|

市场调查报告书

商品编码

1664877

冷冻系统市场机会、成长动力、产业趋势分析与 2024 - 2032 年预测Refrigeration System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

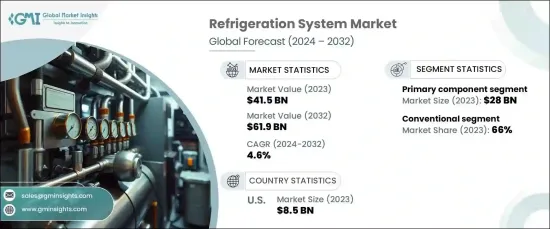

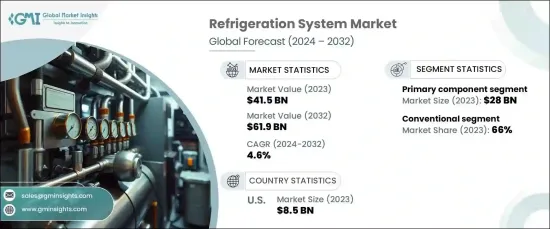

2023 年全球冷冻系统市场价值为 415 亿美元,预计 2024 年至 2032 年期间将以 4.6% 的复合年增长率稳步增长。尖端技术的进步和向节能製冷解决方案的转变进一步推动了市场的发展。

冷冻系统市场分为主要组件和辅助组件。 2023 年,主要零件部分的市场规模为 280 亿美元,预计到 2032 年的复合年增长率为 4.7%。压缩机是任何冷却系统的核心,决定了能源消耗,推动不断创新以提高性能并降低能源成本。同时,蒸发器和冷凝器在热传递中起着关键作用,确保一致的温度控制和可靠的系统性能。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 415亿美元 |

| 预测值 | 619亿美元 |

| 复合年增长率 | 4.6% |

根据冷冻类型,市场分为传统系统和智慧系统。传统冷冻系统在 2023 年占据了 66% 的市场份额,预计到 2032 年将达到 404 亿美元。 它们被广泛采用是由于其价格低廉和维护要求低,使其成为中小型企业的首选,尤其是在成本敏感的市场。此外,传统系统受益于成熟的供应链和技术专长,从而实现无缝实施。技术基础设施不发达的地区往往严重依赖这些系统,因为智慧冷却技术需要可能尚未广泛普及的先进框架。

美国引领北美冷冻系统市场,2023 年估值为 85 亿美元,预计到 2032 年复合年增长率为 4.6%。中国完善的冷链网路、严格的食品安全标准和药品储存是额外的成长动力。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 日益增加的环境法规和永续发展倡议

- 技术进步和向低 GWP 冷媒的日益转变

- 冷链物流需求不断成长

- 产业陷阱与挑战

- 初期投资及营运成本高

- 技术障碍和安全考虑

- 成长动力

- 技术概览

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021-2032 年

- 主要趋势

- 主要组件

- 压缩机

- 往復式压缩机

- 螺旋压缩机

- 离心式压缩机

- 涡旋压缩机

- 冷凝器

- 风冷式冷凝器

- 水冷式冷凝器

- 蒸发式冷凝器

- 蒸发器

- 板式蒸发器

- 管式蒸发器

- 翅片蒸发器

- 控制系统

- 压缩机

- 辅助零件

- 电磁阀

- 压力调节器

- 高压调节器

- 低压调节器

- 筛选器

- 热交换器

- 板式热交换器

- 管壳式热交换器

- 翅片式热交换器

- 膨胀阀

- 其他的

第 6 章:市场估计与预测:依冷冻类别,2021-2032 年

- 主要趋势

- 聪明的

- 传统的

第 7 章:市场估计与预测:按应用,2021 年至 2032 年

- 主要趋势

- 商业的

- 大卖场和超市/食品零售商

- 饭店业

- 医疗设施

- 其他(娱乐休閒、花卉等)

- 工业的

- 食品和饮料加工

- 化工及石化

- 製药

- 电子及其他製造业

- 冷藏仓库

- 能源与公用事业

- 其他(冶金、半导体等)

- 运输

- 卡车冷藏

- 货柜运输

- 海上船舶

- 其他(航太系统、轨道运输等)

第 8 章:市场估计与预测:按用户,2021 年至 2032 年

- 主要趋势

- OEM

- 建构函数

- 经销商

第 9 章:市场估计与预测:按配销通路,2021-2032 年

- 主要趋势

- 直接销售

- 间接销售

第 10 章:市场估计与预测:按地区,2021-2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 波兰

- 葡萄牙

- 俄罗斯

- 丹麦

- 瑞典

- 匈牙利

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 印尼

- 亚太地区其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- MEA 其他地区

第 11 章:公司简介

- BITZER Kühlmaschinenbau GmbH

- Carrier Global Corporation

- Daikin Industries Ltd.

- Danfoss A/S

- Dorin

- Embraco (Nidec Corporation)

- Emerson Electric Co.

- Frick India Limited

- GEA

- Grundfos

- Hitachi

- Hussmann Corporation

- Ingersoll-Rand, Plc.

- Johnson Controls

- Lennox International

- Tecumseh Products Company

The Global Refrigeration System Market was valued at USD 41.5 billion in 2023 and is projected to grow at a steady CAGR of 4.6% from 2024 to 2032. This growth is fueled by increasing demand across key industries such as food and beverage, pharmaceuticals, and chemicals, where reliable refrigeration plays a critical role in product preservation and regulatory compliance. Advancements in cutting-edge technologies and the shift toward energy-efficient refrigeration solutions are further driving the market forward.

The refrigeration system market is segmented into primary and auxiliary components. In 2023, the primary component segment accounted for USD 28 billion and is forecasted to grow at a CAGR of 4.7% through 2032. This segment's leading position is attributed to the indispensable roles of compressors, evaporators, and condensers in ensuring efficient refrigeration cycles. Compressors, the heart of any refrigeration system, dominate energy consumption, spurring ongoing innovations to boost performance and reduce energy costs. Meanwhile, evaporators and condensers play a pivotal role in heat transfer, ensuring consistent temperature control and reliable system performance.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $41.5 Billion |

| Forecast Value | $61.9 Billion |

| CAGR | 4.6% |

Based on refrigeration type, the market is categorized into conventional and smart systems. Conventional refrigeration systems held a 66% market share in 2023 and are projected to reach USD 40.4 billion by 2032. Their widespread adoption is driven by affordability and low maintenance requirements, making them a preferred option for small and medium-sized enterprises, especially in cost-sensitive markets. Additionally, conventional systems benefit from established supply chains and technical expertise, enabling seamless implementation. Regions with underdeveloped technological infrastructure often rely heavily on these systems, as smart refrigeration technologies require advanced frameworks that may not yet be widely accessible.

The United States leads the refrigeration system market in North America, with a valuation of USD 8.5 billion in 2023 and an anticipated CAGR of 4.6% through 2032. The dominance of the U.S. market is underpinned by its strong industrial and commercial sectors, which prioritize refrigeration for product quality and compliance with stringent regulations. The country's well-established cold chain network, strict food safety standards, and pharmaceutical storage are additional growth drivers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing environmental regulations and sustainability initiatives

- 3.6.1.2 Technological progress and increasing shift towards low-GWP refrigerants

- 3.6.1.3 Rising demand for cold chain logistics

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment and operational costs

- 3.6.2.2 Technical hurdles and safety considerations

- 3.6.1 Growth drivers

- 3.7 Technological overview

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021-2032 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Primary component

- 5.2.1 Compressors

- 5.2.1.1 Reciprocating compressors

- 5.2.1.2 Screw compressors

- 5.2.1.3 Centrifugal compressors

- 5.2.1.4 Scroll compressors

- 5.2.2 Condensers

- 5.2.2.1 Air-cooled condensers

- 5.2.2.2 Water-cooled condensers

- 5.2.2.3 Evaporative condensers

- 5.2.3 Evaporators

- 5.2.3.1 Plate evaporators

- 5.2.3.2 Tube evaporators

- 5.2.3.3 Finned evaporators

- 5.2.4 Control systems

- 5.2.1 Compressors

- 5.3 Auxiliary components

- 5.3.1 Solenoid valves

- 5.3.2 Pressure regulators

- 5.3.2.1 High-pressure regulators

- 5.3.2.2 Low-pressure regulators

- 5.3.3 Filters

- 5.3.4 Heat exchangers

- 5.3.4.1 Plate heat exchangers

- 5.3.4.2 Shell and tube heat exchangers

- 5.3.4.3 Finned heat exchangers

- 5.3.5 Expansion valves

- 5.3.6 Others

Chapter 6 Market Estimates & Forecast, By Refrigeration Category, 2021-2032 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Smart

- 6.3 Conventional

Chapter 7 Market Estimates & Forecast, By Application, 2021-2032 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Commercial

- 7.2.1 Hypermarket & supermarket /food retailers

- 7.2.2 Hospitality

- 7.2.3 Healthcare facilities

- 7.2.4 Others (entertainment & leisure, floral, etc.)

- 7.3 Industrial

- 7.3.1 Food & beverage processing

- 7.3.2 Chemical & petrochemical

- 7.3.3 Pharmaceutical

- 7.3.4 Electronics& other manufacturing

- 7.3.5 Cold storage warehouses

- 7.3.6 Energy & utility

- 7.3.7 Others (metallurgy, semiconductor, etc.)

- 7.4 Transportation

- 7.4.1 Truck refrigeration

- 7.4.2 Container shipping

- 7.4.3 Maritime vessels

- 7.4.4 Others (aerospace system, rail transport, etc.)

Chapter 8 Market Estimates & Forecast, By User, 2021-2032 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Constructer

- 8.4 Distributors

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2032 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2032 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 United Kingdom

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.3.7 Poland

- 10.3.8 Portugal

- 10.3.9 Russia

- 10.3.10 Denmark

- 10.3.11 Sweden

- 10.3.12 Hungary

- 10.3.13 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Rest of APAC

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Rest of Latin America

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

- 10.6.4 Rest of MEA

Chapter 11 Company Profiles

- 11.1 BITZER Kühlmaschinenbau GmbH

- 11.2 Carrier Global Corporation

- 11.3 Daikin Industries Ltd.

- 11.4 Danfoss A/S

- 11.5 Dorin

- 11.6 Embraco (Nidec Corporation)

- 11.7 Emerson Electric Co.

- 11.8 Frick India Limited

- 11.9 GEA

- 11.10 Grundfos

- 11.11 Hitachi

- 11.12 Hussmann Corporation

- 11.13 Ingersoll-Rand, Plc.

- 11.14 Johnson Controls

- 11.15 Lennox International

- 11.16 Tecumseh Products Company