|

市场调查报告书

商品编码

1664820

超音波手术刀市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Ultrasonic Scalpel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

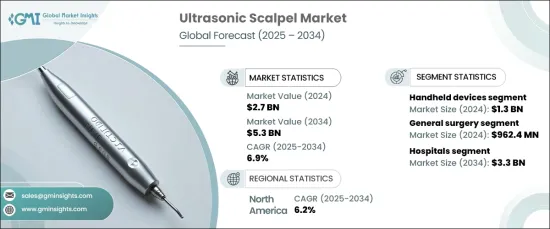

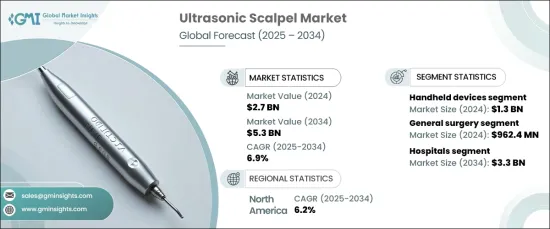

2024 年全球超音波手术刀市场价值为 27 亿美元,预计 2025 年至 2034 年期间将以 6.9% 的强劲复合年增长率增长。

推动市场扩张的关键因素是全球向微创手术 (MIS) 的转变,微创手术正在成为现代医疗保健的黄金标准。这些手术,包括腹腔镜手术,具有显着的优势,例如恢復时间短、风险小、患者治疗效果好。超音波手术刀已成为这些手术中不可或缺的工具,在组织切割和凝固方面提供无与伦比的精确度,对于最佳效果至关重要。此外,门诊手术中心的激增也增加了对超音波手术刀等紧凑高效工具的需求,这些工具专为需要快速週转的大容量环境而设计。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 27亿美元 |

| 预测值 | 53亿美元 |

| 复合年增长率 | 6.9% |

市场按产品类型细分,包括手持设备、发电机和配件。其中,手持式超音波手术刀的收入最高,到2024年将达到13亿美元。它们的人体工学设计和高性能使其对于现代外科手术实践至关重要。随着 MIS 在全球范围内持续受到关注,对这些先进工具的需求预计将稳步上升。

在应用方面,市场涵盖一般外科、骨科外科、眼科外科、泌尿外科、妇科外科等类别。普通外科手术占据最大的市场份额,2024 年创造了 9.624 亿美元的收入。

从区域来看,北美占据超音波手术刀市场主导地位,到 2024 年将达到 12 亿美元,预测期内预计复合年增长率为 6.2%。该地区的成长是由慢性疾病盛行率的上升和人口老化所推动的,这两者共同增加了对外科手术的需求。用于解决与年龄相关的健康问题的先进手术工具的需求不断增长,这继续推动市场扩张,使北美成为主要的成长贡献者。

随着技术进步和对微创手术的日益青睐推动需求,超音波手术刀市场有望大幅成长。这一趋势强调了超音波手术刀在塑造现代外科手术实践的未来方面发挥的关键作用,提供精确度、效率和更好的患者治疗效果。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病盛行率不断上升

- 微创手术需求上升

- 产品技术不断进步

- 产业陷阱与挑战

- 设备成本高且有替代技术

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 价值链分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 手持装置

- 产生器

- 配件

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 一般外科

- 妇科手术

- 骨科手术

- 泌尿科

- 眼科手术

- 其他应用

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 专科诊所

- 其他最终用户

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Anhui Wanyi Science and Technology

- Apollo Technosystems

- Axon Medical Solutions

- Bioventus

- BOWA Medical UK

- Hangzhou Rex Medical Instrument

- HENAN TRADING

- Johnson and Johnson

- Miconvey

- Olympus

- Reach Surgical

- SI Surgical

- Stryker

- Surgnova

- Wuhan BBT Mini-Invasive Medical Tech

The Global Ultrasonic Scalpel Market was valued at USD 2.7 billion in 2024 and is projected to expand at a robust CAGR of 6.9% from 2025 to 2034. This remarkable growth is fueled by rising demand for outpatient procedures, an increasing volume of gynecological and cardiovascular surgeries, and the growing adoption of robotic-assisted surgical techniques.

A key driver of this market expansion is the global shift toward minimally invasive surgeries (MIS), which are becoming the gold standard in modern healthcare. These procedures, including laparoscopic surgeries, offer significant advantages such as reduced recovery times, minimal risks, and improved patient outcomes. Ultrasonic scalpels have emerged as indispensable tools for these surgeries, offering unparalleled precision in tissue cutting and coagulation, essential for achieving optimal results. Moreover, the surge in outpatient surgical centers has amplified the demand for compact and efficient tools like ultrasonic scalpels, which are tailored for high-volume environments requiring quick turnarounds.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 6.9% |

The market is segmented by product type, including handheld devices, generators, and accessories. Among these, handheld ultrasonic scalpels generated the highest revenue, reaching USD 1.3 billion in 2024. These devices are highly favored by surgeons for their precision and control, especially in confined spaces during minimally invasive surgeries. Their ergonomic design and high-performance capabilities make them vital for modern surgical practices. As MIS continues to gain traction globally, the demand for these advanced tools is expected to rise steadily.

In terms of application, the market spans categories such as general surgery, orthopedic surgery, ophthalmic surgery, urological surgery, gynecological surgery, and others. General surgery accounted for the largest market share, generating USD 962.4 million in revenue in 2024. This segment encompasses a wide range of essential procedures where ultrasonic scalpels play a critical role in ensuring precision and effectiveness, making them indispensable in achieving successful surgical outcomes.

Regionally, North America dominated the ultrasonic scalpel market, reaching USD 1.2 billion in 2024, with a projected CAGR of 6.2% during the forecast period. The region's growth is driven by the increasing prevalence of chronic health conditions and an aging population, which together amplify the demand for surgical interventions. The rising need for advanced surgical tools to address age-related health issues continues to bolster market expansion, positioning North America as a key growth contributor.

The ultrasonic scalpel market is poised for substantial growth as technological advancements and the rising preference for minimally invasive procedures drive demand. This trend underscores the critical role of ultrasonic scalpels in shaping the future of modern surgical practices, offering precision, efficiency, and enhanced patient outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Rise in demand for minimally invasive surgeries

- 3.2.1.3 Growing technological advancements in products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of devices and availability of alternative technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Value chain analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Handheld devices

- 5.3 Generators

- 5.4 Accessories

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 General surgery

- 6.3 Gynecological surgery

- 6.4 Orthopedic surgery

- 6.5 Urological surgery

- 6.6 Ophthalmic surgery

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgery centers

- 7.4 Specialty clinics

- 7.5 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anhui Wanyi Science and Technology

- 9.2 Apollo Technosystems

- 9.3 Axon Medical Solutions

- 9.4 Bioventus

- 9.5 BOWA Medical UK

- 9.6 Hangzhou Rex Medical Instrument

- 9.7 HENAN TRADING

- 9.8 Johnson and Johnson

- 9.9 Miconvey

- 9.10 Olympus

- 9.11 Reach Surgical

- 9.12 SI Surgical

- 9.13 Stryker

- 9.14 Surgnova

- 9.15 Wuhan BBT Mini-Invasive Medical Tech