|

市场调查报告书

商品编码

1664843

远距工作工具/软体市场机会、成长动力、产业趋势分析与预测 2025 - 2034Remote Working Tools/Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

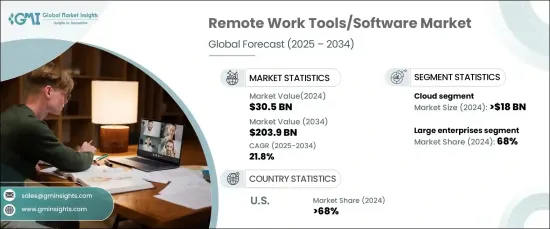

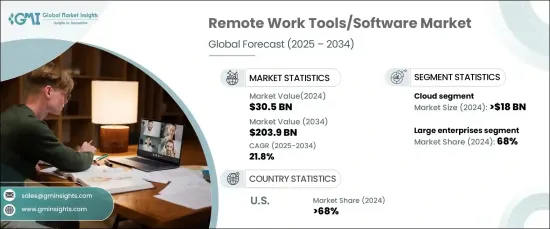

2024 年全球远距工作工具/软体市场估值达到 305 亿美元,预计 2025 年至 2034 年期间复合年增长率为 21.8%。即时语言翻译、自动排程、预测分析和智慧任务优先等创新功能可提高生产力,同时减少手动工作量。各行业的企业越来越多地采用人工智慧驱动的解决方案来简化工作流程并适应不断变化的营运需求,特别是在混合和远端工作环境中。

人们也越来越关注旨在促进工作与生活平衡的工具。整合压力管理和心理健康支援等健康和保健功能的软体越来越受欢迎。企业逐渐意识到员工健康对于提高生产力的重要性,这有望推动这些专业解决方案的需求。这为软体供应商满足这一不断扩大的细分市场需求创造了重大机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 305亿美元 |

| 预测值 | 2039亿美元 |

| 复合年增长率 | 21.8% |

根据部署模式,市场分为基于云端的解决方案和内部部署的解决方案。 2024 年,基于云端的工具价值超过 190 亿美元,凭藉其灵活性、成本效益和易于访问性占据市场主导地位。云端平台支援跨不同地点的无缝业务运营,无需大量硬体。自动更新、资料备份和协作框架等功能对于支援远端团队至关重要。随着云端安全的进步和混合工作模式的广泛采用,对这些工具的需求持续上升。越来越多的组织选择云端解决方案来提高效率、降低成本并维持营运连续性。

根据组织规模,市场分为中小型企业 (SME) 和大型企业。大型组织需要可扩展且强大的工具来管理大量劳动力,因此在 2024 年占据了 68% 的市场份额。这些企业优先考虑安全性,采用具有先进加密和合规功能的软体。与现有系统的整合以及高级解决方案的更高预算进一步推动了采用,使企业能够优化生产力并简化全球营运。

由于早期采用混合工作模式、强大的数位基础设施和精通技术的劳动力,美国市场将在 2024 年占据超过 68% 的收入份额。支持性政策和国家以创新为中心的文化继续加速市场的成长。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 软体/工具供应商

- 技术提供者

- 云端服务供应商

- 系统整合商

- 最终用途

- 利润率分析

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 混合工作模式的采用日益增多

- 安全协作工具的需求不断增加

- 全球广泛采用基于云端的软体

- 对自动化远距工作流程的偏好日益增长

- 产业陷阱与挑战

- 基于云端的解决方案中的安全漏洞

- 发展中地区数位基础设施不足

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 软体/工具

- 协作工具

- 通讯工具

- 生产力工具

- 人力资源和薪资工具

- 安全工具

- 服务

- 专业的

- 託管

第六章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 云

- 本地

第 7 章:市场估计与预测:按组织规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第 8 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 金融保险业协会

- 卫生保健

- 资讯科技和电信

- 政府

- 製造业

- 教育

- 其他的

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 东南亚

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Adobe

- Asana

- Atlassian

- Basecamp

- Cisco Webex

- ClickUp

- Dropbox

- GitHub

- HubSpot

- Microsoft

- Miro

- Monday.com

- Notion

- RingCentral

- Salesforce

- Smartsheet

- Trello

- Zoho

- Zoom Video Communications

The Global Remote Working Tools/Software Market reached a valuation of USD 30.5 billion in 2024 and is forecasted to grow at a CAGR of 21.8% from 2025 to 2034. AI-powered tools are transforming how teams collaborate and communicate in remote settings. Innovative features such as real-time language translation, automated scheduling, predictive analytics, and intelligent task prioritization boost productivity while reducing manual workload. Businesses across various sectors are increasingly adopting AI-driven solutions to streamline workflows and adapt to changing operational demands, particularly in hybrid and remote work environments.

There is also a growing focus on tools designed to promote work-life balance. Software with integrated health and wellness features, such as stress management and mental well-being support, is gaining popularity. Organizations are recognizing the importance of employee health in driving productivity, which is expected to fuel demand for these specialized solutions. This creates significant opportunities for software providers to cater to this expanding market segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.5 Billion |

| Forecast Value | $203.9 Billion |

| CAGR | 21.8% |

The market is categorized by deployment mode into cloud-based and on-premise solutions. In 2024, cloud-based tools accounted for over USD 19 billion, dominating the market due to their flexibility, cost-effectiveness, and ease of access. Cloud platforms enable seamless business operations across various locations, eliminating the need for extensive hardware. Features like automatic updates, data backup, and collaborative frameworks are essential for supporting remote teams. With advancements in cloud security and the widespread adoption of hybrid work models, demand for these tools continues to rise. Organizations increasingly opt for cloud solutions to enhance efficiency, cut costs, and maintain operational continuity.

By organization size, the market is divided into small and medium-sized enterprises (SME) and large enterprises. Large organizations held 68% of the market share in 2024 due to their need for scalable and robust tools to manage extensive workforces. These enterprises prioritize security, adopting software with advanced encryption and compliance capabilities. Integration with existing systems and higher budgets for premium solutions further drive adoption, enabling businesses to optimize productivity and streamline global operations.

The US market led with over 68% of the revenue share in 2024, driven by early adoption of hybrid work models, a strong digital infrastructure, and a tech-savvy workforce. Supportive policies and the nation's innovation-focused culture continue to accelerate the market's growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Software/tool provider

- 3.2.2 Technology provider

- 3.2.3 Cloud service provider

- 3.2.4 System Integrators

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising adoption of hybrid work models

- 3.7.1.2 Increasing demand for secure collaboration tools

- 3.7.1.3 Widespread adoption of cloud-based software globally

- 3.7.1.4 Growing preference for automated remote workflows

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Security vulnerabilities in cloud-based solutions

- 3.7.2.2 Inadequate digital infrastructure in developing regions

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Software/Tools

- 5.2.1 Collaboration tools

- 5.2.2 Communication tools

- 5.2.3 Productivity tools

- 5.2.4 HR and payroll tools

- 5.2.5 Security tools

- 5.3 Services

- 5.3.1 Professional

- 5.3.2 Managed

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Cloud

- 6.3 On-premise

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By End-Use, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 Healthcare

- 8.4 IT & Telecom

- 8.5 Government

- 8.6 Manufacturing

- 8.7 Education

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Argentina

- 9.5.3 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Adobe

- 10.2 Asana

- 10.3 Atlassian

- 10.4 Basecamp

- 10.5 Cisco Webex

- 10.6 ClickUp

- 10.7 Dropbox

- 10.8 GitHub

- 10.9 Google

- 10.10 HubSpot

- 10.11 Microsoft

- 10.12 Miro

- 10.13 Monday.com

- 10.14 Notion

- 10.15 RingCentral

- 10.16 Salesforce

- 10.17 Smartsheet

- 10.18 Trello

- 10.19 Zoho

- 10.20 Zoom Video Communications