|

市场调查报告书

商品编码

1664818

椰油酰基羟乙基磺酸钠市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Sodium Cocoyl Isethionate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

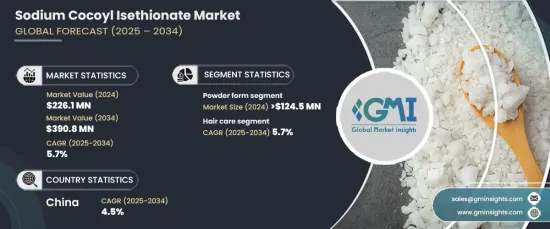

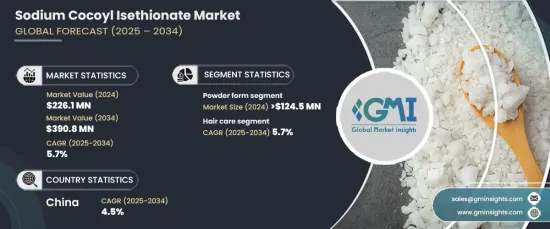

2024 年全球椰油酰羟乙基磺酸钠市场价值达到 2.261 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.7%。 椰油酰羟乙基磺酸钠以其多功能性和温和的清洁特性而闻名,是一种从椰子油中提取的表面活性剂,广泛应用于个人护理产品中。它能够有效清洁且不剥离天然油脂,是敏感肌肤配方的理想成分。消费者对天然和温和的个人护理成分的偏好日益增加,极大地促进了其需求的成长。人们不断转向清洁美容、环保配方和无硫酸盐产品,进一步推动了其在各种应用领域的应用。随着消费者环保意识的增强,对植物衍生和可生物降解成分(包括椰油酰羟乙基磺酸钠)的需求将会扩大。人们对护肤习惯的认识不断提高以及新兴市场的可支配收入不断增加也推动了市场的成长。

粉状椰油酰羟乙基磺酸钠在 2024 年占据了 1.245 亿美元的显着份额,预计到 2034 年将以 5.7% 的复合年增长率增长。製造商欣赏其生产固体产品的便利性及其无缝融入各种应用的能力。其重量轻且适合永续包装,进一步增强了其对注重环保实践的品牌的吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.261亿美元 |

| 预测值 | 3.908 亿美元 |

| 复合年增长率 | 5.7% |

在护髮领域,椰油酰基羟乙基磺酸钠在 2024 年创造了 7,920 万美元的收入,预计在预测期内的复合年增长率为 5.7%。它的温和性和泡沫特性使其成为洗髮精和护髮素的首选。透过支援无硫酸盐配方和保持天然头皮油脂,它满足了消费者对敏感和干燥髮质产品日益增长的需求。该成分的可持续采购和可生物降解特性与人们对清洁和绿色美容解决方案日益增长的兴趣相一致,巩固了其作为护髮创新重要组成部分的地位。

中国已成为亚太地区领先的市场,2024 年估值为 3,530 万美元,预计 2025 年至 2034 年的复合年增长率为 4.5%。随着美容趋势的演变和可支配收入的提高,对个人护理产品的需求不断增加,进一步增强了其主导地位。此外,中国对永续和清洁美容实践的承诺继续推动市场向前发展,巩固对全球椰油酰基羟乙基磺酸钠产业的影响力。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 对无硫酸盐个人护理产品的需求不断增长

- 消费者对天然和温和成分的偏好日益增加

- 清洁美容和永续产品趋势的成长

- 产业陷阱与挑战

- 与合成界面活性剂相比生产成本较高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依形式,2021-2034

- 主要趋势

- 粉状

- 颗粒状

- 片状

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 头髮护理

- 洗髮精

- 护髮素

- 头髮造型产品

- 皮肤护理

- 沐浴露

- 肥皂和清洁剂

- 刮鬍泡沫

- 其他的

- 口腔护理

- 婴儿护理

- 其他的

第 7 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- BASF

- Chemistry Connection

- Clariant International

- Essential Wholesale & Labs

- EWG's Skin Deep

- Galaxy Surfactants

- Guangdong Kiyu New Material

- Hefei TNJ Chemical Industry

- JEEN International

- Natures Garden

- Trulux

The Global Sodium Cocoyl Isethionate Market reached a valuation of USD 226.1 million in 2024 and is forecasted to grow at a CAGR of 5.7% between 2025 and 2034. Known for its versatility and gentle cleansing properties, sodium cocoyl isethionate is a surfactant derived from coconut oil that finds widespread application in personal care products. Its ability to cleanse effectively without stripping natural oils makes it an ideal ingredient for sensitive skin formulations. Increasing consumer preference for natural and mild personal care ingredients has significantly contributed to its growing demand. The ongoing shift towards clean beauty, eco-friendly formulations, and sulfate-free products further propels its adoption across various applications. As consumers become more environmentally conscious, the demand for plant-derived and biodegradable components, including sodium cocoyl isethionate, is set to expand. The growing awareness of skincare routines and the rising disposable incomes in emerging markets are also driving market growth.

The powdered form of sodium cocoyl isethionate commanded a significant share of USD 124.5 million in 2024 and is projected to grow at a 5.7% CAGR through 2034. Its popularity stems from its stability, ease of use, and compatibility with a wide range of formulations. Manufacturers appreciate its convenience for producing solid products and its ability to blend seamlessly into various applications. Its lightweight nature and suitability for sustainable packaging further enhance its appeal to brands focused on eco-friendly practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $226.1 Million |

| Forecast Value | $390.8 Million |

| CAGR | 5.7% |

In the hair care sector, sodium cocoyl isethionate generated USD 79.2 million in revenue in 2024 and is anticipated to grow at a CAGR of 5.7% during the forecast period. Its mildness and foaming properties make it a preferred choice for shampoos and conditioners. By supporting sulfate-free formulations and maintaining natural scalp oils, it meets the rising consumer demand for products catering to sensitive and dry hair types. The ingredient's sustainable sourcing and biodegradable nature align with the growing interest in clean and green beauty solutions, solidifying its position as a vital component in hair care innovation.

China emerged as the leading market in the Asia Pacific region, with a valuation of USD 35.3 million in 2024 and an expected CAGR of 4.5% from 2025 to 2034. The country's strong production capabilities and extensive supply chain infrastructure position it as a global hub for personal care ingredients. Increasing demand for personal care products, supported by evolving beauty trends and higher disposable incomes, further strengthens its dominance. Additionally, China's commitment to sustainable and clean beauty practices continues to drive the market forward, solidifying its influence on the global sodium cocoyl isethionate industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for sulfate-free personal care products

- 3.6.1.2 Increasing consumer preference for natural and gentle ingredients

- 3.6.1.3 Growth of the clean beauty and sustainable product trends

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs compared to synthetic surfactants

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Powder form

- 5.3 Granular form

- 5.4 Flake form

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Hair care

- 6.2.1 Shampoos

- 6.2.2 Conditioners

- 6.2.3 Hair styling products

- 6.3 Skin care

- 6.3.1 Shower gels

- 6.3.2 Soaps & cleansers

- 6.3.3 Shaving foams

- 6.3.4 Others

- 6.4 Oral care

- 6.5 Baby care

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 BASF

- 8.2 Chemistry Connection

- 8.3 Clariant International

- 8.4 Essential Wholesale & Labs

- 8.5 EWG's Skin Deep

- 8.6 Galaxy Surfactants

- 8.7 Guangdong Kiyu New Material

- 8.8 Hefei TNJ Chemical Industry

- 8.9 JEEN International

- 8.10 Natures Garden

- 8.11 Trulux