|

市场调查报告书

商品编码

1664857

电力市场中的区块链机会、成长动力、产业趋势分析与 2025 - 2034 年预测Blockchain in Power Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

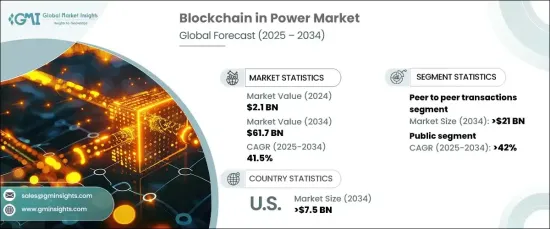

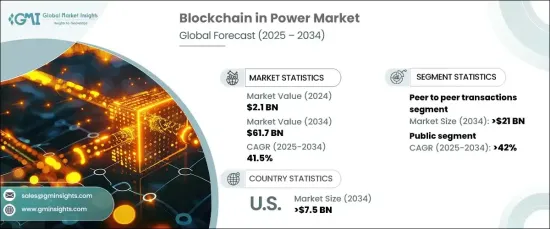

预计 2024 年全球电力市场区块链规模将达到 21 亿美元, 资料年至 2034 年的复合年增长率将达到惊人的 41.5%。透过整合再生能源和优化电力分配,区块链支援电网现代化,并透过自动智慧合约简化计费和能源结算等关键流程,从而显着降低营运成本。

电力产业采用区块链的主要驱动力之一是日益增长的透明度需求。区块链可以安全记录发电和配电等交易,从而提高问责制并降低诈欺风险。此外,点对点(P2P)能源交易的激增正在加速向分散能源市场的转变。这种转变有助于减少对传统中介机构的依赖,降低成本并提高系统效率。区块链技术还简化了电力购买协议(PPA),实现了流程自动化并最大限度地减少了纠纷。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21亿美元 |

| 预测值 | 617亿美元 |

| 复合年增长率 | 41.5% |

包括微电网在内的分散式电网的日益普及进一步推动了区块链的发展。区块链有效管理本地发电,整合再生能源,并确保电力流的无缝追踪和即时计费,使其成为现代能源系统的重要组成部分。

市场分为几个主要部分,包括电动车 (EV) 充电、电网交易、能源融资、永续归因、点对点交易等。其中,点对点交易领域将经历显着扩张,预计到2034年该领域规模将达到210亿美元。

电力领域的区块链也分为公共部分和私人部分。到 2034 年,公共区块链领域预计将以 42% 的惊人复合年增长率成长。这些网路确保可再生能源认证、补贴分配和能源交易资料的安全跟踪,从而提高问责制并最大限度地降低风险。

在美国,电力市场的区块链规模预计到 2034 年将达到 75 亿美元。此外,对强大的网路安全措施以保护关键电网营运和能源交易的需求日益增长,这加速了区块链技术的部署,为该行业提供了安全且面向未来的解决方案。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与技术格局

第 5 章:市场规模及预测:依类别,2021 – 2034 年

- 主要趋势

- 民众

- 私人的

第 6 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 电网交易

- 点对点交易

- 能源融资

- 可持续性归因

- 电动车充电

- 其他的

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 荷兰

- 法国

- 西班牙

- 亚太地区

- 中国

- 日本

- 新加坡

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 智利

第八章:公司简介

- ACCIONA

- ConsenSys

- Electron

- Greeneum

- IBM

- Infosys Limited

- LO3 Energy

- Power Ledger

- SAP

- SunContract

The Global Blockchain In The Power Market is projected to reach USD 2.1 billion in 2024, with an impressive growth rate of 41.5% CAGR expected from 2025 to 2034. Blockchain technology is revolutionizing the energy sector by facilitating direct transactions between electricity producers and consumers, offering a secure, real-time system for managing data, and enhancing grid efficiency. By integrating renewable energy sources and optimizing electricity distribution, blockchain supports grid modernization and simplifies critical processes like billing and energy settlements through automated smart contracts, significantly reducing operational costs.

One of the main drivers behind blockchain adoption in the power industry is the growing demand for transparency. Blockchain enables secure recording of transactions, such as power generation and distribution, boosting accountability and reducing the risk of fraud. Additionally, the surge in peer-to-peer (P2P) energy trading is accelerating the shift toward decentralized energy markets. This shift helps reduce reliance on traditional intermediaries, cutting costs and increasing system efficiency. Blockchain technology also streamlines Power Purchase Agreements (PPAs), automating processes and minimizing disputes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $61.7 Billion |

| CAGR | 41.5% |

The growing adoption of decentralized grids, including microgrids, is further propelling blockchain's growth. Blockchain efficiently manages localized power generation, integrates renewable energy sources, and ensures seamless tracking of electricity flows and real-time billing, making it a critical component of modern energy systems.

The market is divided into key segments, including electric vehicle (EV) charging, grid transactions, energy financing, sustainability attribution, peer-to-peer transactions, and more. Among these, the peer-to-peer transactions segment is set to experience significant expansion, with projections indicating it could reach USD 21 billion by 2034. Blockchain enables direct energy trading between parties, cutting the dependence on traditional utilities, eliminating intermediaries, and simplifying billing processes-making energy transactions more transparent and cost-effective.

Blockchain in the power sector is also categorized into public and private segments. The public blockchain sector is poised to grow at an outstanding CAGR of 42% through 2034. Public blockchain networks promote transparency in energy transactions, offering key advantages for public-sector organizations that manage power resources. These networks ensure the secure tracking of renewable energy certifications, subsidy allocations, and energy trading data, improving accountability and minimizing risk.

In the United States, the blockchain in power market is projected to reach USD 7.5 billion by 2034. Government initiatives and regulatory support for cutting-edge technologies are driving blockchain adoption as part of the larger effort to modernize the power sector. Additionally, the increasing need for robust cybersecurity measures to protect critical grid operations and energy transactions is accelerating the deployment of blockchain technology, providing a secure and future-proof solution for the industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Category, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Public

- 5.3 Private

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Grid transactions

- 6.3 Peer to peer transactions

- 6.4 Energy financing

- 6.5 Sustainability attribution

- 6.6 Electric vehicle charging

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Netherlands

- 7.3.4 France

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 Singapore

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Chile

Chapter 8 Company Profiles

- 8.1 ACCIONA

- 8.2 ConsenSys

- 8.3 Electron

- 8.4 Greeneum

- 8.5 IBM

- 8.6 Infosys Limited

- 8.7 LO3 Energy

- 8.8 Power Ledger

- 8.9 SAP

- 8.10 SunContract