|

市场调查报告书

商品编码

1664868

石油和天然气市场中的区块链机会、成长动力、产业趋势分析和 2025 - 2034 年预测Blockchain in Oil and Gas Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

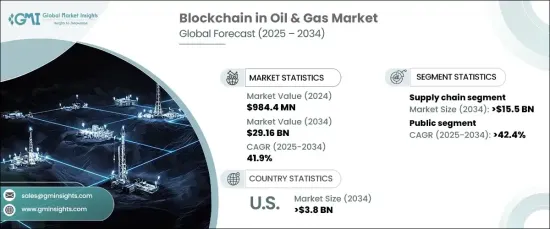

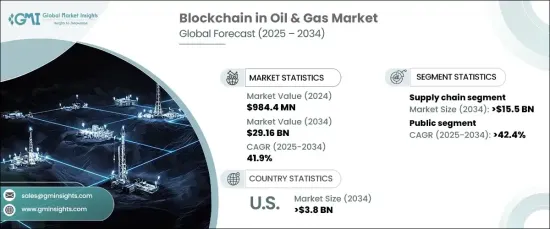

2024 年全球石油和天然气区块链市场价值为 9.844 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到 41.9%。 区块链技术是一种分散的数位分类帐系统,它透过提供安全、防篡改的交易记录,彻底改变了石油和产业。对于要求无与伦比的透明度和营运效率的行业来说,这项尖端技术即将带来革命。

石油和天然气产业变得越来越复杂,推动了对区块链等创新解决方案的需求。透过自动化交易和简化流程,区块链大大减少了对手动文书工作的依赖,减少了延误、错误和诈欺。这些优势使区块链成为优化资源和材料管理同时提高整体供应链效率的不可或缺的工具。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.844亿美元 |

| 预测值 | 291.6亿美元 |

| 复合年增长率 | 41.9% |

区块链技术在整个石油和天然气价值链中有着广泛的应用,包括供应链管理、营运、交易和安全。尤其是供应链领域,预计资料占据主导地位,预计到 2034 年将产生 155 亿美元的产值。透过区块链实现跨区域材料和产品的追踪,企业可以增强库存管理和预测准确性,使其成为产业转型的基石。

市场分为公共和私人区块链解决方案。预计到 2034 年,公共区块链的复合年增长率将达到惊人的 42.4%。此外,对永续实践和遵守环境法规的日益重视进一步推动了公共区块链解决方案的采用。

在美国,石油和天然气市场的区块链规模预计到 2034 年将达到 38 亿美元。区块链技术确保了整个供应链从开采到最终分销的责任。此外,严格的环境和安全法规以及财务揭露要求正在加速区块链的采用。私人企业与政府机构之间的合作试点计画进一步推动了美国市场的扩张

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与技术格局

第 5 章:市场规模及预测:依类别,2021 – 2034 年

- 主要趋势

- 民众

- 私人的

第 6 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 供应链

- 营运

- 贸易

- 安全

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 荷兰

- 法国

- 西班牙

- 亚太地区

- 中国

- 日本

- 新加坡

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 智利

第八章:公司简介

- Accenture

- ConsenSys

- Hindustan Petroleum

- IBM

- Infosys Limited

- Kaleido

- Neoflow

- SAP

- VAKT Global

- VeChain

- Zupple Labs

The Global Blockchain In Oil And Gas Market, valued at USD 984.4 million in 2024, is projected to surge at a remarkable CAGR of 41.9% between 2025 and 2034. Blockchain technology, a decentralized digital ledger system, is revolutionizing the oil and gas sector by providing secure, tamper-proof transaction recording. This cutting-edge technology is emerging as a game-changer for an industry that demands unparalleled transparency and operational efficiency.

The oil and gas industry is becoming increasingly complex, driving the need for innovative solutions like blockchain. By automating transactions and streamlining processes, blockchain significantly reduces the reliance on manual paperwork, cutting down delays, errors, and fraud. These advantages position blockchain as an indispensable tool for optimizing resource and material management while enhancing overall supply chain efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $984.4 Million |

| Forecast Value | $29.16 Billion |

| CAGR | 41.9% |

Blockchain technology finds diverse applications across the oil and gas value chain, including supply chain management, operations, trading, and security. The supply chain segment, in particular, is poised to dominate, projected to generate USD 15.5 billion by 2034. The need for real-time data sharing among stakeholders is a primary driver of this growth. With blockchain-enabled tracking of materials and products across multiple regions, companies can enhance inventory management and forecasting accuracy, making it a cornerstone of industry transformation.

The market is categorized into public and private blockchain solutions. Public blockchains are anticipated to experience an impressive CAGR of 42.4% through 2034. Governments and public agencies increasingly favor public blockchains for their transparency and ability to combat corruption in resource management. Moreover, the rising emphasis on sustainable practices and compliance with environmental regulations further bolsters the adoption of public blockchain solutions.

In the United States, the blockchain in oil & gas market is forecast to reach USD 3.8 billion by 2034. Growing regulatory scrutiny, investor demands, and public expectations are driving the need for transparent and immutable record-keeping systems. Blockchain technology ensures accountability across the supply chain, from extraction to final distribution. Additionally, stringent environmental and safety regulations, along with financial disclosure requirements, are accelerating blockchain adoption. Collaborative pilot projects between private companies and government bodies further fuel market expansion in the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Category, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Public

- 5.3 Private

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Supply chain

- 6.3 Operations

- 6.4 Trading

- 6.5 Security

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Netherlands

- 7.3.4 France

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 Singapore

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Chile

Chapter 8 Company Profiles

- 8.1 Accenture

- 8.2 ConsenSys

- 8.3 Hindustan Petroleum

- 8.4 IBM

- 8.5 Infosys Limited

- 8.6 Kaleido

- 8.7 Neoflow

- 8.8 SAP

- 8.9 VAKT Global

- 8.10 VeChain

- 8.11 Zupple Labs