|

市场调查报告书

商品编码

1801897

草坪及园艺设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Lawn and Garden Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

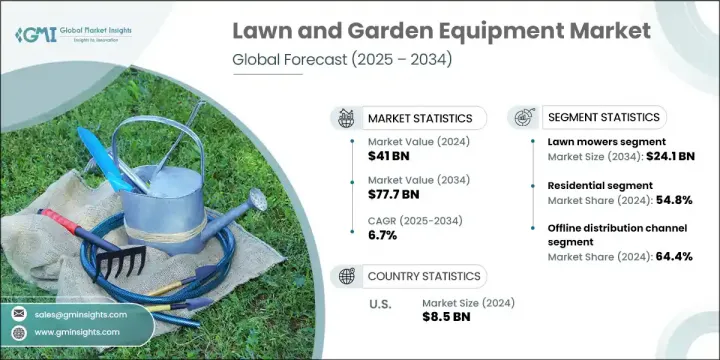

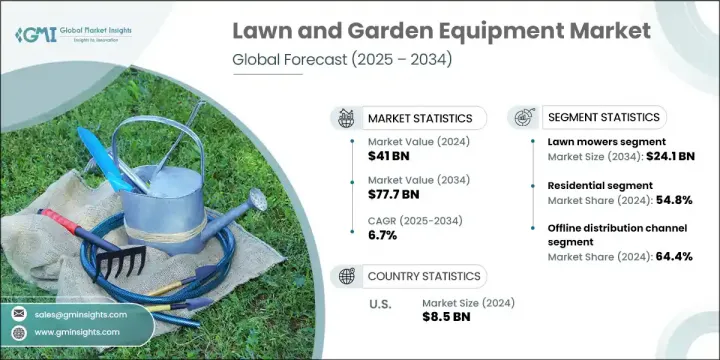

2024年,全球草坪和园艺设备市场规模达410亿美元,预计到2034年将以6.7%的复合年增长率成长,达到777亿美元。不断增长的可支配收入和不断壮大的中产阶级人口,正在激发消费者对家居装修和户外美学的兴趣。随着屋主越来越重视个人化的户外空间,对园林绿化工具、智慧园艺系统和高效庭院维护设备的需求也稳定成长。新的住宅开发项目,尤其是在郊区和半城市地区,正在鼓励人们将草坪和花园视为不可或缺的生活空间。

这一趋势,在网路可近性增强、融资选择便利性以及日益重视环保和科技融合生活方式的推动下,正在塑造市场前景。随着人们对使用者友善互联设备的偏好日益增长,製造商正专注于自动化解决方案,例如机器人割草机、基于应用程式的灌溉系统和智慧园艺工具。这些创新不仅减少了人工工作量,还使用户能够实现精准控制,并提升绿地的整体功能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 410亿美元 |

| 预测值 | 777亿美元 |

| 复合年增长率 | 6.7% |

2024年,割草机的市场规模达到123亿美元,预计2034年将达到241亿美元。由于其功能性、易用性以及在草坪健康维护中的关键作用,这类工具仍然是使用率最高的产品类别。持续的修剪有助于保持草坪的最佳健康状态,提升房屋外观吸引力,并为业主营造整洁宜人的户外环境。无论是小型住宅庭院还是大型绿地,割草机都是日常户外维护中不可或缺的一部分。

预计2025年至2034年间,商业领域的复合年增长率将达到7.1%。作为城市美化和永续发展计画的一部分,企业和机构正在增加对景观设计和绿色基础设施的投资。维护良好的户外环境有助于提升品牌形象,并为饭店、企业和公共场所营造温馨舒适的环境。随着城市规划越来越多地纳入绿化区域,对用于管理更大空间的高效、经济的草坪和园艺设备的需求也持续增长。

2024年,美国草坪和园艺设备市场规模达85亿美元,预计2025年至2034年的复合年增长率将达到6.9%。美国凭藉其广泛的住房拥有率,尤其是在草坪普遍分布的农村和郊区,引领市场发展。浓厚的DIY文化,加上草坪护理的季节性特点,使得机器人割草机、骑乘式割草机以及环保工具等各种产品的需求持续高涨。户外生活的流行,尤其是在温暖的月份,推动了人们对园艺和庭院维护设备的持续投资。

全球草坪和园艺设备市场的领导者包括久保田株式会社、百力通公司、史丹利百得、菲斯卡斯集团、本田技研工业株式会社、Ariens 公司、STIGA SpA、光机控股株式会社、牧田株式会社、Falcon Garden Tools、Toro 公司、富实华集团公司、牧田株式会社、Falcon Garden Tools、Toro 公司、富实华集团公司、富实业有限公司、加拿大富实业有限公司、加拿大富实业有限公司、富实业有限公司、富实业有限公司、新实业有限公司. & Co. KG 与约翰迪尔公司。草坪和园艺设备产业的公司正专注于多项策略重点,以巩固其市场地位。重点放在研发智慧互联产品上,例如机器人割草机和感测器驱动的灌溉系统。各公司正在投资永续发展,推出电动和电池供电的工具,以满足日益增长的环境问题。扩大针对住宅和商业应用的产品线也是一项关键的成长策略。

目录

第一章:方法论与范围

第二章:执行摘要

2.3.1 产业主管的关键决策点

2.3.2. 市场参与者的关键成功因素

- 未来展望及策略建议

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 技术进步

- 人们对环保和永续产品的兴趣日益浓厚

- 居家装潢和户外休閒活动的成长

- 产业陷阱与挑战

- 成长动力

3.2.2.1 使用燃料驱动工具的环境问题

3.2.2.2 先进设备维护成本高

- 机会

- 智慧园艺工具需求不断成长

- 新兴市场的扩张

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计(HS 编码 - 8432)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 鼓风机

- 链锯

- 切割机和碎纸机

- 联结机

- 割草机

- 洒水器和软管

- 其他(修枝剪、挖土机等)

第六章:市场估计与预测:按功率,2021 - 2034 年

- 主要趋势

- 手动的

- 电动

- 燃气驱动

- 其他(汽油动力等)

第七章:市场估计与预测:按价格,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:按最终用户,2021 - 2034 年

- 主要趋势

- 住宅

- 商业的

- 其他(公共公园、机构和社区空间)

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 专卖店

- 家居装饰店

- 其他(个人、百货等)

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- Ariens Company

- Briggs & Stratton Corporation

- Deere & Company

- Falcon Garden Tools

- Fiskars Group

- Honda Motor Co., Ltd

- Husqvarna Group

- Koki Holdings Co., Ltd

- Kubota Corporation

- Makita Corporation

- MTD Holdings Inc

- Robert Bosch GmbH

- Stanley Black & Decker

- STIGA SpA

- Stihl Holding AG & Co. KG

- Techtronic Industries Co. Ltd (TTI)

- The Toro Company

The Global Lawn and Garden Equipment Market was valued at USD 41 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 77.7 billion by 2034. Rising disposable incomes and the expanding middle-class population are fueling consumer interest in home improvement and outdoor aesthetics. As homeowners increasingly prioritize personalized outdoor spaces, the demand for landscaping tools, smart gardening systems, and efficient yard maintenance equipment is steadily rising. New residential developments, especially in suburban and semi-urban zones, are encouraging people to treat lawns and gardens as integral living spaces.

This trend, supported by greater online accessibility, easier financing options, and a growing emphasis on eco-friendly and tech-integrated living, is shaping the outlook of the market. With a growing preference for user-friendly and connected equipment, manufacturers are focusing on automated solutions such as robotic lawn mowers, app-based irrigation systems, and intelligent gardening tools. These innovations not only reduce manual workload but also allow users to achieve precise control and enhance the overall functionality of their green spaces.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $41 Billion |

| Forecast Value | $77.7 Billion |

| CAGR | 6.7% |

The lawn mowers generated USD 12.3 billion in 2024 and is forecast to reach USD 24.1 billion by 2034. These tools remain the most utilized product category due to their functionality, ease of use, and critical role in maintaining healthy grass. Consistent mowing supports optimal lawn health, improves curb appeal, and provides a neat and welcoming outdoor setting for homeowners. Whether for small residential yards or larger green areas, lawn mowers are an essential component in outdoor maintenance routines.

The commercial segment is anticipated to grow at a CAGR of 7.1% between 2025 and 2034. Businesses and institutions are increasingly investing in landscaping and green infrastructure as part of urban beautification and sustainability initiatives. Well-maintained outdoor environments help enhance brand image and provide welcoming surroundings across hospitality, corporate, and public settings. With growing urban planning that incorporates green zones, the demand for efficient, cost-effective lawn and garden equipment to manage larger spaces continues to rise.

United States Lawn and Garden Equipment Market was valued at USD 8.5 billion in 2024 and is expected to grow at a CAGR of 6.9% from 2025 to 2034. The U.S. leads the market due to widespread homeownership, especially in rural and suburban areas where lawns are common. A strong do-it-yourself culture, coupled with the seasonal nature of lawn care, keeps demand high for various products such as robotic mowers, riding mowers, and environmentally conscious tools. The popularity of outdoor living, particularly during warmer months, drives recurring investments in garden and yard maintenance equipment.

Leading players in the Global Lawn and Garden Equipment Market include Kubota Corporation, Briggs & Stratton Corporation, Stanley Black & Decker, Fiskars Group, Honda Motor Co., Ltd, Ariens Company, STIGA S.p.A, Koki Holdings Co., Ltd, Makita Corporation, Falcon Garden Tools, The Toro Company, Husqvarna Group, Techtronic Industries Co., Ltd (TTI), Robert Bosch GmbH, MTD Holdings Inc, Stihl Holding AG & Co. KG, and Deere & Company. Companies in the lawn and garden equipment sector are focusing on multiple strategic priorities to strengthen their market position. Emphasis is being placed on R&D to develop smart, connected products such as robotic mowers and sensor-driven irrigation systems. Firms are investing in sustainability by introducing electric and battery-powered tools that cater to growing environmental concerns. Product line expansion tailored to both residential and commercial applications is also a key growth strategy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Power type

- 2.2.4 Price

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

2.3.1 Key decision points for industry executives

2.3.2. Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements

- 3.2.1.2 Increasing interest in eco-friendly and sustainable products

- 3.2.1.3 Growth in home improvement and outdoor leisure activities

- 3.2.2 Industry pitfalls & challenges

- 3.2.1 Growth drivers

3.2.2.1 Environmental concerns regarding the use of fuel-powered tools

3.2.2.2 High maintenance cost of advanced equipment

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for smart gardening tools

- 3.2.3.2 Expansion in emerging markets

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code- 8432)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Blowers

- 5.3 Chain saws

- 5.4 Cutters & shredders

- 5.5 Tractors

- 5.6 Lawn mowers

- 5.7 Sprinkler & hoses

- 5.8 Others (pruners, diggers, etc.)

Chapter 6 Market Estimates and Forecast, By Power, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Electric powered

- 6.4 Gas powered

- 6.5 Others (gasoline powered, etc.)

Chapter 7 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By End User, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Others (public parks, institutions, and community spaces)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Home Improvement stores

- 9.3.3 Others (individual, department stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Ariens Company

- 11.2 Briggs & Stratton Corporation

- 11.3 Deere & Company

- 11.4 Falcon Garden Tools

- 11.5 Fiskars Group

- 11.6 Honda Motor Co., Ltd

- 11.7 Husqvarna Group

- 11.8 Koki Holdings Co., Ltd

- 11.9 Kubota Corporation

- 11.10 Makita Corporation

- 11.11 MTD Holdings Inc

- 11.12 Robert Bosch GmbH

- 11.13 Stanley Black & Decker

- 11.14 STIGA S.p.A

- 11.15 Stihl Holding AG & Co. KG

- 11.16 Techtronic Industries Co. Ltd (TTI)

- 11.17 The Toro Company