|

市场调查报告书

商品编码

1664840

雷射二极体市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Laser Diode Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球雷射二极体市场价值为 77 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到 14.4%。这些设备具有体积小、节能和精确调製功能的特点,使其成为电信、医疗保健和消费性电子等众多产业不可或缺的一部分。

这一市场成长主要得益于对先进资料传输技术的需求不断增长、医疗雷射的创新以及雷射二极体在工业自动化中的广泛应用。向小型化、节能电子产品的转变进一步推动了雷射二极体技术的进步。大量的研发投入,加上各领域不断增长的需求,确保了未来几年市场稳定扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 77亿美元 |

| 预测值 | 294亿美元 |

| 复合年增长率 | 14.4% |

根据操作模式,市场分为单模雷射二极体和多模雷射二极体。预计多模式市场将占据主导地位,到 2034 年将达到 146 亿美元。它们在工业应用和医疗设备中的应用越来越广泛,凸显了它们在商业和工业领域日益增长的相关性。

在掺杂材料方面,市场包括红外线砷化铝镓、砷化镓、磷化铝镓铟、氮化铟镓、氮化镓等。砷化镓成为领先细分市场,预估预测期内复合年增长率为 16.2%。其独特的特性,例如高效的光子产生和高量子效率,使其成为雷射二极体的首选材料。砷化镓在高温下表现良好,增强了其在各行业的应用。

在北美,美国占据区域市场主导地位,到 2024 年占据 80% 以上的份额。对高速通讯、先进製造流程和尖端应用的关注确保美国仍然是全球雷射二极体市场的重要贡献者。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 小型化雷射二极体的需求不断增长

- 高功率雷射二极体在自动驾驶汽车技术中的快速普及

- 高速资料传输需求激增

- 垂直腔面发射雷射 (VCSEL) 技术发展崛起

- 再生能源应用的出现

- 产业陷阱与挑战

- 需要较高的初始投资

- 对使用稀土元素的担忧

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按营运模式,2021 年至 2034 年

- 主要趋势

- 单模雷射二极体

- 多模雷射二极体

第六章:市场估计与预测:依波长,2021-2034

- 主要趋势

- 红外线雷射二极体

- 红色雷射二极体

- 蓝光雷射二极体

- 绿色雷射二极体

- 紫外线雷射二极体

- 其他的

第 7 章:市场估计与预测:按掺杂材料,2021-2034 年

- 主要趋势

- 砷化铝镓

- 砷化镓

- 铝镓铟磷化物

- 氮化铟镓

- 氮化镓

- 其他的

第 8 章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 分布反馈雷射二极体

- 双异质结构雷射二极体

- 量子级联雷射二极体

- 量子阱雷射二极体

- 垂直腔面发射雷射二极体

- 其他的

第 9 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 汽车

- 消费性电子产品

- 卫生保健

- 工业的

- 军事与国防

- 电信

- 其他的

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Alpes Lasers SA

- Ams-OSRAM AG

- Arima Lasers Corp

- BluGlass Limited

- Coherent Corp.

- Frankfurt Laser Company

- Hamamatsu Photonics KK

- IPG Photonics Inc.

- Jenoptik AG

- Lumentum Holding Inc.

- Lumics GmbH

- MKS Instruments

- Nichia Corporation

- Panasonic Industry Co., Ltd.

- Power Technology Inc

- ROHM Co., Ltd.

- RPMC Lasers, Inc.

- Sharp Corp.

- Sheaumann Laser, Inc.

- Thorlabs, Inc.

- TOPTICA Photonics AG

- TRUMPF SE + Co. KG

- Ushio, Inc.

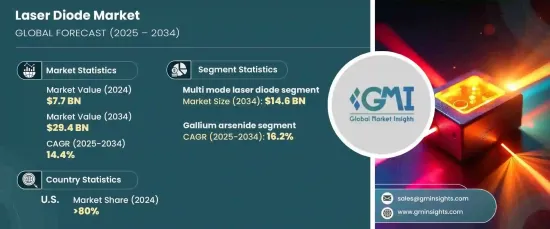

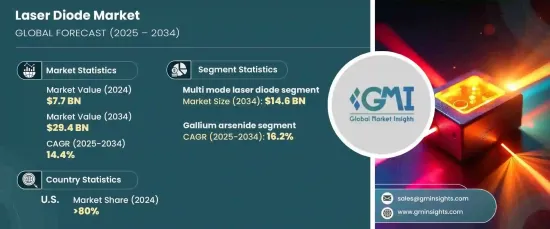

The Global Laser Diode Market, valued at USD 7.7 billion in 2024, is projected to grow at an impressive CAGR of 14.4% from 2025 to 2034. A laser diode is a semiconductor device that generates coherent light through stimulated emission, utilizing materials such as gallium arsenide (GaAs). These devices offer compact size, energy efficiency, and precise modulation capabilities, making them integral to a wide array of industries including telecommunications, healthcare, and consumer electronics.

This market growth is primarily driven by the increasing demand for advanced data transmission technologies, innovations in medical lasers, and the expanding use of laser diodes in industrial automation. The shift towards miniaturized, energy-efficient electronics further propels advancements in laser diode technology. Substantial investments in research and development, coupled with rising demand across various sectors, ensure a steady expansion of the market in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $29.4 Billion |

| CAGR | 14.4% |

Based on mode of operation, the market is segmented into single-mode and multi-mode laser diodes. The multi-mode segment is expected to dominate, reaching USD 14.6 billion by 2034. These diodes are recognized for their ability to support multiple light propagation modes, enabling high-power output. Their growing adoption in industrial applications and medical equipment underscores their increasing relevance in both commercial and industrial sectors.

In terms of doping material, the market includes infrared gallium aluminum arsenide, gallium arsenide, aluminum gallium indium phosphide, indium gallium nitride, gallium nitride, and others. Gallium arsenide emerges as the leading segment, anticipated to grow at a CAGR of 16.2% during the forecast period. Its unique properties, such as efficient photon generation and high quantum efficiency, make it a preferred material for laser diodes. Gallium arsenide's ability to perform well at elevated temperatures enhances its application across various industries.

In North America, the United States dominates the regional market, accounting for over 80% of the share in 2024. The country's strong technological ecosystem, investments in innovation, and advancements in semiconductor technologies drive demand for laser diodes across multiple sectors. The focus on high-speed communication, advanced manufacturing processes, and cutting-edge applications ensures that the US remains a significant contributor to the global laser diode market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Growth drivers

- 3.7.1.1 Growing demand for miniaturized laser diodes

- 3.7.1.2 Rapid proliferation of high-power laser diodes in autonomous vehicle technologies

- 3.7.1.3 Surge in demand for high-speed data transmission

- 3.7.1.4 Rise in development of vertical cavity surface-emitting laser (VCSEL) technology

- 3.7.1.5 Emergence of renewable energy applications

- 3.8 Industry pitfalls & challenges

- 3.8.1.1 High initial investment required

- 3.8.1.2 Concerns over using rare earth elements

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Mode of Operation, 2021-2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Single mode laser diode

- 5.3 Multi mode laser diode

Chapter 6 Market Estimates & Forecast, By Wavelength, 2021- 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Infrared laser diode

- 6.3 Red laser diode

- 6.4 Blue laser diode

- 6.5 Green laser diode

- 6.6 UV laser diode

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Doping Material, 2021-2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Gallium aluminum arsenide

- 7.3 Gallium arsenide

- 7.4 Aluminum gallium indium phosphide

- 7.5 Indium gallium nitride

- 7.6 Gallium nitride

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 Distributed feedback laser diode

- 8.3 Double heterostructure laser diode

- 8.4 Quantum cascade laser diode

- 8.5 Quantum well laser diode

- 8.6 Vertical cavity surface emitting laser diode

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Consumer electronics

- 9.4 Healthcare

- 9.5 Industrial

- 9.6 Military & defense

- 9.7 Telecommunication

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alpes Lasers S.A.

- 11.2 Ams-OSRAM AG

- 11.3 Arima Lasers Corp

- 11.4 BluGlass Limited

- 11.5 Coherent Corp.

- 11.6 Frankfurt Laser Company

- 11.7 Hamamatsu Photonics K.K.

- 11.8 IPG Photonics Inc.

- 11.9 Jenoptik AG

- 11.10 Lumentum Holding Inc.

- 11.11 Lumics GmbH

- 11.12 MKS Instruments

- 11.13 Nichia Corporation

- 11.14 Panasonic Industry Co., Ltd.

- 11.15 Power Technology Inc

- 11.16 ROHM Co., Ltd.

- 11.17 RPMC Lasers, Inc.

- 11.18 Sharp Corp.

- 11.19 Sheaumann Laser, Inc.

- 11.20 Thorlabs, Inc.

- 11.21 TOPTICA Photonics AG

- 11.22 TRUMPF SE + Co. KG

- 11.23 Ushio, Inc.