- 7.6 Beverages

- 7.6.1 Carbonated drinks

- 7.6.2 Fruit juices and nectars

- 7.6.3 Alcoholic beverages

- 7.6.4 Plant-based beverage

- 7.7 Infant nutrition and baby food

- 7.7.1 Infant formula

- 7.7.2 Baby food products

- 7.8 Other

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Archer Daniels Midland Company (ADM)

- 9.2 Cargill, Inc.

- 9.3 Croda International Plc

- 9.4 Kerry Group plc

- 9.5 Corbion N.V.

- 9.6 Ingredion Incorporated

- 9.7 Lasenor Emul, S.L.

- 9.8 Palsgaard A/S

- 9.9 Lonza

- 9.10 Riken Vitamin