|

市场调查报告书

商品编码

1664907

管钳市场机会、成长动力、产业趋势分析与 2024 - 2032 年预测Pipe Wrenches Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

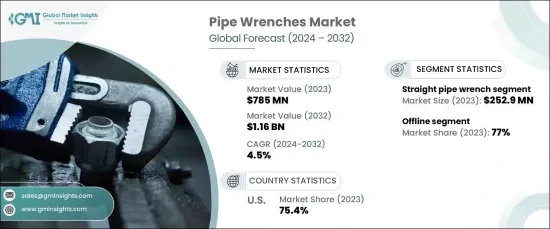

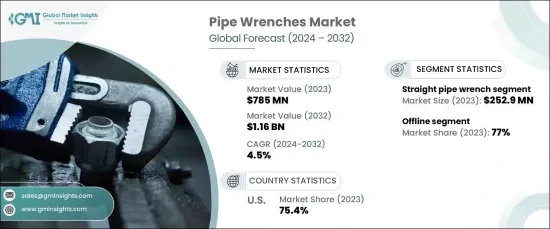

2023 年全球管钳市场价值为 7.85 亿美元,预计到 2032 年将以 4.5% 的复合年增长率增长。住宅和商业建筑的快速发展以及供水系统和管道的升级增加了对管道工具的需求。公共和私营部门对基础设施建设的大量投资进一步支持了市场成长,特别是在组装和维护应用方面。

技术进步和产品创新在塑造市场方面发挥关键作用。製造商优先考虑人体工学设计,以减少使用者疲劳并提高效率。铝等轻质材料的引入,确保了耐用性,同时提高了易用性。此外,扭力测量功能等数位增强功能正在提高精度,使这些工具在现代应用中更加可靠和有效。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 7.85亿美元 |

| 预测值 | 11.6亿美元 |

| 复合年增长率 | 4.5% |

依产品类型,市场分为直管钳、偏置管钳、链管钳、端管钳、附钳等。直管扳手市场占据主导地位,2023 年的营收为 2.529 亿美元,预计复合年增长率为 4.9%。它在住宅、商业和工业领域的多功能性使其成为首选。製造商正致力于改善设计人体工学并采用轻质材料来增强功能性和用户舒适度,进一步推动各行业的应用。

根据分销管道,市场分为线上和线下部分。线下部分将在 2023 年占据 77% 的份额,预计在预测期内的复合年增长率为 4.4%。由于客户偏好亲自检查产品和提供个人化服务,线下销售仍占据主导地位。五金店和专业零售商继续透过提供专家建议、即时可用性和客製化建议来吸引专业用户,保持对面对面购买的强劲需求。

2023 年美国管钳市场占有 75.4% 的份额,预计复合年增长率为 4.4%。美国市场的成长得益于持续的基础设施投资,包括管道、供水系统和建筑物的建设和维护。人们对现代化公用事业网路和改善管道设施的日益关注支撑了对管钳的持续需求,使其成为维护和建设项目不可或缺的工具。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 基础建设发展与都市化

- 技术进步与产品创新

- 工业部门的维护和修理活动

- 产业陷阱与挑战

- 环境法规和永续性问题

- 来自替代工具的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:管钳市场估计与预测:按产品类型,2021-2032 年

- 主要趋势

- 直管扳手

- 偏置管扳手

- 链条管钳

- 端管扳手

- 带扳手

第 6 章:管钳市场估计与预测:按材料,2021-2032 年

- 主要趋势

- 铝

- 钢

- 塑胶或复合材料

第 7 章:管钳市场估计与预测:按规模,2021-2032 年

- 主要趋势

- 最大 200 毫米

- 200 毫米 - 400 毫米

- 400 毫米 - 600 毫米

- 600 毫米 - 800 毫米

- 800 毫米以上

第 8 章:管钳市场估计与预测:依最终用途,2021-2032 年

- 主要趋势

- 住宅

- 商业的

- 工业的

第 9 章:管钳市场估计与预测:依定价,2021-2032 年

- 主要趋势

- 低的

- 中等的

- 高的

第 10 章:管钳市场估计与预测:按配销通路,2021-2032 年

- 主要趋势

- 在线的

- 离线

第 11 章:管钳市场估计与预测:按地区,2021-2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- Apex Tool Group

- Bahco

- Channellock

- Footprint Tools

- Gedore

- Husky

- Klein Tools

- Matco Tools

- Milwaukee Tool

- RIDGID

- Snap-on

- Stanley Black & Decker

- Teng Tools

- TTI Group

- Wright Tool

The Global Pipe Wrenches Market was valued at USD 785 million in 2023 and is projected to grow at a CAGR of 4.5% through 2032. Rising urbanization and expanding infrastructure projects worldwide are fueling the demand for pipe wrenches. Rapid development in residential and commercial construction, along with upgrades to water supply systems and pipelines, has heightened the need for plumbing tools. Substantial investments from both public and private sectors in infrastructure development further support market growth, particularly for assembly and maintenance applications.

Technological advancements and product innovations play a pivotal role in shaping the market. Manufacturers are prioritizing ergonomic designs to reduce user fatigue and enhance efficiency. The introduction of lightweight materials, such as aluminum, ensures durability while improving ease of use. Additionally, digital enhancements like torque measurement features are increasing precision, making these tools more reliable and effective for modern applications.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $785 Million |

| Forecast Value | $1.16 Billion |

| CAGR | 4.5% |

By product type, the market is segmented into straight pipe wrenches, offset pipe wrenches, chain pipe wrenches, end pipe wrenches, strap wrenches, and others. The straight pipe wrench segment dominated the market with a revenue of USD 252.9 million in 2023 and is forecasted to grow at a CAGR of 4.9%. Its versatility across residential, commercial, and industrial sectors makes it a preferred choice. Manufacturers are focusing on improving design ergonomics and incorporating lightweight materials to enhance functionality and user comfort, further driving adoption in various industries.

Based on distribution channels, the market is divided into online and offline segments. The offline segment captured 77% share in 2023 and is expected to grow at a CAGR of 4.4% during the forecast period. Offline sales remain dominant due to customer preferences for hands-on product inspections and personalized service. Hardware stores and specialty retailers continue to attract professional users by offering expert advice, immediate availability, and tailored recommendations, maintaining strong demand for in-person purchases.

U.S. pipe wrenches market held 75.4% share in 2023, with an anticipated CAGR of 4.4%. Growth in the U.S. market is driven by ongoing infrastructure investments, including the construction and maintenance of pipelines, water systems, and buildings. The increasing focus on modernizing utility networks and improving plumbing installations supports consistent demand for pipe wrenches, making them indispensable tools for maintenance and construction projects.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Infrastructure development and urbanization

- 3.6.1.2 Technological advancements and product innovation

- 3.6.1.3 Maintenance and repair activities in industrial sectors

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Environmental regulations and sustainability concerns

- 3.6.2.2 Competition from alternative tools

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Pipe Wrenches Market Estimates & Forecast, By Product Type, 2021-2032 (USD Million)

- 5.1 Key trends

- 5.2 Straight pipe wrench

- 5.3 Offset pipe wrench

- 5.4 Chain pipe wrench

- 5.5 End pipe wrench

- 5.6 Strap wrench

Chapter 6 Pipe Wrenches Market Estimates & Forecast, By Material, 2021-2032 (USD Million)

- 6.1 Key trends

- 6.2 Aluminum

- 6.3 Steel

- 6.4 Plastic or composite

Chapter 7 Pipe Wrenches Market Estimates & Forecast, By Size, 2021-2032 (USD Million)

- 7.1 Key trends

- 7.2 Up to 200 mm

- 7.3 200 mm - 400 mm

- 7.4 400 mm - 600 mm

- 7.5 600 mm - 800 mm

- 7.6 Above 800 mm

Chapter 8 Pipe Wrenches Market Estimates & Forecast, By End Use, 2021-2032 (USD Million)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Pipe Wrenches Market Estimates & Forecast, By Pricing, 2021-2032 (USD Million)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Pipe Wrenches Market Estimates & Forecast, By Distribution Channel, 2021-2032 (USD Million)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Pipe Wrenches Market Estimates & Forecast, By Region, 2021-2032 (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Apex Tool Group

- 12.2 Bahco

- 12.3 Channellock

- 12.4 Footprint Tools

- 12.5 Gedore

- 12.6 Husky

- 12.7 Klein Tools

- 12.8 Matco Tools

- 12.9 Milwaukee Tool

- 12.10 RIDGID

- 12.11 Snap-on

- 12.12 Stanley Black & Decker

- 12.13 Teng Tools

- 12.14 TTI Group

- 12.15 Wright Tool