|

市场调查报告书

商品编码

1664874

医疗辐射屏蔽市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Medical Radiation Shielding Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

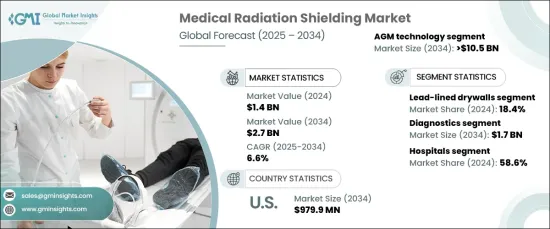

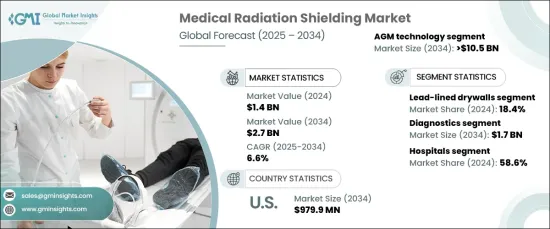

2024 年全球医疗辐射屏蔽市场价值为 14 亿美元,预计 2025 年至 2034 年期间复合年增长率将达到 6.6%。

根据产品,市场细分为 MRI 屏蔽产品、铅衬干墙、屏蔽罩、屏障和隔间、铅板、铅片、铅砖、铅窗帘和屏风、铅丙烯酸和其他辐射屏蔽产品。其中,铅衬干墙部分在 2024 年占据市场主导地位,占总市场份额的 18.4%。铅衬干式墙具有极高的辐射屏蔽效果,因为铅是一种緻密的材料,具有吸收和阻挡电离辐射的能力。当铅衬板与干式墙壁整合时,它会形成一道坚固的保护屏障,大大减少患者和医护人员受到的辐射暴露,因此对于安全的医学影像和放射治疗程序至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 27亿美元 |

| 复合年增长率 | 6.6% |

医疗辐射屏蔽市场进一步分为诊断、治疗和研究等应用。在诊断领域,关键领域包括神经病学、肿瘤学、心臟病学和其他诊断应用。 2024 年,诊断领域占据了 64.2% 的市场份额,预计将大幅增长,到 2034 年达到 17 亿美元。为了最大限度地减少不必要的辐射暴露,在这些过程中,使用铅衬墙、门和窗来保护患者和医务人员。

从地理分布来看,美国医疗辐射屏蔽市场预计将经历显着成长,到 2034 年将达到 9.799 亿美元。对先进辐射防护解决方案的高需求正在推动该地区医疗辐射防护市场的成长。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 放射学和诊断成像的使用增加

- 辐射安全产品的技术进步

- 辐射安全意识不断增强

- 癌症放射治疗的成长

- 产业陷阱与挑战

- 产品成本高

- 缺乏熟练的专业人员

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- MRI 屏蔽产品

- 铅衬干式墙

- 盾牌、屏障和隔间

- 铅板

- 铅板

- 铅砖

- 铅窗帘和屏风

- 丙烯酸铅

- 其他辐射屏蔽产品

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 诊断

- 神经病学

- 肿瘤学

- 心臟病学

- 其他诊断

- 疗法

- 研究

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 诊断影像中心

- 其他最终用户

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- AmRay

- A&L Shielding

- Burlington Medical

- Entromedical Healthcare Solutions

- Frank Shields

- INFAB

- Lemer Pax

- Marshield

- Modcon

- Nippon Electric Glass

- Protech Medical

- Radiation Detection Company

- Radiation Protection Products

- Ray-Bar Engineering Corporation

- Shielding International

The Global Medical Radiation Shielding Market was valued at USD 1.4 billion in 2024 and is projected to grow at a robust 6.6% CAGR from 2025 to 2034. Medical radiation shielding involves the use of materials and structures, typically made from lead or other dense substances, designed to protect patients, healthcare professionals, and medical equipment from harmful ionizing radiation during medical procedures.

The market is segmented by product into MRI shielding products, lead-lined drywalls, shields, barriers and booths, lead panels, lead sheets, lead bricks, lead curtains and screens, lead acrylic, and other radiation shielding products. Among these, the lead-lined drywalls segment led the market in 2024, accounting for 18.4% of the total market share. Lead-lined drywalls are highly effective for radiation shielding because lead is a dense material known for its ability to absorb and block ionizing radiation. When integrated into drywall, lead-lined panels create a robust protective barrier, significantly reducing radiation exposure to both patients and healthcare workers, thus making them essential for safe medical imaging and radiation therapy procedures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 6.6% |

The medical radiation shielding market is further divided into applications such as diagnostics, therapeutics, and research. Within the diagnostics segment, key areas include neurology, oncology, cardiology, and other diagnostic applications. In 2024, the diagnostics segment accounted for a substantial 64.2% of the market share and is expected to grow significantly, reaching USD 1.7 billion by 2034. Diagnostic imaging techniques, particularly CT scans and X-rays, rely on ionizing radiation to create detailed internal images of the body. To minimize unnecessary radiation exposure, lead-lined walls, doors, and windows are used to shield both patients and medical staff during these procedures.

In terms of geography, the U.S. medical radiation shielding market is anticipated to experience significant growth, reaching USD 979.9 million by 2034. The U.S. is home to one of the most advanced healthcare systems in the world, with state-of-the-art hospitals, medical centers, and research institutions that are continually adopting the latest radiation shielding technologies. This high demand for advanced radiation protection solutions is driving the growth of the medical radiation shielding market in the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing use of radiology and diagnostic imaging

- 3.2.1.2 Technological advancement in radiation safety products

- 3.2.1.3 Rising awareness of radiation safety

- 3.2.1.4 Growth in radiation therapy for cancer treatment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of products

- 3.2.2.2 Lack of skilled professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 MRI shielding products

- 5.3 Lead-lined drywalls

- 5.4 Shields, barriers, and booths

- 5.5 Lead panels

- 5.6 Lead sheet

- 5.7 Lead bricks

- 5.8 Lead curtains and screens

- 5.9 Lead acrylic

- 5.10 Other radiation shielding products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diagnostics

- 6.2.1 Neurology

- 6.2.2 Oncology

- 6.2.3 Cardiology

- 6.2.4 Other diagnostics

- 6.3 Therapeutics

- 6.4 Research

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic imaging centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AmRay

- 9.2 A&L Shielding

- 9.3 Burlington Medical

- 9.4 Entromedical Healthcare Solutions

- 9.5 Frank Shields

- 9.6 INFAB

- 9.7 Lemer Pax

- 9.8 Marshield

- 9.9 Modcon

- 9.10 Nippon Electric Glass

- 9.11 Protech Medical

- 9.12 Radiation Detection Company

- 9.13 Radiation Protection Products

- 9.14 Ray-Bar Engineering Corporation

- 9.15 Shielding International