|

市场调查报告书

商品编码

1664886

柴油共轨喷射系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Diesel Common Rail Injection System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

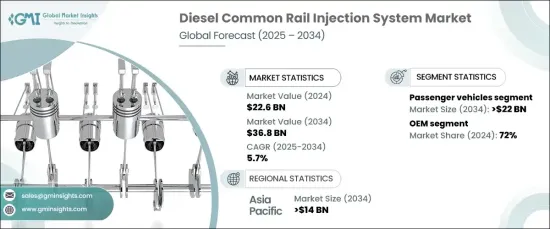

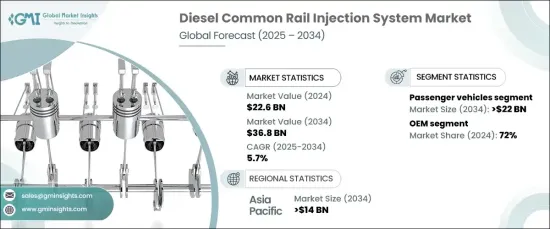

2024 年全球柴油共轨喷射系统市场价值为 226 亿美元,预计 2025 年至 2034 年期间将以 5.7% 的复合年增长率强劲增长。世界各国政府都在执行更严格的标准,敦促製造商采用先进的燃油喷射技术以满足要求。

对省油、高性能柴油引擎的需求不断增长,进一步加速了市场扩张。柴油共轨喷射系统可增强燃料输送、优化燃烧效率并减少排放,与不断发展的监管框架完美契合。因此,这些系统对于现代柴油引擎至关重要,不仅确保符合严格的标准,而且还提高引擎的功率和效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 226亿美元 |

| 预测值 | 368亿美元 |

| 复合年增长率 | 5.7% |

市场主要分为两个类别:乘用车和商用车。乘用车目前占据主导地位,到 2024 年将占据 60% 的份额,预计到 2034 年将达到 220 亿美元。

市场销售通路包括OEM (原始设备製造商)和售后市场。 2024 年,原始设备製造商 (OEM) 以 72% 的份额引领市场,得益于与汽车製造商的密切合作,将先进的喷射系统直接整合到新车中。透过优先遵守严格的排放标准并致力于提高引擎性能,OEM 处于燃油效率技术创新的前沿。

在亚太地区,柴油共轨喷射系统市场在 2024 年占全球份额的 35%,预计到 2034 年将达到 140 亿美元。该地区的製造商越来越多地采用先进的喷射系统来满足严格的环境法规,从而促进进一步的创新和广泛应用。

随着监管压力和燃油效率要求的不断上升,柴油共轨喷射系统市场将在未来几年稳步成长。对清洁技术的持续投资,以及全球减少汽车排放的努力,将推动柴油喷射系统的进一步进步。由于乘用车和商用车领域的强劲需求,预计到 2034 年及以后市场将经历显着扩张。

报告内容

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 零件供应商

- 系统整合商

- 引擎製造商

- 汽车製造商

- 售后市场供应商

- 利润率分析

- 成本明细分析

- 专利格局

- 技术与创新格局

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 全球排放法规愈发严格

- 对燃油效率和性能的需求不断增加

- 汽车製造业成长,尤其是在亚太地区和发展中地区

- 燃油喷射器的技术进步,例如压电喷射器

- 对车辆安全的日益重视

- 产业陷阱与挑战

- 电动车日益普及

- CRDI 系统非常复杂,需要精确的校准和维护

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按燃油喷射器,2021 - 2034 年

- 主要趋势

- 螺线管

- 压电

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

第七章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 柴油引擎

- 生质柴油

第 8 章:市场估计与预测:按销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- BorgWarner

- Continental

- Cummins

- Denso

- Federal-Mogul Powertrain

- FPT Industrial

- Hella KGaA

- Hitachi Automotive Systems

- Hyundai Kefico

- Isuzu Motors

- Liebherr Group

- Magneti Marelli

- Mahle

- Perkins Engines

- Robert Bosch

- Siemens

- Stanadyne

- Weichai Power

- Woodward

- Yanmar Co.

The Global Diesel Common Rail Injection System Market, valued at USD 22.6 billion in 2024, is expected to experience robust growth at a CAGR of 5.7% from 2025 to 2034. This growth is primarily driven by increasingly stringent emission regulations designed to reduce harmful pollutants like nitrogen oxides (NOx) and particulate matter. Governments across the globe are enforcing stricter standards, urging manufacturers to adopt advanced fuel injection technologies to meet compliance.

The rising demand for fuel-efficient, high-performance diesel engines further accelerates market expansion. Diesel common rail injection systems enhance fuel delivery, optimize combustion efficiency, and reduce emissions, aligning perfectly with evolving regulatory frameworks. As a result, these systems have become essential in modern diesel engines, ensuring not only compliance with stringent standards but also improved engine power and efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.6 Billion |

| Forecast Value | $36.8 Billion |

| CAGR | 5.7% |

The market is divided into two key categories: passenger vehicles and commercial vehicles. Passenger vehicles currently dominate, holding a 60% share in 2024, and are expected to reach USD 22 billion by 2034. Their widespread adoption, particularly in regions where diesel engines are favored for long-distance travel and superior fuel efficiency, fuels this dominance.

Sales channels in the market include both OEM (Original Equipment Manufacturer) and aftermarket segments. OEMs led the market with a 72% share in 2024, benefiting from close collaborations with automakers to integrate advanced injection systems directly into new vehicles. By prioritizing compliance with stringent emission standards and focusing on enhancing engine performance, OEMs are at the forefront of innovation in fuel-efficient technologies.

In the Asia Pacific region, the diesel common rail injection system market accounted for 35% of the global share in 2024 and is projected to reach USD 14 billion by 2034. This growth is driven by rapid industrialization, a booming automotive manufacturing sector, and increasing demand for commercial vehicles. Manufacturers in this region are increasingly adopting advanced injection systems to meet rigorous environmental regulations, fostering further innovation and widespread adoption.

The diesel common rail injection system market is poised for steady growth in the coming years as both regulatory pressures and fuel efficiency demands continue to rise. Ongoing investments in cleaner technologies, along with the global push toward reducing vehicle emissions, will drive further advancements in diesel injection systems. With strong demand across both the passenger and commercial vehicle sectors, the market is expected to experience significant expansion through 2034 and beyond.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 System integrators

- 3.2.3 Engine manufacturers

- 3.2.4 Vehicle manufacturers

- 3.2.5 Aftermarket suppliers

- 3.3 Profit margin analysis

- 3.4 Cost breakdown analysis

- 3.5 Patent landscape

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Stricter emission regulations worldwide

- 3.9.1.2 Increasing demand for fuel efficiency and performance

- 3.9.1.3 Growth in automotive manufacturing, particularly in Asia-Pacific and developing regions

- 3.9.1.4 Technological advancements in fuel injectors, such as piezoelectric injectors

- 3.9.1.5 The growing emphasis on vehicle safety

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Rising popularity of electric vehicles

- 3.9.2.2 CRDI systems are complex and require precise calibration and maintenance

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Fuel Injector, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Solenoid

- 5.3 Piezoelectric

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Bio-diesel

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 BorgWarner

- 10.2 Continental

- 10.3 Cummins

- 10.4 Denso

- 10.5 Federal-Mogul Powertrain

- 10.6 FPT Industrial

- 10.7 Hella KGaA

- 10.8 Hitachi Automotive Systems

- 10.9 Hyundai Kefico

- 10.10 Isuzu Motors

- 10.11 Liebherr Group

- 10.12 Magneti Marelli

- 10.13 Mahle

- 10.14 Perkins Engines

- 10.15 Robert Bosch

- 10.16 Siemens

- 10.17 Stanadyne

- 10.18 Weichai Power

- 10.19 Woodward

- 10.20 Yanmar Co.