|

市场调查报告书

商品编码

1664895

勃起功能障碍药物市场机会、成长动力、产业趋势分析与预测 2025 - 2034Erectile Dysfunction Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

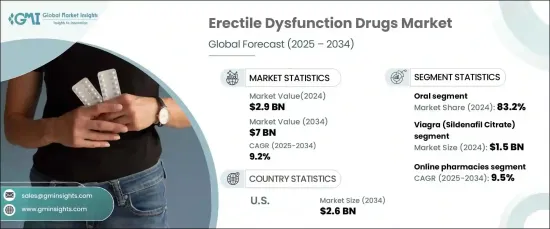

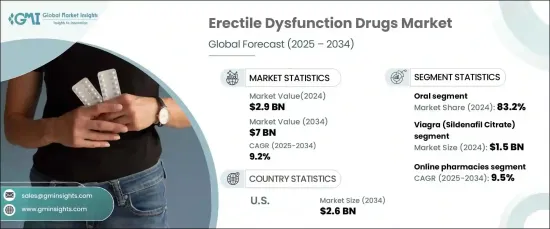

2024 年全球勃起功能障碍药物市场价值为 29 亿美元,预计将实现强劲增长,预计 2025 年至 2034 年的复合年增长率为 9.2%。这些药物的主要作用是增强阴茎区域的血流量,从而实现对性唤起的自然勃起。

市场分为西地那非枸橼酸盐、他达拉非、伐地那非、阿伐那非、乌地那非和其他配方。其中,枸橼酸西地那非在 2024 年占据主导地位,创造了 15 亿美元的收入。其领先地位归功于:

- 强大的品牌认知度

- 临床疗效已证实

- 广泛用于治疗 ED 的第一线药物

快速起效、完善的安全性以及医疗保健提供者的持续偏好等其他优势继续巩固其主导地位。人们对 ED 治疗的认识不断提高和全球人口老化,再加上糖尿病、肥胖症和心血管疾病的盛行率不断上升,预计将在未来几年进一步推动对西地那非枸橼酸盐的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 29亿美元 |

| 预测值 | 70亿美元 |

| 复合年增长率 | 9.2% |

市场也根据给药途径分类,包括口服、肠胃外和其他方法。口服药物成为 2024 年最受欢迎的选择,占了高达 83.2% 的市场。他们的主导地位得益于:

- 方便易用

- 广泛适用,无需专业医疗监督

- 与门诊护理高度相容

口服 ED 药物可以谨慎的自我治疗,与注射或其他给药方式相比,可以提高患者的依从性和舒适度。

美国勃起功能障碍药物市场预计将大幅成长,预计到 2034 年将达到 26 亿美元。线上咨询、订阅服务和谨慎的送货上门服务正在消除障碍、提高治疗依从性并减少寻求 ED 解决方案时常常产生的耻辱感。

目录

第 1 章:方法论与范围

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 勃起功能障碍盛行率不断上升

- 药物输送系统的技术进步

- 老龄人口不断增加

- 产业陷阱与挑战

- 副作用和安全问题

- 严格的监管环境

- 成长动力

- 成长潜力分析

- 监管格局

- 差距分析

- 管道分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第 5 章:市场估计与预测:按药物,2021 年至 2034 年

- 主要趋势

- 威而钢(枸橼酸西地那非)

- 希爱力(他达拉非)

- Levitra/Staxyn(伐地那非)

- Stendra/Spedra(阿伐那非)

- Zydena(乌地那非)

- 其他药物

第 6 章:市场估计与预测:按管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 肠外

- 其他给药途径

第 7 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Bayer

- Eli Lilly and Company

- Endo

- Futura Medical

- Hims & Hers Health

- Lupin

- Meda Pharmaceuticals

- Petros Pharmaceuticals

- Pfizer

- Sandoz

- Simple Pharma

- Sun Pharmaceutical Industries

- Teva Pharmaceutical Industries

- Zydus Lifesciences

The Global Erectile Dysfunction Drugs Market, valued at USD 2.9 billion in 2024, is on track to experience robust growth, with a projected CAGR of 9.2% from 2025 to 2034. ED medications are specifically designed to address the inability to achieve or sustain an erection sufficient for sexual satisfaction. These drugs work primarily by enhancing blood flow to the penile area, enabling natural erections in response to sexual arousal.

The market is segmented into Sildenafil Citrate, Tadalafil, Vardenafil, Avanafil, Udenafil, and other formulations. Among these, Sildenafil Citrate dominated in 2024, generating USD 1.5 billion in revenue. Its leading position is attributed to:

- Strong brand recognition

- Proven clinical efficacy

- Widespread use as a first-line treatment for ED

Additional advantages such as rapid onset, a well-established safety profile, and sustained preference among healthcare providers continue to solidify its dominance. Rising awareness of ED treatments and an aging global population, combined with the increasing prevalence of diabetes, obesity, and cardiovascular diseases, are expected to further drive demand for Sildenafil Citrate in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $7 Billion |

| CAGR | 9.2% |

The market is also classified by route of administration, including oral, parenteral, and other methods. Oral medications emerged as the most popular choice in 2024, capturing an impressive 83.2% of the market share. Their dominance is fueled by:

- Convenience and ease of use

- Wide availability without the need for specialized medical supervision

- High compatibility with outpatient care

Oral ED drugs allow for discreet, self-administered treatment, fostering better patient compliance and comfort compared to injections or alternative delivery methods.

The U.S. erectile dysfunction drugs market is poised for significant growth, projected to reach USD 2.6 billion by 2034. Key factors driving this expansion include the rapid adoption of telemedicine and digital health platforms, which have revolutionized access to ED treatments. Online consultations, subscription-based services, and discreet home delivery options are eliminating barriers, improving treatment adherence, and reducing the stigma often associated with seeking ED solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of erectile dysfunction

- 3.2.1.2 Technological advancement in drug delivery systems

- 3.2.1.3 Increasing aging population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects and safety concerns

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Pipeline analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Viagra (Sildenafil Citrate)

- 5.3 Cialis (Tadalafil)

- 5.4 Levitra/Staxyn (Vardenafil)

- 5.5 Stendra/Spedra (Avanafil)

- 5.6 Zydena (Udenafil)

- 5.7 Other drugs

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

- 6.4 Other routes of administration

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bayer

- 9.2 Eli Lilly and Company

- 9.3 Endo

- 9.4 Futura Medical

- 9.5 Hims & Hers Health

- 9.6 Lupin

- 9.7 Meda Pharmaceuticals

- 9.8 Petros Pharmaceuticals

- 9.9 Pfizer

- 9.10 Sandoz

- 9.11 Simple Pharma

- 9.12 Sun Pharmaceutical Industries

- 9.13 Teva Pharmaceutical Industries

- 9.14 Zydus Lifesciences