|

市场调查报告书

商品编码

1664834

浸入式冷却液市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Immersion Cooling Fluids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

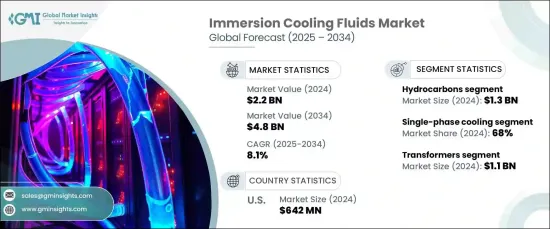

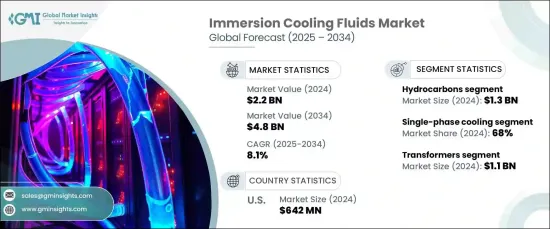

2024 年全球浸入式冷却液市场价值 22 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 8.1%。该技术因其卓越的冷却性能和能源效率而越来越受到关注。

高效能係统中对节能解决方案的需求不断增加是推动市场成长的重要因素。由于产业面临与热管理相关的挑战,浸入式冷却提供了一种比传统冷却方法更紧凑、更有效的替代方案。流体技术的进步进一步提高了导热性和冷却效率,从而推动了它的采用。这些改进扩大了这些液体在多个行业中的可用性,为可持续、高效的冷却解决方案铺平了道路。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 22亿美元 |

| 预测值 | 48亿美元 |

| 复合年增长率 | 8.1% |

市场根据流体类型分为碳氢化合物和氟碳化合物。碳氢化合物(包括矿物油和合成油)在 2024 年创造了 13 亿美元的收入,并且由于其出色的传热能力和成本优势仍然是首选。它们与多种系统设计的兼容性以及较低的环境影响促进了它们的广泛使用。虽然氟碳化合物因其稳定性而受到关注,但碳氢化合物由于其整体性能优势仍占据主导地位。

从技术角度来看,市场分为单相冷却和双相冷却。单相冷却由于其简单性、可靠性和较低的维护要求,在 2024 年占据了 68% 的市场份额。它在高效能应用中的广泛使用凸显了其在解决关键冷却需求方面的有效性。儘管两相冷却在管理升高的热负载方面提供了增强的性能,但由于其已建立的基础设施,单相繫统仍然是首选。

根据应用,市场包括变压器、资料中心和电池等部分。 2024 年,Transformers 以 11 亿美元的营收引领市场。它们的冷却要求强调了浸没液在维持最佳功能和延长设备寿命方面的作用。随着各行各业越来越重视能源效率,预计各类应用对这些流体的需求将会成长。

2024 年,美国领先区域市场,营收达 6.42 亿美元。中国对永续性的重视,加上基础设施的进步和不断增长的工业需求,使得北美成为推动浸入式冷却技术应用的关键参与者。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 资料中心对节能冷却解决方案的需求不断增长

- 电动车 (EV) 电池越来越多地采用浸入式冷却技术

- 流体技术的进步提高了传热和冷却效率

- 产业陷阱与挑战

- 浸入式冷却系统的初始成本和资本投入较高

- 资料中心和电动车电池以外行业的认知和采用有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模及预测:依流体类型,2021-2034 年

- 主要趋势

- 碳氢化合物

- 矿物

- 合成的

- 氟碳化合物

第 6 章:市场规模与预测:依技术,2021-2034 年

- 主要趋势

- 单相冷却

- 两相冷却

第 7 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 变压器

- 资料中心

- 电动汽车电池

- 其他的

第 8 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- 3M

- Cargill

- Chemie

- Chevron

- Dow

- Engineered Fluids

- Ergon

- ExxonMobil Chemical

- Shell

- Soltex

- Valvoline

The Global Immersion Cooling Fluids Market, valued at USD 2.2 billion in 2024, is anticipated to grow at a CAGR of 8.1% between 2025 and 2034. Immersion cooling fluids, designed to submerge electronic components, excel in efficiently dissipating heat from devices such as servers, transformers, and batteries. This technology is gaining traction for its superior cooling performance and energy efficiency.

Increasing demand for energy-efficient solutions in high-performance systems is a significant factor driving market growth. As industries face challenges related to heat management, immersion cooling offers a more compact and effective alternative to conventional cooling methods. Its adoption is further propelled by advancements in fluid technology that enhance thermal conductivity and cooling efficiency. These improvements broaden the usability of these fluids across multiple industries, paving the way for sustainable and efficient cooling solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $4.8 Billion |

| CAGR | 8.1% |

The market is categorized by fluid type into hydrocarbons and fluorocarbons. Hydrocarbons, including mineral oils and synthetic variants, generated USD 1.3 billion in 2024 and remain the preferred choice due to their superior heat transfer capabilities and cost advantages. Their compatibility with diverse system designs and lower environmental impact bolster their widespread use. While fluorocarbons are gaining attention for their stability, hydrocarbons maintain dominance due to their overall performance benefits.

From a technological standpoint, the market is divided into single-phase and two-phase cooling. Single-phase cooling captured 68% of the market share in 2024, thanks to its simplicity, reliability, and lower maintenance requirements. Its widespread use in high-performance applications highlights its effectiveness in addressing critical cooling needs. Although two-phase cooling offers enhanced performance for managing elevated heat loads, single-phase systems remain the favored choice due to their established infrastructure.

By application, the market includes segments such as transformers, data centers, and batteries. Transformers led the market in 2024 with USD 1.1 billion in revenue. Their cooling requirements emphasize the role of immersion fluids in maintaining optimal functionality and prolonging equipment life. As industries increasingly prioritize energy efficiency, demand for these fluids is expected to grow across various applications.

In 2024, the US led the regional market, earning USD 642 million in revenue. The country's emphasis on sustainability, coupled with advancements in infrastructure and growing industrial demands, positions North America as a key player in driving the adoption of immersion cooling technology.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for energy-efficient cooling solutions in data centers

- 3.6.1.2 Increasing adoption of immersion cooling technology in electric vehicle (EV) batteries

- 3.6.1.3 Advancements in fluid technology enhancing heat transfer and cooling efficiency

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial cost and capital investment for immersion cooling systems

- 3.6.2.2 Limited awareness and adoption in industries outside data centers and EV batteries

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Fluid Type, 2021-2034 (USD Billion, Metric Tons)

- 5.1 Key trends

- 5.2 Hydrocarbons

- 5.2.1 Mineral

- 5.2.2 Synthetic

- 5.3 Fluorocarbons

Chapter 6 Market Size and Forecast, By Technology, 2021-2034 (USD Billion, Metric Tons)

- 6.1 Key trends

- 6.2 Single-phase cooling

- 6.3 Two-phase cooling

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Metric Tons)

- 7.1 Key trends

- 7.2 Transformers

- 7.3 Data centre

- 7.4 EV batteries

- 7.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Metric Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 Cargill

- 9.3 Chemie

- 9.4 Chevron

- 9.5 Dow

- 9.6 Engineered Fluids

- 9.7 Ergon

- 9.8 ExxonMobil Chemical

- 9.9 Shell

- 9.10 Soltex

- 9.11 Valvoline