|

市场调查报告书

商品编码

1664814

油酸酯市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Oleate Esters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

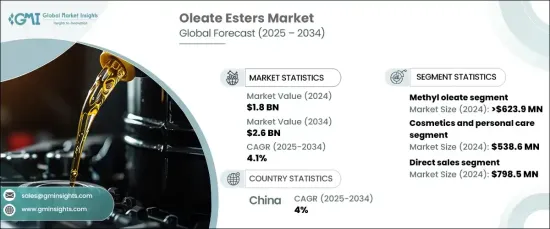

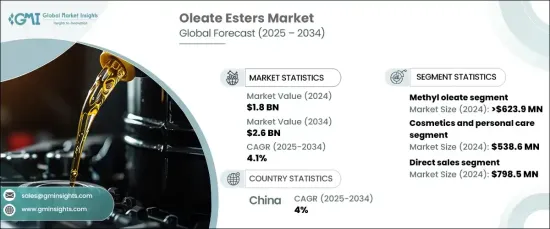

2024 年全球油酸酯市场规模达到 18 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.1%。个人护理和食品等行业正在转向植物性、清洁标籤配方,推动油酸酯的采用。此外,它们在可生物降解润滑剂和涂料中的应用符合各行业对永续性的日益重视。

油酸甲酯市场价值预计在 2024 年达到 6.239 亿美元,预测期内复合年增长率预计为 4.2%。这款产品的广泛吸引力在于它的多功能性和环保特性。油酸甲酯源自油酸,是一种有效的乳化剂、界面活性剂和溶剂,是化妆品、个人护理和医药等行业的首选。它的生物降解性进一步满足了人们对永续替代品日益增长的偏好。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 26亿美元 |

| 复合年增长率 | 4.1% |

2024 年,化妆品和个人护理行业创收 5.386 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.3%。将它们加入乳液、乳霜和精华液等护肤产品中,可增强质地、稳定性和整体产品吸引力,从而推动其广泛应用。

中国油酸酯市场在 2024 年创收 1.759 亿美元,预计到 2034 年复合年增长率将达到 4%。工业化进程的不断加快以及消费者对天然、环保配方的兴趣进一步推动了油酸酯在永续产品开发中的应用。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 对天然和永续成分的需求不断增加

- 消费者对环保和可生物降解产品的偏好日益增加

- 个人护理和化妆品行业的成长

- 产业陷阱与挑战

- 永续原料生产成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2034 年

- 主要趋势

- 油酸甲酯

- 油酸乙酯

- 油酸丁酯

- 油酸异丙酯

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 化妆品和个人护理

- 食品和饮料

- 药品

- 润滑剂

- 农业化学品

- 纺织品和皮革

- 其他的

第 7 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接销售

- 网路零售商

- 分销商/批发商

- 其他的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Acme Synthetic Chemicals

- BASF SE

- Cayman Chemical

- Croda International

- Italmatch Chemical SpA

- Kao Corporation

- KLK OLEO

- CHS Industrial Products Industry.

- PT. Ecogreen Oleochemicals

- Victorian Chemical Company

- Wilmar International

The Global Oleate Esters Market reached USD 1.8 billion in 2024 and is projected to grow at a CAGR of 4.1% between 2025 and 2034. The increasing demand for natural and sustainable ingredients is a key driver, as consumers prioritize environmentally friendly and health-conscious products. Industries such as personal care and food are shifting towards plant-based, clean-label formulations, propelling the adoption of oleate esters. Additionally, their use in biodegradable lubricants and coatings aligns with the growing emphasis on sustainability across sectors.

The methyl oleate segment, valued at USD 623.9 million in 2024, is anticipated to grow at a CAGR of 4.2% during the forecast period. This product's widespread appeal lies in its versatility and eco-friendly properties. Methyl oleate, derived from oleic acid, serves as an effective emulsifier, surfactant, and solvent, making it a preferred choice in industries like cosmetics, personal care, and pharmaceuticals. Its biodegradability further complements the increasing preference for sustainable alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 4.1% |

The cosmetics and personal care sector generated USD 538.6 million in 2024 and is projected to grow at a CAGR of 4.3% between 2025 - 2034. Oleate esters are valued in this sector for their multifunctional properties, including their roles as emulsifiers, moisturizers, and skin-conditioning agents. Their inclusion in skincare products such as lotions, creams, and serums enhances texture, stability, and overall product appeal, driving their widespread adoption.

China oleate esters market generated USD 175.9 million in 2024 and expected to grow at a CAGR of 4% through 2034. The country's thriving manufacturing sector, coupled with strong demand from personal care, cosmetics, and pharmaceutical industries, has positioned it as a key player. Growing industrialization and consumer interest in natural, eco-friendly formulations have further fueled the adoption of oleate esters in sustainable product development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for natural and sustainable ingredients

- 3.6.1.2 Rising consumer preference for eco-friendly and biodegradable products

- 3.6.1.3 Growth of the personal care and cosmetics industry

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs for sustainable raw materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Methyl oleate

- 5.3 Ethyl oleate

- 5.4 Butyl oleate

- 5.5 Isopropyl oleate

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cosmetics and personal care

- 6.3 Food & beverages

- 6.4 Pharmaceuticals

- 6.5 Lubricants

- 6.6 Agricultural chemicals

- 6.7 Textiles and leather

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Distribution channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Online retailers

- 7.4 Distributors/wholesalers

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Acme Synthetic Chemicals

- 9.2 BASF SE

- 9.3 Cayman Chemical

- 9.4 Croda International

- 9.5 Italmatch Chemical S.p.A.

- 9.6 Kao Corporation

- 9.7 KLK OLEO

- 9.8 CHS Industrial Products Industry.

- 9.9 PT. Ecogreen Oleochemicals

- 9.10 Victorian Chemical Company

- 9.11 Wilmar International