|

市场调查报告书

商品编码

1664889

飞机窗帘市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Aircraft Curtains Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

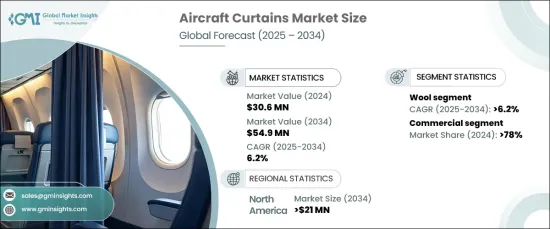

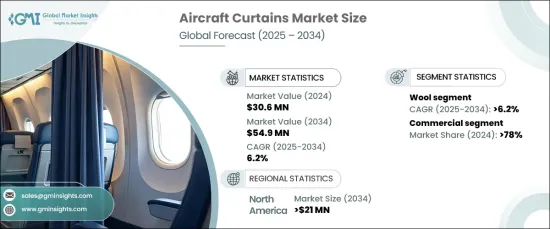

2024 年全球飞机窗帘市场价值 3,060 万美元,预计 2025 年至 2034 年期间的复合年增长率为 6.2%。客舱内部设计的创新和对乘客满意度的高度关注进一步推动了成长。主要产业参与者将受益于对优质材料和针对航空策略的品牌解决方案日益增长的需求。

随着全球航空旅行持续復苏和扩张,对飞机内饰美观和功能性的投资预计将加速。市场的发展轨迹反映了一个明显的趋势:航空公司优先考虑舒适性、风格和功能性,以吸引乘客并提高品牌忠诚度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3060万美元 |

| 预测值 | 5,490 万美元 |

| 复合年增长率 | 6.2% |

市场分为羊毛、聚酯和合成材料,其中羊毛成为主要成长动力。预计到 2034 年,羊毛的复合年增长率将达到 6.2%,其柔软度、保暖性以及优雅的表面处理等天然属性使其成为高级客舱内饰的首选。航空公司越来越多地采用羊毛来提供更舒适的飞行体验并营造奢华的氛围,这反映出人们对提升飞行体验日益增长的趋势。

根据最终用户,市场分为商业和军事部分。商业领域预计到 2024 年将占据 78% 的份额,并将大幅扩张。航空公司正致力于透过投资个人化和视觉吸引力十足的客舱内部来提升乘客体验。采用与航空公司品牌相符的独特面料、图案和颜色製作的窗帘越来越受欢迎,尤其是在提供全方位服务的航空公司和优质低成本运营商中。这一转变彰显了我们致力于提供升级的、令人难忘的飞行旅程的承诺。

北美引领全球飞机窗帘市场,预计到 2034 年其估值将达到 2,100 万美元。在美国,航空公司优先考虑整合精緻的客製化客舱内饰,以满足消费者不断变化的期望,特别是对于长途航班的期望。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 航空公司机队现代化和客舱升等日益增多

- 布料创新的技术进步

- 航空旅行需求不断增长以及航空公司扩张

- 越来越重视飞机内部的卫生与清洁

- 越来越符合不断发展的安全标准

- 产业陷阱与挑战

- 严格的安全和法规遵循

- 供应商基础有限且竞争激烈

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 机舱窗帘

- 窗帘

第 6 章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 羊毛

- 聚酯纤维

- 合成的

第 7 章:市场估计与预测:按最终用户,2021 年至 2034 年

- 主要趋势

- 商业的

- 军队

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- ABC International

- ACM Aircraft Cabin Modification

- Arville

- Belgraver Aircraft Interiors

- Botany Weaving

- Epsilon Aerospace

- Fellfab

- Fu-Chi Innovation Technology

- Industrial Neotex

- Lantal

- Niemla

- Spectra Interior Products

- Vandana Carpets

The Global Aircraft Curtains Market, valued at USD 30.6 million in 2024, is poised for robust growth, projected to achieve a CAGR of 6.2% from 2025 to 2034. This upward trajectory is fueled by the rising demand for premium cabin interiors that enhance passenger comfort and reflect brand identity. The growth is further propelled by innovations in cabin interior design and a heightened focus on passenger satisfaction. Key industry players stand to benefit from the growing demand for premium materials and branded solutions tailored to airline strategies.

As global air travel continues to recover and expand, investments in aesthetic and functional aircraft interiors are expected to accelerate. The market's trajectory reflects a clear trend: airlines prioritizing comfort, style, and functionality to captivate passengers and enhance brand loyalty.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.6 million |

| Forecast Value | $54.9 million |

| CAGR | 6.2% |

The market is segmented into wool, polyester, and synthetic materials, with wool emerging as a key growth driver. Anticipated to grow at a CAGR of 6.2% by 2034, wool's natural attributes-such as softness, insulation, and an elegant finish-make it a top choice for premium cabin interiors. Airlines are increasingly embracing wool to deliver superior comfort and create a luxurious ambiance, reflecting a growing trend toward elevated in-flight experiences.

By end-user, the market is divided into commercial and military segments. The commercial segment, which holds a commanding 78% share in 2024, is projected to expand significantly. Airlines are focusing on enhancing the passenger experience by investing in personalized and visually appealing cabin interiors. Curtains crafted from unique fabrics, patterns, and colors aligned with airline branding are gaining popularity, particularly among full-service carriers and premium low-cost operators. This shift underscores a commitment to delivering an upgraded, memorable, in-flight journey.

North America leads the global aircraft curtains market and is expected to reach a valuation of USD 21 million by 2034. The region's growth is driven by initiatives to modernize airline fleets, adopt eco-friendly solutions, and elevate passenger comfort. In the U.S., airlines are prioritizing the integration of sophisticated, customized cabin interiors to meet evolving consumer expectations, especially for long-haul flights.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising airline fleet modernization and cabin upgrades

- 3.6.1.2 Technological advancements in fabric innovation

- 3.6.1.3 Growing air travel demand and expansion of airlines

- 3.6.1.4 Rising focus on hygiene and cleanliness in aircraft interiors

- 3.6.1.5 Growing compliance with evolving safety standards

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Stringent safety and regulatory compliance

- 3.6.2.2 Limited supplier base and high competition

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Cabin curtains

- 5.3 Window curtains

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Wool

- 6.3 Polyester

- 6.4 Synthetic

Chapter 7 Market Estimates & Forecast, By End-user, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Military

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABC International

- 9.2 ACM Aircraft Cabin Modification

- 9.3 Arville

- 9.4 Belgraver Aircraft Interiors

- 9.5 Botany Weaving

- 9.6 Epsilon Aerospace

- 9.7 Fellfab

- 9.8 Fu-Chi Innovation Technology

- 9.9 Industrial Neotex

- 9.10 Lantal

- 9.11 Niemla

- 9.12 Spectra Interior Products

- 9.13 Vandana Carpets