|

市场调查报告书

商品编码

1664904

生物基建筑材料市场机会、成长动力、产业趋势分析及 2024 - 2032 年预测Bio-Based Building Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

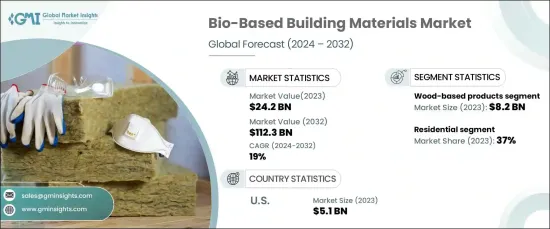

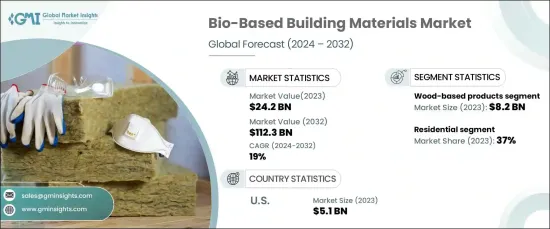

2023 年全球生物基建筑材料市场规模达到 242 亿美元,预计 2024 年至 2032 年期间复合年增长率将达到 19%。生物基材料因其可再生性、低碳足迹以及改善室内空气品质的能力而备受追捧,使其成为现代永续建筑实践的基石。

依材料类型,市场分为天然纤维、木质产品、农业废弃物产品、生物聚合物、生物绝缘材料、生物混凝土等。其中,木质产品在 2023 年以 82 亿美元的估值占据市场主导地位,预计 2024 年至 2032 年期间的复合年增长率为 19.5%。它的多功能性、强度和减少的环境影响使其成为建筑和基础设施项目中结构和美学应用的首选。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 242亿美元 |

| 预测值 | 1123亿美元 |

| 复合年增长率 | 19% |

根据最终用途,市场分为住宅、商业、工业和基础设施部门。住宅领域在 2023 年占据主导地位,占据 37% 的市场份额,预计到 2032 年将以 19.3% 的复合年增长率增长。生物基替代品不含有害化学物质和排放物,符合人们对永续、更健康生活空间日益增长的需求,推动了其在住宅领域的应用。

美国生物基建筑材料市场在 2023 年创造了 51 亿美元的产值,预计在 2024 年至 2032 年期间的复合年增长率将达到 19.2%。以永续基础设施和节能建筑为重点的政策进一步加速了生物基材料的采用,巩固了美国作为该市场的全球领先地位。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 永续建筑需求不断成长

- 技术进步

- 产业陷阱与挑战

- 初始成本较高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:依材料类型,2021-2032 年

- 主要趋势

- 天然纤维

- 木质产品

- 以农业废弃物为基础的产品

- 生物聚合物

- 生物绝缘材料

- 生物混凝土

- 其他(生物黏合剂和黏合剂等)

第六章:市场估计与预测:依建筑类型,2021-2032 年

- 主要趋势

- 新建筑

- 改造和翻新

第 7 章:市场估计与预测:按应用,2021 年至 2032 年

- 主要趋势

- 结构部件

- 绝缘

- 地板

- 墙板和覆层

- 屋顶

- 其他(装饰材料等)

第 8 章:市场估计与预测:按最终用途,2021-2032 年

- 主要趋势

- 住宅

- 商业的

- 工业的

- 基础设施

第 9 章:市场估计与预测:按配销通路,2021-2032 年

- 主要趋势

- 直接的

- 间接

第 10 章:市场估计与预测:按地区,2021-2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- BASF SE

- Clayworks Ltd.

- Cork House

- Durisol

- EcoCocon

- ECOR Global

- Forbo Flooring Systems

- Green Building Supply

- Hempitecture Inc.

- Interface, Inc.

- Kirei

- MycoWorks

- NatureWorks LLC

- Novamont SpA

- Plantd

The Global Bio-Based Building Materials Market reached USD 24.2 billion in 2023 and is projected to grow at an impressive CAGR of 19% from 2024 to 2032. This growth is fueled by increasing sustainability initiatives and the rising demand for eco-friendly construction materials. Bio-based materials have become highly sought after due to their renewable nature, low carbon footprint, and ability to enhance indoor air quality, making them a cornerstone of modern, sustainable building practices.

By material type, the market is segmented into natural fibers, wood-based products, agro-waste-based products, bio-polymers, bio-insulation materials, bio-concrete, and others. Among these, wood-based products led the market with a valuation of USD 8.2 billion in 2023, and they are expected to grow at a CAGR of 19.5% from 2024 to 2032. Wood's sustainability, renewability, and biodegradability make it a standout choice over traditional materials. Its versatility, strength, and reduced environmental impact position it as a go-to option for both structural and aesthetic applications in construction and infrastructure projects.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $24.2 Billion |

| Forecast Value | $112.3 Billion |

| CAGR | 19% |

The market is categorized into residential, commercial, industrial, and infrastructure sectors based on end-use. The residential segment dominated in 2023, capturing 37% of the market share, and is projected to grow at a CAGR of 19.3% through 2032. Homeowners are increasingly prioritizing materials that improve indoor air quality and minimize environmental impact. Bio-based alternatives, free from harmful chemicals and emissions, align with the growing demand for sustainable, healthier living spaces, driving their adoption in the residential sector.

The U.S. bio-based building materials market generated USD 5.1 billion in 2023 and is set to expand at a CAGR of 19.2% from 2024 to 2032. Growth in the U.S. is primarily driven by government incentives, tax benefits, and certification programs promoting green construction practices. Policies focused on sustainable infrastructure and energy-efficient buildings have further accelerated the adoption of bio-based materials, solidifying the U.S. as a global leader in this market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for sustainable construction

- 3.6.1.2 Technological advancements

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Higher initial costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2032 (USD Billion)

- 5.1 Key trends

- 5.2 Natural fibers

- 5.3 Wood-based products

- 5.4 Agro-waste-based products

- 5.5 Bio-polymers

- 5.6 Bio-insulation materials

- 5.7 Bio-concrete

- 5.8 Others (bio-adhesives and binders, Etc)

Chapter 6 Market Estimates & Forecast, By Construction Type, 2021-2032 (USD Billion)

- 6.1 Key trends

- 6.2 New construction

- 6.3 Renovation and retrofit

Chapter 7 Market Estimates & Forecast, By Application, 2021-2032 (USD Billion)

- 7.1 Key trends

- 7.2 Structural components

- 7.3 Insulation

- 7.4 Flooring

- 7.5 Wall panels and cladding

- 7.6 Roofing

- 7.7 Others (decorative materials, Etc)

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2032 (USD Billion)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

- 8.5 Infrastructure

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2032 (USD Billion)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2032 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 BASF SE

- 11.2 Clayworks Ltd.

- 11.3 Cork House

- 11.4 Durisol

- 11.5 EcoCocon

- 11.6 ECOR Global

- 11.7 Forbo Flooring Systems

- 11.8 Green Building Supply

- 11.9 Hempitecture Inc.

- 11.10 Interface, Inc.

- 11.11 Kirei

- 11.12 MycoWorks

- 11.13 NatureWorks LLC

- 11.14 Novamont S.p.A.

- 11.15 Plantd