|

市场调查报告书

商品编码

1664890

半自动贴标机市场机会、成长动力、产业趋势分析及 2024 - 2032 年预测Semi-Automatic Labelling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

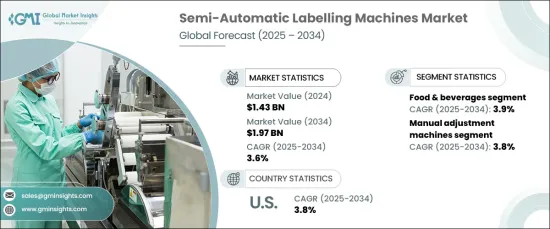

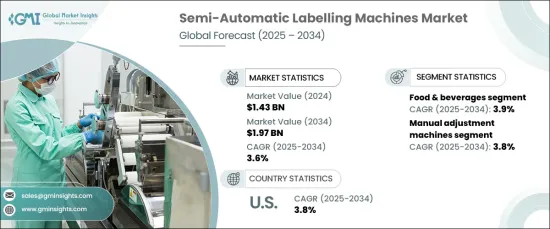

2023 年全球半自动贴标机市场规模达到 14.3 亿美元,预计 2024 年至 2032 年期间的复合年增长率为 3.6%。凭藉美国食品和饮料行业的强劲机会和强劲的成长前景,该市场具有良好的发展前景。

市场分为手动调节机和可编程机,其中手动调节机部分在 2023 年将创造 8.43 亿美元的收入。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 14.3亿美元 |

| 预测值 | 19.7亿美元 |

| 复合年增长率 | 3.6% |

手动调节机对于新创公司、小型製造商和预算有限的中小企业特别有吸引力。这些机器非常适合生产量较低到中等的企业,例如手工品牌和小众产品製造商,因为全自动系统的高成本在经济上不可行。由于其价格低廉且效率高,所以成为这些领域的热门选择。

根据最终用途,市场分为化学品、消费品、电子产品、食品和饮料、药品和其他。其中,食品和饮料部门在 2023 年占据了 34% 的市场份额,预计 2024 年至 2032 年期间的复合年增长率为 3.9%。

随着城市化进程的加速和生活节奏的日益加快,对即食食品、零食和饮料等包装食品的需求持续上升。这种成长凸显了满足监管、品牌和物流要求的高效标籤系统的重要性。在这个领域,遵守严格的标籤规定至关重要,要求清晰显示详细的营养资讯、成分清单、有效期限和条码。半自动贴标机在满足这些标准方面表现出色,同时简化了生产流程。

2023 年,美国半自动贴标机市场收入为 3.01 亿美元,预计 2024 年至 2032 年期间复合年增长率为 3.8%。对零食、瓶装饮料和即食食品等包装食品和饮料的需求不断增长,进一步推动了半自动贴标机的采用。这些机器对于遵守 FDA 和 USDA 制定的监管标准至关重要,这些标准要求准确标註营养资讯、成分和健康声明。透过确保标籤位置精确一致,半自动贴标机可协助企业维持合规性,同时增强产品展示。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 包装商品的需求不断增加

- 监理合规性不断提高

- 产业陷阱与挑战

- 初始成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2032 年

- 主要趋势

- 手动调整机

- 可程式机器

第六章:市场估计与预测:按速度,2021-2032 年

- 主要趋势

- 低于20个标籤/分钟

- 20 - 30 个标籤/分钟

- 30张标籤/分钟以上

第 7 章:市场估计与预测:按应用,2021 年至 2032 年

- 主要趋势

- 瓶子和容器

- 盒子和纸箱

- 圆柱形产品

- 其他(平面和不规则表面等)

第 8 章:市场估计与预测:依最终用途,2021-2032 年

- 主要趋势

- 化学品

- 消费品

- 电子产品

- 食品和饮料

- 製药

- 其他(物流、电商等)

第 9 章:市场估计与预测:按地区,2021-2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Accutek Packaging Equipment Company

- Adeneli Packaging Corp.

- All-Fill Inc.

- APACKS

- BW Packaging (Barry-Wehmiller)

- Herma GmbH

- Kraus Maschinenbau GmbH

- Marchesini Group

- Shanghai BaZhou Industrial Co., Ltd.

- Shree Bhagwati Equipments

- Tronics

- WINSKYS

- Worldpack Automation Systems

- Zhejiang Haizhou Packing Machinery Co., Ltd.

- Zhengzhou Henuo Machinery Co., Ltd.

The Global Semi-Automatic Labelling Machines Market reached USD 1.43 billion in 2023 and is projected to expand at a CAGR of 3.6% between 2024 and 2032. The market growth is driven by the cost-effectiveness, adaptability of semi-automatic labelling machines to diverse industries, and essential role in meeting regulatory and consumer demands. With strong opportunities in the food and beverage sector and robust growth prospects in the U.S., this market is well-positioned for a promising future.

The market is segmented into manual adjustment machines and programmable machines, with the manual adjustment machines segment generating USD 843 million in revenue in 2023. This segment is expected to grow at a robust CAGR of 3.8% during the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $1.43 Billion |

| Forecast Value | $1.97 Billion |

| CAGR | 3.6% |

Manual adjustment machines are particularly appealing to startups, small manufacturers, and SME with budget constraints. These machines are ideal for businesses with low to medium production volumes, such as artisanal brands and niche product manufacturers, where the high cost of fully automated systems is not economically viable. Their affordability and efficiency make them a popular choice in these segments.

Based on end-use, the market is categorized into chemicals, consumer goods, electronics, food & beverages, pharmaceuticals, and others. Among these, the food & beverages segment captured a significant 34% market share in 2023 and is anticipated to grow at a CAGR of 3.9% between 2024 and 2032.

As urbanization accelerates and lifestyles become increasingly fast-paced, the demand for packaged food products-ranging from ready-to-eat meals to snacks and beverages-continues to rise. This growth underscores the importance of efficient labelling systems that meet regulatory, branding, and logistical requirements. In this sector, compliance with stringent labelling regulations is crucial, requiring detailed nutritional information, ingredient lists, expiration dates, and barcodes to be clearly displayed. Semi-automatic labelling machines excel in meeting these standards while streamlining production processes.

The U.S. semi-automatic labelling machines market accounted for USD 301 million in revenue in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2032. This growth is driven by a burgeoning preference for convenience foods, health-conscious options, and premium product offerings. The rising demand for packaged food and beverages, such as snacks, bottled drinks, and ready-to-eat meals, has further fueled the adoption of semi-automatic labelling machines. These machines are instrumental in adhering to regulatory standards set by the FDA and USDA, which mandate accurate labelling of nutritional information, ingredients, and health claims. By ensuring precise and consistent label placement, semi-automatic labelling machines help businesses maintain compliance while enhancing product presentation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for packaged goods

- 3.6.1.2 Rising regulatory compliance

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2032 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual adjustment machines

- 5.3 Programmable machines

Chapter 6 Market Estimates & Forecast, By Speed, 2021-2032 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Below 20 labels/min

- 6.3 20 - 30 labels/min

- 6.4 Above 30 labels/min

Chapter 7 Market Estimates & Forecast, By Application, 2021-2032 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Bottles and containers

- 7.3 Boxes and cartons

- 7.4 Cylindrical products

- 7.5 Others (Flat and Irregular Surfaces, Etc)

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2032 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Chemicals

- 8.3 Consumer goods

- 8.4 Electronics

- 8.5 Food & beverages

- 8.6 Pharmaceutical

- 8.7 Others (Logistics & E-commerce, Etc)

Chapter 9 Market Estimates & Forecast, By Region, 2021-2032 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Accutek Packaging Equipment Company

- 10.2 Adeneli Packaging Corp.

- 10.3 All-Fill Inc.

- 10.4 APACKS

- 10.5 BW Packaging (Barry-Wehmiller)

- 10.6 Herma GmbH

- 10.7 Kraus Maschinenbau GmbH

- 10.8 Marchesini Group

- 10.9 Shanghai BaZhou Industrial Co., Ltd.

- 10.10 Shree Bhagwati Equipments

- 10.11 Tronics

- 10.12 WINSKYS

- 10.13 Worldpack Automation Systems

- 10.14 Zhejiang Haizhou Packing Machinery Co., Ltd.

- 10.15 Zhengzhou Henuo Machinery Co., Ltd.